BURLINGTON, ON / ACCESSWIRE / November 29, 2022 / Murchison Minerals Ltd. ("Murchison" or the "Company") (TSXV:MUR)(OTCQB:MURMF) is pleased to announce assay results from BDF22-002, the second diamond drillhole completed at the Barre de Fer ("BDF") zone, as part of the 2022 Summer Exploration Program on the 100% - owned HPM (Haut-Plateau de la Manicouagan) Project, located in Quebec. The results demonstrate the near-surface, high-grade nature of Barre de Fer and the potential for future expansion of the zone. In advance of the maiden resource, slated to be released in Q1 of 2023, the Company will continue to release assay results from the summer drill program as they become available.

BDF22-002 Highlights

- The hole was drilled to a depth of 452 m and intersected two broad zones of Ni-Cu-Co sulphide bearing mineralization totalling 175.15 m of composite thickness (Table 1) including:

- 121.20 m grading 1.36% NiEq. or 4.07% CuEq. (123.80 to 245.0 m)

- Including 10.10 m at 2.78% NiEq. or 8.31% CuEq. (134.1 to 144.20 m)

- Including 21.00 m at 3.21% NiEq. or 9.59% CuEq. (152.5 to 173.5 m)

- Including 10.50 m at 1.76% NiEq. or 5.27% CuEq. (207.5 to 218.0 m)

- Best drillhole intersection to date on the HPM Property, drilled 120 m along strike to the north of HPM-08-003, the previous best hole which intersected 52.15 m grading 2.04% NiEq. (1.52% Ni, 0.79% Cu, 0.08% Co starting at 74.45m)

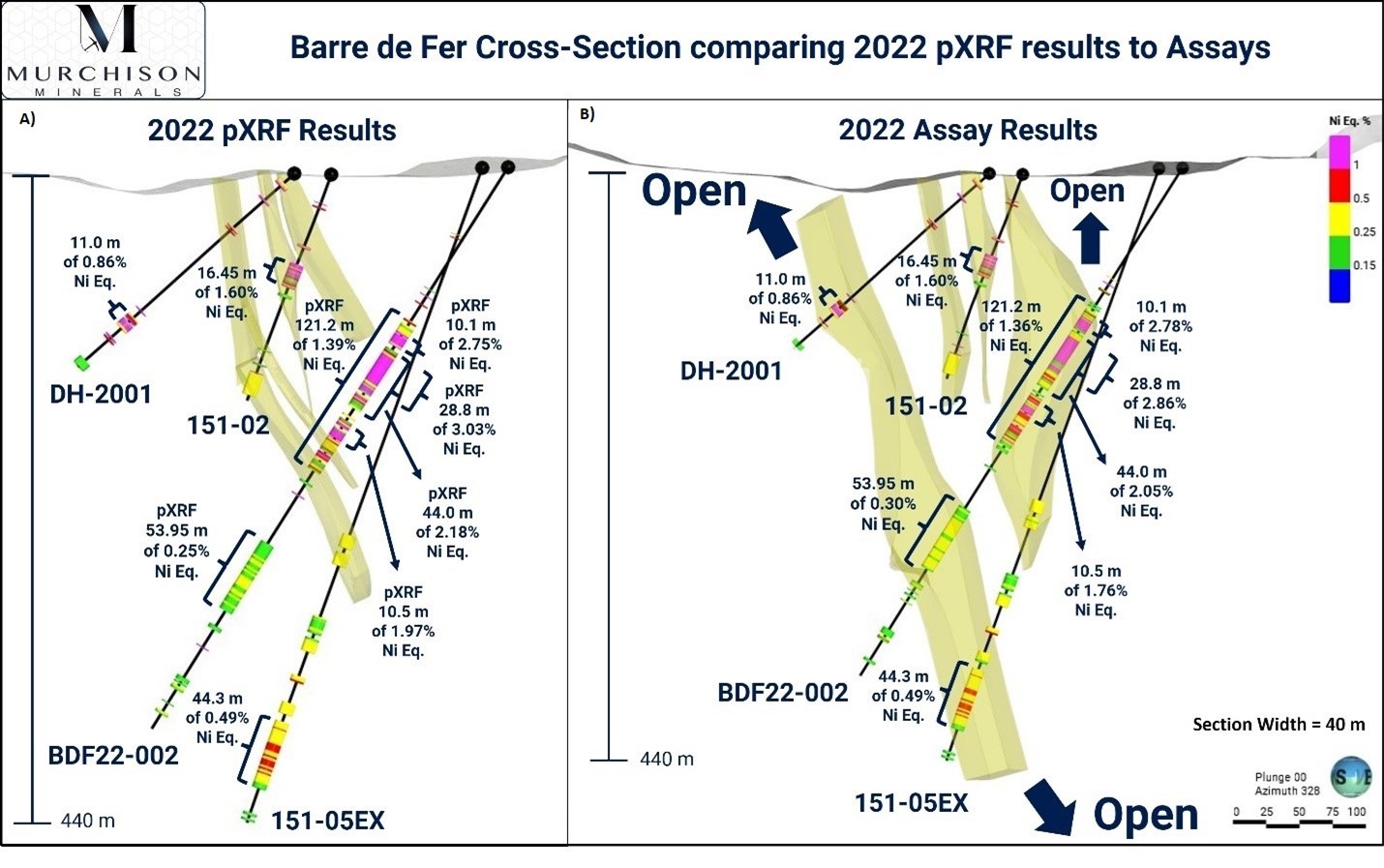

- The hole successfully confirmed mineralization approximately 85 m downdip from DH-151-02 and approximately 55 m up dip of DH-151-05EX

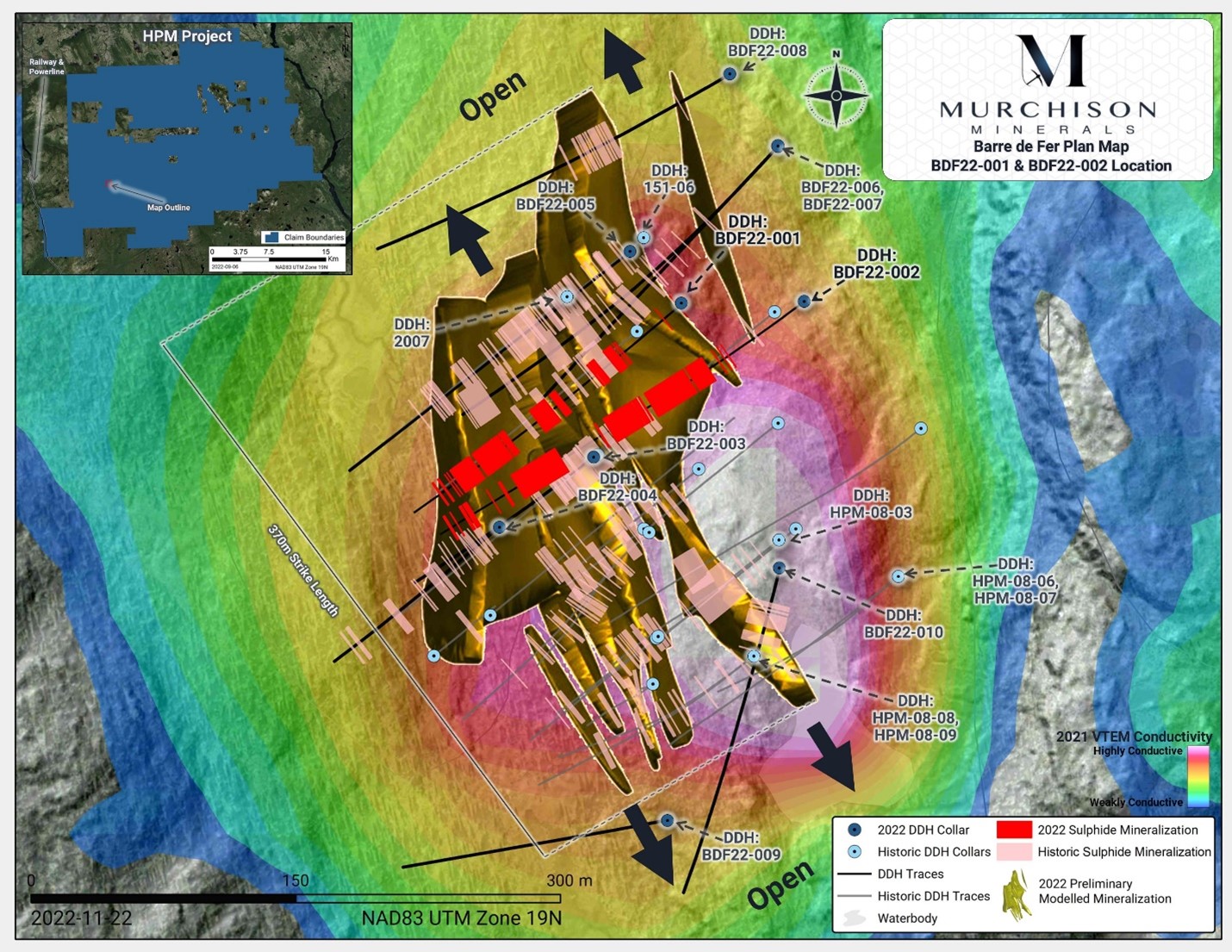

- The bulk of the mineralization was intersected outside of the previously modelled zone (Figure 1 & 2)

- Results continue to show a strong correlation between previously released pXRF results and lab assays (Table 2)

Table 1: BDF22-002 Assay Results

Hole | ? | From (m) | To (m) | Length* (m) | Ni % | Cu % | Co % | NiEq. %** | CuEq. %** |

BDF22-002 | 123.8 | 245 | 121.20 | 1.02 | 0.56 | 0.07 | 1.36 | 4.07 | |

Includes | 134.1 | 144.2 | 10.10 | 2.08 | 1.17 | 0.14 | 2.78 | 8.31 | |

Includes | 152 | 196 | 44.00 | 1.58 | 0.71 | 0.11 | 2.05 | 6.14 | |

Including | 152 | 180.8 | 28.80 | 2.21 | 0.99 | 0.15 | 2.86 | 8.55 | |

Including | 152.5 | 173.5 | 21.00 | 2.45 | 1.22 | 0.16 | 3.21 | 9.59 | |

Including | 177.05 | 180.8 | 3.75 | 2.85 | 0.57 | 0.19 | 3.45 | 10.30 | |

Includes | 207.5 | 218 | 10.50 | 1.30 | 0.80 | 0.09 | 1.76 | 5.26 | |

303.55 | 357.5 | 53.95 | 0.22 | 0.10 | 0.02 | 0.30 | 0.88 |

* Reported as core length, true thickness is not known. **Nickel Equivalent (NiEq.) & Copper Equivalent (CuEq.) values were calculated using the following USD metal prices from Sept 12, 2022: $10.84/lb Nickel, $3.63/lb Copper, and $23.56/lb Cobalt.

Table 2: BDF22-002 NiEq. pXRF Comparison to Lab Assay Results

Hole | From (m) | To (m) | Length (m)* | pXRF NiEq. %** | Assay NiEq. %** | |

BDF22-002 | 123.8 | 245 | 121.20 | 1.39 | 1.36 | |

Includes | 134.1 | 144.2 | 10.10 | 2.75 | 2.78 | |

Includes | 152 | 196 | 44.00 | 2.18 | 2.05 | |

Including | 152 | 180.8 | 28.80 | 3.03 | 2.86 | |

Including | 152.5 | 173.5 | 21.00 | 3.43 | 3.21 | |

Including | 177.05 | 180.8 | 3.75 | 3.43 | 3.45 | |

Includes | 207.5 | 218 | 10.50 | 1.97 | 1.76 | |

303.55 | 357.5 | 53.95 | 0.25 | 0.30 |

* Reported as core length, true thickness is not known. **Nickel Equivalent (NiEq.) & Copper Equivalent (CuEq.) values were calculated using the following USD metal prices from Sept 12, 2022: $10.84/lb Nickel, $3.63/lb Copper, and $23.56/lb Cobalt. NiEq.% was calculated using Ni%+((Cu Price/Ni Price) *Cu %)+((Co Price/Ni Price) *Co %). CuEq.% was calculated using Cu%+((Ni Price/Cu Price)* Ni %)+((Co Price/Cu Price)*Co %).

Figure 1: Location map of Barre de Fer, showing drillhole BDF22-002 & BDF22-001

Figure 2: Barre de Fer Zone Cross-Section. A) Displays Preliminary Nickel Mineralization Model (April 2022) and pXRF results from BDF22-002. B) Displays Preliminary Nickel Mineralization Post 2022 Summer Exploration program with assay results from BDF22-002

Murchison Minerals President and CEO Troy Boisjoli comments:

"Today's results speak for themselves, BDF22-002 is one of the top nickel-sulphide intersections made at a pre-resource project globally over the last several years. These results demonstrate the significance of the BDF Zone and overall potential of the HPM Project, which is a clearly one of the few new emerging nickel-sulphide districts globally. Our HPM Project is developing at a time when worldwide nickel demand is slated to increase significantly over the coming years. The opportunity is compounded for Murchison by the fact there is significant pre-existing infrastructure like a maintained highway, rail, and available hydropower all within kilometers of our site. Those fundamentals, along with the fact the Government of Quebec is implementing a vertically integrated critical minerals strategy have us very excited about the future."

Murchison Minerals Vice-President of Exploration John Shmyr comments:

"The scale of mineralization observed in BDF22-002 is exceptional and confirms BDF is part of a major magmatic nickel sulphide mineralizing system. The results from BDF22-002 are significant milestone for the Company and demonstrate that we are only scratching the surface of the exploration potential at the HPM property. The team is eagerly progressing on the maiden resource at the BDF Zone, and today's results will be a substantial contributor to that initial resource estimate."

BDF22-002 Mineralization

The mineralization observed in BDF22-002 occurs within two separate zones. The upper zone comprises multi-metre intervals of massive and breccia sulphide within zones of stringer and disseminated sulphide mineralization hosted in peridotite and gabbronorite (Figure 3 & 4).

The lower zone of mineralization (303.55 m to 357.50 m) comprises primarily disseminated sulphide, over a broad 53.95m wide zone hosted within a gabbronorite.

The sulphide mineralization consists of pyrrhotite with granular pentlandite and chalcopyrite loops with pentlandite. The massive sulphide mineralization is predominantly hosted in a dark, moderately serpentinized peridotite and lesser olivine gabbronorites and a dark, fine grained norite. The primary magmatic sulphide mineral textures coupled with the development of disseminated sulphide mineralization and magmatic breccias indicate that the mineralization is similar to chonolith style deposits like Voisey's Bay. Work progresses to define the stratigraphic controls of the intrusive rocks on the distribution of massive, breccia, and disseminated sulphide types; these controls will guide future exploration in the extension and discovery of additional mineral zone along strike and at depth.

Table 3: 2022 Drill Campaign Assay Results to Date

Hole | ? | From (m) | To (m) | Length* (m) | Ni % | Cu % | Co % | NiEq. %** | CuEq. %** |

BDF22-001 | 89.95 | 108 | 18.05 | 1.44 | 0.44 | 0.10 | 1.86 | 5.00 | |

Includes | 96.5 | 108 | 11.5 | 1.98 | 0.56 | 0.13 | 2.53 | 6.80 | |

Includes | 97.8 | 105.9 | 8.1 | 2.69 | 0.69 | 0.18 | 3.41 | 9.16 | |

122 | 132.85 | 10.85 | 0.29 | 0.24 | 0.03 | 0.44 | 1.18 | ||

180.5 | 189 | 8.5 | 0.62 | 0.37 | 0.05 | 0.88 | 2.36 | ||

196.5 | 219.2 | 22.7 | 0.23 | 0.11 | 0.02 | 0.32 | 0.85 | ||

267 | 336.9 | 69.9 | 0.50 | 0.23 | 0.04 | 0.68 | 1.83 | ||

Includes | 283.4 | 299.5 | 16.1 | 0.92 | 0.43 | 0.07 | 1.26 | 3.38 | |

BDF22-002 | 123.8 | 245 | 121.2 | 1.02 | 0.56 | 0.07 | 1.36 | 4.07 | |

Includes | 134.1 | 144.2 | 10.1 | 2.08 | 1.17 | 0.14 | 2.78 | 8.31 | |

Includes | 152 | 196 | 44 | 1.58 | 0.71 | 0.11 | 2.05 | 6.14 | |

Including | 152 | 180.8 | 28.8 | 2.21 | 0.99 | 0.15 | 2.86 | 8.55 | |

Including | 152.5 | 173.5 | 21 | 2.45 | 1.22 | 0.16 | 3.21 | 9.59 | |

Including | 177.05 | 180.8 | 3.75 | 2.85 | 0.57 | 0.19 | 3.45 | 10.30 | |

Includes | 207.5 | 218 | 10.5 | 1.30 | 0.80 | 0.09 | 1.76 | 5.26 | |

303.55 | 357.50 | 53.95 | 0.22 | 0.10 | 0.02 | 0.30 | 0.88 |

Table 4: Drillhole Information

Hole | Easting | Northing | Elevation (m) | Depth (m) | Azimuth (°) | Dip (°) |

BDF22-001 | 614922 | 5722901 | 886 | 404 | 229 | -61 |

BDF22-002 | 614991 | 5722902 | 891 | 452 | 233 | -57 |

Figure 3: Massive sulphide mineralization in BDF22-002 at 135.70 m to 180.80 m.

Figure 4: Zoom in on Massive Sulphide in BDF22-002 displaying observable pentlandite (nickel sulphide) and chalcopyrite (copper sulphide) with pyrrhotite (iron sulphide) mineralization.

2022 Summer Diamond Drilling

During the 2022 summer exploration program at HPM , a total of thirteen (13) diamond drillholes were completed, comprising 4,316 metres. This includes ten (10) drill holes at BDF, and an additional three (3) holes at Syrah. The pXRF results for the ten holes drilled at BDF were previously released and lab assays are pending for the remaining eleven (11) holes.

Today's release of lab assay results from BDF22-002 as well as the previously released assay results from BDF22-001 validate the rigorous Direct Rock Sampling (DRS) Portable X-Ray Fluorescence (pXRF) process that the Company developed in advance of the 2022 Summer Exploration Program. The DRS process allowed the Company to produce near laboratory quality results in the field. In turn, this process enabled the Company to model zones of mineralization in real time, creating a dynamic exploration process which was unaffected by laboratory delays faced by many industry peers.

QA/QC

Murchison has implemented and is adhering to a strict Quality Assurance/Quality Control program. NQ-size core was drilled, and mineralized intervals were marked by geologists during core description. The marked intervals were sampled using a core saw, one-half is kept as a witness sample at core facility in Saguenay, Quebec and the other assigned a unique number and placed within a plastic bag. The specific gravity of every 10th sample was measured using the mass-in-air / mass-in-water method. Samples were shipped directly to SRC Geoanalytical Labs in Saskatoon, Saskatchewan. The samples were ground and prepared for analysis by the lab using total digestion. Analyzes were performed using ICP-OES for nickel, copper, and cobalt. Every 25th sample sent to the lab was a field duplicate (quarter core), blanks and certified reference material were also submitted approximately every 25th sample.

Qualifying Statement

The foregoing scientific and technical disclosures on the HPM Project have been reviewed by John Shmyr, P.Geo., VP Exploration, a registered member of the Professional Engineers and Geoscientists of Saskatchewan and current holder of a special authorization with the Ordre des Géologues du Québec. Mr. Shmyr is a Qualified Person as defined by National Instrument 43-101. The Qualified Person has verified the data disclosed in this release, including sampling, analytical and test data underlying the information contained in this release. Mr. Shmyr consents to the inclusion in the announcement of the matters based on his information in the form and context in which it appears.

Some data disclosed in this News Release relating to sampling and drilling results is historical in nature. Neither the Company nor a qualified person has yet verified this data and therefore investors should not place undue reliance on such data. In some cases, the data may be unverifiable due to lack of drill core. Mineralization hosted on adjacent and/or nearby and/or geologically similar properties is not necessarily indicative of mineralization hosted on the Company's properties.

About Murchison Minerals Ltd. (TSXV: MUR, OTCQB: MURMF)

Murchison is a Canadian-based exploration company focused on nickel-copper-cobalt exploration at the 100% - owned HPM Project in Quebec and the exploration and development of the 100% - owned Brabant Lake zinc-copper-silver project in north-central Saskatchewan. The Company also holds an option to earn 100% interest in the Barraute VMS exploration project also located in Quebec, north of Val d'Or. Murchison currently has 218.2 million shares issued and outstanding.

Additional information about Murchison and its exploration projects can be found on the Company's website at www.murchisonminerals.ca. For further information, please contact:

Troy Boisjoli, President and CEO,

Erik H Martin, CFO, or

Justin LaFosse, Director Corporate Development

Tel: (416) 350-3776

info@murchisonminerals.com

CHF Capital Markets

Thomas Do, IR Manager

Tel: (416) 868-1079 x 232

thomas@chfir.com

Forward-Looking Information

The content and grades of any mineral deposits at the Company's properties are conceptual in nature. There has been insufficient exploration to define a mineral resource on the property and it is uncertain if further exploration will result in any target being delineated as a mineral resource.

Certain information set forth in this news release may contain forward-looking information that involves substantial known and unknown risks and uncertainties. This forward-looking information is subject to numerous risks and uncertainties, certain of which are beyond the control of the Company, including, but not limited to, the impact of general economic conditions, industry conditions, and dependence upon regulatory approvals. FLI herein includes, but is not limited to: future drill results; stakeholder engagement and relationships; parameters and methods used with respect to the assay results; the prospects, if any, of the deposits; future prospects at the deposits; and the significance of exploration activities and results. FLI is designed to help you understand management's current views of its near- and longer-term prospects, and it may not be appropriate for other purposes. FLI by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such FLI. Although the FLI contained in this press release is based upon what management believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders and prospective purchasers of securities of the Company that actual results will be consistent with such FLI, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such FLI. Except as required by law, the Company does not undertake, and assumes no obligation, to update or revise any such FLI contained herein to reflect new events or circumstances, except as may be required by law. Unless otherwise noted, this press release has been prepared based on information available as of the date of this press release. Accordingly, you should not place undue reliance on the FLI or information contained herein. Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in FLI. Assumptions upon which FLI is based, without limitation, include: the ability of exploration activities to accurately predict mineralization; the accuracy of geological modelling; the ability of the Company to complete further exploration activities; the legitimacy of title and property interests in the deposits; the accuracy of key assumptions, parameters or methods used to obtain the assay results; the ability of the Company to obtain required approvals; the results of exploration activities; the evolution of the global economic climate; metal prices; environmental expectations; community and nongovernmental actions; and any impacts of COVID-19 on the deposits, the Company's financial position, the Company's ability to secure required funding, or operations. Risks and uncertainties about the Company's business are more fully discussed in the disclosure materials filed with the securities regulatory authorities in Canada, which are available at www.sedar.com. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Murchison Minerals Ltd.

View source version on accesswire.com:https://www.accesswire.com/729160/Murchison-Minerals-Confirms-Extensive-High-Grade-Nickel-Sulphide-Mineralization-at-the-HPM-Property-with-Assays-Returning-1212-metre-Interval-at-136-NiEq-or-407-CuEq-Including-210-metre-at-321-NiEq-or-959-CuEq