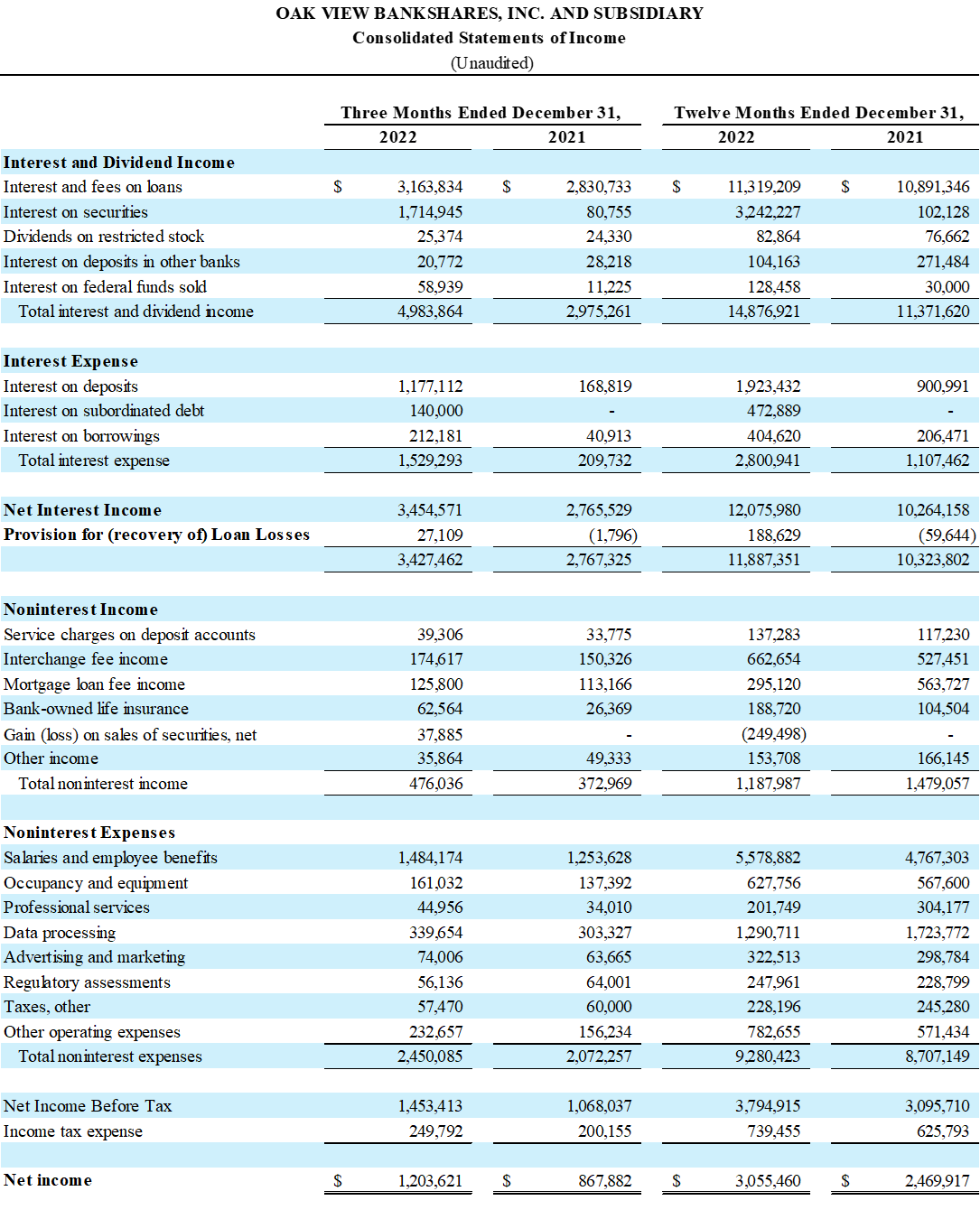

WARRENTON, VA / ACCESSWIRE / January 25, 2023 / Oak View Bankshares, Inc. (the "Company") (OTC Pink:OAKV), parent company of Oak View National Bank (the "Bank"), reported net income of $1.20 million for the quarter ended December 31, 2022, compared to net income of $868,000 for the quarter ended December 31, 2021, an increase of 38.68%. Basic and diluted earnings per share for the fourth quarter were $0.41 compared to $0.29 per share for the fourth quarter of 2021.

Net income for the twelve months ended December 31, 2022, was $3.06 million, compared to $2.47 million for the twelve months ended December 31, 2021, an increase of 23.71%. Basic and diluted earnings per share for the twelve months ended December 31, 2022, were $1.03 compared to $0.84 for the twelve months ended December 31, 2021.

On January 19, 2023, the Board of Directors of the Company declared an annual dividend of $0.10 per share to shareholders of record as of the close of business on January 30, 2023, payable on February 6, 2023.

Selected Highlights:

- Return on average assets was 1.02% and return on average equity was 17.64% for the quarter ended December 31, 2022, compared to 1.01% and 12.19%, respectively, for the quarter ended December 31, 2021. Return on average assets was 0.75% and 0.78% and return on average equity was 11.73% and 8.98% for the twelve months ended December 31, 2022, and 2021, respectively.

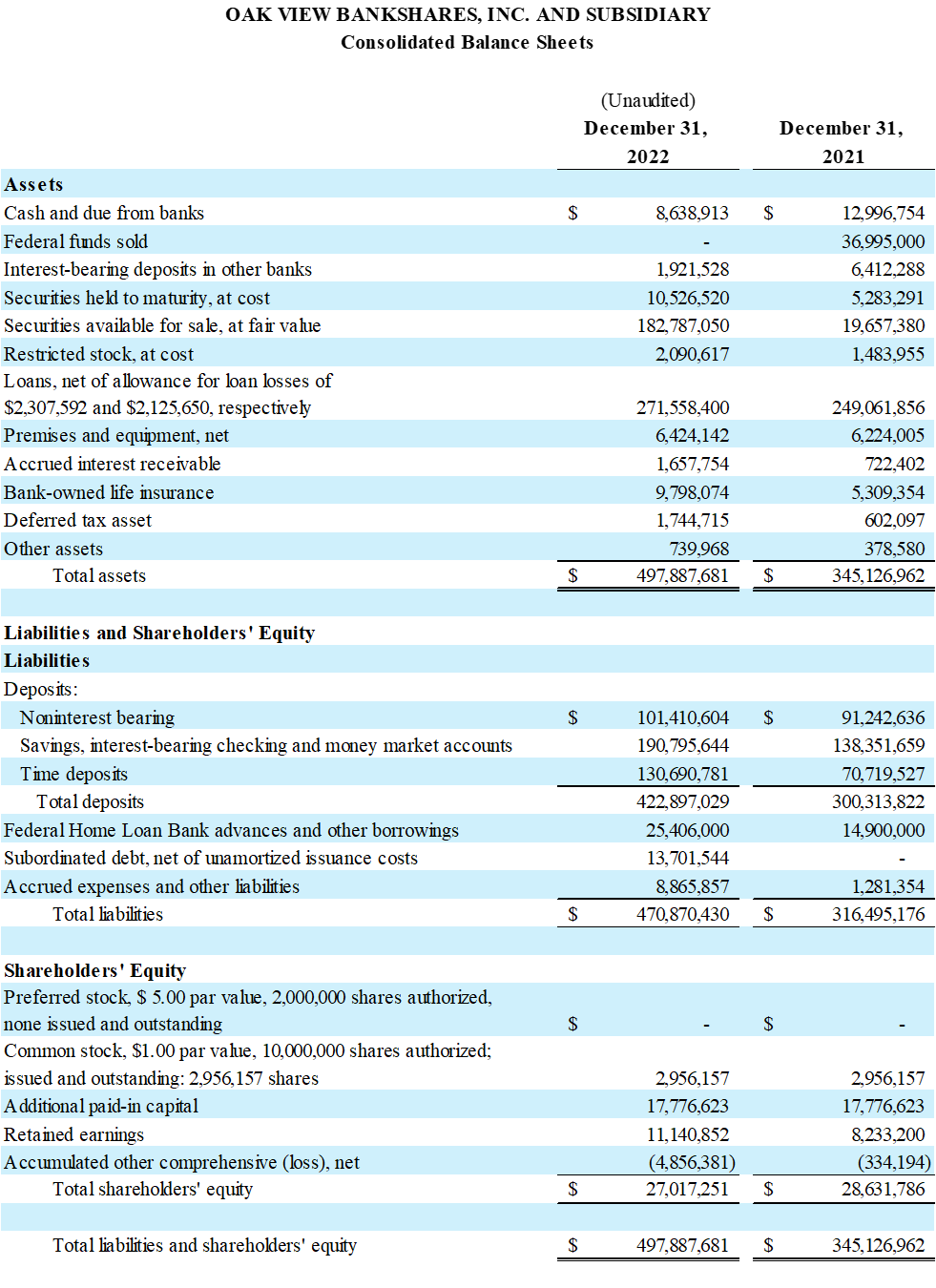

- Total assets were $497.89 million on December 31, 2022, compared to $345.13 million on December 31, 2021.

- Total loans were $273.87 million on December 31, 2022, compared to $251.19 million on December 31, 2021.

- The investment portfolio increased to $193.31 million on December 31, 2022, compared to $24.94 million on December 31, 2021.

- Total deposits were $422.90 million on December 31, 2022, compared to $300.31 million on December 31, 2021.

- Credit quality continues to be outstanding. There were no nonperforming loans as of December 31, 2022.

- Regulatory capital remains strong with ratios exceeding the "well capitalized" thresholds in all categories.

Michael Ewing, CEO and Chairman of the Board said, " This was a phenomenal year for our Company. We began the year by finalizing a proactive subordinated debt issuance which fortified our capital foundation, allowing us to pursue increased deposit market share. Deposits were deployed into loans and securities, with a greater proportion in securities as demand for well-priced and well-structured loans tempered." Mr. Ewing continued, "Management constantly evaluates the most efficient way to deploy the capital entrusted to it, with the aim of striking the optimal balance among safety and soundness, profitability and growth. Our strong liquidity and capital profiles will allow us to continue building franchise value."

Mr. Ewing concluded, "We are very happy to share our success with shareholders by doubling the annual dividend over the prior year year, while retaining an appropriate capital cushion to support our strategic objectives."

Net Interest Income

The net interest margin was 3.10% for the quarter ended December 31, 2022, compared to 3.35% for the fourth quarter of 2021, respectively. Year to date net interest margin was 3.29%, compared to 3.37% for the twelve months ended December 31, 2021.

Net interest income was $3.45 million for the quarter ended December 31, 2022, compared to $2.77 million for the quarter ended December 31, 2021. Net interest income was $12.08 million and $10.26 million for the twelve months ended December 31, 2022, and 2021, respectively.

Interest income increased $2.01 million and $3.51 million for the quarter and twelve months ended December 31, 2022, respectively, as a result of increased investment opportunities to deploy capital into investments with attractive risk and return characteristics and increased loan income due primarily to the higher interest rate environment.

Interest expense increased $1.32 million and $1.69 million for the quarter and twelve months ended December 31, 2022, respectively. Increases in interest expense are primarily attributable to interest expense related to the issuance of subordinated debt in February 2022, interest expense paid on deposits resulting from increases in volume and in interest rates and interest expense paid on FHLB advances and other borrowings due to higher balances needed to deploy capital into higher yielding investment opportunities.

Noninterest Income

Noninterest income was $476,000 for the quarter ended December 31, 2022, compared to $373,000 for the quarter ended December 31, 2021. Debit card interchange fee income and mortgage loan fee income were the largest contributors of noninterest income. Debit card interchange fee income was $175,000 for the quarter, compared to $150,000 for the fourth quarter 2021. Mortgage loan fee income was $126,000 for the quarter, compared to $113,000 for the fourth quarter of 2021.

Year to date noninterest income was $1.19 million, compared to $1.48 million for the twelve months ended December 31, 2021. Debit card interchange fee income was $663,000 and $527,000 for the twelve months ended December 31, 2022, and 2021, respectively. Mortgage loan fee income was $295,000 and $564,000 for the twelve months ended December 31, 2022, and 2021, respectively.

During the third and fourth quarters, management sold investment securities and redeployed the proceeds into assets with more attractive risk and return characteristics. As part of the portfolio repositioning, the Company incurred year to date net losses on sales of securities of $250,000.

Noninterest Expense

Noninterest expense was $2.45 million for the quarter ended December 31, 2022, compared to $2.07 million for the fourth quarter of 2021. Year to date noninterest expense was $9.28 million, compared to $8.71 million for the twelve months ended December 31, 2021.

Salaries and employee benefits were the largest category of noninterest expense. Fourth quarter expenses related to salaries and benefits were $1.48 million for the quarter, compared to $1.25 million for the fourth quarter of 2021. Year to date salary and employee benefit expenses were $5.58 million compared to $4.77 million for the twelve months ended December 31, 2021. Salaries and employee benefits increased primarily related to newly added positions and taking advantage of growth opportunities in our markets.

Asset Quality

On December 31, 2022, the allowance for loan losses was $2.31 million or 0.84% of outstanding loans,net of unearned income, compared to $2.13 million or 0.85% of outstanding loans, net of unearned income, on December 31, 2021.

The provision for loan losses was $27,000 for the quarter ended December 31, 2022, compared to a recovery in the provision for loan losses of $2,000 for the quarter ended December 31, 2021. The provision for loan losses was $189,000 for the twelve months ended December 31, 2022, compared to a recovery in the provision for loan losses of $60,000 for the twelve months ended December 31, 2021.

Shareholders' Equity

Shareholders' equity was $27.02 million on December 31, 2022, compared to $28.63 million on December 31, 2021. Increases in retained earnings of $2.91 million were offset by the increase in unrealized losses in the available-for-sale investment portfolio of $4.52 million. The increase in unrealized losses on the available-for-sale investment portfolio was due to mark-to-market adjustments resulting from rising interest rates.

As of December 31, 2022, the Bank's regulatory capital ratios were 14.25% in Common Equity Tier 1 and Tier 1 Capital, 15.06% in Total Capital and 8.65% in Leverage Ratio. These ratios exceeded the "well capitalized" thresholds for the period.

About Oak View Bankshares, Inc. and Oak View National Bank

Oak View Bankshares, Inc. is the parent bank holding company for Oak View National Bank, a locally owned and managed community bank serving Fauquier, Culpeper, Rappahannock, and surrounding Counties. For more information about Oak View Bankshares, Inc. and Oak View National Bank, please visit our website at www.oakviewbank.com. Member FDIC.

For additional information, contact Tammy Frazier, Executive Vice President & Chief Financial Officer, Oak View Bankshares, Inc., at 540-359-7155.

SOURCE: Oak View Bankshares, Inc. VA

View source version on accesswire.com:https://www.accesswire.com/736734/Oak-View-Bankshares-Inc-Announces-Record-Earnings-for-2022-and-Doubles-Dividend