2023: sustained like-for-like growth and new margin gains

- Record results in line with the targets recently raised: +12.5%(1) like-for-like growth in revenue and a 15.5% operating margin, up +40 basis points

- Outlook for 2023: sustained strong like-for-like growth of around +10%(1); further improvement in operating margin (up +20 basis points)

- 2025 targets confirmed, at more than €10 billion in revenue and a 16% operating margin

- A strong, enduring CSR commitment, reaffirmed in 2022 with new advances

Regulatory News:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230216005580/en/

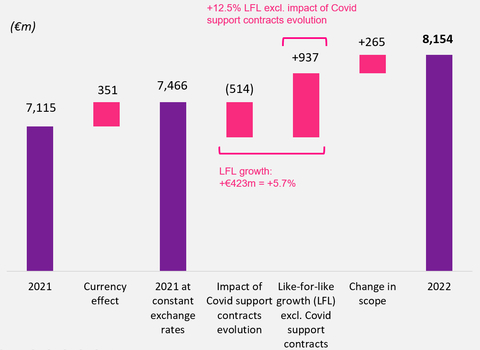

Analysis of 2022 revenue growth (Graphic: Teleperformance)

The Board of Directors of Teleperformance (Paris:TEP), a global leader in outsourced digital integrated business services, met today and reviewed the consolidated and parent company financial statements for the year ended December 31, 2022. The Group also announced its financial results for the year.

Robust growth and record margins

- Revenue: €8,154 million

Up +14.6% as reported

Up +12.5% like-for-like excluding Covid support contracts(1)

Up +5.7% like-for-like(2)

- EBITA before non-recurring items: Up 17.8 to €1,262 million (margin of 15.5%, up +40 bps)

- Net profit Group share: Up +15.8% to €645 million

- Dividend per share: Up +16.7% to €3.85(3)

- Net free cash flow: Up +6.3% to €703 million

Acquisition of PSG Global Solutions

- A leading provider of digital recruitment process outsourcing solutions in the United States

- Enhances the Group's leadership in its activities serving the US healthcare sector

- Strengthens the Group's digital recruitment practices, creating a significant competitive advantage at a time of scarce human resources.

A strong, enduring CSR commitment reaffirmed in 2022

- With more than 410,000 employees, development of an efficient and responsible hybrid organization, combining work-from-home and on-site solutions, with around 50% of employees now working remotely

- Ranked 11th in the world's Top 25 Best Workplaces by Fortune Magazine, in partnership with Great Place to Work®; Best Employer certification earned in 64 countries covering more than 97% of the total workforce

- Successful deployment of the wide-ranging action and communication plan in response to the unfounded polemics that emerged in the second half concerning ESG practices in the Group's content moderation activities in the United States and Colombia

- Signature of a global agreement with UNI reflecting a concerted commitment to improving the workplace environment

Outlook for 2023

- Around +10% like-for-like revenue growth (excluding Covid support contracts)

- More than +7%(2) like-for-like revenue growth

- A +20 basis-point increase in EBITA margin before non-recurring items, to 15.7%

- Further targeted acquisitions capable of creating value and strengthening high value-added businesses

Ahead of schedule in delivering the reaffirmed 2025 financial targets

- Revenue above €10 billion at constant scope of consolidation

- EBITA margin before non-recurring items of around 16%

(1) At constant scope of consolidation and exchange rates, excluding the impact of lower revenue from Covid support contracts (2) At constant scope of consolidation and exchange rates (3) Subject to shareholder approval at the next Annual General Meeting, to be held on April 13, 2023. The ex-dividend date would be on April 21, 2023 and the dividend would be paid on April 25, 2023

FINANCIAL HIGHLIGHTS

€ millions | 2022 | 2021 | % change |

€1=US$1.05 | €1=US$1.18 | ||

Revenue | 8,154 | 7,115 | +14.6% |

Like-for-like growth On a like-for-like basis, excluding Covid support contracts | +5.7% +12.5% | ||

EBITDA before non-recurring items | 1,750 | 1,478 | +18.4% |

of revenue | 21.5% | 20.7% | |

EBITA before non-recurring items | 1,262 | 1,071 | +17.8% |

of revenue | 15.5% | 15.1% | |

EBIT | 994 | 869 | +14.4% |

Net profit Group share | 645 | 557 | +15.8% |

Diluted earnings per share (€) | 10.80 | 9.36 | +15.4% |

Dividend per share (€) | 3.85* | 3.30 | +16.7% |

Net free cash flow | 703 | 661 | +6.3% |

* Subject to shareholder approval at the next Annual General Meeting, to be held on April 13, 2023

Commenting on this performance, Teleperformance Chairman and Chief Executive Officer Daniel Julien said: "2022 was a highly challenging year for the Group, but more importantly, it was a year of success and robust growth. Revenue rose by almost +15% as reported to amply exceed €8 billion for the year. Recurring like-for-like growth stood at +12.5%*, while operating margin improved by 40 basis points, in line with the raised targets issued in late November last year. Teleperformance once again delivered sustained growth in net profit, with a +16% increase. In an uncertain economic and geopolitical environment, this solid performance reflects the appeal and resilience of our business model, which is built on our positioning as the preferred global partner helping to drive the digital transformation of many digital economy leaders and large corporations in a wide range of client industries, as well as government agencies around the world.

The year also saw the acquisition of a leader in digital recruitment process outsourcing solutions in the United States, a move that fits seamlessly with our "TP Cube" growth strategy. It has enabled us to further strengthen our leadership in activities serving the US healthcare sector and our own digital recruitment practices. This represents a significant competitive advantage at a time of scarce human resources and fast-changing recruitment and hiring practices.

The Group's growth was not only robust, it was also responsible. With more than 410,000 employees in 91 countries, half of whom are currently working from home, workplace well-being and the continuous application of ESG best practices are absolute priorities for Teleperformance. This commitment was recognized by our ranking this year as no. 11 of more than 10,000 companies assessed in Fortune Magazine's Top 25 Best Workplaces in partnership with Great Place to Work®.

We therefore took very seriously the repeated and unfounded polemics in social and other media concerning our ESG practices, which triggered a sudden plunge in our stock price last November 10. We quickly deployed an action and communication plan to restore the confidence of the entire financial community, which included:

- Announcing, on November 11, a €150 million share buyback program to protect the interests of our shareholders,

- In the United States, launching an external audit by a world-class firm, confirming that there had been no legal or ethical violations in our content moderation activities,

- In Colombia, organizing a number of constructive meetings with the Colombian government leading to positive outcome, and commissioning an external audit by Bureau Veritas, which enabled the Group to receive independent assurance regarding use and inclusion of International Standard ISO 26000 -social responsibility- guidelines.

- Withdrawing from the highly egregious Trust Safety content moderation segment, to attenuate the perception risks associated with those activities,

- Signing a worldwide agreement with UNI Global Union.

The action plan was pursued in early 2023 with the organization of the TP Open Doors site visits on January 17 and 24 for investors and analysts in six countries on four continents. This unprecedented, wide-ranging transparency initiative enabled investors to form their own opinions by having 'seen and touched' the reality on the ground.

In late January 2023, the OECD National Contact Point acknowledged that its recommendations had been effectively applied, thereby ending its proceedings, while emphasizing the Group's proper performance of its duty of care.

In addition, on February 1, the Group released the results of an independent, worldwide survey of its content moderation employees worldwide by the Korn Ferry organizational consulting firm. The highly satisfactory findings rank Teleperformance very high in employee well-being among a sample of 600 companies.

Lastly, after Colombia, our content moderation employees and processes in six other countries were audited by Bureau Veritas, with findings released on February 13. Teleperformance received independent assurance regarding use and inclusion of International Standard ISO 26000 -social responsibility- guidelines in these countries.

In 2023, Teleperformance will continue to grow its business at a sustained pace and increase its margins. Over the year, it expects to deliver recurring like-for-like growth of around +10.0%* and a 20 basis-point improvement in margin. Well ahead of our roadmap, we are confirming our 2025 financial targets of at least €10 billion in revenue, excluding acquisitions, and a 16% EBITA margin."

* Excluding the impact of lower revenue from Covid support contracts

2022 REVENUE

Consolidated revenue

Revenue amounted to €8,154 million for the year ended December 31, 2022, representing a year-on-year increase of +5.7% at constant exchange rates and scope of consolidation (like-for-like) and of +14.6% as reported. Reported revenue was lifted by the +€351 million positive currency effect, stemming mainly from the rise in the US dollar against the euro. Changes in the scope of consolidation added €265 million, reflecting the consolidation of Health Advocate from July 1, 2021, Senture from January 1, 2022 and PSG Global Solutions from November 1, 2022.

Like-for-like growth in 2022 was particularly strong given the negative impact of lower revenue from Covid support contracts (down -€514 million compared with 2021). Adjusted for this expected non-recurring impact, like-for-like growth stood at +12.5% for the year.

This robust performance, in an uncertain economic and geopolitical environment, reflects the appeal and resilience of the Group's business model. Its global footprint and attractive offering of integrated solutions have positioned the Group as a preferred partner helping to drive the digital transformation of many digital economy leaders and large corporations in a wide range of client industries.

The Specialized Services activities also enjoyed sustained growth, led by the ongoing strong recovery of TLScontact's visa application management business and the steady development of LanguageLine Solutions' online interpreting business, particularly in the second half.

Fourth-quarter revenue amounted to €2,152 million, up +11.5% as reported, including a favorable currency effect, stemming primarily from the rise in the US dollar against the euro, and the positive impact of the first-time consolidation of Senture and PSG Global Solutions. Like-for-like growth, which came to +4.8% compared with fourth-quarter 2021, was reduced by almost 100 basis points due to the impact of hyperinflation in Argentina. This was a satisfactory performance given the absence of any material contribution from Covid support contracts during the quarter. Adjusted for this non-recurring impact, like-for-like growth stood at +10.8% for the period.

Revenue by activity

Preamble: new presentation by region

On October 1, 2022, Teleperformance introduced a new geographic organization aligned with the structure of its markets. This has led to a change in the Group's business segment reporting, which is based on regions. The breakdown of 2021 and 2022 revenue by quarter based on the new organization is provided in the Appendix.

Summary of differences between the former and current business reporting presentations

Former presentation by activity | Entities deleted (-) vs.

| Entities added (+) vs.

| New presentation by activity |

CORE SERVICES D.I.B.S.* | CORE SERVICES D.I.B.S.* | ||

English-speaking Asia-Pacific | United Kingdom | India | North America Asia-Pacific |

South Africa | |||

Ibero-LATAM | Spain | LATAM | |

Portugal | |||

Continental Europe MEA | Spain | Europe MEA (EMEA) | |

Portugal | |||

United Kingdom | |||

South Africa | |||

India | India | ||

SPECIALIZED SERVICES | SPECIALIZED SERVICES |

2022 | 2021 | % change | |||

€ millions | Like-for-like | Like-for-like

| Reported | ||

CORE SERVICES D.I.B.S.* | 6,989 | 6,295 | +3.8% | +11.7% | +11.0% |

North America Asia-Pacific | 2,679 | 2,039 | +11.3% | +11.3% | +31.3% |

LATAM | 1,653 | 1,358 | +15.4% | +15.4% | +21.8% |

Europe MEA (EMEA) | 2,657 | 2,898 | -7.7% | +10.2% | -8.3% |

SPECIALIZED SERVICES | 1,165 | 820 | +18.6% | +18.6% | +42.0% |

TOTAL | 8,154 | 7,115 | +5.7% | +12.5% | +14.6% |

* Digital Integrated Business Services

** Excluding the impact of lower revenue from Covid support contracts ("Covid contracts")

- Core Services Digital Integrated Business Services (D.I.B.S.)

Revenue amounted to €6,989 million in 2022, a year-on-year increase of +3.8% like-for-like. Reported growth came to +11.0%, with the difference versus like-for-like growth primarily attributable to the rise against the euro in the US dollar and, to a lesser extent, in most other currencies including the Brazilian real, the Indian rupee and the Mexican peso. In addition, reported growth includes the contribution of Senture, which has been consolidated in the Group's financial statements from January 1, 2022.

Excluding the impact of Covid support contracts, the Core Services D.I.B.S. activity delivered +11.7% growth on a like-for-like basis in 2022. This strong momentum is based in particular on the Group's robust and diversified client portfolio.

In the fourth quarter, Core Services D.I.B.S. revenue amounted to €1,829 million, up +2.8% like-for-like from the prior-year period. Excluding the impact of Covid support contracts, like-for-like growth was +9.7%.

- North America Asia-Pacific

Revenue totaled €2,679 million in 2022, representing a like-for-like increase of +11.3%. The reported increase of +31.3% was primarily attributable to favorable currency effects corresponding to the rise against the euro in the US dollar and, to a lesser extent, in the Indian rupee, the Canadian dollar and the Philippine peso and the positive impact of consolidating Senture from January 1, 2022.

Regional revenue come to €732 million in the fourth quarter, up +5.8% like-for-like The slowdown from prior quarters mainly reflected the less favorable comparatives for US onshore activities during the period (due to the rapid ramp-up of new contracts in late 2021) and the decline in activity in China, curtailed by the zero Covid policy.

In 2022, the region's primary growth drivers were offshore activities in India and the Philippines, which delivered very firm gains throughout the year, particularly in the travel, healthcare and financial services sectors. Offshore solutions are particularly attractive because they can effectively address temporary hiring difficulties encountered in the domestic labor market in the United States.

The US onshore activities reported a mixed performance that varied by client sector. The Group's satisfactory momentum in this market was led by the strength and diversification of its client portfolio. In particular, revenue in the social media, online entertainment and financial services sectors grew at a very brisk pace.

- LATAM

Revenue in the LATAM region amounted to €1,653 million in 2022, a year-on-year increase of +15.4% like-for-like. The reported increase of +21.8% mainly reflected the rise in the US dollar, Brazilian real and Mexican peso against the euro.

In the fourth quarter, revenue came to €416 million, up +12.5% on a like-for-like basis. The slowdown compared with previous quarters was mainly due to the hyperinflationary conditions in Argentina, which were very unfavorable over the quarter.

This very satisfactory performance was largely attributable to the Group's strong gains in the healthcare, social media, online entertainment and automotive sectors. In addition, the financial services and travel sectors maintained a satisfactory pace.

Over the full year, momentum was strong in most countries in the region. Business growth was particularly robust in Peru, the Dominican Republic and Mexico (domestic activities). Activities are also enjoying fast expansion in Nicaragua, Guatemala and Honduras, where Teleperformance recently opened new facilities.

- Europe MEA (EMEA)

Revenue amounted to €2,657 million in 2022, a year-on-year decline of -7.7% like-for-like and of -8.3% as reported, with the difference corresponding to negative currency effects due mainly to the fall of the Turkish lira against the euro. The like-for-like decline in revenue is linked to the sharp decrease in the contribution from Covid support contracts in the Netherlands, the United Kingdom, France and Germany. Excluding the impact of Covid support contracts, like-for-like growth stood at +10.2%, with faster momentum in the second half.

In the fourth quarter, revenue in the region came to €681 million, down -4.9% on a like-for-like basis, due to the sharp decline in the contribution from Covid support contracts. Excluding the impact of Covid support contracts, like-for-like growth was +11.8%.

In 2022, the Group benefited from the start-up of many new contracts and fast growing demand from multinational clients, particularly in the automotive, travel, online entertainment and financial services sectors.

Multilingual activities, which are the primary contributors to the region's revenue stream and mainly serve the large global leaders in the digital economy, reported sustained growth for the year, particularly at the hubs in Portugal, Egypt and Turkey.

In addition, 2022 saw fast growth in the United Kingdom with the banking and insurance sectors and government agencies (excluding Covid support contracts).

Lastly, the German-speaking market was lifted by the strong gains in the nearshore activities and the ramp-up of new contracts, in particular for multinational clients in the travel and automotive sectors.

- Specialized Services

Revenue from Specialized Services stood at €1,165 million in 2022, a year-on-year increase of +18.6% like-for-like and of +42.0% as reported. The difference between like-for-like and reported growth stemmed from the favorable currency effect of the rise of the US dollar against the euro and the positive impact of consolidating Health Advocate since July 1, 2021 and of PSG Global Solutions since November 1, 2022.

Fourth-quarter revenue stood at €323 million, up +17.5% on a like-for-like basis, in line with the prior quarter trend line.

The recovery in TLScontact volumes continued in the fourth quarter. However, the basis for comparison was less favorable than in previous quarters, as passenger traffic picked up mainly from the second half of 2021 onwards. Business volume exceeded pre-crisis levels despite the lockdowns in China throughout the year. The recently announced reopening of the country should support TLScontact's growth in 2023.

The accelerated growth of LanguageLine Solutions, the main contributor to Specialized Services revenue, continued in the fourth quarter. The healthcare sector, which accounts for more than half of this business' revenue, notably continued to deliver rapid growth.

2022 RESULTS

EBITDA before non-recurring items stood at €1,750 million for 2022, up +18.4% from the prior year. EBITDA margin before non-recurring items widened by 80 basis points to 21.5%.

EBITA before non-recurring items rose by +17.8% to €1,262 million from €1,071 million in 2021, representing a margin of 15.5% versus 15.1% in 2021. The improvement was led by the swift growth in the Specialized Services activities, whose strong margins further widened, thanks in particular to the sharp recovery in TLScontact volumes. Core Services and D.I.B.S. margins remained solid despite the adverse impact of the steep falloff in the contribution from Covid support contracts. In addition, reported margins were boosted by the rise in the dollar against the euro with a positive transaction effect linked to the Group's offshore activities and a positive translation effect (mix).

OPERATING EARNINGS BY ACTIVITY

EBITA before non-recurring items by activity

2022 | 2021 | |

€ millions | ||

CORE SERVICES D.I.B.S.* | 890 | 824 |

% of revenue | 12.7% | 13.1% |

North America Asia-Pacific | 330 | 221 |

of revenue | 12.3% | 10.8% |

LATAM | 219 | 187 |

of revenue | 13.3% | 13.7% |

Europe MEA (EMEA) | 271 | 350 |

of revenue | 10.2% | 12.1% |

Holding companies | 70 | 66 |

SPECIALIZED SERVICES | 372 | 247 |

% of revenue | 31.9% | 30.2% |

TOTAL | 1,262 | 1,071 |

% of revenue | 15.5% | 15.1% |

* Digital Integrated Business Services

- Core Services D.I.B.S.

Core Services D.I.B.S reported EBITA before non-recurring items of €890 million in 2022, up from €824 million in 2021. EBITA margin declined to 12.7% from 13.1% the year before, reflecting contrasting trends by region, with the EMEA region in particular negatively affected by the lower contribution from Covid support contracts.

- North America Asia-Pacific

EBITA before non-recurring items in the North America Asia-Pacific region rose to €330 million from €221 million in 2021. EBITA margin widened sharply to 12.3% from 10.8% the year before, impelled primarily by the renewed momentum in offshore activities in the Philippines and the strong growth in high value-added offshore activities in India.

- LATAM

EBITA before non-recurring items in the Ibero-LATAM region rose to €219 million in 2022 from €187 million the year before, while EBITA margin stood at 13.3%, versus 13.7% in 2021. The period-on-period decline was due to the development costs incurred for the opening and the ramp up of numerous new sites to support the rapid pace of business growth, especially in Peru and Colombia.

- Europe MEA (EMEA)

EBITA before non-recurring items in the EMEA region came to €271 million in 2022, versus €350 million in 2021, yielding a margin of 10.2% versus 12.1% one year earlier. The margin decline was mainly due to the sharp falloff in the contribution from Covid support contracts which had a very positive impact on the region's margin in 2021, notably in France and the Netherlands.

- Specialized Services

Specialized Services reported EBITA before non-recurring items of €372 million in 2022, compared with €247 million in 2021. EBITA margin expanded to 31.9% from 30.2% in 2021.

This good performance mainly reflects the return of TLScontact's operating margins to levels close to those achieved pre-Covid-19, following a strong recovery in business volumes, satisfactory growth in premium ancillary services and implementation of cost-cutting measures during the crisis.

LanguageLine Solutions' margin remained high, buoyed by the satisfactory growth in business, especially in the second half. It is also being supported by the company's clear leadership in the North American online interpreting market, its efficient business model based on entirely home-based interpreters and unrivaled technological tools, the successful development of video interpreting solutions, and a very assertive marketing process.

Other Income statement items

EBIT amounted to €994 million, versus €869 million in 2021. It included:

- amortization of acquisition-related intangible assets in an amount of €141 million, versus €111 million in 2021;

- €113 million in accounting expenses relating to performance share plans, versus €87 million the year before.

The financial result represented a net expense of €93 million, on a par with the €94 million reported in 2021, despite the increase in interest rates over the year.

Income tax expense came to €256 million, corresponding to an effective average tax rate of 28.5%, versus 28.1% in 2021.

Net profit Group share totaled €645 million, up +15.8% from €557 million in 2021, while diluted earnings per share came to €10.80, versus €9.36 the year before.

The Board of Directors will recommend that shareholders at the Annual General Meeting on April 13, 2023 approve an increase in the 2022 dividend to €3.85 per share from the €3.30 paid in respect of 2021. This would correspond to a payout ratio of 36%.

Cash flows and financial structure

Net free cash flow after lease expenses, interest and tax paid amounted to €703 million, versus €661 million the year before, representing an increase of +6.3%.

The change in consolidated working capital requirement over the year was an outflow of €172 million, compared with an outflow of €75 million in 2021. The increase, part of which was non-recurring, was led by (i) the €18 million in social security contribution payments that had been deferred under measures taken by certain governments in response to the Covid crisis and (ii) the €75 million impact of phasing out, in 2022, the use of temporary employment agencies, which had helped to meet peak demand for Covid support in 2021

Net capital expenditure amounted to €297 million, or 3.6% of revenue, versus €229 million and 3.2% in 2021. This level corresponds to expenditure to develop a hybrid model combining work-from-home and on-site solutions throughout the world (see Operating Highlights).

Net debt stood at €2,609 million at December 31, 2022, virtually unchanged from a year earlier (€2,656 million). Dividend payments totaled €194 million, financing of the share buyback program €146 million and the acquisition of PSG Global Solutions €304 million. As a result, the net debt-to-EBITDA ratio came to 1.50x, or 1.47x on a pro forma basis excluding the PSG Global Solutions acquisition.

The Group's liquidity improved during year following the refinancing transactions carried out in June.

2022 OPERATING HIGHLIGHTS

- Hybrid expansion of the global footprint

In 2022, Teleperformance continued to deploy its global expansion strategy in the structurally growing outsourced customer and citizen experience management market despite the uncertain economic and geopolitical environment. Over 30 new sites were opened around the world, notably in Europe, Africa, the United States, Peru, and Colombia, adding nearly 12,000 workstations.

The Group has developed a hybrid service model. Existing sites were reorganized during the year and employees continued to be offered work-from-home solutions. As of December 31, 2022, some 50% of employees were telecommuting.

- Acquisition of PSG Global Solutions

In October 2022, Teleperformance announced the acquisition of PSG Global Solutions, a leading provider of digital recruitment process outsourcing (RPO) solutions in the United States. The transaction enabled the Group to further strengthen its high value-added Specialized Services activities, its leading position in the fast-growing US healthcare sector, and its digital recruitment practices.

The consideration for the transaction was US$300 million. The company has been fully consolidated since November 1, 2022.

- Best Employer certifications: 64 country organizations certified

Teleperformance has made the well-being of its employees a key priority worldwide. As of December 31, 2022, the Group had been certified in 64 countries as a "Best Employer" by independent experts like Great Place to Work. These certifications cover more than 97% of the Group's global workforce, versus 70% pre-Covid (22 country organizations certified as of end-2019).

- Action and communication plan launched in November 2022 in response to ESG polemics in the media in H2 2022

In November 2022, an action and communication plan was deployed to restore the confidence of the entire financial community, which had been shaken by repeated and unfounded polemics in social and other media concerning the Group's ESG practices, which triggered a sudden plunge in the stock price on November 10The plan primarily involved:

Announcing, on November 11, a €150 million share buyback program to protect the interests of Teleperformance shareholders

In the United States, launching an external audit by a world-class firm, confirming that there had been no legal or ethical violations in Teleperformance USA's content moderation activities

In Colombia, organizing a number of constructive meetings with the Colombian government leading to positive outcome and commissioning an external audit by Bureau Veritas, which enabled the Group toreceive independent assurance regarding use and inclusion of International Standard ISO 26000 -social responsibility- guidelines

Withdrawing from the highly egregious Trust Safety content moderation segment, to attenuate the perception risks associated with those activities

Signing a worldwide agreement with UNI Global Union

The action plan was pursued in early 2023 with the organization of TP Open Doors site visits on January 17 and 24 for investors and analysts in six countries on four continents. This unprecedented, wide-ranging transparency initiative enabled investors to form their own opinions by having 'seen and touched' the reality on the ground.

In late January 2023, the OECD National Contact Point acknowledged that its recommendations had been effectively applied, thereby definitively ending its proceedings, while emphasizing the Group's proper performance of its duty of care.

On February 1, 2023, the Group released the results of an independent, worldwide survey of its content moderation employees worldwide by the Korn Ferry organizational consulting firm. The highly satisfactory findings rank Teleperformance very high in employee well-being among a sample of 600 companies.

Lastly, after Colombia, Teleperformance's content moderation employees and processes in six other countries were audited by Bureau Veritas, with findings released on February 13. 2023. Teleperformance received independent assurance regarding use and inclusion of International Standard ISO 26000 -social responsibility- guidelines in these countries.

For more information on the action and communication plan, please click here

OUTLOOK

- 2023 financial objectives:

Teleperformance expects 2023 to be another year of sustained, profitable growth.

Recurring like-for-like revenue growth of around +10% (excluding Covid support contracts);

- A more than €200 million decline in the contribution from Covid support contracts;

- Like-for-like revenue growth above +7%;

- A 20-basis point increase in EBITA margin before non-recurring items, to 15.7%;

- Further targeted acquisitions capable of creating value and strengthening the Group's business model.

- 2025 financial objectives

Teleperformance is committed to becoming an undisputed global leader in digital integrated business services solutions by 2025.

The Group confirms that it is ahead of schedule in meeting its financial targets:

Revenue above €10 billion at constant scope of consolidation

- EBITA margin before non-recurring items of 16%

Acquisitions will contribute €1 billion to €2 billion in additional revenue by 2025.

Disclaimer

All forward-looking statements are based on Teleperformance management's present expectations of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. For a detailed description of these factors and uncertainties, please refer to the "Risk Factors" section of our Universal Registration Document, available at www.teleperformance.com. Teleperformance undertakes no obligation to publicly update or revise any of these forward-looking statements.

Analyst and Investor Information Meeting

Friday, February 17, 2023 at 8:30 am CET

Annual results will be presented at a physical meeting in Paris on Friday, February 17, 2023 at 8:30 am.

The proceedings will be available live or for delayed viewing at:

https://channel.royalcast.com/landingpage/teleperformance/20230217_1/

All the documentation related to 2022 Annual Results is available on http://www.teleperformance.com at: https://www.teleperformance.com/en-us/investors/publications-and-events/financial-publications/

Indicative investor calendar

First-quarter 2023 revenue: April 25, 2023

Annual shareholders' meeting: April 13, 2023

Ex-dividend date: April 21, 2023

Dividend payment: April 25, 2023

About Teleperformance Group

Teleperformance (TEP ISIN: FR0000051807 Reuters: TEPRF.PA Bloomberg: TEP FP), a global leader in outsourced digital integrated business services serves as a strategic partner to the world's largest companies in many industries. It offers a One Office support services model including end-to-end digital solutions, which guarantee successful customer interaction and optimized business processes, anchored in a unique, comprehensive high touch, high tech approach. More than 410,000 employees, based in 91 countries, support billions of connections every year in over 300 languages and 170 markets, in a shared commitment to excellence as part of the "Simpler, Faster, Safer" process.This mission is supported by the use of reliable, flexible, intelligent technological solutions and compliance with the industry's highest security and quality standards, based on Corporate Social Responsibility excellence. In 2022, Teleperformance reported consolidated revenue of €8,154 million (US$8.6 billion, based on €1 $1.05) and net profit of €645 million.

Teleperformance shares are traded on the Euronext Paris market, Compartment A, and are eligible for the deferred settlement service. They are included in the following indices: CAC 40, STOXX 600, S&P Europe 350, MSCI Global Standard and Euronext Tech Leaders. In the area of corporate social responsibility, Teleperformance shares are included in the CAC 40 ESG since September 2022, the Euronext Vigeo Euro 120 index since 2015, the EURO STOXX 50 ESG index since 2020, the MSCI Europe ESG Leaders index since 2019, the FTSE4Good index since 2018 and the S&P Global 1200 ESG index since 2017.

For more information: www.teleperformance.com Follow us on Twitter: @teleperformance

Appendices

Appendix 1 Quarterly revenue by activity (new organization)

Q4 2022 | Q4 2021 | % change | |||

€ millions | Like-for-like | Like-for-like

| Reported | ||

CORE SERVICES D.I.B.S.* | 1,829 | 1,691 | +2.8% | +9.7% | +8.2% |

North America Asia-Pacific | 732 | 594 | +5.8% | +5.8% | +23.1% |

LATAM | 416 | 367 | +12.5% | +12.5% | +13.4% |

Europe MEA (EMEA) | 681 | 730 | -4.9% | +11.8% | -6.6% |

SPECIALIZED SERVICES | 323 | 239 | +17.5% | +17.5% | +35.5% |

TOTAL | 2,152 | 1,930 | +4.8% | +10.8% | +11.5% |

Q3 2022 | Q3 2021 | % change | |||

€ millions | Like-for-like | Like-for-like

| Reported | ||

CORE SERVICES D.I.B.S.* | 1,749 | 1,529 | +5.1% | +13.0% | +14.4% |

North America Asia-Pacific | 683 | 507 | +11.2% | +11.2% | +34.8% |

LATAM | 434 | 346 | +15.5% | +15.5% | +25.3% |

Europe MEA (EMEA) | 632 | 676 | -6.0% | +13.1% | -6.6% |

SPECIALIZED SERVICES | 307 | 226 | +18.8% | +18.8% | +36.3% |

TOTAL | 2,056 | 1,755 | +7.0% | +13.8% | +17.2% |

Q2 2022 | Q2 2021 | % change | |||

€ millions | Like-for-like | Like-for-like

| Reported | ||

CORE SERVICES D.I.B.S.* | 1,700 | 1,539 | +2.2% | +13.5% | +10.5% |

North America Asia-Pacific | 636 | 462 | +15.4% | +15.4% | +37.6% |

LATAM | 421 | 328 | +16.5% | +16.5% | +28.3% |

Europe MEA (EMEA) | 643 | 749 | -13.8% | +10.6% | -14.1% |

SPECIALIZED SERVICES | 284 | 180 | +22.9% | +22.9% | +57.7% |

TOTAL | 1,984 | 1,719 | +4.5% | +14.5% | +15.4% |

Q1 2022 | Q1 2021 | % change | |||

€ millions | Like-for-like | Like-for-like

| Reported | ||

CORE SERVICES D.I.B.S.* | 1,711 | 1,536 | +5.4% | +10.7% | +11.4% |

North America Asia-Pacific | 628 | 477 | +14.1% | +14.1% | +31.8% |

LATAM | 382 | 316 | +17.1% | +17.1% | +20.9% |

Europe MEA (EMEA) | 701 | 743 | -5.7% | +5.5% | -5.6% |

SPECIALIZED SERVICES | 251 | 176 | +15.5% | +15.5% | +42.2% |

TOTAL | 1,962 | 1,712 | +6.5% | +11.1% | +14.6% |

* Digital Integrated Business Services ** Excluding the impact of lower revenue from Covid support contracts ("Covid contracts")

Appendix 2 Simplified Consolidated Financial Statements

Consolidated income statement

€ millions

2022 | 2021 | ||

| Revenues | 8 154 | 7 115 | |

| Other revenues | 10 | 10 | |

| Personnel | -5 339 | -4 810 | |

| External expenses | -1 044 | -811 | |

| Taxes other than income taxes | -31 | -26 | |

| Depreciation and amortization | -281 | -220 | |

| Amortization of intangible assets acquired as part of a business combination | -141 | -111 | |

| Depreciation of right-of-use assets (personnel-related) | -15 | -13 | |

| Depreciation of right-of-use assets | -192 | -174 | |

| Impairment loss on goodwill | -8 | ||

| Share-based payments | -113 | -87 | |

| Other operating income and expenses | -6 | -4 | |

| Operating profit | 994 | 869 | |

| Income from cash and cash equivalents | 10 | 8 | |

| Gross financing costs | -72 | -56 | |

| Interest on lease liabilities | -44 | -41 | |

| Net financing costs | -106 | -89 | |

| Other financial income and expenses | 13 | -5 | |

| Financial result | -93 | -94 | |

| Profit before taxes | 901 | 775 | |

| Income tax | -256 | -218 | |

| Net profit | 645 | 557 | |

| Net profit Group share | 645 | 557 | |

| Net profit attributable to non-controlling interests | |||

| Earnings per share (in euros) | 10,95 | 9,49 | |

| Diluted earnings per share (in euros) | 10,80 | 9,36 |

Consolidated balance sheet

€ millions

| ASSETS | 12/31/2022 | 12/31/2021* | |

| Non-current assets | |||

| Goodwill | 3 177 | 2 800 | |

| Other intangible assets | 1 345 | 1 422 | |

| Right-of-use assets | 626 | 626 | |

| Property, plant and equipment | 613 | 587 | |

| Loan hedging instruments Assets | 17 | 10 | |

| Other financial assets | 98 | 59 | |

| Deferred tax assets | 78 | 66 | |

| Total non-current assets | 5 954 | 5 570 | |

| Current assets | |||

| Current income tax receivable | 75 | 87 | |

| Accounts receivable Trade | 1 707 | 1 580 | |

| Other current assets | 245 | 226 | |

| Other financial assets | 66 | 46 | |

| Cash and cash equivalents | 817 | 837 | |

| Total current assets | 2 910 | 2 776 | |

| TOTAL ASSETS | 8 864 | 8 346 | |

| EQUITY AND LIABILITIES | 12/31/2022 | 12/31/2021 | |

| Equity | |||

| Share capital | 148 | 147 | |

| Share premium | 576 | 575 | |

| Translation reserve | 9 | -101 | |

| Other reserves | 2 939 | 2 536 | |

| Equity attributable to owners of the Company | 3 672 | 3 157 | |

| Non-controlling interests | 0 | 0 | |

| Total equity | 3 672 | 3 157 | |

| Non-current liabilities | |||

| Post-employment benefits | 34 | 33 | |

| Lease liabilities | 510 | 515 | |

| Loan hedging instruments Liabilities | 24 | ||

| Other financial liabilities | 2 021 | 2 270 | |

| Deferred tax liabilities | 315 | 332 | |

| Total non-current liabilities | 2 904 | 3 150 | |

| Current liabilities | |||

| Provisions | 90 | 83 | |

| Current income tax | 167 | 127 | |

| Accounts payable Trade | 232 | 280 | |

| Other current liabilities | 911 | 831 | |

| Lease liabilities | 178 | 172 | |

| Other financial liabilities | 710 | 546 | |

| Total current liabilities | 2 288 | 2 039 | |

| TOTAL EQUITY AND LIABILITIES | 8 864 | 8 346 | |

| * Restated following the finalization of the measurement of the fair value of the identifiable assets and liabilities acquired of Senture. | |||

Consolidated cash flow statement

€ millions

| Cash flows from operating activities | 2022 | 2021 | ||

| Net profit Group share | 645 | 557 | ||

| Net profit attributable to non-controlling interests | ||||

| Income tax expense | 256 | 218 | ||

| Net financial interest expense | 53 | 33 | ||

| Interest expense on lease liabilities | 44 | 41 | ||

| Non-cash items of income and expense | 759 | 595 | ||

| Income tax paid | -291 | -228 | ||

| Internally generated funds from operations | 1 466 | 1 216 | ||

| Change in working capital requirements | -172 | -75 | ||

| Net cash flow from operating activities | 1 294 | 1 141 | ||

| Cash flows from investing activities | ||||

| Acquisition of intangible assets and property, plant and equipment | -298 | -232 | ||

| Loans granted | -16 | |||

| Acquisition of subsidiaries, net of cash and cash equivalents acquired | -304 | -929 | ||

| Proceeds from disposals of intangible assets and property, plant and equipment | 1 | 3 | ||

| Loans repaid | 15 | |||

| Net cash flow from investing activities | -602 | -1 158 | ||

| Cash flows from financing activities | ||||

| Acquisition net of disposal of treasury shares | -146 | 6 | ||

| Change in ownership interest in controlled entities | ||||

| Dividends paid to parent company shareholders | -194 | -141 | ||

| Financial interest paid | -49 | -33 | ||

| Lease payments | -244 | -218 | ||

| Increase in financial liabilities | 1 627 | 1 134 | ||

| Repayment of financial liabilities | -1 709 | -921 | ||

| Net cash flow from financing activities | -715 | -173 | ||

| Change in cash and cash equivalents | -23 | -190 | ||

| Effect of exchange rates on cash held | 1 | 32 | ||

| Net cash at January 1st | 835 | 993 | ||

| Net cash at December 31st | 813 | 835 | ||

Appendix 3 Glossary Alternative Performance Measures

Change in like-for-like revenue:

Change in revenue at constant exchange rates and scope of consolidation [current year revenue last year revenue at current year rates revenue from acquisitions at current year rates] last year revenue at current year rates.

2021 revenue | 7,115 | |

Currency effect | 351 | |

2021 revenue at constant exchange rates | 7,466 | |

Like-for-like growth | 423 | |

Change in scope | 265 | |

2022 revenue | 8,154 | |

EBITDA before non recurring items or current EBITDA (Earnings before Interest, Taxes, Depreciation and Amortizations):

Operating profit before depreciation amortization, depreciation of right-of-use of leased assets, amortization of intangible assets acquired as part of a business combination, goodwill impairment charges and non-recurring items.

2022 | 2021 | ||

Operating profit | 994 | 869 | |

Depreciation and amortization | 281 | 220 | |

Depreciation of right-of-use of leased assets | 192 | 174 | |

Depreciation of right-of-use of leased assets personnel related | 15 | 13 | |

Amortization of intangible assets acquired as part of a business combination | 141 | 111 | |

Goodwill impairment | 8 | ||

Share-based payments | 113 | 87 | |

Other operating income and expenses | 6 | 4 | |

EBITDA before non-recurring items | 1,750 | 1,478 | |

EBITA before non recurring items or current EBITA (Earnings before Interest, Taxes and Amortizations):

Operating profit before amortization of intangible assets acquired as part of a business combination, goodwill impairment charges and non-recurring items.

2022 | 2021 | ||

Operating profit | 994 | 869 | |

Amortization of intangible assets acquired as part of a business combination | 141 | 111 | |

Goodwill impairment | 8 | ||

Share-based payments | 113 | 87 | |

Other operating income and expenses | 6 | 4 | |

EBITA before non-recurring items | 1,262 | 1 ,071 | |

Non recurring items:

Principally comprises restructuring costs, incentive share award plan expense, costs of closure of subsidiary companies, transaction costs for the acquisition of companies, and all other expenses that are unusual by reason of their nature or amount.

Net free cash flow:

Cash flow generated by the business acquisitions of intangible assets and property, plant and equipment net of disposals lease payments financial income/expenses.

2022 | 2021 | ||

Net cash flow from operating activities | 1 294 | 1 141 | |

Acquisition of intangible assets and property, plant and equipment | -298 | -232 | |

Proceeds from disposals of intangible assets and property, plant and equipment | 1 | 3 | |

Loans granted | -16 | ||

Loans repaid | 15 | ||

Lease payments | -244 | -218 | |

Financial interest paid | -49 | -33 | |

Net cash flow from financing activities | 703 | 661 | |

Net debt:

Current and non-current financial liabilities cash and cash equivalents

12/31/2022 | 12/31/2021 | ||

Non-current liabilities* | |||

Financial liabilities | 2,021 | 2,270 | |

Current liabilities* | |||

Financial liabilities | 710 | 546 | |

Lease liabilities (IFRS 16) | 688 | 687 | |

Loan hedging instruments | 7 | -10 | |

Cash and cash equivalents | -817 | -837 | |

Net debt | 2,609 | 2,656 | |

* Excluding lease liabilities

Diluted earnings per share (net profit attributable to shareholders divided by the number of diluted shares and adjusted):

Diluted earnings per share is determined by adjusting the net profit attributable to ordinary shareholders and the weighted average number of ordinary shares outstanding by the effects of all potentially diluting ordinary shares. These include convertible bonds, stock options and incentive share awards granted to employees when the required performance conditions have been met at the end of the financial year.

NB: The alternative performance measures (APMs) are defined in Appendix 3

View source version on businesswire.com: https://www.businesswire.com/news/home/20230216005580/en/

Contacts:

FINANCIAL ANALYSTS AND INVESTORS

Investor relations and financial

communication department

TELEPERFORMANCE

Tel: +33 1 53 83 59 15

investor@teleperformance.com

PRESS RELATIONS

Europe

Karine Allouis Laurent Poinsot

IMAGE7

Tel: +33 1 53 70 74 70

teleperformance@image7.fr

PRESS RELATIONS

Americas and Asia-Pacific

Nicole Miller

TELEPERFORMANCE

Tel: 1 801-257-5811

nicole.miller@teleperformance.com