Positive PEA results support the Company's vision to increase production and processing capacity to 2,200 tpd

VANCOUVER, BC / ACCESSWIRE / February 14, 2023 / Silver X Mining Corp. (TSXV:AGX)(OTCQB:AGXPF)(F:WPZ) ("Silver X" or the "Company") announces positive results of a Preliminary Economic Assessment ("PEA") for the expansion of the Tangana Mining Unit ("Tangana"), the flagship asset within the Company's 100% owned Nueva Recuperada Silver District, which declared commercial production in January 2023. The PEA was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") prepared by LOM Consultants. All dollar amounts are in US dollars unless otherwise noted.

"The PEA shows the great growth potential of Tangana and supports the Company's vision to triple current production capacity over the next few years," stated José García, CEO and Interim Chairman of Silver X. "The objective is to have two milling facilities - a new mill at Tangana, as outlined in this PEA, along with the existing mill, which is currently producing from Tangana but that will in the future process mineral from Plata (formerly referred to as Esperanza) and other mineralized areas in the district. This PEA represents the first technical and economic evaluation of the deposit at Tangana, demonstrating a manageable initial capital cost for the new mill and multiple opportunities for project growth. We will continue to evaluate resource expansion at Tangana with the possibility of further synergies with nearby deposits and the proposed project infrastructure. We envision solid organic growth within our district-scale project, with the expectation of an increase in production capacity from 720 tonnes per day to 2220 tonnes per day by 2026."

Mr. García continued: "The updated resource estimate within the PEA also demonstrates remarkable success in upgrading resources at Tangana and clearly shows how effective exploration can be for the project. I believe that we might only be in the early stages of a much larger and profitable mining project."

PEA Highlights

- Upgraded Mineral Resources to 3.60Mt of Measured and Indicated ("M&I") Resources from 0.98Mt in the 2022 Mineral Resource Estimate and 11.89Mt of Inferred Resources from 14.94Mt with a new resource block model, representing 3X growth in M&I Resources when compared to the previous reported estimate.

- Life of Mine ("LOM") of 12 years at a capacity of 1,500 tonnes per day ("tpd") based on a resource inventory of 5.75Mt, of which 1.75Mt corresponds to Measured Resources, 0.49Mt corresponds to Indicated Resources and 3.51Mt corresponds to Inferred Resources.

- Average annual production of 4.2 million ounces ("Moz") of silver equivalent ("AgEq")1 with circa 5Moz AgEq mined.

- Robust economics with an After-Tax NPV of $175 million at 10% discount rate and After-Tax IRR of 39%.

- LOM Cash Costs of $8.8/oz AgEq and LOM All-In Sustaining Costs ("AISC")2 of $16.2/oz AgEq.

- Initial Capex of $61 million, including 20% contingency, for the new processing facility, dry-stacked tailings and mine development.

Silver X will host a webinar to discuss the PEA results in more detail. To register for the event, see "Upcoming Webinar" below.

PEA Financial Summary

| Parameter | Units | Values | |

| Net Present Value (10%) | Pre-Tax | $ Million | 227 |

| After-Tax | $ Million | 175 | |

| Internal Rate of Return (IRR) | Pre-Tax | % | 49 |

| After-Tax | % | 39 | |

| After-Tax Payback | Years | 4 | |

| Initial Capital | $ Million | 61 | |

| Sustaining Capital (including closure costs) | $ Million | 143 | |

| Total Cash Operating Cost | $/t | 53 | |

| Cash Costs (LOM) | $/oz AgEq | 8.8 | |

| AISC (LOM) | $/oz AgEq | 16.2 | |

| Long term Metal Prices | |||

Silver Gold Lead Zinc | $/oz $/oz $/lb $/lb | 22.56 1,746 0.93 1.25 | |

Notes:

- Base case price for all metals was assessed base on CIBC's consensus on prices Feb 2023.

- LOM includes 12 years, with year 1 at 246,000 tpa, years 2 to 11 at 540,00 tpa, and year 12 with 110,000 tpa.

- LOM mineral inventory combines measured, indicated and inferred resources.

- Cash Costs and AISC are non-GAAP financial performance measures with no standardized definition under IFRS; see additional disclosure under "Non-IFRS Measures".

- "Mineralized Material" represents mined material estimated to generate positive cash flows.

- "Mined" means total tonnes mined (mineralized + waste).

- Average ore value over the life of mine is $158.14/t.

- Average underground mining cost is approximately $24.14/t; processing cost is $16.95/t; overheads is $7.90/t, marketing and other costs are $3.73/t. Average total costs is $78/t.

- Opex include a 10% contingency. Mine contractor rates are current, including a 30% markup on basic unit prices.

- Revenues are calculated on existing terms and conditions for lead-silver-gold concentrates and zinc concentrates, including international benchmark for payability, treatment charges, refining charges, rollback, and penalties.

1 AgEq ounces were calculated based on all metals produced and mined using the estimated sales prices of each metal for each period.

2 Cash costs and AISC are non-IFRS financial ratios. These are based on non-IFRS financial measures that do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers. Please refer to the "Non-IFRS Measures" section of this press release for further information.

PEA Mining, Processing and Environmental and Social Impact Study

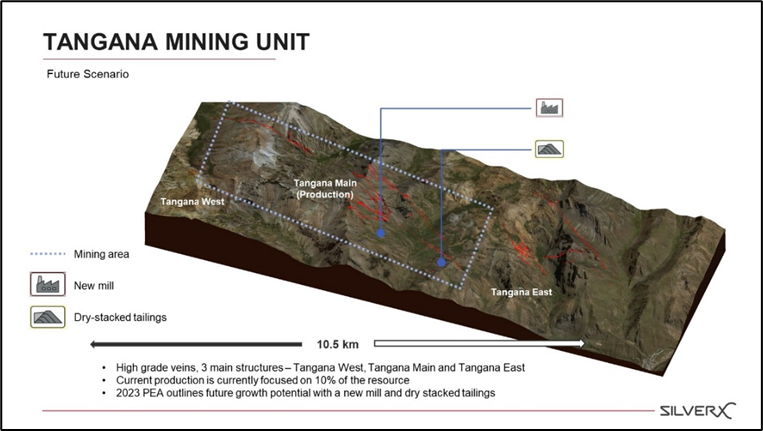

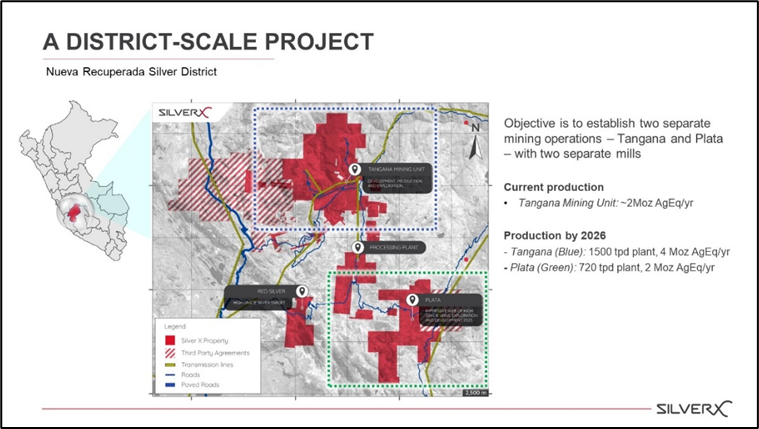

The goal for the Nueva Recuperada Silver District is to have two milling facilities: a new plant for the Tangana Mining Unit with a capacity of 1500 tpd as indicated in the PEA (see Figure 1) in addition to the current Nueva Recuperada mill of 720 tpd located 15 km south of Tangana and central to the other mineralized areas in the district (see Figure 2). The existing mill would be dedicated to processing minerals from the Company's Plata project and other mineralized areas.

Figure 1. Future scenario of Tangana Mining Unit outlined by the 2023 PEA with new mill and dry stacked tailings

Figure 2. The Nueva Recuperada Silver District will comprise two separate mining operations - Tangana and Plata

The Company is making progress on a new Environmental and Social Impact Assessment (ESIA) encompassing the above-described components. The Company expects to file the ESIA with SENACE (the National Service for Environmental Certification, Ministry Environment) within the first half of 2023 and the Company expects approval before the end of the year. Detailed information can be found in the Company's news release dated October 6, 2021, available on the Company's website at www.silverxmining.com.

Initial Capital Cost Estimate

The initial capital cost estimate has been developed to provide an estimate suitable for the PEA, including costs to design, procure, construct and commission the facilities.

| Initial Capital Expenditure | USD Million |

| Mine | $10.9 |

| Processing plant | $29.8 |

| Tailings and facilities | $6.9 |

| Camps and roads | $0.8 |

| EPCM & Owner's cost and studies | $2.8 |

| Total pre-contingency | $51.2 |

| Contingency | $9.7 |

| Total | $60.9 |

Notes:

- Capital costs estimate include a 20% contingency.

- Mine pre-production capital estimate includes six months of mine development.

- Processing facilities consist of a conventional crushing, grinding and flotation plant for primary sulphides.

- Tailings are assumed to be dry stacked, including a conventional dyke configuration.

- Capital estimate for processing equipment is approximately $9M, including an estimate for civil works, structures, piping, electric, etc. of $18.1M.

Nueva Recuperada Project Mineral Resource Estimate

Mineral Resources for the project have been updated within the 2023 PEA with a new block model. Mineral Resources at the Tangana Mining Unit are 27% in the M&I categories, reflecting the amount of drilling and geological data that have been completed in this area and demonstrates the high potential of further growth of Mineral Resources as well as conversion of Inferred Resources to M&I Resources.

Grades | Contained Metal | ||||||||||

Nueva Recuperada | Mt | Au | Ag | Pb | Zn | AgEq | Moz AgEq | Moz Ag | koz Au | kt Pb | kt Zn |

Measured 2 | 1.94 | 2.13 | 80.54 | 1.72 | 1.19 | 11.65 | 22.58 | 5.02 | 133.0 | 33.3 | 23.0 |

Indicated 3 | 1.66 | 0.96 | 56.78 | 1.46 | 1.44 | 7.82 | 12.95 | 3.02 | 51.2 | 24.2 | 23.8 |

Total M+I | 3.60 | 1.59 | 69.59 | 1.60 | 1.30 | 9.88 | 35.53 | 8.04 | 184.2 | 57.5 | 46.8 |

Total Inferred 4 | 11.89 | 0.31 | 152.50 | 1.72 | 1.79 | 9.88 | 117.52 | 58.31 | 119.0 | 204.1 | 213.3 |

Notes:

- The independent QP for the mineral resource estimate, as defined by NI 43-101, is David Heyl, P.Geo. The effective date is February 13, 2023.

- The estimate is reported for an underground, conventional cut and fill scenario.

- The mineral resource estimate includes two resource models: 1) A block model defined for the core of the resource, estimated through the drilling and mine development; geo-statistical method is the reverse of the distance; 2) a polygonal model for some of the inferred resources based on veins outcrops and surface sampling.

- The approximate cut-off grade applied to all resources is $60/t.

- These Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability.

- The Mineral Resource estimate follows CIM Definition Standards.

- The QPs of this PEA are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing, or other relevant issues that could materially affect the Mineral Resource estimate other than those disclosed in this NI 43-101 compliant Technical Report.

The current study only focuses on the Tangana Mining Unit and does not factor in the other resource areas with the project or the several untested exploration targets within the Nueva Recuperada Silver District. Additional exploration success at Tangana and the inclusion of other areas could have a significant influence on the size, value and timing of the overall development plan as we move forward.

Cautionary Statement Regarding PEA

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Preparation of the PEA

The PEA was prepared by the independent consultant, LOM Consultants, in accordance with NI 43-101 and has an effective date of February 8, 2023. The technical report relating to the PEA will be filed on SEDAR and posted to the Company's website within 45 days of this news release. The Company also engaged David Heyl (Qualified Person as defined by NI 43-101) for the supervision of the resource modeling.

As a result of this PEA, the Technical Report for the Nueva Recuperada project with an effective date of January 1, 2022, including the estimates of mineral resources contained therein, is no longer current and should not be relied upon by investors.

Qualified Person

Mr. A. David Heyl, B.Sc., C.P.G., who is a qualified person under NI 43-101, has reviewed and approved the technical content of this news release for Silver X. With over 35 years of field and upper management experience, Mr. Heyl has a solid geological background in generating and conducting exploration and mining programs for gold, rare earth metals, and base metals, resulting in several discoveries. Mr. Heyl has 20 years of experience in Peru. He worked for Barrick Gold, was the exploration manager for Southern Peru Copper, and spent over twelve years working in and supervising underground and open pit mining operations in the Americas.

Cautionary Note regarding Production without Mineral Reserves

The decision to commence production at the Nueva Recuperada Project and the Company's ongoing mining operations as referenced herein (the "Production Decision and Operations") are based on economic models prepared by the Company in conjunction with management's knowledge of the property and the existing estimate of inferred mineral resources on the property. The Production Decision and Operations are not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with the Production Decision and Operations, in particular: the risk that mineral grades will be lower than expected; the risk that additional construction or ongoing mining operations are more difficult or more expensive than expected; and production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis in accordance with NI 43-101.

Upcoming Webinar

The Company will host a webinar to discuss the results of the PEA in greater detail on Tuesday, February 21, 2023, at 1:00PM ET / 10:00AM PT. A Q&A will follow the presentation. To register visit: https://my.6ix.com/4QxgLB3t.

About Silver X Mining Corp.

Silver X is a Canadian silver mining company with assets in Peru. The Company's flagship asset is the Tangana silver, gold, lead and zinc project located in Huancavelica, Peru, 10 km north-northwest of the Nueva Recuperada polymetallic concentrate plant. Founders and management have a successful track record of increasing shareholder value. For more information visit our website at www.silverxmining.com.

ON BEHALF OF THE BOARD

José M. García

CEO and Interim Chairman

For further information, please contact:

Fiona Grant Leydier

Vice President, Investor Relations and Corporate Marketing

T: +1 604 831 8070

E: f.grant@silverxmining.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This press release contains forward-looking information within the meaning of applicable Canadian securities legislation ("forward-looking information"). Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain acts, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". All information contained in this press release, other than statements of current and historical fact, is forward looking information. Forward-looking information contained in this press release may include, without limitation, the results of the PEA, including the production, operating and other cost estimates, metal price assumptions, cash flow projections, metal recoveries, mine life projections and production rates for the Project and the Company's expectations regarding potential opportunities to build upon the PEA, the expected filing and approval of the ESIA, and the expected financial performance of the Company.

The following are some of the assumptions upon which forward-looking information is based: that general business and economic conditions will not change in a material adverse manner; demand for, and stable or improving price for the commodities we produce; receipt of regulatory and governmental approvals, permits and renewals in a timely manner; that the Company will not experience any material accident, labour dispute or failure of plant or equipment or other material disruption in the Company's operations at the Project and Nueva Recuperada Plant; the availability of financing for operations and development; the Company's ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; that the estimates of the resources at the Project and the geological, operational and price assumptions on which these and the Company's operations are based are within reasonable bounds of accuracy (including with respect to size, grade and recovery); the Company's ability to attract and retain skilled personnel and directors; and the ability of management to execute strategic goals.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the Company's annual and interim MD&As and in its public documents filed on www.sedar.com from time to time. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Non-IFRS Measures

The Company has included certain non-IFRS financial measures and ratios in this news release, such as Cash Costs and All-In Sustaining Costs ("AISC"). The Company believes that these measures, in addition to measures prepared in accordance with IFRS, provide investors an improved ability to evaluate the underlying performance of the Company. The non-IFRS measures and ratios are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These financial measures and ratios do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

SOURCE: Silver X Mining Corp.

View source version on accesswire.com:https://www.accesswire.com/739196/Silver-X-Announces-Preliminary-Economic-Assessment-for-the-Tangana-Mining-Unit-Expansion