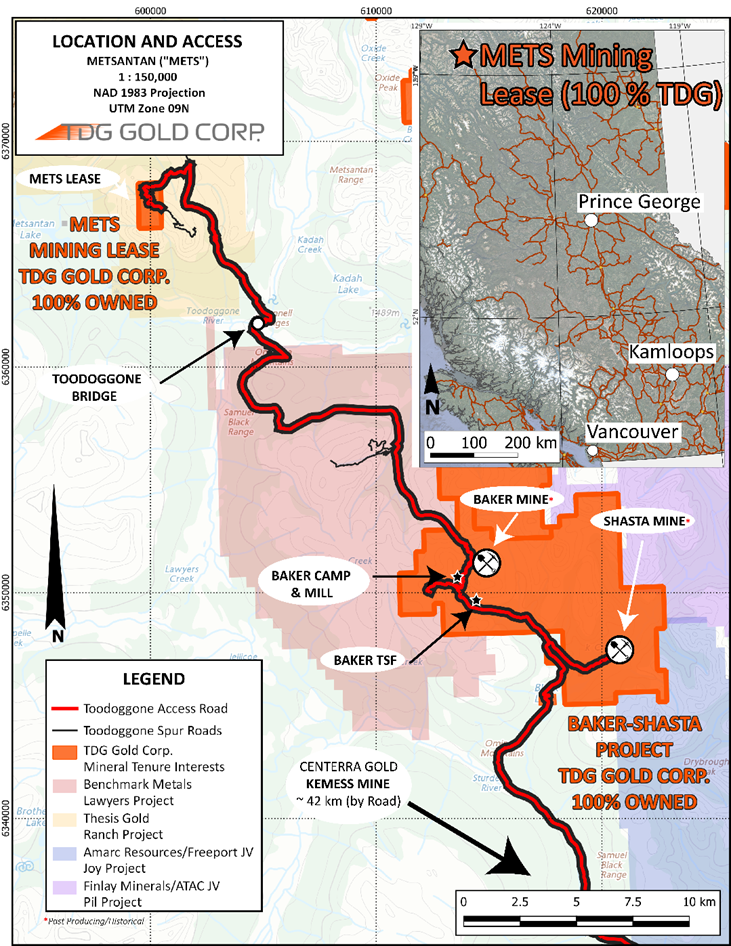

WHITE ROCK, BC / ACCESSWIRE / December 21, 2022 / TDG Gold Corp (TSXV:TDG) (the "Company" or "TDG") is pleased to present the Exploration Target Range ("ETR") for the Mets mining lease in the Toodoggone District of north-central British Columbia. Mets is located approximately 23 kilometres ("km") northwest of TDG's former producing Baker mine and mill which is road accessible via TDG's Baker mine road and the newly constructed bridge over the Toodoggone River (Figure 1). The Mets mining lease was recently renewed for a term of 30 years with support of First Nations and local communities.

The ETR size ranges from 593,000 ounces gold ("Au") contained in 1.29 million tonnes ("Mt") at 14.29 grams per tonne ("g/t") gold ("Au") using a 3.00 g/t cut off grade ("COG") to 642,000 oz Au contained in 1.07 Mt at 18.59 g/t Au using a 5.00 g/t COG (Table 1).

Figure 1 - Location of the Mets Lease & Access Road through Baker Mine in the Toodoggone District.

On November 01, 2022, TDG recovered the complete data and information archive of the exploration and development work at Mets between 1986-92, including original laboratory assay certificates, underground development schematics, historical ore reserve calculations and mine development progress reports. Over 350 metres ("m") of underground development took place at Mets in 1992, including a portal and decline to the historically defined mineralized horizon contained within the A-Zone. However, no extraction or processing is recorded to have taken place. This information and the results of more recent geophysical studies form the basis of the ETR within this news release.

Table 1 - Exploration Target Range* at Mets.

Tonnage: | 1.07 - 1.29 Mt |

Gold Grade: | 14.29 - 18.59 g/t |

Metal Content: | 593,000 - 642,000 oz |

Cut-off Grade: | 3.0 - 5.0 g/t |

*The Exploration Target Range is based on historical assay data and has not undergone statistical analysis to determine if an appropriate grade capping methodology should be applied and is thus uncapped for Au concentrations.

Mets is an early-stage exploration project and does not contain any mineral resources as defined by NI 43-101. The potential quantities and grades disclosed herein are conceptual in nature and there has been insufficient exploration to define a mineral resource for the targets disclosed herein. It is uncertain if further exploration will result in these targets being delineated as a mineral resource. The Company's Qualified Person has not done sufficient work to classify the ETR at Mets as a current mineral reserve or mineral resource. The Company is not treating the ETR as a current mineral resource and the exploration target range should not be relied upon.

The process of assessing the Mets ETR uses quantitative and qualitative approaches that integrate historical drillhole, geological, geophysical, and underground data with reasonable assumptions based on geological potential and deposit type model. Tonnage and grade ranges have been determined by using the geometry of the potential mineralized horizon defined by historical drilling and downhole assay data and extrapolated with reasonable geological assumptions based on surficial geological, geochemical and geophysical data.

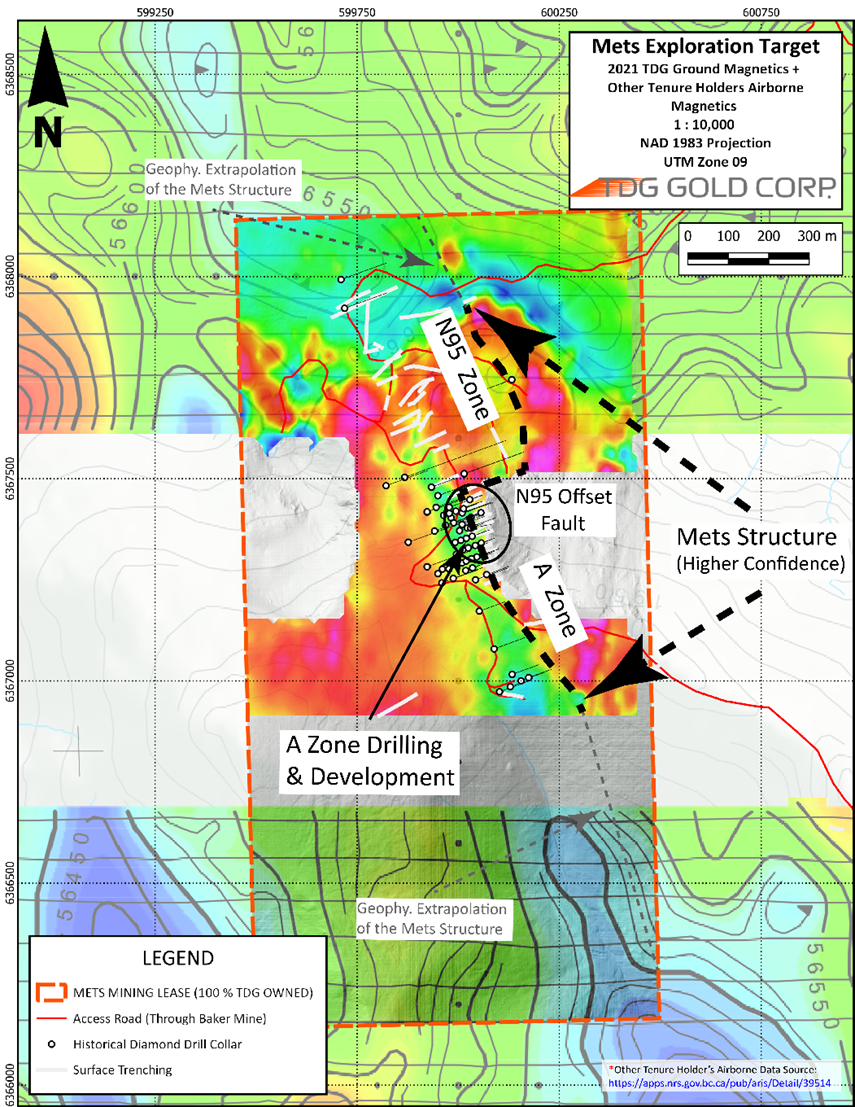

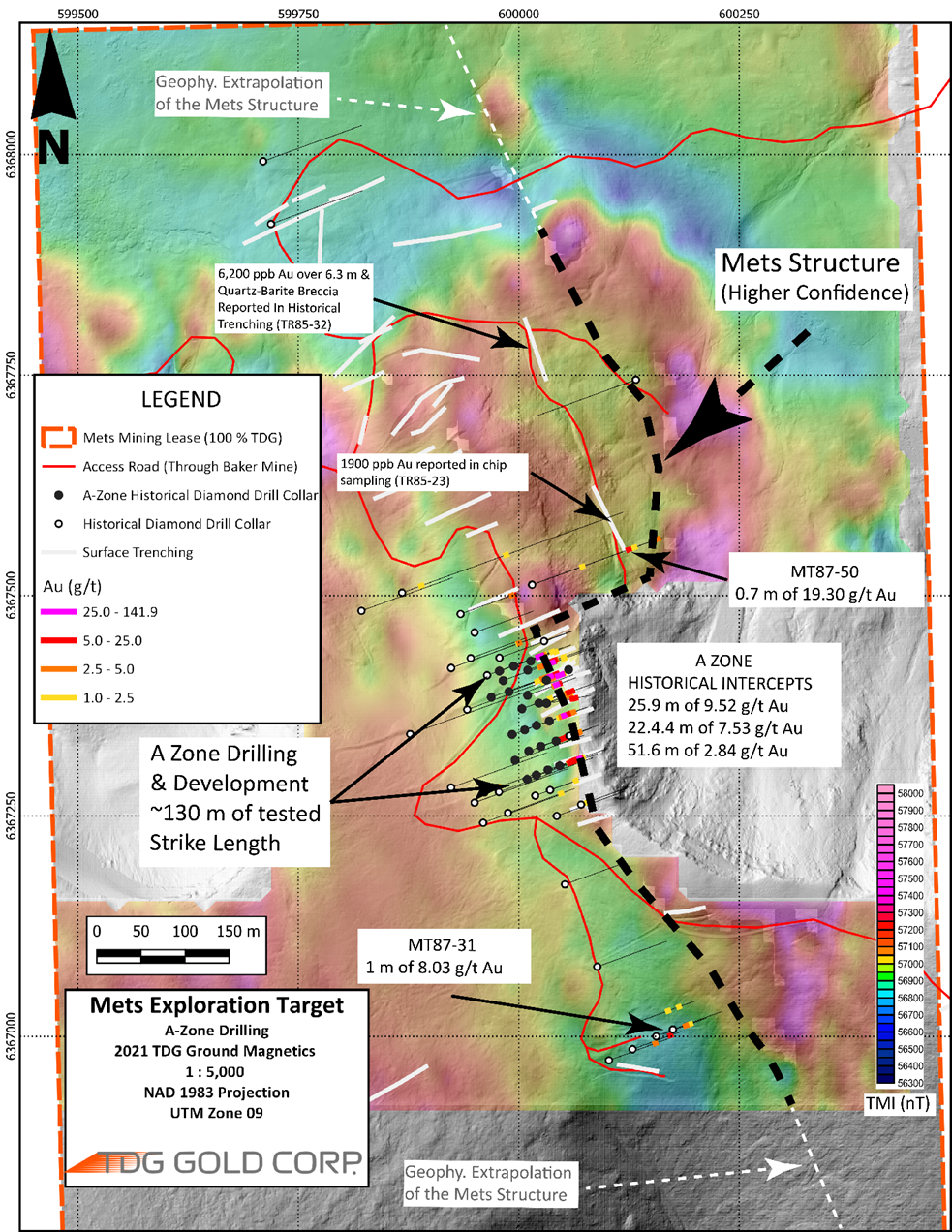

The Mets ETR is delineated along a strong magnetic lineament (the Mets Structure) defined by high resolution ground and airborne geophysical surveys, coincident with surface mineralization, alteration and geological mapping. These coincident features are interpreted to strike the entire length of the Mets property for approximately 2,240 m (Figure 2). Approximately 1,195 m of strike length of the Mets Structure is classified by TDG as 'higher confidence' for the purposes of ETR calculation and which has received over 8,240 m of historical drilling and 2,600 m of trenching (Figures 3). Historical drilling was focused on the A-Zone which includes approximately 130 m of strike length that intercepted high grade gold mineralization and was the focus of pre-mining development work in 1992.

The Mets historical drill database of the A Zone intersections compiled to date comprises approximately 850 m of assayed core of the approximately 2,450 m drilled in 27 diamond drill holes of NQ or BQ size.

Using a 3.00 g/t Au COG, an average intercept length of 5.53 m, was determined at an average grade of 14.29 g/t Au; using a 5.00 g/t COG, average intercept length of 4.60 m at an average grade of 18.59 g/t Au. In all scenarios, a vertical extent of mineralization was calculated to be approximately 75 m (topographically adjusted). Approximately 10 % of assay intercepts used in the analysis imply a nugget effect in precious metal concentrations. Applying a standard grade capping methodology using 98 percentile Au and 99 percentile Ag (50 g/t Au, 10 g/t Ag) would be expected to reduce the overall grade by approximately 20-30 %.

Steven Kramar, TDG's Vice President, Exploration commented: "The compilation of the Mets historical data indicates mineralization correlates well with a strong magnetic NW-SE trending structural lineament. The opportunity for TDG is therefore to expand upon the high-grade component of this gold dominated mineralization. The project is well located and accessible by road and covered by a 30-year mining lease."

Figure 2 - Mets Exploration Target (Mets Structure) Showing 2,240 m of Potential Strike Length.

Figure 3 - A Zone Drilling and Development along the Mets Structure; Potential Strike Length is Determined to be Approximately 1,195 m.

The Mets mining lease is underlain by a succession of subaerial volcanic and volcaniclastic rocks, stratigraphically termed the "Toodoggone Formation" comprising andesitic and dacitic compositions and associated epiclastic rocks. The Mets Structure is a quartz-barite breccia that appears to track the geological contact between tuffaceous dacite (footwall) and potassium porphyritic andesite (hanging wall). The alteration envelope of the Mets Structure is strong silicification and/or bleaching of the host rocks proximal to the structure and advanced argillic/propylitic distal halo. Mineralization in the breccia is Au dominant, Ag subordinate (i.e., high Au/Ag ratio) occurring as free gold grains along margins of quartz and/or barite grains and trace amounts of electrum, argentite and tetrahedrite.

Data was sourced from historical records recovered by TDG that included collar locations, drill logs and assay certificates. Analytical work was undertaken by a third-party laboratory and the ETR is based on results from independent laboratories. A more comprehensive table of significant historical intercepts from the A-Zone was released on October 19, 2022 (link).

Qualified Person

The technical content of this news release has been reviewed and approved Steven Kramar, MSc., P.Geo., Vice President, Exploration for TDG Gold Corp., a qualified person as defined by National Instrument 43-101.

This news release includes historical information that has been reviewed by the Company's geological team and qualified person. The Company's review of the historical records and information reasonably substantiate the validity of the information presented in this news release; however, the Company cannot directly verify the accuracy of the historical data, including the procedures used for sample collection and analysis. There is insufficient exploration on these prospects to define a mineral resource. It is uncertain if after additional exploration a mineral resource will be delineated. Therefore, the Company encourages investors to exercise appropriate caution when evaluating these results.

About TDG Gold Corp.

TDG is a major mineral claim holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG's flagship projects are the former producing, high grade gold-silver Shasta, Baker and Mets mines, which are all road accessible, produced intermittently between 1981-2012, and have over 65,000 m of historical drilling. The projects have been advanced through compilation of historical data, new geological mapping, geochemical and geophysical surveys, and at Shasta, drill testing of the known mineralization occurrences and their extensions. An initial NI 43-101 Mineral Resource Estimate was published for Shasta in May 2022, while additional extensional and new target areas surrounding the project have been identified and prioritized for future drill programs.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information contact:

TDG Gold Corp.,

Telephone: +1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements that are based on the Company's current expectations and estimates. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in ore grade or recovery rates; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

SOURCE: TDG Gold Corp.

View source version on accesswire.com:https://www.accesswire.com/732758/TDG-Gold-Corp-Announces-Exploration-Target-Range-for-Mets-Mining-Lease