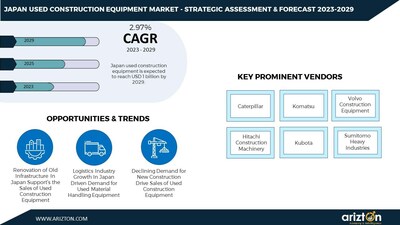

CHICAGO, Jan. 13, 2023 /PRNewswire/ -- According to Arizton's latest research report, the Japan used construction equipment market is estimated to witness the sale of around 50,455 units by 2029. Investment is planned for redevelopment & urban planning in Tokyo city in 2022. The government is also investing in redevelopment projects in western Japan'sKansai and Kinki areas. In 2022, the government announced a ~USD 407 billion stimulus package to offset rising fuel and grain prices caused by the war in Ukraine. The government has also planned to invest USD 113.9 billion till 2030 for the development of renewable energy industry. USD 33.5 billion in funds are allocated for the decarbonization of power sources, and investment is also planned for decarbonization in the manufacturing industry and research & development of the renewable energy industry. Such growth enablers by the country's government have played a key role in supporting Japan used construction equipment market growth.

Growth in e-commerce and logistics industries in Japan prompts the demand for warehouses. Logistics companies are investing over $6 billion in expanding their centers across Japan. According to the ministry of economy, trade & industry, the logistics industry is expected to grow on average of 8% for the next five years. Some major logistics projects are Logiport Nagoya, Kobe Nagata logistics center & LF Nara facilities in the Ikoma region. Hence, growth in logistics & e-commerce industries expect to have positive impact on the demand for used forklifts & telescopic handlers in Japan. By 2029, used forklift and telescopic handlers segment value in Japan is estimated to reach $169.3 million.

Market Size and Forecast are Projected in:

- Value ($ Billion)

- Volume (Units)

Japan Used Construction Equipment Market Report Scope

Report Attributes | Details |

Market Size (2029) | USD 1 BILLION |

Market Size (2022) | USD 814.6 MILLION |

CAGR (2022-2029) | 2.97 % |

Market Size (Volume) | 50,455 Units (2029) |

Historic Year | 2020-2021 |

Base Year | 2022 |

Forecast Year | 2023-2029 |

Type | Earthmoving Equipment, Road Construction Equipment, and Material Handling Equipment |

End-Users | Construction, Manufacturing, Mining, and Others |

Key Vendors | Key Vendors: Caterpillar, Komatsu, Volvo Construction Equipment, Hitachi Construction Machinery, Kubota, Sumitomo Heavy Industries, Kobelco, SANY, Liebherr, AND Hyundai Construction Machinery Other Prominent Vendors: Yanmar, Takeuchi Manufacturing, Tadano, and Toyota Material Handling Auctioneers Profile: Ritchie Bros. Auctioneers, NORI Enterprise Co, Ltd, Hitachi Construction Machinery, TOZAI BOEKI CO. LTD, and YANAGAWA SHOJI Co LTD. Distributors Profiles: WWB KENKI, Chukyo Juki Ltd, and Tokuworld Corporation Corp |

Page Number | 118 |

Customization Request | If our report does not include the information you are searching for, you may contact us to have a report tailored to your specific business needs https://www.arizton.com/customize-report/3620 |

Click Here to Download the Free Sample Report

Key Highlights

- The Earthmoving segment has the largest share of Japan used construction equipment market. The excavators held the largest share in the earthmoving segment in 2022.

- In 2021, the country's government planned to invest USD 708 billion in economic recovery. The investment is directed at the development of public infrastructure & digital technology. Investment is also planned for Expo 2025 in the Osaka region of the country. The government is investing in renewable energy projects to reduce carbon emissions by 46% by 2030.

- Japan is facing the challenge of aging infrastructure. More than 50% of roads, bridges & tunnels will be older than 50 years by 2033. Therefore, the government increases its focus on repairing and maintaining roadways, highways & bridges. The rise in repair and redevelopment is expected to drive sales of used earthmoving equipment in Japan used construction equipment market.

- Growth in the logistics industry due to the growing demand for goods in the global and domestics market supports the demand for used forklifts & telehandlers in Japan used construction equipment market. The country's export witnessed a sharp rise of 21.5% in 2021. Moreover, it is anticipated that using robotics & automation in the manufacturing industry will temporarily solve the labor shortage issue- and it is estimated that the industry will witness a 2.4% growth in output in 2022.

- The country witnessed a surge in warehouse space across the country in 2021. The country's E-commerce and logistics industry growth triggers the demand for large warehouse spaces in major cities. Growth in the logistics & E-commerce industry is expected to positively impact the demand for used forklifts & telescopic handlers in Japan used construction equipment market.

- The demand for new generation used excavators with ICT and remote monitoring technology is gaining market share in Japan. Skilled labor shortage & rising accident cases at construction sites prompt the use of automated used construction equipment in Japan.

- In 2021, demand for used forklifts witnessed high growth in Japan used construction equipment market due to the rise in the E-Commerce sector. Used hydraulic excavators are used for disaster management projects in the country. In 2022, Hitachi Construction Machinery Japan signed 83 disaster agreements with local municipalities to provide equipment for disaster response & recovery in Japan.

Click Here to Download the Free Sample Report

Key Vendors

- Caterpillar

- Komatsu

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Kubota

- Sumitomo Heavy Industries

- Kobelco

- SANY

- Liebherr

- Hyundai Construction Machinery

Other Prominent Vendors

- Yanmar

- Takeuchi Manufacturing

- Tadano

- Toyota Material Handling

Auctioneers Profile

- Ritchie Bros. Auctioneers

- NORI Enterprise Co, Ltd

- Hitachi Construction Machinery

- TOZAI BOEKI CO. LTD

- YANAGAWA SHOJI Co LTD.

Distributors Profiles

- WWB KENKI

- Chukyo Juki Ltd

- Tokuworld Corporation Corp

Market Segmentation

Type

- Earthmoving Equipment:

- Excavator

- Backhoe Loaders

- Motor Graders

- Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers)

- Material Handling Equipment

- Crane

- Forklift & Telescopic Handlers

- Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

- Road Construction Equipment

- Road Rollers

- Asphalt Pavers

- End Users

- Construction

- Manufacturing

- Mining

- Others

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers innovative research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.?

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.?

Click Here to Contact Us?

Call: +1-312-235-2040?

????????? +1 302 469 0707?

Mail: enquiry@arizton.com

Photo: https://mma.prnewswire.com/media/1982426/Japan_Used_Construction_Equipment_Market.jpg

Logo: https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/more-than-50k-units-of-used-construction-equipment-to-be-sold-in-japan-by-2029-surge-in-increased-financing-boosting-the-growth--arizton-301720390.html

View original content:https://www.prnewswire.co.uk/news-releases/more-than-50k-units-of-used-construction-equipment-to-be-sold-in-japan-by-2029-surge-in-increased-financing-boosting-the-growth--arizton-301720390.html