VANCOUVER, BC / ACCESSWIRE / November 10, 2022 / Klondike Gold Corp. (TSXV:KG)(FRA:LBDP)(OTCQB:KDKGF) ("Klondike Gold" or the "Company") is pleased to announce an Initial Mineral Resource Estimate in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards incorporated by reference in National Instrument 43-101 ("NI 43-101") for the Lone Star and Stander Deposits at the Klondike District Gold Project, located near Dawson City in the Dawson Mining District, Yukon, Canada.

The Initial Mineral Resource Estimate comprises a total Indicated Mineral Resource of 469,000 ounces of gold and a total Inferred Mineral Resource of 112,000 ounces of gold on the near-surface Lone Star and Stander Deposits. The Mineral Resource Estimate is based upon drilling results from 2014 through 2021 field seasons. The pit-constrained Mineral Resource Estimate is summarized below.

Table 1: Pit-Constrained Mineral Resource Estimate at a 0.2 g/t Au Cut-Off - Effective November 10, 2022 - Lone Star and Stander Deposits

Classification | Deposit | Tonnage Tonnes | Average Au Grade g/t | Au Content oz. |

Indicated | Lone Star | 19,535,528 | 0.643 | 403,857 |

Stander | 2,049,741 | 0.987 | 65,044 | |

Total | 21,585,269 | 0.676 | 468,901 | |

Inferred | Lone Star | 6,156,522 | 0.503 | 99,562 |

Stander | 304,821 | 1.265 | 12,397 | |

Total | 6,461,343 | 0.539 | 111,959 |

Notes:

- The effective date for the Mineral Resource is November 10, 2022.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The CIM definitions were followed for classification of Mineral Resources. The quantity and grade of reported inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred Mineral Resources as an indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.2 g/t Au, using a gold price of US$1,700/ounces and a US$/CAN$ exchange rate of 0.75.

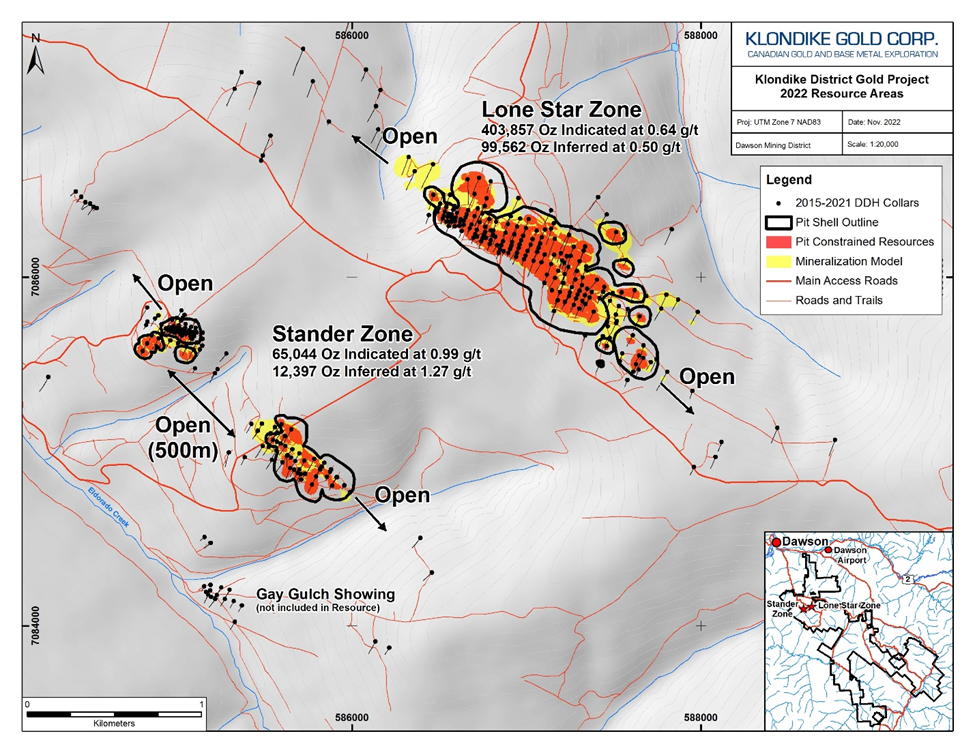

Both the Lone Star and Stander open pit deposits remain open with mineralization known to extend beyond the current resource model boundaries. Additionally, the average indicated mineral resource grade at Stander Deposit is 35% higher than at Lone Star Deposit. (Refer to Figure 1: Klondike District Gold Project 2022 Resource Areas.)

Figure 1: Klondike District Gold Project 2022 Resource Areas

A supporting NI 43-101 Technical Report will be filed on SEDAR at www.sedar.com within 45 days of this press release.

Peter Tallman, Klondike Gold's CEO states "The Company is excited to generate the first-ever Mineral Resource documenting bedrock gold resources in the 125-year history of alluvial gold mining in the famous Klondike goldfields. This milestone is many decades overdue from a historical perspective. We are also pleased with the value this Initial Mineral Resource Estimate generates for our shareholders. We have observed previously that our exploration has not yet found the 'best' mineralization and we are confident there are many additional discoveries still to be made in this prolific district."

MINERAL RESOURCE ESTIMATE

Lone Star Deposit

The drill hole database is comprised of 241 diamond drill holes for the Lone Star deposit with a cut-off date of May 6, 2022. There are 29,623 assays for gold in g/t for a total of 26,988m of drilling. The original Au assays were composited to 1.0m as it is the most common sampling length with 55% of the data sampled to this length. A total of 14,476 composites were generated from 195 holes located within the mineralized domain as defined by the geology model.

The geology model is composed of a mineralized domain developed at a 0.2 g/t Au cut-off grade. The mineralized zone extends approximately 2 km along strike at an azimuth of 120° by 700 m wide and to a depth of approximately 400m below surface.

The high-grade gold outliers of the 1.0m composites within the mineralized domain were capped to 20.0 g/t Au. Statistics conducted on the capped composites showed lognormal distributions with reasonably well-behaved gold grade distributions.

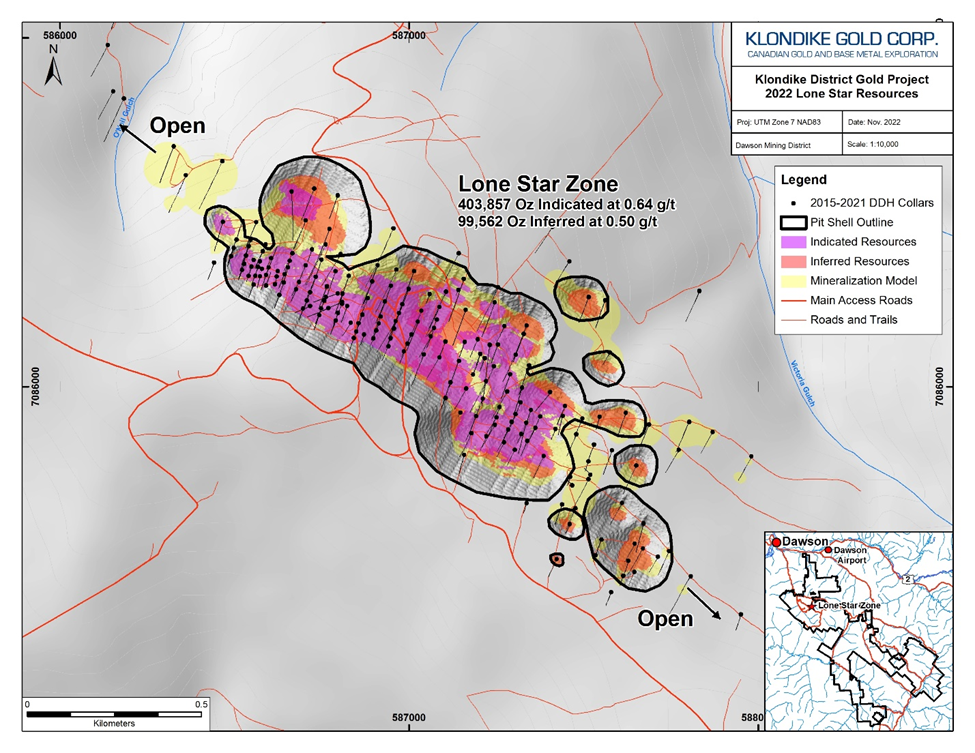

The spatial continuity of the gold grades was examined with a variographic study. Results showed main orientations of gold grade continuity along the strike of the deposit oriented at 115°. Ranges of gold grade continuity within the mineralized domain are 49m along strike, 25m across strike and 33m vertically. (Refer to Figure 2: Klondike District Gold Project 2022 Lone Star Resources)

Figure 2: Klondike District Gold Project 2022 Lone Star Resources

The gold grades were estimated with an ordinary kriging technique into a rotated block model of 5.0m x 5.0m x 5.0m blocks with its X axis at an azimuth of 120°. A minimum of 2 and maximum of 12 samples were used to calculate a grade estimate from the capped 1.0m composites. A 3-pass estimation approach was used with the first pass having a search ellipsoid oriented and dimensioned to the second range of the variograms and the second and third passes having a search ellipsoid dimensioned to two times and three times the second range of the variograms, respectively. Estimates were calculated within the mineralized domain only. The gold grade estimates were visually and statistically validated to ensure that no bias is present and the level of smoothing/variability is adequate.

The mineral resource was classified as indicated and inferred. The tonnage was calculated with a specific gravity value of 2.80 for the mineralized domain. The mineral resource was constrained within a pit shell optimized from a Lerchs-Grossman algorithm with the following parameters: US$ 1,700/oz Au, US$ 2.50/t mining, US$ 5.50/t processing, US$ 2.00 G&A, 80% recovery, and 45° pit slope.

The mineral resources are presented below at various gold grade cut-offs for the Lone Star deposit.

Table 2: Pit-Constrained Mineral Resource Estimate at Various Au Cut-Off Grades - Effective November 10, 2022 - Lone Star Deposit

Classification | Au Cut-Offs g/t | Tonnage Tonnes | Average Au Grade g/t | Au Content oz. |

Indicated | 0.1 | 27,270,412 | 0.502 | 440,135 |

0.2 | 19,535,528 | 0.643 | 403,857 | |

0.3 | 14,576,827 | 0.778 | 364,614 | |

0.4 | 11,184,871 | 0.909 | 326,878 | |

0.5 | 8,832,213 | 1.031 | 292,765 | |

Inferred | 0.1 | 8,503,730 | 0.403 | 110,181 |

0.2 | 6,156,522 | 0.503 | 99,562 | |

0.3 | 4,333,985 | 0.609 | 84,859 | |

0.4 | 3,276,452 | 0.693 | 73,001 | |

0.5 | 2,273,378 | 0.803 | 58,692 |

Notes:

- The effective date for the Mineral Resource is November 10, 2022.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The CIM definitions were followed for classification of Mineral Resources. The quantity and grade of reported inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred Mineral Resources as an indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.2 g/t Au, using a gold price of US$1,700/ounces and a US$/CAN$ exchange rate of 0.75.

Stander Deposit

The drill hole database is comprised of 174 diamond drill holes for the Stander deposit with a cut-off date of May 6, 2022. There are 16,758 assays for gold in g/t for a total of 15,178m of drilling. The original Au assays were composited to 1.0m as it is the most common sampling length with 55% of the data sampled to this length. A total of 4,906 composites were generated from 96 holes located within the mineralized domains as defined by the geology model.

The Stander deposit is made of 2 mineralized zones; the Central zone and the East zone located some 500m to the southeast. Both mineralized zones were delineated at a 0.2 g/t Au cut-off grade. The Central mineralized zone extends approximately 400m along strike at an azimuth of 130° by 200 m wide and to a depth of approximately 150m below surface. The East mineralized zone extends approximately 700m along strike at an azimuth of 130° by 250 m wide and to a depth of approximately 200m below surface.

The high-grade gold outliers of the 1.0m composites within the mineralized domain were capped to 25.0 g/t Au for the Central zone and to 20.0 g/t Au for the East zone. Statistics conducted on the capped composites showed lognormal distributions with reasonably well-behaved gold grade distributions.

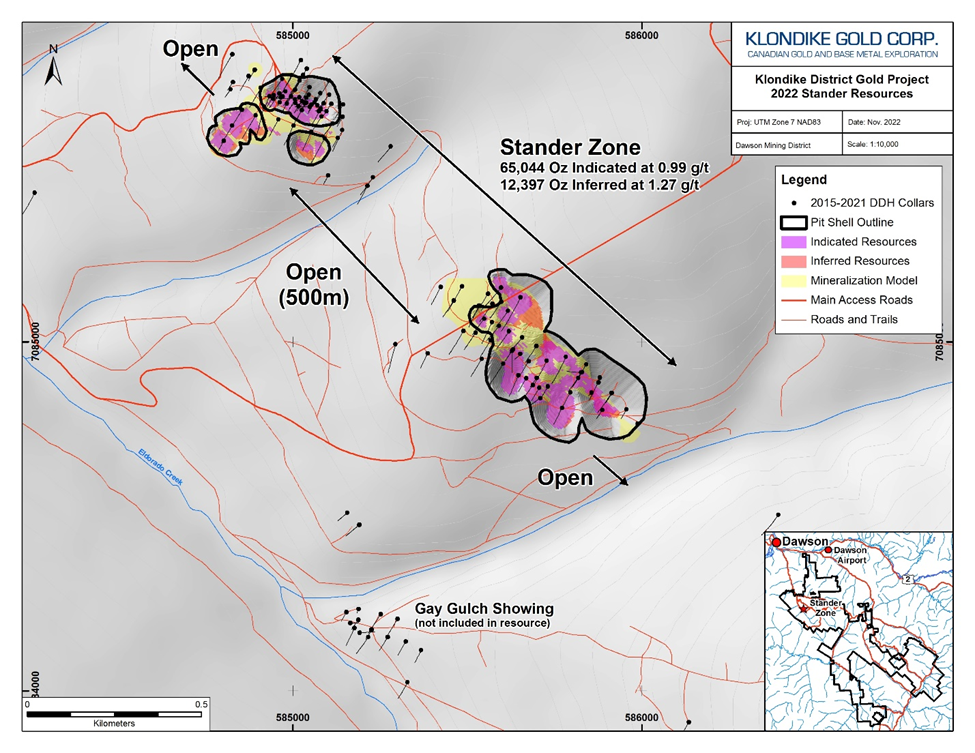

The spatial continuity of the gold grades was examined with a variographic study. Results showed main orientations of gold grade continuity along the strike of the deposit oriented at 140° for both zones. Ranges of gold grade continuity within the Central mineralized zone are 39m along strike, 27m across strike and 20m vertically. For the East mineralized zone the ranges of gold grade continuity are 47m along strike, 32m across strike and 28m vertically. (Refer to Figure 3: Klondike District Gold Project 2022 Standers Resources.)

Figure 3: Klondike District Gold Project 2022 Stander Zone Resources

The gold grades were estimated with an ordinary kriging technique into a rotated block model of 5.0m x 5.0m x 5.0m blocks with its X axis at an azimuth of 135°. A minimum of 2 and maximum of 12 samples were used to calculate a grade estimate from the capped 1.0m composites. A 3-pass estimation approach was used with the first pass having a search ellipsoid oriented and dimensioned to the second range of the variograms and the second and third passes having search ellipsoids dimensioned to two and three times the second range of the variograms, respectively. Estimates were calculated within the mineralized zones only. The gold grade estimates were visually and statistically validated to ensure that no bias is present and the level of smoothing/variability is adequate.

The mineral resource was classified as indicated and inferred. The tonnage was calculated with a specific gravity value of 2.7833 for the mineralized zones. The mineral resource was constrained within a pit shell optimized from a Lerchs-Grossman algorithm with the following parameters: US$ 1,700/oz Au, US$ 2.50/t mining, US$ 5.50/t processing, US$ 2.00 G&A, 80% recovery, and 45° pit slope.

The mineral resources are presented below at various gold grade cut-offs for the Stander deposit.

Table 3: Pit-Constrained Mineral Resource Estimate at Various Au Cut-Off Grades - Effective November 10, 2022 - Stander Deposit

Classification | Au Cut-Offs g/t | Tonnage Tonnes | Average Au Grade g/t | Au Content oz. |

Indicated | 0.1 | 2,751,402 | 0.772 | 68,291 |

0.2 | 2,049,741 | 0.987 | 65,044 | |

0.3 | 1,613,422 | 1.186 | 61,521 | |

0.4 | 1,294,878 | 1.393 | 57,992 | |

0.5 | 994,964 | 1.678 | 53,677 | |

Inferred | 0.1 | 372,678 | 1.060 | 12,701 |

0.2 | 304,821 | 1.265 | 12,397 | |

0.3 | 255,120 | 1.459 | 11,967 | |

0.4 | 200,503 | 1.763 | 11,365 | |

0.5 | 167,284 | 2.024 | 10,886 |

Notes:

- The effective date for the Mineral Resource is November 10, 2022.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The CIM definitions were followed for classification of Mineral Resources. The quantity and grade of reported inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred Mineral Resources as an indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.2 g/t Au, using a gold price of US$1,700/ounces and a US$/CAN$ exchange rate of 0.75.

The mineral resources for the Lone Star and Stander deposits are presented below at various gold grade cut-offs.

Table 4: Pit-Constrained Mineral Resource Estimate at Various Au Cut-Off Grades - Effective November 10, 2022 - Lone Star and Stander Deposits

Classification | Au Cut-Offs g/t | Tonnage Tonnes | Average Au Grade g/t | Au Content oz. |

Indicated | 0.1 | 30,021,814 | 0.527 | 508,426 |

0.2 | 21,585,269 | 0.676 | 468,901 | |

0.3 | 16,190,249 | 0.819 | 426,135 | |

0.4 | 12,479,749 | 0.959 | 384,870 | |

0.5 | 9,827,177 | 1.097 | 346,442 | |

Inferred | 0.1 | 8,876,408 | 0.431 | 122,881 |

0.2 | 6,461,343 | 0.539 | 111,959 | |

0.3 | 4,589,105 | 0.656 | 96,826 | |

0.4 | 3,476,955 | 0.755 | 84,366 | |

0.5 | 2,440,662 | 0.887 | 69,578 |

Notes:

- The effective date for the Mineral Resource is November 10, 2022.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The CIM definitions were followed for classification of Mineral Resources. The quantity and grade of reported inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred Mineral Resources as an indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.2 g/t Au, using a gold price of US$1,700/ounces and a US$/CAN$ exchange rate of 0.75.

QUALIFIED PERSON

The Mineral Resource Estimate was prepared by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc., an independent Qualified Person in accordance with the requirements of NI 43-101 and Mr. Jutras has approved the disclosure herein.

ABOUT KLONDIKE GOLD CORP.

Klondike Gold Corp. is a Vancouver based gold exploration company advancing its 100%-owned Klondike District Gold Project located at Dawson City, Yukon, one of the top mining jurisdictions in the world. The Klondike District Gold Project targets gold associated with district scale orogenic faults along the 55-kilometer length of the famous Klondike Goldfields placer district. Multi-kilometer gold mineralization has been identified at both the Lone Star Zone and Stander Zone, among other targets. The Company has identified an Initial Mineral Resource of 469,000 Indicated and 112,000 Inferred gold ounces, a milestone first for the Klondike District. The Company is focused on exploration and development of its 586 square kilometer property accessible by scheduled airline and government-maintained roads located on the outskirts of Dawson City, YT within the Tr'ondëk Hwëch'in First Nation traditional territory.

ON BEHALF OF KLONDIKE GOLD CORP.

"Peter Tallman"

President and CEO

(604) 609-6138

E-mail: info@klondikegoldcorp.com

Website: www.klondikegoldcorp.com

Klondike Gold disclaimers

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information

"This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities laws. This information and statements address future activities, events, plans, developments and projections. All statements, other than statements of historical fact, constitute forward-looking statements or forward-looking information. Such forward-looking information and statements are frequently identified by words such as "may," "will," "should," "anticipate," "plan," "expect," "believe," "estimate," "intend" and similar terminology, and reflect assumptions, estimates, opinions and analysis made by management of Klondike in light of its experience, current conditions, expectations of future developments and other factors which it believes to be reasonable and relevant. All statements in this discussion, other than statements of historical facts, that address future exploration drilling, exploration activities, anticipated metal production, internal rate of return, estimated ore grades, commencement of production estimates and projected exploration and capital expenditures (including costs and other estimates upon which such projections are based) and events or developments that the Company expects, are forward-looking statements. Although the Company believes, the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include metal prices, exploration successes, continued availability of capital and financing, and general economic, market or business conditions. Accordingly, readers should not place undue reliance on forward-looking statements. Forward-looking information and statements involve known and unknown risks and uncertainties that may cause Klondike's actual results, performance and achievements to differ materially from those expressed or implied by the forward-looking information and statements and accordingly, undue reliance should not be placed thereon.

Risks and uncertainties that may cause actual results to vary include but are not limited to the availability of financing; fluctuations in commodity prices; changes to and compliance with applicable laws and regulations, including environmental laws and obtaining requisite permits; political, economic and other risks; as well as other risks and uncertainties which are more fully described in our annual and quarterly Management's Discussion and Analysis and in other filings made by us with Canadian securities regulatory authorities and available at www.sedar.com. Klondike Gold disclaims any obligation to update or revise any forward-looking information or statements except as may be required."

SOURCE: Klondike Gold Corp.

View source version on accesswire.com:https://www.accesswire.com/724933/Klondike-Gold-Announces-469000-Indicated-and-112000-Inferred-Gold-Ounces-Initial-Mineral-Resource-Estimate-for-the-Klondike-District-Property-Yukon-Canada