CHICAGO, Oct. 21, 2022 /PRNewswire/ -- Form Energy recently announced a USD 450 million Series E financing round, mainly led by TPG's global impact investing platform, TPG Rise. GIC and Canada Pension Plan Investment Board (CPP Investments) have joined this round, in addition to existing investors ArcelorMittal, Breakthrough Energy Ventures (BEV), and Energy Impact Partners, among others.

Renewable energy is unreliable, as solar and wind power can be affected by diverse weather conditions, leading to disruptions in supply. An interminable and cost-efficient storage system is required to ensure the transition toward renewable energy happens faster. Form Energy's 100-hour iron-air battery can be deployed at utility scale and be used in power-grid infrastructure to serve as such energy storage system. The recent Series E funding expedites the company's ability to set up a globally competitive battery manufacturing supply chain-with this round, Form Energy is one step closer to offering its technology and competing alongside existing conventional battery variants in the market.

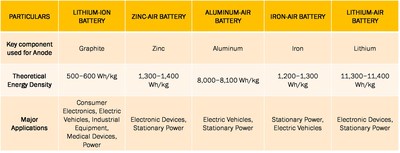

Compared to other popular battery configurations, such as lithium-ion, metal-air batteries are economical as the anode is made using low-cost metals (aluminum, iron, and zinc) and the cathode source (oxygen from the air) is abundant. An iron-air battery works on the principle of 'reversible oxidation of iron'-when discharging, a number of tiny iron pellets come in contact with the air, making them rust and turning the iron to iron oxide; while charging, the oxygen in this rust is removed, reverting it to iron.

Apart from iron-air batteries, zinc-air batteries have potential applications in small electronic devices, such as hearing aids and watches, and in stationary energy storage applications. The properties of metal-air batteries can create an opportunistic environment in key application areas, such as electric vehicles, portable electronics, and large-scale energy reserves.

Metal-air battery is an emerging battery technology that has high prospects in the near future. As per MarketsandMarkets' estimates, the metal-air battery market could be a remarkable opportunity-worth USD 993 million by 2027, at a CAGR of 14.8% from 2022 to 2027.

Iron-air batteries offer higher energy density than lithium-ion

Iron-air batteries are anticipated to have substantially higher energy densities than currently leading lithium-ion batteries. Moreover, their key constituent-iron-is present in abundance and, therefore, a low-cost material. Iron-air batteries are projected to have a theoretical energy density higher than 1,200 Wh/kg compared with lithium-ion batteries that currently offer around 600 Wh/kg.

Note: The theoretical energy density values given above are in approximate ranges as per various sources.

Source: Secondary Research, Company Websites, Press Releases, and MarketsandMarkets Analysis

In the case of volumetric energy density, iron-air batteries offer an even better performance of 9,700 Wh/l, almost five times that of lithium-ion batteries (2,000 Wh/l). Furthermore, rechargeable iron-air batteries are expected to supply 100 hours of energy at an operating cost comparable to conventional power stations and less than one-tenth of lithium-ion batteries, setting them up for remarkable growth in the coming years.

Post extensive research, MarketsandMarkets foresees iron-air batteries having considerable potential, especially in power and automotive applications, that are currently dominated by lithium-ion batteries.

Also, the significantly better RoI of iron-air batteries over lithium-ion batteries could result in massive opportunities for iron-air batteries in the power sector. Owing to several better ROI of iron-air batteries over Li-ion batteries, power sector could have massive opportunities for iron-air batteries. While iron-air batteries expected to fully scale in next few years, some of the key lithium-ion battery manufacturers that are eyeing utility scale storage as a customer group, such as BAK Power, CATL, and LithiumWerks, will be affected with the competition from iron-air battery manufacturers. As end users opt for more cost-effective and efficient energy storage option, such as iron-air batteries, lithium-ion battery companies are expected to corner lower business from these conventional batteries.

About MarketsandMarkets

MarketsandMarkets provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets's flagship competitive intelligence and market research platform, "Knowledge Store" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

Contact:

Mr. Aashish Mehra

MarketsandMarkets INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com

Visit Our Web Site: https://www.marketsandmarkets.com/

Photo 1: https://mma.prnewswire.com/media/1927056/Comparison_of_Lithium_ion_Battery_with_Metal_air_Batteries.jpg

Photo 2: https://mma.prnewswire.com/media/1927055/Major_Players_in_Metal_air_Battery_Market.jpg

Logo: https://mma.prnewswire.com/media/660509/MarketsandMarkets_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/usd-450-million-funding-for-iron-air-battery-developer-form-energy-to-lead-to-extensive-growth-opportunities-in-metal-air-battery-technology---exclusive-report-by-marketsandmarkets-301656220.html

View original content:https://www.prnewswire.co.uk/news-releases/usd-450-million-funding-for-iron-air-battery-developer-form-energy-to-lead-to-extensive-growth-opportunities-in-metal-air-battery-technology---exclusive-report-by-marketsandmarkets-301656220.html