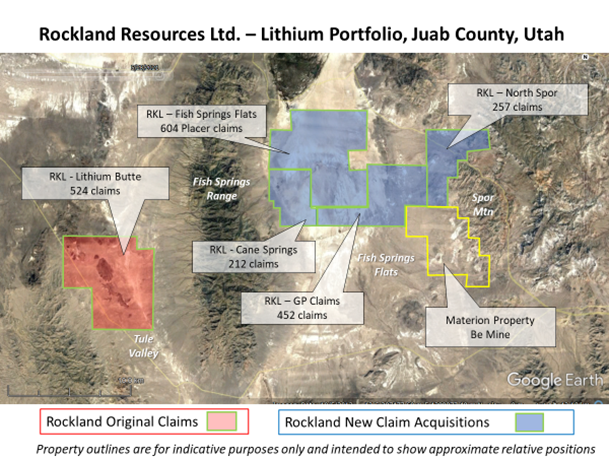

VANCOUVER, BC / ACCESSWIRE / September 20, 2022 / Rockland Resources Ltd. (the "Company" or "Rockland") (CSE:RKL) is pleased to report a major expansion of the Company's claim position in west-central Utah directed at lithium mineralization hosted in clay or claystone volcanic tuff units. An additional 1,525 claims have been located in 4 property blocks comprising 30,500 acres (12,343 ha). When combined with the original Lithium Butte Property, where sampling has returned values up to 4,080 parts per million lithium (ppm Li), the Company's holdings total 2,076 claims, comprising 41,520 acres (16,219 ha).

- Lithium Butte and area properties are positioned as Utah's leading claystone lithium project

- District scale (41,520 acres) land position prospective for lithium in mining friendly Utah, USA

- Utah is No 3 USA location on the 2021 Fraser Institute list, exceptional property location, near highways, power and manpower

- Lithium mineralized claystones as well as lithium in brine potential

- Similar geology to Nevada's hotbed of activity in the Clayton Valley - Tonopah area

- Highly elevated lithium content in the primary Spor Mtn Formation Volcanic Beryllium-tuff member

- Claystone alteration has further enriched lithium concentrations

- Early channel sampling has provided grades of 25.2 metres at 1,388 ppm lithium including 8 metres of 2,155 ppm lithium within the channel

- Initial grab samples at Lithium Butte provided values of 1,200 ppm up to 4,080 ppm Lithium - a great starting point

- Properties also contain beryllium (Be) mineralization with values over 4,000 ppm Be and are contiguous with producing Materion Corp. (MTRN - NYSE) Be mine

- On site company testing facility set up with LIBS analyzer and geologists to provide much faster turnaround time to help move the project move forward fast

All claims are located in Juab County, Utah, and are interpreted to be prospective for lithium mineralization, based on similarities to the Lithium Butte Property, where Company sampling and a historic (2010) database indicate widespread lithium mineralization hosted in clay or claystone volcanic tuff units. The newly acquired claims are located about 10 kilometres North-Northeast of the northwestern portion of the Lithium Butte property, east of the Fish Springs Mountain Range. The 4 claim blocks comprise the North Spor, GP, Cane Springs and Fish Springs Flat properties adjoin to the north and west of the Spor Mountain beryllium mine owned by Materion Corporation (NYSE: MTRN), the sole producer of beryllium ore in the United States. Rockland's primary exploration target is claystone hosted lithium mineralization, however, the Fish Springs Flat Property covers an area interpreted to be prospective for lithium brine mineralization (Mills, S.E. and Rupke, A., 2020, Utah Geological Survey, Circular 129).

Dr. Richard Sutcliffe, Rockland's President stated "Rockland has had the advantage of being an early mover in the acquisition of lithium exploration properties in the Basin and Range Geological Province of western Utah. The Company has acquired an extensive land position in two adjacent basins that both have the hallmarks of the lithium claystone mineralization model including lithium enriched volcanic units, geothermal fluid activity, restricted basins, claystone horizons, and favourable structure. Our field team is currently conducting geological mapping and soil surveys that utilize an in-house LIBS analyzer capable of lithium analysis to rapidly evaluate targets for future drilling."

The Company also announces that pursuant to an agreement dated August 5th, 2022 between the Company and Multiple Metals Resources Ltd. ("MMRL"), the Company has agreed to grant MMRL a 10% carried interest in the Lithium Butte (60 core claims) Property. The Company will bear all exploration costs in relation to the mineral interests until such time as the Company has incurred $2.5 million in exploration expenditures, after which all exploration costs will be shared on a pro rata basis between the Company and MMRL, subject to standard dilution conditions. If MMRL's interest is diluted to less than 2%, it will convert to a 0.5% net smelter returns royalty. MMRL is an arm's length party to the Company. The 60 claims represent 1,200 acres (486 ha) of the total 41,520 acres (16,219 ha).

Additionally, the Company has agreed to grant MMRL and Helvellyn Capital Corp. a 1.5% net smelter returns royalty over any mineral claims that it acquires in a specified portion of Juab County, Utah. The net smelter returns royalty is subject to a 0.5% buyback right in consideration of $1 million. Helvellyn Capital Corp. is a private Ontario company of which Richard Sutcliffe, the President and a director of the Company, is the principal.

Program QA/QC - Previous and recent sampling on the Lithium Butte Property was carried out by Dr. Richard Sutcliffe, P. Geo., a Qualified Person as defined in NI43-101, who is also responsible for reviewing and approving the geological contents of this news release. Samples were transported in sealed bags by the Project Manager and shipped to Activation Laboratories ("Actlabs") in Ancaster, Ontario. Actlabs is an independent ISO/IEC 17025 certified laboratory. Li analysis will be performed using sodium peroxide fusion and inductively coupled plasma mass spectrometry (ICP-MS).

About Rockland Resources Ltd.

Rockland Resources is engaged in the business of mineral exploration and the acquisition of mineral property assets for the benefit of its shareholders. In addition to the Utah Lithium Property, the Company is acquiring the 41,818-hectare Elektra claystone project concessions that are contiguous with Gangfeng Lithium's Sonora Lithium Clay Project located in Sonora, Mexico. The Company also holds and option to earn a 100-per-cent interest in the Cole Gold Mines property, located in Ball township, Red Lake mining division, Ontario. The Cole Property hosts high-grade gold mineralization in a classic Red Lake-type structurally controlled gold deposit environment.

On Behalf of the Board of Directors

Dr. Richard H. Sutcliffe, P.Geo.

President and Director

For further information, please contact:

Mike England

Email: mike@engcom.ca

Neither the Canadian Stock Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS: This news release contains forward-looking statements, which relate to future events or future performance and reflect management's current expectations and assumptions. Such forward-looking statements reflect management's current beliefs and are based on assumptions made by and information currently available to the Company. Investors are cautioned that these forward looking statements are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results to differ materially from those expected. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances. All of the forward-looking statements made in this press release are qualified by these cautionary statements and by those made in our filings with SEDAR in Canada (available at WWW.SEDAR.COM).

SOURCE: Rockland Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/716691/Rockland-Resources-More-Than-Triples-Lithium-Claystone-Portfolio-in-Juab-County-Utah