BURLINGTON, ON / ACCESSWIRE / October 12, 2022 / Murchison Minerals Ltd. ("Murchison" or the "Company") (TSXV:MUR)(OTCQB:MURMF) is pleased to announce results analysed using portable x-ray fluorescence (pXRF) from an additional five diamond drillholes, at the Barre de Fer ("BDF") Zone, as part of the 2022 Summer Exploration Program on the 100% - owned HPM (Haut-Plateau de la Manicouagan) Project, located in Quebec. The holes from today's release focused on expansion and delineation of the known zone of mineralization - designed to support work for the future maiden resource on BDF. The results to date have significantly expanded both the depth and width of the modelled nickel-bearing sulphide mineralization, while further demonstrating the potential for any future development at BDF to be open-pit amenable.

The Company completed a total of 13 diamond drillholes during the diamond drilling Phase of 2022 Summer Program, comprising 4,316 metres. Ten of the thirteen holes were drilled at BDF, with the remaining three being drilled at the Syrah target. Results from the first two holes at BDF were previously released (BDF22-001 and BDF22-002). After today's release the Company has pXRF results pending from six holes - three of which were drilled at BDF. The next release will focus on the remaining holes drilled at BDF which targeted areas along strike of the currently modelled zone of mineralization.

It should be noted that pXRF results provide only an indication of the amount of Ni, Cu, and Co present, certified assaying of the core samples is still required to accurately determine the amount of mineralization (Nickel-Copper-Cobalt). The Company has implemented rigorous QA/QC procedures utilizing a direct rock sampler (Figure 6) to produce reasonably representative preliminary results (see pXRF Sample Procedures and QA/QC below).

Highlights

- Drilling intersected semi-massive sulphide mineralization as shallow as 8.50 m in BDF22-003

- The results to date (inclusive of BDF22-001 and 002) have successfully expanded the preliminary model, with respect to both depth and width:

- Mineralization at depth has now been modelled down to 450 m, versus the preliminary model at 295 m

- Mineralization was expanded along the width of the mineralized zone from 150 m to 200 m, with individual lenses now modelled up to 48 m in thickness, compared to the 28 m in the preliminary version

- BDF22-003 intersected 3.67 m estimated at 3.74% pXRF NiEq or 11.14% pXRF CuEq (between 24.0 and 27.67 m) and 4.31 m estimated at 2.37% pXRF NiEq or 7.08 CuEq (between 36.69 m and 41.0 m)

- BDF22-004 intersected 9.5 m estimate at 0.79% pXRF NiEq or 2.34% pXRF CuEq (between 20.5 and 30.0 m), including 3.5 m estimated at 1.50% pXRF NiEq or 4.48 CuEq

Figure 1: Massive sulphide mineralization in BDF22-003 at 36.69 m to 41.00 m.

Murchison Minerals President and CEO Troy Boisjoli comments:

"Today's results continue to demonstrate the robust fundamentals of the HPM project. At Barre de Fer we continue to intersect near surface, high-grade nickel-copper-cobalt mineralization, that is an indication BDF would be amenable to open pit extraction. When you couple that with results from our prospecting program that discovered multiple new mineralized sulphide showings on surface, it adds to our confidence that we are exploring in an emerging nickel-sulphide district with advanced infrastructure. The HPM project has road, hydroelectric facilities, and rail, all within kilometres of the site and all within the province of Quebec - one of the best mining jurisdictions globally. With the projected deficit in the nickel space, and the lack of viable projects globally - in the development and exploration pipelines - have Murchison well positioned with HPM's great fundamentals, to move the project forward."

Murchison Minerals Vice-President of Exploration John Shmyr comments:

"The results we are receiving from the 2022 Barre de Fer drill campaign are encouraging from the shear scope and scale of the sulphides intersected particularly when paired with grade of the Ni, Cu and Co. The technical team is optimistic and we look forward to advancing BDF towards a maiden resource as the drill results continue to exceed our expectations."

Table 1: BDF22-003, 004, 005, 006 & 007 pXRF Highlighted Results

Hole | ? | From (m) | To (m) | Length* (m) | pXRF Ni % | pXRF Cu % | pXRF Co % | pXRF NiEq %** | pXRF CuEq %** |

BDF22-003 | 8.5 | 14 | 5.5 | 0.73 | 0.34 | 0.04 | 0.94 | 2.8 | |

24 | 27.67 | 3.67 | 2.82 | 1.87 | 0.13 | 3.74 | 11.14 | ||

36.69 | 41 | 4.31 | 1.77 | 1.26 | 0.08 | 2.37 | 7.08 | ||

44.28 | 49.68 | 5.4 | 1.03 | 0.2 | 0.04 | 1.18 | 3.53 | ||

Includes | 45.6 | 47.15 | 1.55 | 2.72 | 0.4 | 0.09 | 3.07 | 9.13 | |

75 | 79 | 4 | 0.46 | 0.28 | 0.03 | 0.63 | 1.88 | ||

Includes | 75 | 76 | 1 | 1.16 | 0.87 | 0.1 | 1.68 | 5 | |

BDF22-004 | 14.34 | 16 | 1.66 | 1.06 | 0.66 | 0.07 | 1.44 | 4.29 | |

20.5 | 30 | 9.5 | 0.56 | 0.52 | 0.02 | 0.79 | 2.34 | ||

Includes | 23.5 | 27 | 3.5 | 0.97 | 1.3 | 0.04 | 1.5 | 4.48 | |

BDF22-005 | 72.5 | 91.68 | 19.18 | 0.3 | 0.13 | 0.02 | 0.39 | 1.17 | |

96 | 98 | 2 | 0.8 | 0.14 | 0.05 | 0.97 | 2.9 | ||

194.25 | 209.6 | 15.35 | 0.37 | 0.16 | 0.02 | 0.47 | 1.41 | ||

BDF22-006 | 213 | 214.95 | 1.95 | 1.2 | 0.25 | 0.07 | 1.44 | 4.29 | |

248.4 | 251.9 | 3.5 | 0.88 | 0.29 | 0.04 | 1.07 | 3.19 | ||

278.51 | 290 | 11.49 | 0.36 | 0.15 | 0.01 | 0.44 | 1.31 | ||

Includes | 286.5 | 289.1 | 2.6 | 0.77 | 0.25 | 0.05 | 0.96 | 2.86 | |

BDF22-007 | 173.25 | 177.25 | 4 | 0.56 | 0.34 | 0.04 | 0.75 | 2.25 | |

232.98 | 233.98 | 1 | 0.55 | 0.31 | 0.04 | 0.73 | 2.18 | ||

239.3 | 240.3 | 1 | 1.07 | 1.32 | 0.07 | 1.66 | 4.95 | ||

245.34 | 248.34 | 3 | 0.84 | 0.23 | 0.03 | 0.99 | 2.96 | ||

255.5 | 275.5 | 20 | 0.45 | 0.23 | 0.01 | 0.56 | 1.67 | ||

Includes | 260.5 | 269.5 | 9 | 0.61 | 0.36 | 0.02 | 0.77 | 2.31 | |

291.5 | 308.5 | 17 | 0.42 | 0.19 | 0.02 | 0.52 | 1.55 | ||

377.5 | 401 | 23.5 | 0.41 | 0.21 | 0.02 | 0.51 | 1.52 |

* Reported as core length, true thickness is not known. **Nickel Equivalent (NiEq) & Copper Equivalent (CuEq) values were calculated using the following USD metal prices from Oct 7, 2022: $10.145/lb Nickel, $3.4067/lb Copper, and $23.566/lb Cobalt. NiEq.% was calculated using Ni%+((Cu Price/Ni Price) *Cu %)+((Co Price/Ni Price) *Co %). CuEq.% was calculated using Cu%+((Ni Price/Cu Price)* Ni %)+((Co Price/Cu Price)*Co %).

Table 2: Drill Hole Information

Hole | Easting UTM* | Northing UTM* | Elevation (m) | Azimuth (°) | Dip (°) | Length (m) |

BDF22-003 | 614872 | 5722814 | 889 | 232 | -63 | 251 |

BDF22-004 | 614818 | 5722774 | 884.6 | 232 | -45 | 176 |

BDF22-005 | 614892 | 5722930 | 886 | 232 | -55 | 351 |

BDF22-006 | 614976 | 5722990 | 891 | 223 | -65 | 461 |

BDF22-007 | 614976 | 5722990 | 891 | 232 | -55 | 409 |

*UTM Projected Coordinate System: NAD83 UTM Zone 19N

BDF Mineralization and 2022 Delineation Drillhole Results

The mineralization observed at BDF occurs predominantly as two different types: i) Meter to multi-metre intervals of massive and brecciated sulphide within zones of stringer and disseminated sulphide mineralization, hosted in gabbronorite and peridotite, ii) Disseminated sulphide with lesser stringer to net sulphide, over broad intervals, hosted within an olivine gabbronorite. The sulphide mineralization consists of pyrrhotite with granular pentlandite and stringer chalcopyrite, or as chalcopyrite loops with pentlandite within massive pyrrhotite.

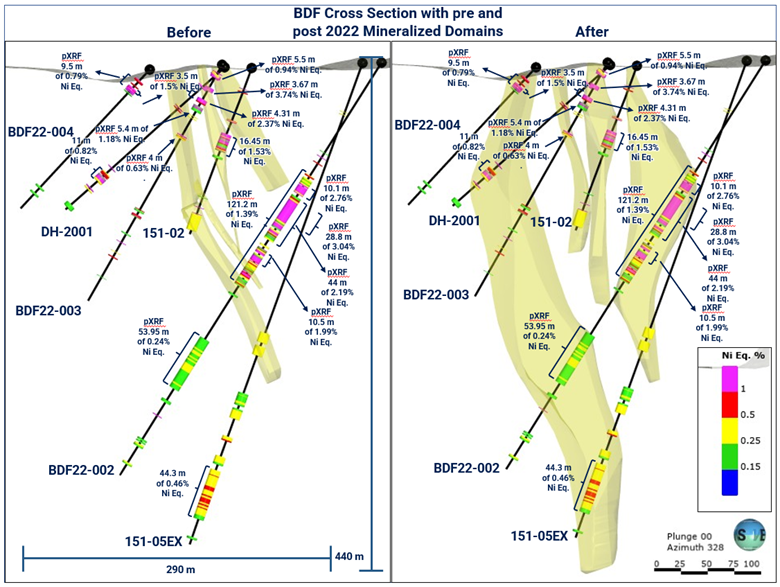

Hole BDF22-003 was drilled to a depth of 251 m and was designed to delineate mineralization between hole DH-2001 and DH-151-02 (Figure 3 & 4) and test the up-dip extension of the lower zone of sulphide mineralization intersected in BDF22-002. The drillhole successfully confirmed the modelled mineralization, intersecting numerous meter scale intervals of massive sulphide hosting high grade Ni-Cu-Co mineralization, delineating the gap between DDH-2001 and DDH-151-02. Furthermore, the hole confirmed the up-dip extension of the footwall mineralization intersected in BDF22-002.

Hole BDF22-004 was drilled to a 176 m, along a fence at the far western extent of the modelled zone of mineralization (Figure 3 & 4). The drillhole was designed to target the up-dip extension of mineralization intersected in DH-2001. BDF22-004 intersected shallow semi-massive to stringer mineralization within a fault zone and proved the continuity of the mineralization to west of the previously modelled zone.

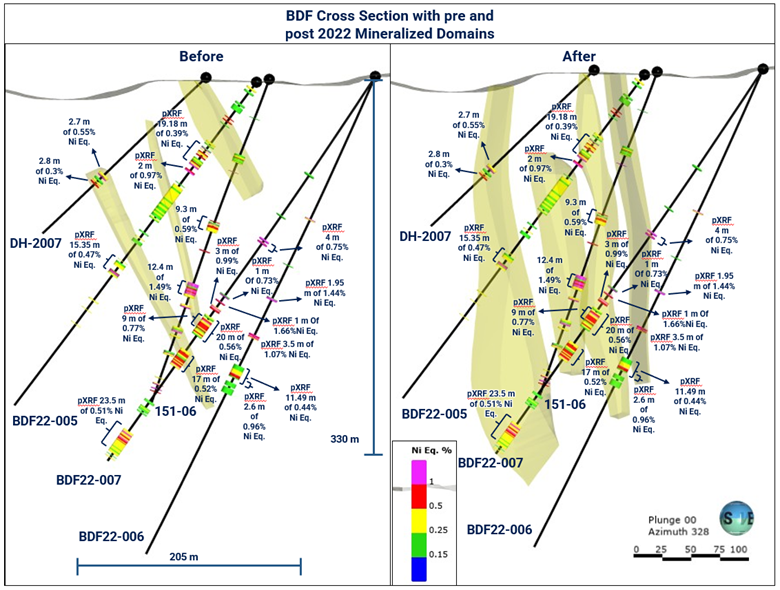

Hole BDF22-005 was drilled to a depth of 351 m, along a fence at the northernmost extent of the modelled zone (Figure 3). The drillhole was designed to delineate mineralization between holes DH-151-06 and DH-2007 (Figure 5). BDF22-005 successfully intersected mineralization at the expected interval within the model, expanding the zone of mineralization along the fence.

Hole BDF22-006 was drilled to a depth of 461 m and was designed to test the down-dip extent of mineralization intersected in DH-151-06. The drillhole successfully intersected mineralization within the expected interval and expanded mineralization down-dip of previous drilling.

Hole BDF22-007 was drilled to a depth of 409 m and was designed to test down-dip extent of mineralization intersected in 151-06, and along strike to the south of BDF22-006. The hole successfully intersected mineralization within the expected interval and expanded mineralization down-dip and along strike of previous drilling.

Figure 2: Close-up of loop pentlandite (light brassy mineral) within massive sulphide mineralization in BDF22-003.

2022 Summer Diamond Drilling

During the 2022 summer exploration program, a total of 13 diamond drill holes were completed, comprising 4,316 metres. This includes ten drillholes at BDF, and an additional three holes at Syrah. The drill core processing has nearly concluded and pXRF results are being determined for the remaining drillholes. Results will be released as soon as the data has been verified. The previously released pXRF results from BDF22-001 and BDF22-002 (See September 8th Release, see September 14th Release and Table 3) demonstrated significant expansion below the currently modeled mineralized domains.

All pXRF analyzed samples have also been submitted to the Saskatchewan Research Council's Geoanalytical Laboratory for commercial certified assaying, results are pending. The Company is expecting final lab assay results in the coming weeks and will release final assay results once the data becomes available. Additionally, the Company is progressing towards establishing a maiden resource on BDF early in 2023.

Table 3: 2022 Drill Campaign pXRF Results to date

Hole | ? | From (m) | To (m) | Length* (m) | pXRF Ni % | pXRF Cu % | pXRF Co % | pXRF NiEq %** | pXRF CuEq %** |

BDF22-001 | 89.95 | 108 | 18.05 | 1.58 | 0.56 | 0.08 | 1.95 | 5.82 | |

| Includes | 96.5 | 108 | 11.5 | 2.13 | 0.64 | 0.1 | 2.58 | 7.67 | |

| Includes | 97.8 | 105.9 | 8.1 | 2.82 | 0.78 | 0.13 | 3.38 | 10.08 | |

122 | 132.85 | 10.85 | 0.29 | 0.24 | 0.02 | 0.42 | 1.24 | ||

180.5 | 189 | 8.5 | 0.63 | 0.3 | 0.03 | 0.8 | 2.38 | ||

196.5 | 219.2 | 22.7 | 0.2 | 0.1 | 0 | 0.23 | 0.7 | ||

267 | 336.9 | 69.9 | 0.5 | 0.24 | 0.04 | 0.67 | 2.01 | ||

| Includes | 283.4 | 299.5 | 16.1 | 1.03 | 0.48 | 0.08 | 1.38 | 4.1 | |

BDF22-002 | 123.8 | 245 | 121.2 | 1.08 | 0.59 | 0.05 | 1.39 | 4.15 | |

| Includes | 134.1 | 144.2 | 10.1 | 2.19 | 1.02 | 0.1 | 2.76 | 8.23 | |

| Includes | 152 | 196 | 44 | 1.72 | 0.84 | 0.08 | 2.19 | 6.52 | |

| Including | 152 | 180.8 | 28.8 | 2.39 | 1.18 | 0.11 | 3.04 | 9.06 | |

| Including | 152.5 | 173.5 | 21 | 2.67 | 1.48 | 0.12 | 3.45 | 10.26 | |

| Including | 177.05 | 180.8 | 3.75 | 2.95 | 0.56 | 0.14 | 3.46 | 10.31 | |

| Includes | 207.5 | 218 | 10.5 | 1.45 | 1.05 | 0.08 | 1.99 | 5.92 | |

303.55 | 357.5 | 53.95 | 0.2 | 0.13 | 0 | 0.24 | 0.73 | ||

BDF22-003 | 8.5 | 14 | 5.5 | 0.73 | 0.34 | 0.04 | 0.94 | 2.8 | |

24 | 27.67 | 3.67 | 2.82 | 1.87 | 0.13 | 3.74 | 11.14 | ||

36.69 | 41 | 4.31 | 1.77 | 1.26 | 0.08 | 2.37 | 7.08 | ||

44.28 | 49.68 | 5.4 | 1.03 | 0.2 | 0.04 | 1.18 | 3.53 | ||

Includes | 45.6 | 47.15 | 1.55 | 2.72 | 0.4 | 0.09 | 3.07 | 9.13 | |

75 | 79 | 4 | 0.46 | 0.28 | 0.03 | 0.63 | 1.88 | ||

Includes | 75 | 76 | 1 | 1.16 | 0.87 | 0.1 | 1.68 | 5 | |

154 | 156.5 | 2.5 | 0.23 | 0.09 | 0.01 | 0.29 | 0.86 | ||

159.5 | 162 | 2.5 | 0.46 | 0.13 | 0.03 | 0.58 | 1.71 | ||

188.67 | 189.21 | 0.54 | 1 | 0.35 | 0.07 | 1.28 | 3.82 | ||

BDF22-004 | 14.34 | 16 | 1.66 | 1.06 | 0.66 | 0.07 | 1.44 | 4.29 | |

20.5 | 30 | 9.5 | 0.56 | 0.52 | 0.02 | 0.79 | 2.34 | ||

Includes | 23.5 | 27 | 3.5 | 0.97 | 1.3 | 0.04 | 1.5 | 4.48 | |

149 | 152 | 3 | 0.17 | 0.11 | 0 | 0.2 | 0.6 | ||

BDF22-005 | 23.5 | 31 | 7.5 | 0.14 | 0.08 | 0 | 0.16 | 0.48 | |

39.25 | 43 | 3.75 | 0.24 | 0.14 | 0.01 | 0.31 | 0.91 | ||

72.5 | 91.68 | 19.18 | 0.3 | 0.13 | 0.02 | 0.39 | 1.17 | ||

96 | 98 | 2 | 0.8 | 0.14 | 0.05 | 0.97 | 2.9 | ||

113.37 | 149.29 | 35.92 | 0.22 | 0.14 | 0.01 | 0.29 | 0.86 | ||

169 | 175 | 6 | 0.15 | 0.1 | 0 | 0.19 | 0.56 | ||

194.25 | 209.6 | 15.35 | 0.37 | 0.16 | 0.02 | 0.47 | 1.41 | ||

BDF22-006 | 136.78 | 137.82 | 1.04 | 0.57 | 0.16 | 0.04 | 0.71 | 2.12 | |

213 | 214.95 | 1.95 | 1.2 | 0.25 | 0.07 | 1.44 | 4.29 | ||

Includes | 213.5 | 214.5 | 1 | 1.86 | 0.37 | 0.11 | 2.24 | 6.68 | |

248.4 | 251.9 | 3.5 | 0.88 | 0.29 | 0.04 | 1.07 | 3.19 | ||

278.51 | 290 | 11.49 | 0.36 | 0.15 | 0.01 | 0.44 | 1.31 | ||

Includes | 286.5 | 289.1 | 2.6 | 0.77 | 0.25 | 0.05 | 0.96 | 2.86 | |

294.5 | 305 | 10.5 | 0.14 | 0.08 | 0 | 0.17 | 0.5 | ||

BDF22-007 | 173.25 | 177.25 | 4 | 0.56 | 0.34 | 0.04 | 0.75 | 2.25 | |

232.98 | 233.98 | 1 | 0.55 | 0.31 | 0.04 | 0.73 | 2.18 | ||

239.3 | 240.3 | 1 | 1.07 | 1.32 | 0.07 | 1.66 | 4.95 | ||

245.34 | 248.34 | 3 | 0.84 | 0.23 | 0.03 | 0.99 | 2.96 | ||

255.5 | 275.5 | 20 | 0.45 | 0.23 | 0.01 | 0.56 | 1.67 | ||

Includes | 260.5 | 269.5 | 9 | 0.61 | 0.36 | 0.02 | 0.77 | 2.31 | |

291.5 | 308.5 | 17 | 0.42 | 0.19 | 0.02 | 0.52 | 1.55 | ||

345.4 | 347.42 | 2.02 | 0.18 | 0.1 | 0 | 0.21 | 0.63 | ||

352 | 358.23 | 6.23 | 0.16 | 0.1 | 0 | 0.19 | 0.57 | ||

377.5 | 401 | 23.5 | 0.41 | 0.21 | 0.02 | 0.51 | 1.52 | ||

52.9 | 53.4 | 0.5 | 0.19 | 0.08 | 0 | 0.22 | 0.65 | ||

118.5 | 122.5 | 4 | 0.46 | 0.14 | 0.02 | 0.55 | 1.65 |

* Reported as core length, true thickness is not known. **Nickel Equivalent (NiEq) & Copper Equivalent (CuEq) values were calculated using the following USD metal prices from Oct 7, 2022: $10.145/lb Nickel, $3.4067/lb Copper, and $23.566/lb Cobalt. NiEq.% was calculated using Ni%+((Cu Price/Ni Price) *Cu %)+((Co Price/Ni Price) *Co %). CuEq.% was calculated using Cu%+((Ni Price/Cu Price)* Ni %)+((Co Price/Cu Price)*Co %).

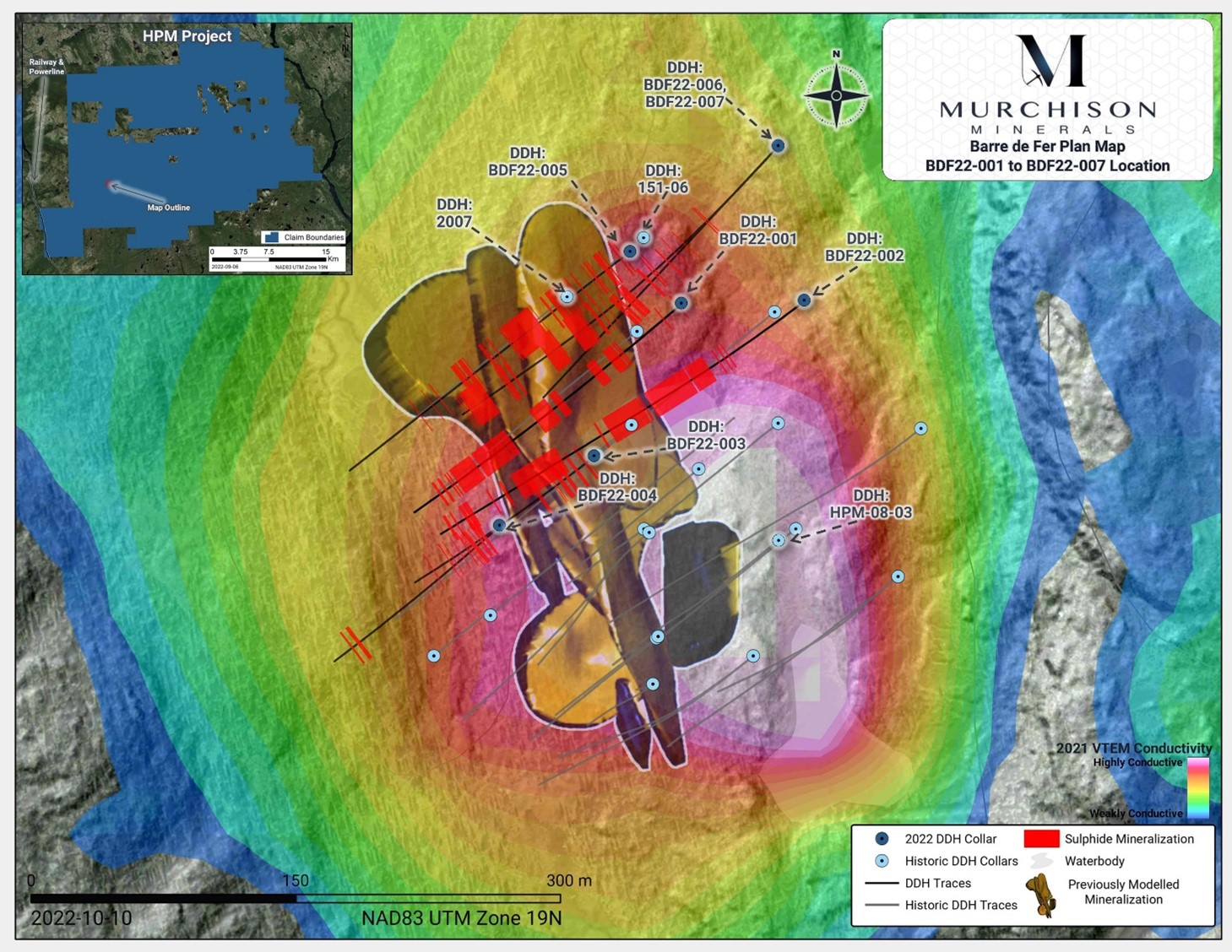

Figure 3: Location map of Barre de Fer looking down, showing drill holes BDF22-001 to BDF22-007

Figure 4: Cross section of the Barre de Fer Zone mineral zone showing the previous model (left) and updated model (right) of the nickel mineralization domains and pXRF results from BDF22-002, BDF22-003, and BDF22-004.

Figure 5: Cross section of the Barre de Fer Zone mineral zone showing the previous model (left) and updated model (right) of the nickel mineralization domains and pXRF results from BDF22-005, BDF22-006, and BDF22-007.

pXRF Sample Procedures and QA/QC

Murchison has implemented a rigorous pXRF sampling and analysis procedure to support the estimation of Ni, Cu and Co concentrations.

In order to collect a homogenous sample, a direct rock sampler (DRS) was utilized for all samples (Figure 6). The DRS consists of a modified angler grinder utilizing a diamond blade in which the rock cuttings are collected within a plastic vial. DRS sampling was undertaken from each core interval that is to be submitted to a commercial laboratory for analyses by total digestion ICP-OES and gold platinum palladium by fire assay. The DRS was used to channel the entire length of each sample with a single pass at a uniform depth of 3 mm and was cut without water. Each channel was cut parallel to core axis; adjacent DRS samples were cut along a uniform plane with consistent relative beta rotation angles to the orientation line, irrespective of the minerals to be intersected. The collected powder is pressed into a small puck with a very thin plastic film overtop and labelled with its unique identifying number. Between each sample all equipment was thoroughly cleaned to prevent cross-contamination. The sample pucks represent a continuous sample across the length of the mineralized intervals. The DRS channel sample collects a limited amount of material for analysis through typically course-grained assemblages of sulphide that can create nugget effects. Where coarse grained material is present, individual pXRF results may be different from the total digestion ICP-OES results. The nugget effect however is buffered by the significant quantity of samples that compose each composite interval since some samples will report low and others high as compared to lab assays.

Each sample puck was analyzed using a Niton XL5 XRF analyzer mounted in a test stand. The samples were analyzed for 90 seconds utilizing 3 element filters, each filter configured for a 30 second analysis. For every 10 samples analyzed, a standard was analyzed consisting of certified reference material that was pressed into a sample puck. Five standards were utilized, and the analyzed standard was selected based on the relative nickel grade of the previous samples in order to analyze a standard with comparable metal grade to the unknown. Multiple blank samples were also prepared by sampling barren quartz hand samples and pressing the material into sample pucks. Regular analysis of the blank material indicates minimal issues regarding sample contamination caused by the diamond blade. Each sample is thus assigned a pXRF Ni, Cu, and Co value which will then be superseded by lab quality assay results when they are received.

Figure 6: Direct rock sampler, sampled core and example sample puck from BDF22-001.

Table 4: - Comparitive Table of Average XRF Results vs Standards

| Sample | Ni % XRF | Ni % Standard | Cu % XRF | Cu % Expected | Co % XRF | Co % Expected |

| Oreas 72b | 0.72 | 0.71 | 0.03 | 0.02 | 0 | 0.01 |

| Oreas 73b | 1.51 | 1.5 | 0.05 | 0.04 | 0.02 | 0.02 |

Table 5: - Example XRF analysis of Blank Material

| Sample | Ni % XRF | Cu % XRF | Co ppm XRF |

| QTZ 1 | <> | 0.02 | <> |

| QTZ 2 | <> | 0.05 | <> |

| QTZ 3 | 0.01 | 0.03 | <> |

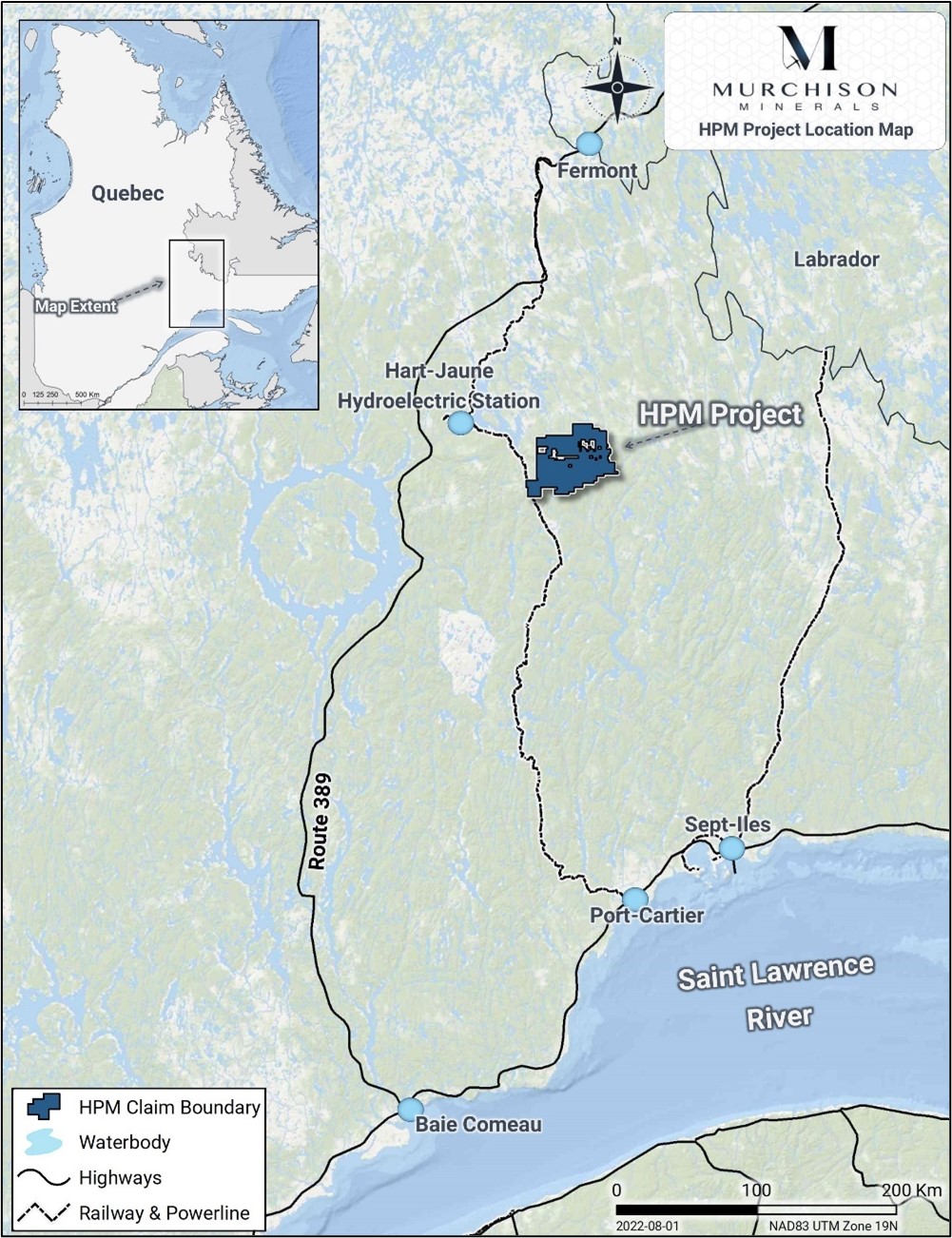

About the HPM Project

The HPM Project is located within the Haut-Plateau de la Manicouagan area, east of the Manicouagan structure, the site of a major 215 Ma impact event. The extensive reservoir at Manicouagan supports five hydro-power plants. The existing Quebec Cartier rail line, located within the HPM Project area, links Labrador City to Port Cartier and Sept Iles, two major iron ore port facilities.

Figure 7: HPM Location Map

The claims host prospective gabbroic, ultramafic and anorthositic bodies within the Manicouagan metamorphic complex and are associated with significant nickel-copper-cobalt sulphide mineralization first identified by Falconbridge in 1999, where they discovered extensive nickel-bearing sulphide mineralization at BDF during drilling in 2001 - 2002. Murchison Minerals Ltd.'s predecessor - Manicouagan Minerals - drilled in the area in 2008 and 2009. The majority of the past drilling at the HPM Project targeted the BDF geophysical conductor and confirmed the presence of nickel-copper-cobalt sulphide mineralization over approximately 300-metres strike length to a depth of 295 metres. The mineralization remains open at depth and partially along strike.

In March of 2022, the Company completed a comprehensive data compilation, verification and modelling program, comprising all previous drill hole data from the BDF Zone. The modelling program consisted of developing a preliminary 3D interpretation of nickel mineralization at BDF. Based on the modelling, the Zone outcrops on surface, extends to a vertical depth of 295 m, has a strike length of 315 m, and is composed of multiple stacked lenses over a maximum footprint width of 150 m. Individual lenses have a maximum thickness of 28 m. During the 2022 Summer Exploration Program, diamond drilling focused on the expansion and delineation of mineralization at BDF. Those results are currently being evaluated and the Preliminary model will be updated as results become available. No resource estimates have been completed on the Zone to date.

After Murchison acquired 100% ownership of the property in 2019, the Company focused exploration work on the camp-scale potential of the region. Aerial EM surveys completed in the spring of 2021 identified more than 50 anomalous conductors. Prospecting crews were able to traverse three (3) of the more than 50 anomalies, and discovered new outcrops of nickel-bearing sulphide mineralization in the process. The prospecting program was followed by an inaugural drill program at the PYC Target area - an EM anomaly with a 1.95-km strike length. Subsequent to the completion of the drill program at PYC, the Company increased its dominant land position in the Haut-Plateau region from 139 km2 to 576 km2. Finally, as a result of the spring 2022 VTEM survey, completed over the remaining 85% of the HPM property area, the Company further increase its land holdings at HPM to 648 km2.

Qualifying Statement

The foregoing scientific and technical disclosures on the HPM Project have been reviewed by John Shmyr, P.Geo., VP Exploration, a registered member of the Professional Engineers and Geoscientists of Saskatchewan and current holder of a special authorization with the Ordre des Géologues du Québec. Mr. Shmyr is a Qualified Person as defined by National Instrument 43-101. The Qualified Person has verified the data disclosed in this release, including sampling, analytical and test data underlying the information contained in this release. Mr. Shmyr consents to the inclusion in the announcement of the matters based on his information in the form and context in which it appears.

Some data disclosed in this News Release relating to sampling and drilling results is historical in nature. Neither the Company nor a qualified person has yet verified this data and therefore investors should not place undue reliance on such data. In some cases, the data may be unverifiable due to lack of drill core. Mineralization hosted on adjacent and/or nearby and/or geologically similar properties is not necessarily indicative of mineralization hosted on the Company's properties.

About Murchison Minerals Ltd. (TSXV: MUR, OTCQB: MURMF)

Murchison is a Canadian-based exploration company focused on nickel-copper-cobalt exploration at the 100% - owned HPM Project in Quebec and the exploration and development of the 100% - owned Brabant Lake zinc-copper-silver project in north-central Saskatchewan. The Company also holds an option to earn 100% interest in the Barraute VMS exploration project also located in Quebec, north of Val d'Or.

Additional information about Murchison and its exploration projects can be found on the Company's website at www.murchisonminerals.ca . For further information, please contact:

Troy Boisjoli, President and CEO,

Erik H Martin, CFO, or

Justin LaFosse, Director Corporate Development

Tel: (416) 350-3776

info@murchisonminerals.com

CHF Capital Markets

Thomas Do, IR Manager

Tel: (416) 868-1079 x 232

thomas@chfir.com

Forward-Looking Information

The content and grades of any mineral deposits at the Company's properties are conceptual in nature. There has been insufficient exploration to define a mineral resource on the property and it is uncertain if further exploration will result in any target being delineated as a mineral resource.

Certain information set forth in this news release may contain forward-looking information that involves substantial known and unknown risks and uncertainties. This forward-looking information is subject to numerous risks and uncertainties, certain of which are beyond the control of the Company, including, but not limited to, the impact of general economic conditions, industry conditions, and dependence upon regulatory approvals. FLI herein includes, but is not limited to: future drill results; stakeholder engagement and relationships; parameters and methods used with respect to the assay results; the prospects, if any, of the deposits; future prospects at the deposits; and the significance of exploration activities and results. FLI is designed to help you understand management's current views of its near- and longer-term prospects, and it may not be appropriate for other purposes. FLI by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such FLI. Although the FLI contained in this press release is based upon what management believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders and prospective purchasers of securities of the Company that actual results will be consistent with such FLI, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such FLI. Except as required by law, the Company does not undertake, and assumes no obligation, to update or revise any such FLI contained herein to reflect new events or circumstances, except as may be required by law. Unless otherwise noted, this press release has been prepared based on information available as of the date of this press release. Accordingly, you should not place undue reliance on the FLI or information contained herein. Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in FLI. Assumptions upon which FLI is based, without limitation, include: the ability of exploration activities to accurately predict mineralization; the accuracy of geological modelling; the ability of the Company to complete further exploration activities; the legitimacy of title and property interests in the deposits; the accuracy of key assumptions, parameters or methods used to obtain the assay results; the ability of the Company to obtain required approvals; the results of exploration activities; the evolution of the global economic climate; metal prices; environmental expectations; community and nongovernmental actions; and any impacts of COVID-19 on the deposits, the Company's financial position, the Company's ability to secure required funding, or operations. Risks and uncertainties about the Company's business are more fully discussed in the disclosure materials filed with the securities regulatory authorities in Canada, which are available at www.sedar.com. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Murchison Minerals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/720036/Murchison-Expands-BDF-Zone-Intersects-Shallow-High-Grade-Nickel-Sulphide-Mineralization-Including-367-m-Estimated-at-374-pXRF-NiEq-or-1114-pXRF-CuEq