Results of New Preliminary Economic Assessment for Riotinto

Demonstrates the potential for strong economics and production growth

NICOSIA, CYPRUS / ACCESSWIRE / February 23, 2023 / Atalaya Mining Plc (AIM:ATYM)(TSX:AYM) is pleased to announce the results from a new preliminary economic assessment ("PEA") for the Cerro Colorado, San Dionisio and San Antonio deposits at its Proyecto Riotinto ("Riotinto") operation in Spain.

Riotinto is Atalaya's flagship asset and currently consists of the operating Cerro Colorado open pit mine, a modern 15 Mtpa processing plant and significant supporting infrastructure. The San Dionisio and San Antonio deposits are located adjacent to the Cerro Colorado pit and the objective of the PEA was to incorporate these deposits into a new integrated mine plan for Riotinto.

PEA Highlights

- Strong potential economic results over a range of metals price assumptions

? $1.07 billion NPV(8%) after-tax at $3.50/lb Cu, $1.20/lb Zn and $0.95/lb Pb ("Base Case" metals prices)

? $1.57 billion NPV(8%) after-tax at $4.03/lb Cu, $1.20/lb Zn and $0.95/lb Pb ("Sensitivity Case" metals prices)

? Economics benefit from significant in-place infrastructure at Riotinto

- Potential uplift in production as a result of processing higher grade material

? ~60 ktpa Cu during copper stockwork-only phase (2023-2026)

? ~90 ktpa CuEq during polymetallic massive sulphide phase (2027+)

- Potential reduction in cash costs due to higher grades and by-product credits

? $2.00/lb Cu payable Cash Costs (LOM average)

? $2.03/lb Cu payable Cash Costs + Sustaining (LOM average)

- Mineralised material of ~241 Mt supports a potential mine life of 15.6 years

? Provides significant long-term optionality to rising metals prices

The PEA is preliminary in nature, and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorised as Mineral Reserves, and there is no certainty that the PEA will be realised. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Optimisation Opportunities and Other Riotinto District Highlights

- PEA serves as a foundation for continued optimisation

? E-LIX System has the potential to unlock additional value by increasing recoveries, reducing offsite costs and lowering the carbon footprint

? Revised mining sequence could bring forward highest value material

? Unused processing equipment at Riotinto could be refurbished, potentially lowering capital costs associated with the Zn and Pb circuits

- Results reinforce the strategic nature of Atalaya's assets in the Riotinto District

? Uniquely positioned to deliver low capital intensity growth due to Atalaya's large resource base and significant infrastructure in the region

? High quality mining jurisdiction, with access to the critical inputs required for modern and sustainable operations, including experienced labour and renewable sources of electricity and water

? Atalaya's other projects in the Riotinto District, such as Masa Valverde, could become further sources of mineralised material

PEA Summary

Table 1: Key Data

Unit | CuSW(1) | PolyMS(1) | Total | |

| Material Mined | ||||

| Tonnage | kt | 195,890 | 45,601 | 241,491 |

| Copper Grade | % | 0.42 | 0.98 | 0.53 |

| Zinc Grade | % | 1.69 | ||

| Lead Grade | % | 0.45 | ||

| Mine Life | Years | 15.6 | ||

Unit | 2023-2026 | 2027-2036 | LOM | |

| Total Production(2) | ||||

| Copper | kt | 1,004 | ||

| Zinc | kt | 575 | ||

| Lead | kt | 76 | ||

| Copper Equivalent(3) | kt | 1,221 | ||

| Average Annual Production(2) | ||||

| Copper | kt | 59 | 69 | |

| Zinc | kt | - | 57 | |

| Lead | kt | - | 8 | |

| Copper Equivalent(3) | kt | 59 | 91 | |

| Cash Costs Net of Zn & Pb Credits(4) | ||||

| Cash Costs | $/lb Cu payable | 2.56 | 1.77 | 2.00 |

| Cash Costs + Sustaining Capex(5) | $/lb Cu payable | 2.60 | 1.81 | 2.03 |

| Base Case Financial Summary | ||||

| $3.50 Cu, $1.20 Zn and $0.95 Pb | ||||

| EBITDA | $m | 464 | 2,522 | 3,176 |

| Capital Expenditures | $m | (186) | (341) | (566) |

| Cash Flow After Tax | $m | 201 | 1,844 | 2,152 |

| NPV after-tax (10%) | $m | 915 | ||

| NPV after-tax (8%) | $m | 1,069 | ||

| Sensitivity Case Financial Summary(6) | ||||

| $4.03 Cu, $1.20 Zn and $0.95 Pb | ||||

| EBITDA | $m | 724 | 3,289 | 4,288 |

| Capital Expenditures | $m | (186) | (341) | (566) |

| Cash Flow After Tax | $m | 413 | 2,473 | 3,064 |

| NPV after-tax (10%) | $m | 1,360 | ||

| NPV after-tax (8%) | $m | 1,573 | ||

(1) CuSW = copper stockwork (Cerro Colorado and San Dionisio copper); PolyMS = polymetallic massive sulphide.

(2) Recovered metal in concentrate.

(3) Copper Equivalent ("CuEq") production is calculated from results presented in the PEA and based on $3.50/lb Cu, $1.20/lb Zn and $0.95/lb Pb. CuEq = Cu + (Zn x 1.20 / 3.50) + (Pb x 0.95 / 3.50).

(4) Based on $1.20/lb Zn and $0.95/lb Pb.

(5) Excludes head office costs typically included in AISC figures.

(6) See Table 9 for Downside Case financial summary.

Table 2: NPV After-Tax ($m) Sensitivity to Copper Price ($/lb) and Discount Rate(1)

2.80 | 2.98 | 3.15 | 3.33 | 3.50 | 3.68 | 3.85 | 4.03 | 4.20 | |

0% | 928 | 1,240 | 1,545 | 1,848 | 2,152 | 2,456 | 2,760 | 3,064 | 3,368 |

5% | 539 | 750 | 957 | 1,163 | 1,369 | 1,575 | 1,781 | 1,987 | 2,193 |

8% | 392 | 564 | 733 | 901 | 1,069 | 1,237 | 1,405 | 1,573 | 1,741 |

10% | 318 | 470 | 619 | 767 | 915 | 1,064 | 1,212 | 1,360 | 1,508 |

12% | 258 | 393 | 526 | 658 | 790 | 922 | 1,053 | 1,185 | 1,317 |

(1) Assumes $1.20/lb Zn and $0.95/lb Pb.

Alberto Lavandeira, CEO, commented:

"We are pleased to announce the outcome of the PEA, which demonstrates strong economics and confirms the results of prior internal studies on the future of our flagship Riotinto operation.

After delivering a major expansion of processing capacity at Riotinto in recent years and announcing new mineral resource estimates for San Dionisio and San Antonio in 2022, we set out to quantify the significant value of an integrated Riotinto approach.

The Riotinto District has many advantages over more remote mining regions around the world, where the ability to bring assets into production in a sustainable and economic manner is becoming increasingly difficult. Our region has a long mining history, the workforce is highly experienced, infrastructure is modern and we benefit from good access to sustainable sources of water and energy. Together, these advantages reduce execution risk, capital intensity and development timelines.

As we progress the permitting process for San Dionisio, we shall continue to evaluate ways to further optimise the development plan for Riotinto. This is an exciting time for Atalaya, and we look forward to leveraging our execution capabilities to grow our copper production and deliver further value for our shareholders."

Background

Riotinto District Portfolio

Atalaya controls a strategic portfolio of assets in the Riotinto District of the Iberian Pyrite Belt, including:

- Operating Cerro Colorado open pit mine

- 15 Mtpa processing plant and supporting infrastructure

- San Dionisio and San Antonio deposits, which were mined historically

- Proyecto Masa Valverde ("PMV")

- Exploration permits, including at Proyecto Riotinto East ("PRE")

The Company's focus is to develop its existing facilities into a centralised processing hub for ore sourced from its various projects in the region.

Mineral Resource Estimates and PEA Objectives

Atalaya announced new independent mineral resource estimates for the San Dionisio and San Antonio deposits in April 2022. These estimates confirmed prior internal estimation work on the deposits and quantified their significant contained metal as well as their higher grades compared to the material currently being mined at Cerro Colorado.

The objective of the PEA was to develop a new integrated mine plan based on existing Riotinto mineral resources that considers concurrent mining of Cerro Colorado, San Dionisio and San Antonio and the processing of polymetallic massive sulphide ("PolyMS") material in addition to the copper stockwork ("CuSW") material currently being processed. Other operations in the Iberian Pyrite Belt, including MATSA and mines in Portugal, currently process similar PolyMS material. The production plan includes Inferred Mineral Resources, which are too speculative in nature to be classified as Mineral Reserves.

Regional Advantages

Atalaya is well positioned to execute on its "central processing hub" growth strategy due to several factors:

- Experience gained from operating the large Cerro Colorado open pit mine and Riotinto processing plant since 2016

- The 15 Mtpa processing plant at Riotinto is the largest mill in the region

- Riotinto's existing tailings storage facility has significant capacity, with land available for future expansion

- The Company has access to multiple sources of water via nearby reservoirs

- Riotinto is connected to the national power grid, where the share of electricity from renewable sources continues to grow

- Highly experienced workforce lives in close proximity to Atalaya's operations

- The long history of mining in the region has developed a strong network of suppliers and service providers, including open pit and underground mining contractors with vast experience at similar deposits

Combined, these attributes are expected to allow Atalaya to continue to increase the scale of its operations while avoiding many of the well-publicised challenges that miners are facing in other minerals districts.

PEA Independent Consultant

Tetra Tech was retained by Atalaya to develop a PEA of the Cerro Colorado, San Dionisio, and San Antonio deposits at Riotinto. Tetra Tech prepared its report (the "Technical Report") in accordance with the Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) guidelines. The PEA is preliminary in nature and includes Inferred Mineral Resources that are too speculative in nature to be classified as Mineral Reserves. There is no certainty that the economic results presented in this PEA will be realized. Mineral Resources are not Mineral Reserves and therefore do not have demonstrated economic viability.

The Technical Report has an effective date of 31 October 2022 and incorporates project information developed by Atalaya and its consultants. The Technical Report will be made available on the Company's website at www.atalayamining.com and under the Company's corporate profile on SEDAR at www.sedar.com. For readers to fully understand the information in this announcement, they should read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the PEA. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

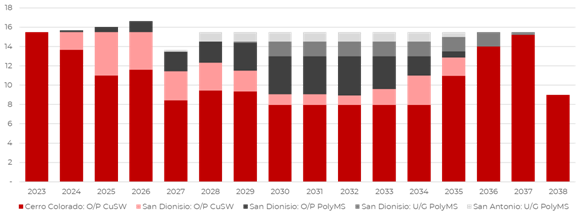

Mining

A production plan for Riotinto was developed based on the existing mineral resources for Cerro Colorado, San Dionisio and San Antonio.

Mining at Cerro Colorado is currently conducted by a contractor using conventional open pit mining methods and produces CuSW material. The PEA contemplates continued open pit mining at Cerro Colorado, but at a reduced annual rate to provide capacity for material mined from the San Dionisio and San Antonio deposits.

At San Dionisio, mining will begin using the same open pit methods, equipment and contractors as Cerro Colorado. The conceptual open pit design includes two phases, with Phase 1 containing primarily CuSW mineralised material and Phase 2 containing a majority of PolyMS mineralised material. During Phase 1, PolyMS material is assumed to be stockpiled until the necessary plant modifications are implemented.

Photo 1: Riotinto Site Layout Looking East

Underground mining at San Dionisio and San Antonio is planned to be completed using the blasthole stoping method to produce PolyMS mineralised material. Underground mining activities have been carried out historically at both deposits. Development requirements include dewatering and rehabilitation of old shafts and drifts as well as the development of any required new underground openings.

The concurrent open pit and underground mining of Cerro Colorado, San Dionisio and San Antonio is planned to produce an aggregate of 15.5 Mtpa of CuSW and PolyMS mineralised material.

Chart 1: Mining Schedule by Mineralised Material Source (Mt)

Table 3: Summary of Mining Inventory

Unit | LOM | |||

| CuSW Tonnage | kt | 195,890 | ||

| Copper Grade | % | 0.42 | ||

| PolyMS Tonnage: Open Pit | kt | 27,046 | ||

| PolyMS Tonnage: Underground | kt | 18,555 | ||

| PolyMS Tonnage: Total | kt | 45,601 | ||

| Copper Grade | % | 0.98 | ||

| Zinc Grade | % | 1.69 | ||

| Lead Grade | % | 0.45 | ||

| Total Tonnage | kt | 241,491 | ||

| Copper Grade | % | 0.53 | ||

| Total Waste | kt | 555,638 | ||

| Strip Ratio: Cerro Colorado & San Dionisio | w:o | 2.5 | ||

| Mine Life | Years | 15.6 | ||

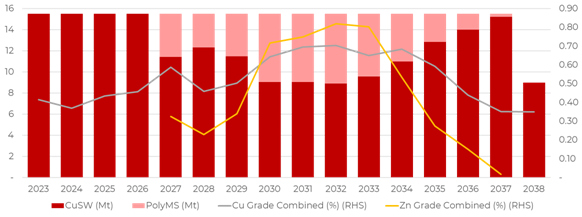

Processing

The existing plant at Riotinto has a nameplate capacity of 15 Mtpa and currently processes CuSW sulphide material using conventional froth flotation to produce a copper concentrate.

Photo 2: Existing 15 Mtpa Plant at Riotinto

In order to process the PolyMS material associated with the San Antonio deposit and portions of the San Dionisio deposit, a modified recovery circuit is required. Preliminary testwork indicates that ultra-fine grinding followed by differential flotation may be required to achieve acceptable metal recoveries and produce three separate saleable concentrates - copper, zinc and lead. The PEA assumes the installation of a differential flotation circuit, however, additional processing options are being studied that may achieve higher metallurgical recoveries.

The PEA contemplates that mineralised material from Cerro Colorado will be blended with higher grade CuSW material from San Dionisio beginning in mid-2024. Starting in 2027, a portion of the plant feed will include PolyMS material sourced from San Dionisio and San Antonio, further increasing the blended head grade.

Chart 2: Processing Schedule by Mineralised Material Type and Grade

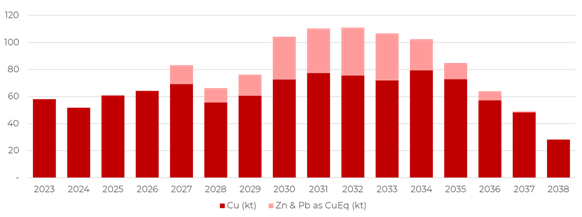

Production

At present, Riotinto produces a copper concentrate with silver by-product credits, which it sells at commercial terms to its offtake partners. As contemplated in the PEA, Riotinto would continue to produce a single copper concentrate in the initial years when only CuSW material is processed. Beginning in 2027 and the start of PolyMS material processing, three separate copper, zinc and lead concentrates would be produced and sold internationally.

As a result of the higher copper grades and by-product credits from the PolyMS material at San Dionisio and San Antonio, the future blended head grade is expected to provide an increase in production at Riotinto, which produced 56 kt Cu in 2021 and 52 kt Cu in 2022.

The PEA assumes that all mineralised material mined from Cerro Colorado is immediately processed, therefore no stockpiling of lower grade mineralised material is contemplated. In certain recent periods, however, stockpiling has been implemented in order to prioritise higher grade material for processing. In addition, the effective date of the PEA is 31 October 2022, which was before the publication of the Company's production guidance for 2023. As a result, the production profile shown in Chart 3 below should not be interpreted as formal production guidance for the near term.

Chart 3: Production Profile(1)(2)

(1) Recovered metal in concentrate.

(2) d CuEq production is calculated from results presented in the PEA and based on $3.50/lb Cu, $1.20/lb Zn and $0.95/lb Pb. CuEq = Cu + (Zn x 1.20 / 3.50) + (Pb x 0.95 / 3.50).

Table 4: Summary of Production

Unit | 2023-2026 | 2027-2036 | LOM | |

| Total Production(1) | ||||

| Copper | kt | 1,004 | ||

| Zinc | kt | 575 | ||

| Lead | kt | 76 | ||

| Copper Equivalent(2) | kt | 1,221 | ||

| Average Annual Production(1) | ||||

| Copper | kt | 59 | 69 | |

| Zinc | kt | - | 57 | |

| Lead | kt | - | 8 | |

| Copper Equivalent(2) | kt | 59 | 91 | |

(1) Recovered metal in concentrate.

(2) Copper Equivalent production is calculated from results presented in the PEA and based on $3.50/lb Cu, $1.20/lb Zn and $0.95/lb Pb. CuEq = Cu + (Zn x 1.20 / 3.50) + (Pb x 0.95 / 3.50).

Capital Costs

Capital expenditures included in the PEA relate to mine development costs for San Dionisio (pre-strip to access CuSW material, followed by underground development) and San Antonio (underground development), modification of the processing plant to include new zinc and lead circuits, as well as sustaining capital, tailings dam expansion and closure costs. Mine equipment is not included in capital costs as all equipment will be provided by the mining contractor.

Table 5: Capital Cost Summary

Unit | 2023-2026 | 2027-2036 | LOM | |

| By Mineralised Material Type | ||||

| Related to CuSW Material | $m | 44 | - | 44 |

| Related to PolyMS Material | $m | 98 | 154 | 252 |

| Related to Overall Operations | $m | 20 | 142 | 196 |

| Subtotal | $m | 162 | 297 | 492 |

| Contingency of 15% | $m | 24 | 44 | 74 |

| Total | $m | 186 | 341 | 566 |

| By Expenditure Type | ||||

| Mine Equipment | $m | - | - | - |

| Mine Development | $m | 68 | 136 | 204 |

| Plant Capital | $m | 74 | 18 | 92 |

| Surface Infrastructure | $m | - | 93 | 93 |

| Sustaining Capital | $m | 20 | 49 | 71 |

| Closure | $m | - | - | 32 |

| Subtotal | $m | 162 | 297 | 492 |

| Contingency of 15% | $m | 24 | 44 | 74 |

| Total | $m | 186 | 341 | 566 |

Operating Costs

Operating cost estimates are based principally on actuals from the existing operations at Riotinto. Open pit mining costs continue to assume the contractor mining model, including when mining begins at San Dionisio. Processing costs for CuSW material are also based on actuals.

For the planned underground mining at San Dionisio and San Antonio, costs are based on estimated mining contractor rates in the region, where key neighbouring mines are operated under a similar model. Processing costs for PolyMS material include additional costs compared to the current copper circuit.

Table 6: Operating Cost Summary

Unit | 2023-2026 | 2027-2036 | LOM | |

| Site Operating Costs | ||||

| Mining | $m | 435 | 1,371 | 1,875 |

| Processing | $m | 492 | 1,275 | 1,962 |

| G&A | $m | 71 | 177 | 275 |

| Subtotal | $m | 998 | 2,822 | 4,112 |

| Contingency of 5% | $m | 50 | 141 | 206 |

| Total | $m | 1,048 | 2,963 | 4,318 |

| Total Site Operating Costs | $/t processed | 16.91 | 19.12 | 17.88 |

| Cash Costs Net of Zn & Pb Credits(1) | ||||

| Cash Costs | $/lb Cu payable | 2.56 | 1.77 | 2.00 |

| Cash Costs + Sustaining Capex(2) | $/lb Cu payable | 2.60 | 1.81 | 2.03 |

(1) Based on $3.50/lb Cu, $1.20/lb Zn and $0.95/lb Pb; assumes nil Ag production.

(2) Excludes head office costs typically included in AISC figures.

Economic Analysis

The PEA shows strong potential economic results over a range of metals price assumptions for copper, zinc and lead. Base Case prices represent consensus long term forecasts published by a wide selection of financial institutions, while the copper price assumed in the Sensitivity Case is based on the recent prevailing copper spot price. The PEA is preliminary in nature, and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorised as mineral reserves, and there is no certainty that the PEA will be realised. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Table 7: Economic Summary at Base Case Metals Prices

| $3.50/lb Cu, $1.20/lb Zn, $0.95/lb Pb | ||||

Unit | 2023-2026 | 2027-2036 | LOM | |

| Gross Revenues | $m | 1,735 | 6,549 | 8,855 |

| Offsite Costs | $m | (223) | (1,064) | (1,361) |

| Net Smelter Return | $m | 1,512 | 5,486 | 7,494 |

| Site Operating Costs | $m | (1,048) | (2,963) | (4,318) |

| EBITDA | $m | 464 | 2,522 | 3,176 |

| Change in Working Capital | $m | (18) | (1) | (50) |

| Capital Expenditures | $m | (186) | (341) | (566) |

| Cash Flow Pre-Tax | $m | 259 | 2,180 | 2,561 |

| Income Tax | $m | (58) | (336) | (408) |

| Cash Flow After-Tax | $m | 201 | 1,844 | 2,152 |

| NPV Pre-Tax (10%) | $m | 1,105 | ||

| NPV After-Tax (10%) | $m | 915 | ||

| NPV Pre-Tax (8%) | $m | 1,286 | ||

| NPV After-Tax (8%) | $m | 1,069 | ||

Table 8: Economic Summary at Sensitivity Case Metals Prices

| $4.03/lb Cu, $1.20/lb Zn, $0.95/lb Pb | ||||

Unit | 2023-2026 | 2027-2036 | LOM | |

| Gross Revenues | $m | 1,995 | 7,316 | 9,967 |

| Offsite Costs | $m | (223) | (1,064) | (1,361) |

| Net Smelter Return | $m | 1,772 | 6,252 | 8,606 |

| Site Operating Costs | $m | (1,048) | (2,963) | (4,318) |

| EBITDA | $m | 724 | 3,289 | 4,288 |

| Change in Working Capital | $m | (20) | (1) | (50) |

| Capital Expenditures | $m | (186) | (341) | (566) |

| Cash Flow Pre-Tax | $m | 518 | 2,947 | 3,672 |

| Income Tax | $m | (105) | (474) | (609) |

| Cash Flow After-Tax | $m | 413 | 2,473 | 3,064 |

| NPV Pre-Tax (10%) | $m | 1,647 | ||

| NPV After-Tax (10%) | $m | 1,360 | ||

| NPV Pre-Tax (8%) | $m | 1,901 | ||

| NPV After-Tax (8%) | $m | 1,573 | ||

Table 9: Economic Summary at Downside Case Metals Prices

| $2.98/lb Cu, $1.20/lb Zn, $0.95/lb Pb | ||||

Unit | 2023-2026 | 2027-2036 | LOM | |

| Gross Revenues | $m | 1,475 | 5,783 | 7,744 |

| Offsite Costs | $m | (223) | (1,064) | (1,361) |

| Net Smelter Return | $m | 1,252 | 4,719 | 6,383 |

| Site Operating Costs | $m | (1,048) | (2,963) | (4,318) |

| EBITDA | $m | 203 | 1,756 | 2,065 |

| Change in Working Capital | $m | (16) | (1) | (50) |

| Capital Expenditures | $m | (186) | (341) | (566) |

| Cash Flow Pre-Tax | $m | 1 | 1,413 | 1,449 |

| Income Tax | $m | (14) | (195) | (209) |

| Cash Flow After-Tax | $m | (13) | 1,218 | 1,240 |

| NPV Pre-Tax (10%) | $m | 562 | ||

| NPV After-Tax (10%) | $m | 470 | ||

| NPV Pre-Tax (8%) | $m | 671 | ||

| NPV After-Tax (8%) | $m | 564 | ||

Table 10: NPV After-Tax ($m) Sensitivity to Copper Price ($/lb) and Discount Rate(1)

2.80 | 2.98 | 3.15 | 3.33 | 3.50 | 3.68 | 3.85 | 4.03 | 4.20 | |

0% | 928 | 1,240 | 1,545 | 1,848 | 2,152 | 2,456 | 2,760 | 3,064 | 3,368 |

5% | 539 | 750 | 957 | 1,163 | 1,369 | 1,575 | 1,781 | 1,987 | 2,193 |

8% | 392 | 564 | 733 | 901 | 1,069 | 1,237 | 1,405 | 1,573 | 1,741 |

10% | 318 | 470 | 619 | 767 | 915 | 1,064 | 1,212 | 1,360 | 1,508 |

12% | 258 | 393 | 526 | 658 | 790 | 922 | 1,053 | 1,185 | 1,317 |

(1) Assumes $1.20/lb Zn and $0.95/lb Pb.

Next Steps

Atalaya continues to advance the permitting process associated with expanding the Cerro Colorado pit into the San Dionisio area, which will require the relocation of the public road, power lines and water lines that run between the two deposits, as well as the fulfilment of other regulatory matters.

Opportunities for Additional Optimisation

Atalaya believes the PEA provides a clear path for the long-term development of Riotinto. The PEA will now serve as a foundation for continued optimisation work that will be completed, including during the permitting process for San Dionisio.

Testwork related to improving the metallurgical recoveries for the PolyMS material will be an ongoing focus. The E-LIX System has the potential to unlock value from this complex material, including by increasing recoveries, reducing offsite costs and also lowering the carbon footprint associated with downstream transportation and smelting. Further testwork is planned once the E-LIX Phase I plant is operational. In addition, historical third-party testwork using conventional flotation, including by Lakefield in 1985-1986, resulted in higher recoveries than assumed in the PEA, therefore additional testing will be completed using alternative approaches.

Other areas of potential optimisation include revising the mining sequence of the various deposits in order to bring forward the highest value material, as well as potential capital cost savings via the study of refurbishing unused processing equipment at Riotinto as an alternative to purchasing new equipment for the new zinc and lead recovery circuits.

Finally, exploration and evaluation work continues at Atalaya's other projects in the Riotinto District, including PMV and PRE. In particular, deposits at PMV have the potential to become further sources of mineralised material that could be processed at Riotinto and integrated into a regional operating model.

Qualified Person Statement

The PEA for Riotinto was prepared by Tetra Tech in accordance with CIM guidelines and with Canadian regulatory requirements set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101"). The report was prepared by Tetra Tech Qualified Persons Dr. Guillermo Dante Ramírez-Rodríguez, PhD, MMSAQP, Jaye Pickarts, MMSA QP, and Ms. Kira Lyn Johnson, MMSAQP, who are Qualified Persons as defined under NI 43-101 and the AIM Rules, and are independent of the Company. The Qualified Persons have reviewed and approved this announcement regarding the results of the PEA in the form and context it appears.

This announcement contains information which, prior to its publication constituted inside information for the purposes of Article 7 of Regulation (EU) No 596/2014.

Glossary of Terms

| Ag | Silver |

| CIM | Canadian Institute of Mining, Metallurgy and Petroleum |

| Cu | Copper |

| CuEq | Copper Equivalent |

| g/t | Grams per tonne |

| Indicated Mineral Resources | An Indicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve. |

| Inferred Mineral Resource | An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. |

| kt | Thousand tonnes |

| Massive Sulphide | Mineral deposit characterised by a great concentration of ore in one place, as opposed to a disseminated or veinlike deposit. |

| Measured Mineral Resources | A Measured Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve. |

| Mineral Resources | A concentration or occurrence of material of intrinsic economic interest in or on the Earth's crust in such a form and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. |

| Mt | Million tonnes |

| Mtpa | Million tonnes per annum |

| n.a. | Not available |

| NI 43-101 | Canadian National Instrument for the Standards of Disclosure for Mineral Projects |

| Pb | Lead |

| PEA | Preliminary Economic Assessment |

| Polymetallic | Deposits that contain economically important quantities of three or more metals. |

| PPM | Parts per million |

| Stockwork | Mineral deposit consisting of a 3D network of planar to irregular veinlets closely enough spaced that the whole mass can be mined. They are also referred to as stringer zones. |

| VMS | Volcanic Massive Sulphide |

| Zn | Zinc |

Contacts:

| SEC Newgate UK | Elisabeth Cowell / Axaule Shukanayeva | + 44 20 3757 6882 |

| 4C Communications | Carina Corbett | +44 20 3170 7973 |

Canaccord Genuity (NOMAD and Joint Broker) | Henry Fitzgerald-O'Connor / James Asensio | +44 20 7523 8000 |

BMO Capital Markets (Joint Broker) | Tom Rider / Andrew Cameron | +44 20 7236 1010 |

Peel Hunt LLP (Joint Broker) | Ross Allister / David McKeown | +44 20 7418 8900 |

About Atalaya Mining Plc

Atalaya is an AIM and TSX-listed mining and development group which produces copper concentrates and silver by-product at its wholly owned Proyecto Riotinto site in southwest Spain. Atalaya's current operations include the Cerro Colorado open pit mine and a modern 15 Mtpa processing plant, which has the potential to become a centralised processing hub for ore sourced from its wholly owned regional projects around Riotinto that include Proyecto Masa Valverde and Proyecto Riotinto East. In addition, the Group has a phased earn-in agreement for up to 80% ownership of Proyecto Touro, a brownfield copper project in the northwest of Spain, as well as a 99.9% interest in Proyecto Ossa Morena. For further information, visit www.atalayamining.com

Forward Looking Statements

This announcement contains certain forward-looking statements and forward-looking information (collectively referred to herein as "forward-looking statements") within the meaning of applicable securities laws. All statements other than statements of historical fact are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "anticipate", "achieve", "could", "believe", "plan", "intend", "objective", "continuous", "ongoing", "estimate", "outlook", "expect", "may", "will", "project", "should" or similar words, including negatives thereof, suggesting future outcomes. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause the Company's actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements.

Forward looking statements contained herein include, but are not limited to, statements regarding the PEA and the associated increases or improvements in production, metallurgical recovery, capital costs, operating costs, project economics and financial metrics, future permitting activities, all of which are based on various assumptions including that the new development plan will proceed on schedule, that the development deposits are mineable as described, that metals prices will be at levels that render Riotinto economic and that internal data and analyses prove to be accurate. Forward-looking statements also include those relating to the future financial and operating performance of the Company and Riotinto, the estimates and realisation of Mineral Resources and Mineral Reserves, the timing and amount of estimated future production, plans relating to future exploration, expansion, development and production activities and the realisation of expected production and life of mine economics of Riotinto.

Certain risks, uncertainties and factors that may cause the actual results, performance or achievements to differ materially from forward-looking statements include, among others, general business, economic, competitive, political and social uncertainties; the actual results of current exploration, production and expansion activities; the actual results of reclamation activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of metals; the future costs of capital to the Company; possible variations of ore grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; environmental risks; uncertainties regarding reclamation expenses, title disputes or claims, limitations of insurance coverage, and the timing and possible outcome of litigation and regulatory matters; political instability, terrorist attacks, insurrection or war; and delays in obtaining governmental approvals or financing or in the completion of development, construction or expansion activities.

The reader is cautioned that such forward-looking statements are not a guarantee of future performance and may prove to be incorrect. These forward-looking statements are statements regarding the Company's intentions, beliefs or current expectations concerning, among other things, the Company's and/or its subsidiaries' results of operations, financial condition, prospects, growth, strategies, the industry in which the Company and its subsidiaries operate and are based on the opinions and estimates of management at the date the statements are made and should not be unduly relied on. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future.

These forward-looking statements speak only as of the date of this announcement and the Company does not undertake any obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof, except as required by applicable securities laws.

Non-GAAP Measures

Atalaya has included certain non-IFRS measures including "EBITDA", "Cash Costs" and "Cash Costs + Sustaining Capex" in this report. Non-IFRS measures do not have any standardised meaning prescribed under IFRS, and therefore they may not be comparable to similar measures presented by other companies. These measures are intended to provide additional information and should not be considered in isolation or as a substitute for indicators prepared in accordance with IFRS.

EBITDA includes gross sales net of treatment and refining charges ("TC/RC"), freight and distribution costs and all operating costs, excluding finance, tax, impairment, depreciation and amortisation expenses. See Table 7 for further details.

Cash Costs per pound of payable copper includes cash operating costs, including TC/RC, freight and distribution costs and net of by-product credits. Cash Costs per pound of payable copper is consistent with the widely accepted industry standard established by Wood Mackenzie and is also known as the C1 cash cost.

Cash Costs + Sustaining Capex per pound of payable copper includes C1 Cash Costs plus recurring sustaining capital expenditures but excludes one-off sustaining capital projects, such as tailings dam expansion.

| Cash Cost Calculation | ||||

Unit | 2023-2026 | 2027-2036 | LOM | |

| Copper Payable | kt | 225 | 662 | 960 |

| Site Operating Costs | ||||

| Mining | $m | 435 | 1,371 | 1,875 |

| Processing | $m | 492 | 1,275 | 1,962 |

| G&A | $m | 71 | 177 | 275 |

| Subtotal | $m | 998 | 2,822 | 4,112 |

| Contingency | $m | 50 | 141 | 206 |

| Total | $m | 1,048 | 2,963 | 4,318 |

| Offsite Costs | $m | 223 | 1,064 | 1,361 |

| By-Product Credits | $m | - | (1,438) | (1,444) |

| Total Cash Costs | $m | 1,271 | 2,588 | 4,235 |

| Total Cash Costs | $/lb Cu payable | 2.56 | 1.77 | 2.00 |

| Sustaining Capex | $m | 20 | 49 | 71 |

| Cash Costs + Sustaining Capex | $m | 1,291 | 2,637 | 4,306 |

| Cash Costs + Sustaining Capex | $/lb Cu payable | 2.60 | 1.81 | 2.03 |

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Atalaya Mining PLC

View source version on accesswire.com:https://www.accesswire.com/740466/Atalaya-Mining-PLC-Announces-Results-of-New-PEA-for-Riotinto