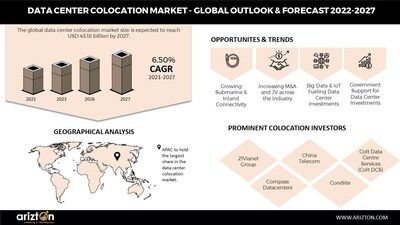

CHICAGO, Jan. 10, 2023 /PRNewswire/ -- According to Arizton's latest research report, the global data center colocation market will grow at a CAGR of 6.5% from 2021 to 2027. The data center colocation market is appealing, with data centers providing higher returns on investment (ROI) than other commercial and industrial properties. The data center colocation market in the Americas is a growing market with an increasing presence of local and global data center operators, especially in countries such as the US, Canada, Brazil, Mexico, Chile, and Colombia. Other emerging markets in 2021 included Argentina, Peru, and others. The demand for data centers grew significantly due to the pandemic, with the major workforce shifting to remote working. The demand for colocation services led to a strong use of existing data center space, and service providers' revenue grew by over 10% in those two quarters.

Several governments across the countries and regions provide tax incentives and support to investors looking to invest in the data center colocation market; such measures attract more operators to invest in the industry. In North America, especially in the US, several state governments offer various incentives to data center operators. For instance, Virginia provides tax incentives for the facility's equipment that meets the capital investment and employment requirements. Over the past decade, Amazon Web Services received over USD 4.7 billion in subsidies from the federal and state governments to build offices, data centers, call centers, and other facilities.

Global Data Center Colocation Market Report Scope

Report Attributes | Details |

Market by Colocation Investment (2027) | USD 43.18 Billion |

CAGR (2021-2027) | 6.5 % |

Market Size - Area (2027) | 30.48 million Square Feet |

Market Size - Power Capacity (2027) | 5,860 MW |

Market by Colocation Revenue (2027) | 68.7 |

Base Year | 2021 |

Forecast Year | 2022-2027 |

Market Segments | Colocation Service, Infrastructure, Electrical Infrastructure, Mechanical Infrastructure, Cooling Systems, Cooling Technique, General Construction, Tier Standard, and Geography |

Regions Covered | APAC, North America, Western Europe, Nordic, Central Eastern Europe, Middle East, Africa, Latin America, and Southeast Asia |

Countries Covered | The US, Canada, Brazil, Mexico, Chile, Other Latin American Countries, the UK, Germany, France, Ireland, Switzerland, Italy, Netherlands, Spain, Belgium, Portugal, Other Western European Countries, Sweden, Denmark, Norway, Finland & Iceland, Russia, Poland, Austria, Other Central & Eastern European Countries, the UAE, Saudi Arabia, Israel, Other Middle Eastern Countries, South Africa, Kenya, Other African Countries, China, Southeast Asia, Japan, Australia, India, South Korea, Hong Kong, New Zealand, the Rest of APAC, Taiwan, Singapore, Malaysia, Indonesia, Vietnam, Thailand, Philippines, and Other Southeast Asian Countries |

Vendors | Prominent Colocation Investors: 21Vianet Group, China Telecom, Colt Data Centre Services (Colt DCS), Compass Datacenters, CoreSite, CyrusOne, Digital Realty, EdgeConneX, Equinix, GDS Services, Global Switch, Iron Mountain, NTT Global Data Centers, QTS Realty Trust, STACK Infrastructure, ST Telemedia Global Data Centres (STT GDC), and Vantage Data Centers Other Prominent Vendors: 3data, 365 Data Centers, Africa Data Centres, AirTrunk, Aligned, American Tower, AQ Compute, Aruba, Atman, atNorth, AT TOKYO, BDx (Big Data Exchange), Bulk Infrastructure, Bridge Data Centres, CDC Data Centres, Chayora, China Mobile, Chindata, CloudHQ, Cologix, COPT Data Center Solutions, CtrlS Datacenters, Cyxtera Technologies, DATA4, DataBank, DC BLOX, Element Critical, ePLDT, eStruxture Data Centers, fifteenfortyseven Critical Systems Realty (1547), Flexential, Green Mountain, H5 Data Centers, HostDime, KDDI, Keppel Data Centres, LG Uplus, maincubes one, MainOne (Equinix), Millicom, NEXTDC, ODATA, Orange Business Services, Prime Data Centers, Princeton Digital Group (PDG), Proximity Data Centres, Raxio Group, Rostelecom Data Centers, Sabey Data Centers, Scala Data Centers, Sify Technologies, Skybox Datacenters, Stream Data Centers, SUNeVision, Switch, T5 Data Centers, Tenglong Holdings Group, Teraco (Digital Realty), TierPoint, Turkcell, Urbacon Data Centre Solutions, Wingu, Yondr, and Yotta Infrastructure (Hiranandani Group) New Entrants: Adani Group, AtlasEdge, AUBix, Cirrus Data Services, ClusterPower, DaSTOR, Data Center First, EDGNEX, EdgeX Data Centers, Enovum Data Centers, ESR Cayman, Global Technical Realty, Hickory, Infinity, Mantra Data Centers, Novva Data Centers, Open Access Data Centres (OADC), PointOne, Quantum Loophole, Quantum Switch, Stratus DC Management, YCO Cloud, YTL Data Center, and ZeroPoint DC (NEOM) |

Page Number | 995 |

Customization Request | If our report does not include the information you are searching for, you may contact us to have a report tailored to your specific business needs https://www.arizton.com/customize-report/3596 |

Click Here to Download the Free Sample Report

The construction of data centers continues to grow substantially, leading service providers to invest more than $1 billion in new development and expansions. The rise in demand across several industries has led data center suppliers to sign several M&A contracts to expand their portfolios. The data center market is also interested in the acquisition of data centers by real estate and investment firms. This acquisition is followed by expansion, leading to the market's strong growth. Most investments will be extremely focused on the edge data center market, with unexpected demand from current and new clients in data centers. In April 2021, CapitaLand, a real estate group, acquired a data center campus from AVIC Trust with an investment of around $564.5 million. The campus consists of around four buildings holding a power capacity of around 55 MW and an IT area of around 807,000 square feet.

The remote working and online shopping trends have propelled the demand for data centers during the COVID-19 pandemic. Organizations operating across sectors, such as IT services, BFSI, hospitals, and education, initiated remote working for their employees. The strict lockdown imposed by the government to control the spread of the virus has resulted in heightened access to internet-related services. During COVID-19, even government agencies adopted cloud-based services, wherein the confidential data of the state is stored securely.

Colocation service providers also witness high demand for cloud connectivity solutions in the region. Moreover, in countries that are likely to be aided by the growth in the internet backbone and colocation facilities, cloud connectivity solutions are expected to grow during the forecast period. Internet-based service providers that include social media applications have prompted them to expand their operations across major Europe, APAC, and North America by constructing hyperscale data centers. Cloud service providers have also increased their wholesale colocation data center spaces by expanding regional operations. The data center market in cloud service adoption is led by the UK, Germany, France, the Netherlands, and Ireland, with locations such as Switzerland, Italy, and Spain in the initial stages of cloud service adoption.

Click Here to Download the Free Sample Report

24+ New Entrants in the Data Center Colocation Market

Prominent Colocation Investors

- 21Vianet Group

- China Telecom

- Colt Data Centre Services (Colt DCS)

- Compass Datacenters

- CoreSite

- CyrusOne

- Digital Realty

- EdgeConneX

- Equinix

- GDS Services

- Global Switch

- Iron Mountain

- NTT Global Data Centers

- QTS Realty Trust

- STACK Infrastructure

- ST Telemedia Global Data Centres (STT GDC)

- Vantage Data Centers

Other Prominent Vendors

- 3data

- 365 Data Centers

- Africa Data Centres

- AirTrunk

- Aligned

- American Tower

- AQ Compute

- Aruba

- Atman

- atNorth

- AT TOKYO

- BDx (Big Data Exchange)

- Bulk Infrastructure

- Bridge Data Centres

- CDC Data Centres

- Chayora

- China Mobile

- Chindata

- CloudHQ

- Cologix

- COPT Data Center Solutions

- CtrlS Datacenters

- Cyxtera Technologies

- DATA4

- DataBank

- DC BLOX

- Element Critical

- ePLDT

- eStruxture Data Centers

- fifteenfortyseven Critical Systems Realty (1547)

- Flexential

- Green Mountain

- H5 Data Centers

- HostDime

- KDDI

- Keppel Data Centres

- LG Uplus

- maincubes one

- MainOne (Equinix)

- Millicom

- NEXTDC

- ODATA

- Orange Business Services

- Prime Data Centers

- Princeton Digital Group (PDG)

- Proximity Data Centres

- Raxio Group

- Rostelecom Data Centers

- Sabey Data Centers

- Scala Data Centers

- Sify Technologies

- Skybox Datacenters

- Stream Data Centers

- SUNeVision

- Switch

- T5 Data Centers

- Tenglong Holdings Group

- Teraco (Digital Realty)

- TierPoint

- Turkcell

- Urbacon Data Centre Solutions

- Wingu

- Yondr

- Yotta Infrastructure (Hiranandani Group)

New Entrants

- Adani Group

- AtlasEdge

- AUBix

- Cirrus Data Services

- ClusterPower

- DaSTOR

- Data Center First

- EDGNEX

- EdgeX Data Centers

- Enovum Data Centers

- ESR Cayman

- Global Technical Realty

- Hickory

- Infinity

- Mantra Data Centers

- Novva Data Centers

- Open Access Data Centres (OADC)

- PointOne

- Quantum Loophole

- Quantum Switch

- Stratus DC Management

- YCO Cloud

- YTL Data Center

- ZeroPoint DC (NEOM)

Market Segmentation

Colocation Service

- Retail Colocation

- Wholesale Colocation

Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- General Construction

Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgear

- Power Distribution Units

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Economizers & Evaporative Coolers

- Other Cooling Units

Cooling Technique

- Air-based Cooling Technique

- Liquid-Based Cooling Technique

General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression

- Physical Security

- DCIM/BMS

Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

Geography

- North America

- US

- Canada

- Latin America

- Brazil

- Mexico

- Chile

- Other Latin American Countries

- Western Europe

- UK

- Germany

- France

- Ireland

- Switzerland

- Italy

- Netherlands

- Spain

- Belgium

- Portugal

- Other Western European Countries

- Nordics

- Sweden

- Denmark

- Norway

- Finland & Iceland

- Central & Eastern Europe

- Russia

- Poland

- Austria

- Other Central & Eastern European Countries

- Middle East

- UAE

- Saudi Arabia

- Israel

- Other Middle Eastern Countries

- Africa

- South Africa

- Kenya

- Other African Countries

- APAC

- China

- Southeast Asia

- Japan

- Australia

- India

- South Korea

- Hong Kong

- New Zealand

- Rest of APAC

- Taiwan

- Southeast Asia

- Singapore

- Malaysia

- Indonesia

- Vietnam

- Thailand

- Philippines

- Other Southeast Asian Countries

Check Out Some of the Top-Selling Related Research Reports:

Data Center Colocation Market in Americas - The Americas data center colocation market is estimated to reach USD 10.58 billion by 2027 from USD 7.75 billion in 2021. The growth in the market is driven by the deployment and advancement of 5G, growth in the application of Artificial Intelligence, Smart city development, renewable energy procurement, adoption of IoT, and Big data.

Europe Data Center Colocation Market - The Europe data center colocation market is estimated to reach USD 11.75 billion by 2027 from USD 8.20 billion in 2021. The market will see the continuous adoption of cloud services among SMEs, with the heightened interest shown towards the digital transformation of businesses by adopting solutions such as IoT, big data, and artificial intelligence, attracting more investments into the Europe data center colocation market.

Middle East and Africa Data Center Colocation Market - The Middle East and Africa data center colocation market is estimated to reach USD 2.61 billion by 2027 from USD 1.58 billion in 2021. Some of the significant factors that are acting as a factor for the growth of the data center colocation market in the Middle East & Africa include increased digitalization initiatives across several countries, cloud service providers colocating the data centers, growth in connectivity, and others.

APAC Data Center Colocation Market - The APAC data center colocation market size by investment was valued at USD 12.06 billion in 2021 and is expected to reach USD 18.23 billion by 2027. APAC is the fastest-growing region, with increased investments from global and local colocation data center operators worldwide. With the construction of additional data centers, local colocation providers in each country also increase their presence, thus boosting market growth.

About Us:?

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.?

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.?

Click Here to Contact Us?

Call: +1-312-235-2040?

????????? +1 302 469 0707?

Mail: enquiry@arizton.com

Photo: https://mma.prnewswire.com/media/1980612/Data_Center_Colocation_Market.jpg

Logo: https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/apac-gains-tremendous-dominance-in-the-data-center-colocation-spaces-the-investment-in-data-center-colocation-to-reach-usd-43-billion-in-2027---arizton-301717834.html

View original content:https://www.prnewswire.co.uk/news-releases/apac-gains-tremendous-dominance-in-the-data-center-colocation-spaces-the-investment-in-data-center-colocation-to-reach-usd-43-billion-in-2027---arizton-301717834.html