After-Tax NPV5 of USD 573 million, 58.4% IRR & 10.6 Month Payback

LONDON, UK / ACCESSWIRE / March 6, 2023 / Meridian Mining UK S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQB:MRRDF) ("Meridian" or the "Company") is pleased to announce the positive results of the Preliminary Economic Assessment led by Ausenco Engineering Canada Inc. ("Ausenco") for the Cabaçal gold-copper deposit in Brazil ("Cabaçal" or the "Project"). The PEA study confirms the economic potential of the project, positioning it as a promising growth opportunity for the company.

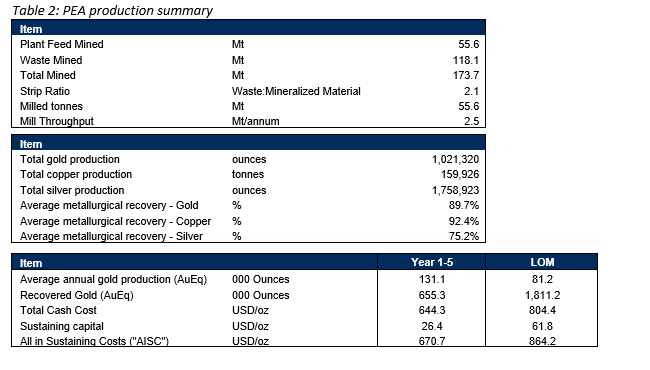

Cabaçal 2023 PEA Highlights: (All amounts are in United States Dollars unless otherwise stated)

- Base case after-tax NPV5 of $573M (CAD1 $778M) and 58.4% IRR using $1,650/oz gold, $3.59/lb copper, and $21.35/oz silver (Table 1);

- Spot case after-tax NPV5 of $745M (CAD1 $1.01B) and 69.7% IRR using3 $1,841/oz gold, $4.13/lb copper, and $21.35/oz silver;

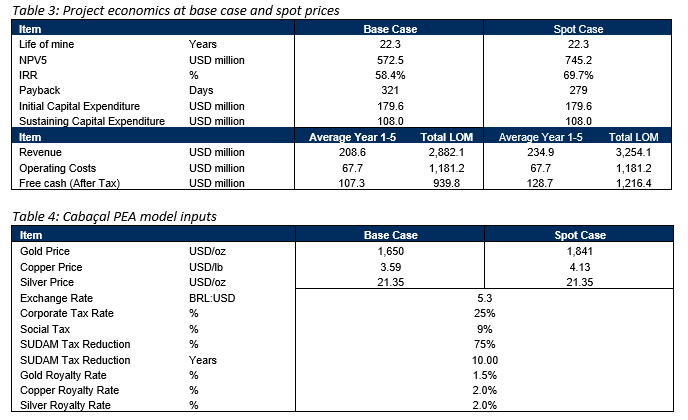

- High-grade year 1 mill feed of 2.3 g/t gold and 0.29% copper which generates high after-tax first year free cash flow of $204M, leading to capital repayment in 10.6 months;

- Average grade of 0.64 g/t gold and 0.31% copper over the life of mine - which demonstrates the efficiency of the flowsheet in recovering the gold, copper and silver;

- Average annual gold equivalent production of 131,100 ounces at AISC of $670.70/oz AuEq2 for years 1-5;Total LOM (22.3 years) production of 1.02M ounces gold, 353 Mlbs of copper and 1.76M ounces of silver;

- Pre-production CAPEX of $179.6M (CAD1 $244.1M);

- Low life-of-mine strip ratio of 2.1:1;

- After tax NPV5:CAPEX Ratio of 3.2:1; and

- Significant potential for future economic optimization and project upside remains through engineering optimizations, increased throughput and additional resources that could be identified through the ongoing drill programs.

- Exchange Rate USD/CAD of 1.35889.

- See technical notes for gold equivalent equation.

- Spot prices on London close on 1st March, 2023.

Meridian will host a Live Webcast to discuss the Cabaçal PEA Results on March 6, 2023 at 10:30am EST (7:30am PST). A presentation by management will be followed by Q&A.

Conference Call Webcast and Dial in Details:

Webcast URL with Audio: https://www.webcaster4.com/Webcast/Page/2958/47803

Telephone Numbers: US/Canada Free: 888-506-0062; International: 973-528-0011; Access Code: 624154

Dr. Adrian McArthur, Meridian's CEO commented, "The PEA demonstrates Cabaçal's exceptional potential as a sustainable, low-cost open-pit mining operation capable of supplying both industrial and precious metals to the global market. The PEA study has shown exceptionally high-margin and meaningful returns, confirming both the quality of the asset and the expertise of our technical team. Within just two years of acquiring Cabaçal, we have produced our first economic study, outlining an after-tax NPV5 of $573m, which is a testament to our commitment to swift and effective progress.

"The PEA lays a solid foundation for expansion, as the Company anticipates that optimization studies will confirm the potential for superior economic returns by increasing annual throughput from 2.5Mt to ~4Mt after year four, while still using the same resource. What excites us even more is the potential for further growth, not only at Cabaçal, but also at our other satellite targets, including the nearby St Helena mine within trucking distance. This presents a genuine opportunity for us to advance Cabaçal, as outlined in our PEA, and to systematically develop a cornerstone asset in a significant new gold and copper camp over time."

"We are pleased to have a team of mining professionals already stationed in Brazil to advance Cabaçal through feasibility following the completion of the PEA. We extend our gratitude to Meridian's team, as well as Ausenco and GE21, for their role in delivering this report and contributing to the revival of the Cabaçal gold and copper mine."

Table 1: Summary of Cabaçal PEA's NPV5 and IRR sensitivities to metal prices

PEA Results Summary

Figure 1: Cabaçal project annual and cumulative cash flow

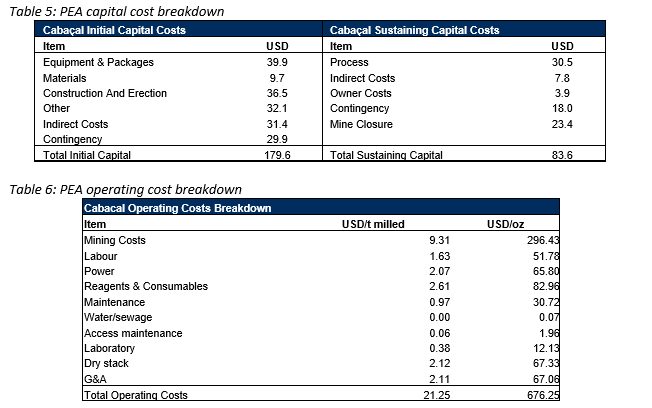

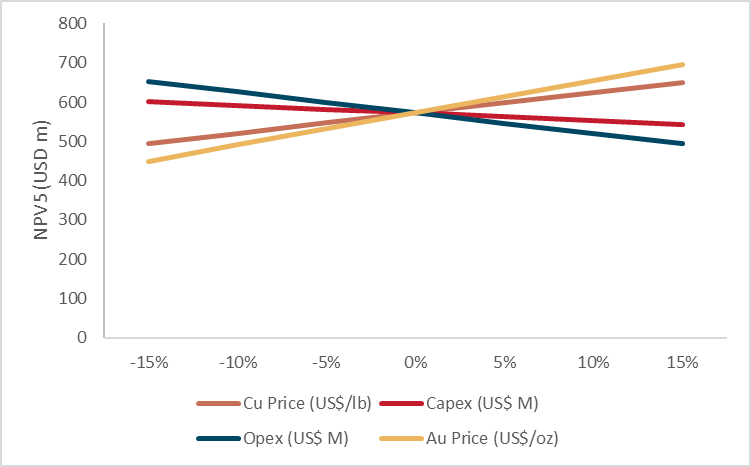

Figure 2: NPV5 Sensitivity to costs and metal prices.

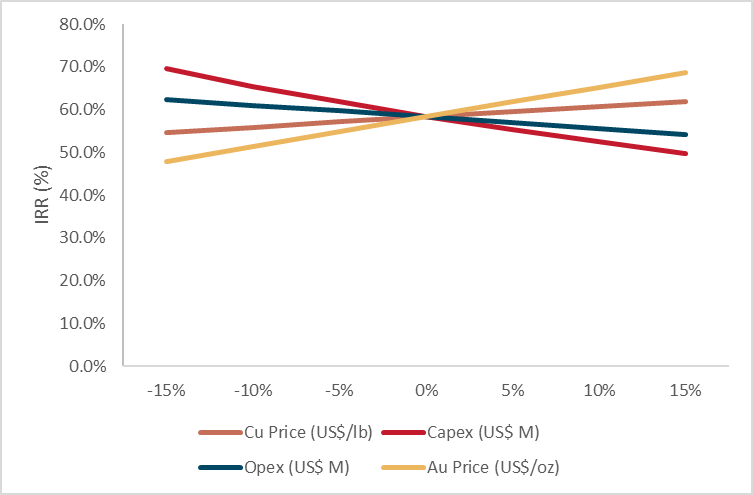

Figure 3: IRR sensitivity to costs and metal prices.

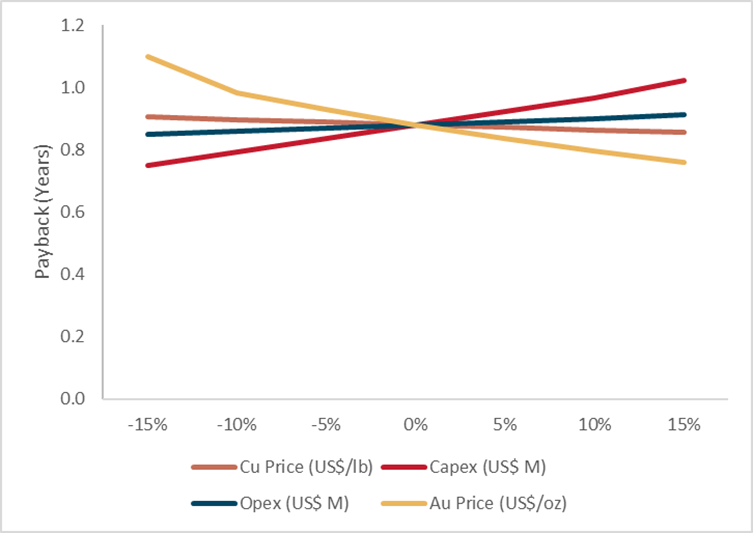

Figure 4: Payback sensitivity to costs and metal prices.

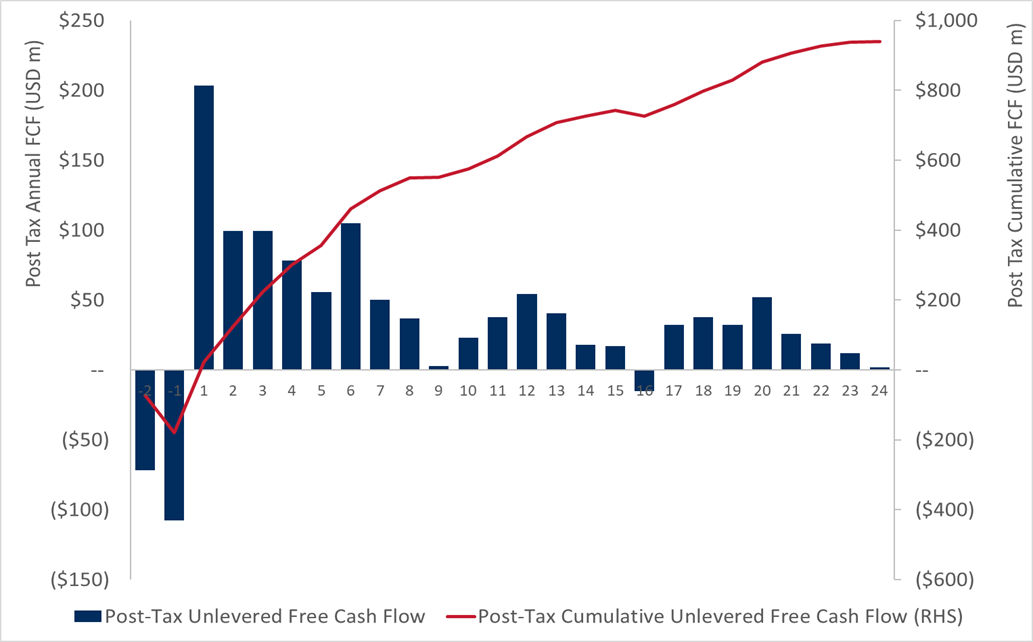

Study Contributors

The PEA team was led by Ausenco, a global provider of consulting and engineering services for mining projects. Ausenco were supported by H&S Consultants Pty Ltd (resource estimation), GE21 Mineral Consultants Ltd (mine plan and schedule), SGS Lakefield Canada (metallurgy), Sete Soluções e Tecnologia Ambiental Ltda (environmental studies) and Hidrovia Hidrogeologia e Meio Ambiente Ltda (hydrological studies).

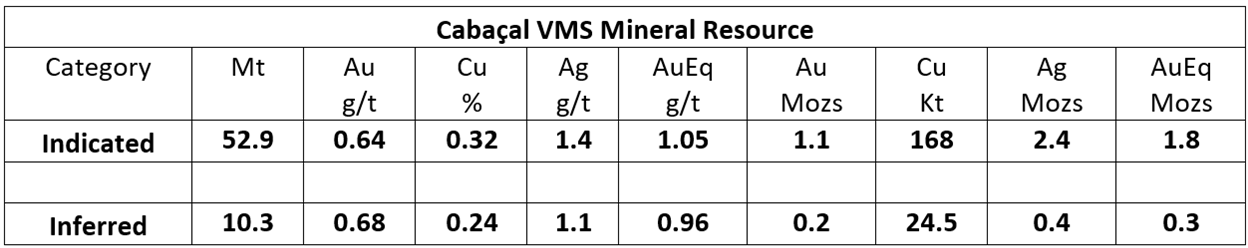

Cabaçal Resource Estimate1

Table 7: Cabaçal Mineral Resource (Effective Date August 21st, 2022, 0.3 g/t AuEq cut-off)

Estimates are based on the Technical Report titled, "Independent Technical Report, Mineral Resource Estimate for the Cabaçal VMS deposit, Cabaçal Project, State of Mato Grosso, Brazil". The Mineral Resource estimate in the table above was prepared by specialist group, H&S Consultants Pty Ltd ("H&SC") and announced by Meridian on September 26, 2022. A technical report was filed on the Company's website and SEDAR within 45 days of this disclosure.

- Mineral Resources are not mineral reserves and do not have demonstrated economic viability; and

- Minor variations may occur during the addition of rounded numbers.

Significantly, the Mineral Resource is near-surface, and extends over 1.9km along strike with a prominent high-grade shallow gold zone in the Cabaçal Northwest Extension. Ongoing drilling on the margins of the Mineal Resource has intercepted significant zones of copper-gold mineralization. Further drill results are pending.

The Mineral Resource estimate included in the PEA is reported according to the classification criteria set out in the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards for Mineral Resources and Reserves ("CIM Definition Standards"). These standards are internationally recognized and allow the reader to compare the Mineral Resource with that reported for similar projects.

The PEA is preliminary in nature. The PEA mine schedule and economic assessment includes numerous assumptions and is based on both Indicated and Inferred mineral resources. Inferred resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the project economic assessments described herein will be achieved or that the PEA results will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Additional exploration will be required to potentially upgrade the classification of the Inferred Mineral Resources to be considered in future project evaluation studies.

Mining

- 22.3-year shallow open pit mining operation proposed at with total feed inventory of 55.6 Mt;

- High-grade year 1 mill feed of 2.3 g/t gold and 0.3% copper with average grade of 0.64 g/t gold and 0.31% copper over the life of mine; and

- Low life-of-mine strip ratio of 2.1.

Cabaçal will be mined using the open pit method in 3 alternating shifts, operating 24 hours a day, 365 days a year. The mining movements were designed to produce enough ROM to feed a mineralized material processing plant with a nominal capacity of 2.5Mtpy and LOM of 22 years and 4 months.

The mining will operate with block model of 10x10x5m and slope angle in the hang wall of 48º and following the mineralized material slope in the foot wall.

Mining will be fully outsourced in the operations of mechanical blasting, loading and haulage. With a soft mineralized material - average WI of 11.8 - blasting will be carried out with a load ratio of 350g/t for mineralized material and 280g/t for waste. A dilution factor of 3% and mining recovery of 97% were considered. The transport distance from the mine to the ROM yard varies from 1.49Km in the pre-stripping to a maximum of 2.50Km in year 18. For the waste the transport distance will range from 1.02Km to 4.02Km in year 18.

The transport of the mineralized material and waste will be carried out by 42t trucks manufactured in Brazil, a fact that contributes to the reduction of CAPEX and OPEX costs. For work associated with these trucks, 8.1t hydraulic excavators were dimensioned, which means 4.7 passes per truck loaded with mineralized material and 5.1 passes per truck loaded with waste.

Trucks will transport the mineralized material for discharge directly into the crusher or to the ROM stockyard. When necessary to recover mineralized material from the ROM stockyard, a 13.7t wheel loader will be used. The waste will direct to the 3 projected waste dumps, each trip being directed to the pile closest to the pit region in mining activities at that time. From the 16th year onwards mining in the northwest extension of the pit will have been completed, thus permitting the return of waste material to this area and thereby reducing costs and environmental impacts.

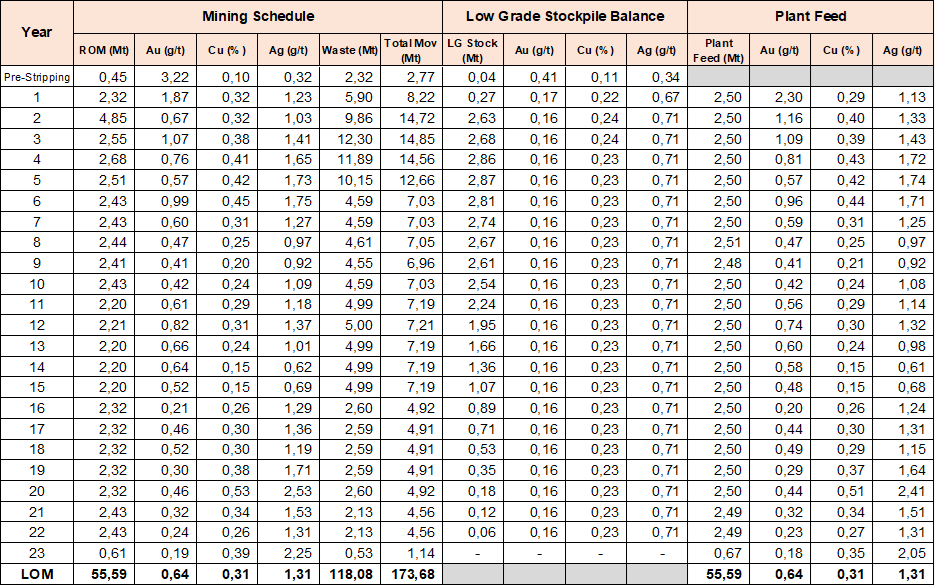

The table below shows annually, since pre-stripping, the mining plan (0.3 g/t AuEq. Cut-off) and the mineralized material feeding plan in the beneficiation plant. A mining plan was adopted that allows the plant to be fed with mineralized material of high gold content equivalent in the first years of production, storing low-grade mineralized material (LG) to be fed later. This allowed the elaboration of a plan optimizing the economic model of the project. The mining strip ratio results in an average value of 2.12.

Table 8: Cabaçal mining schedule

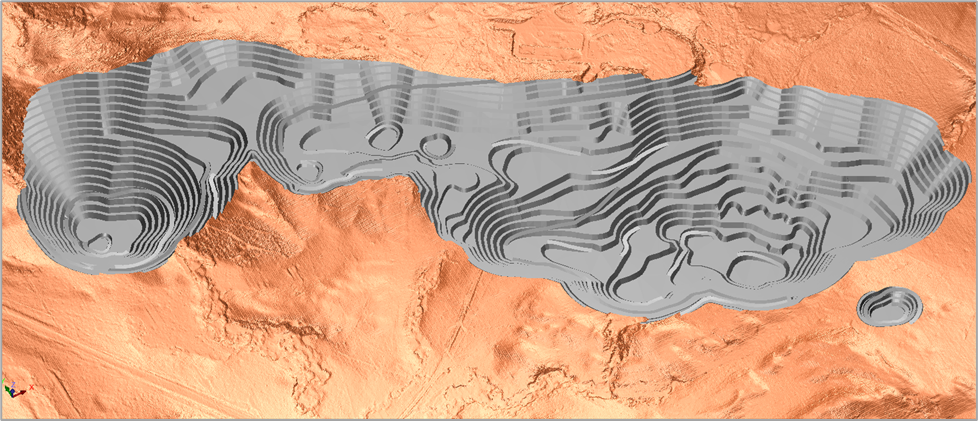

Figure 5: The final pit shell of the Cabaçal mine.

Metallurgical Testing

- Testwork supports production of a high-grade copper concentrate of 28.4% with payable gold and silver;

- High metallurgical recoveries of 87.39% for gold and 92.4% for copper;

- Circa 30 % of gold recovered via a gravimetric circuit;

- Copper flotation is effective;

- Rougher concentrate is reground to 40 microns prior to cleaning to enhance grades and recoveries; and

- Waste rock and mill tailings projected to be non-acid generating.

In 2022, Meridian selected samples from seven metallurgical drill holes to confirm historical Cabaçal process performance in a testwork program at SGS Lakefield, Canada. The holes provided samples from the four known main VMS systems at Cabaçal and most of the samples were within the expected head grade range for the deposit. A key feature of the Cabaçal mineralization is the low S:Cu ratio, which implies low pyrite/pyrrhotite content. The average feed would be expected to be ~ 1.5 S:Cu which confirms the historical mineralogy, suggesting that chalcopyrite is about 65% of the sulphides in the sulphide assemblage. Comminution tests were conducted. The average Bond Work Index was 11.2 which is considered to be relatively soft and not atypical for VMS deposits. The average Abrasion Index was 0.28 which suggests moderate abrasion. Samples were considered to be of medium to hard competency for SAG milling (average SMC A x b was 44.5). A three stage Gravity Recoverable Gold ("GRG") test was conducted on the Master Composite sample. The final GRG number is 64.3, which is considered quite high and is an indication that this material is amenable to gravity gold recovery. It is anticipated that gold not recovered in the gravity circuit will be picked up in the downstream flotation circuit. Rougher conditions for flotation testwork used natural pH, potassium amyl xanthate ("PAX") collector and Methyl Isobutyl Carbinol ("MIBC") frother. Sulphur recovery was typically around 95% leaving a non-acid generating tailing, which was typically less than 0.1% in sulphur content. Mass pull for the Master Composite was around 5 to 6 percent by weight. The rougher flotation was conducted mostly in solids percent around 35%. The slope between recovery and concentrate grade is quite flat, which indicates that the Cabaçal mineralization could produce higher grade concentrates. A 24.8 % copper concentrate was produced with 94.4% copper recovery, 87.2% gold recovery (gravity + float) and 81.9% silver recovery (gravity + float). The recoveries achieved are in line with the historic metallurgy. A pyrite concentrate was produced from the cleaner tailings to remove the acid generating minerals. The concentrate assayed 44% of sulphur with notable levels of gold and silver which could have market potential.

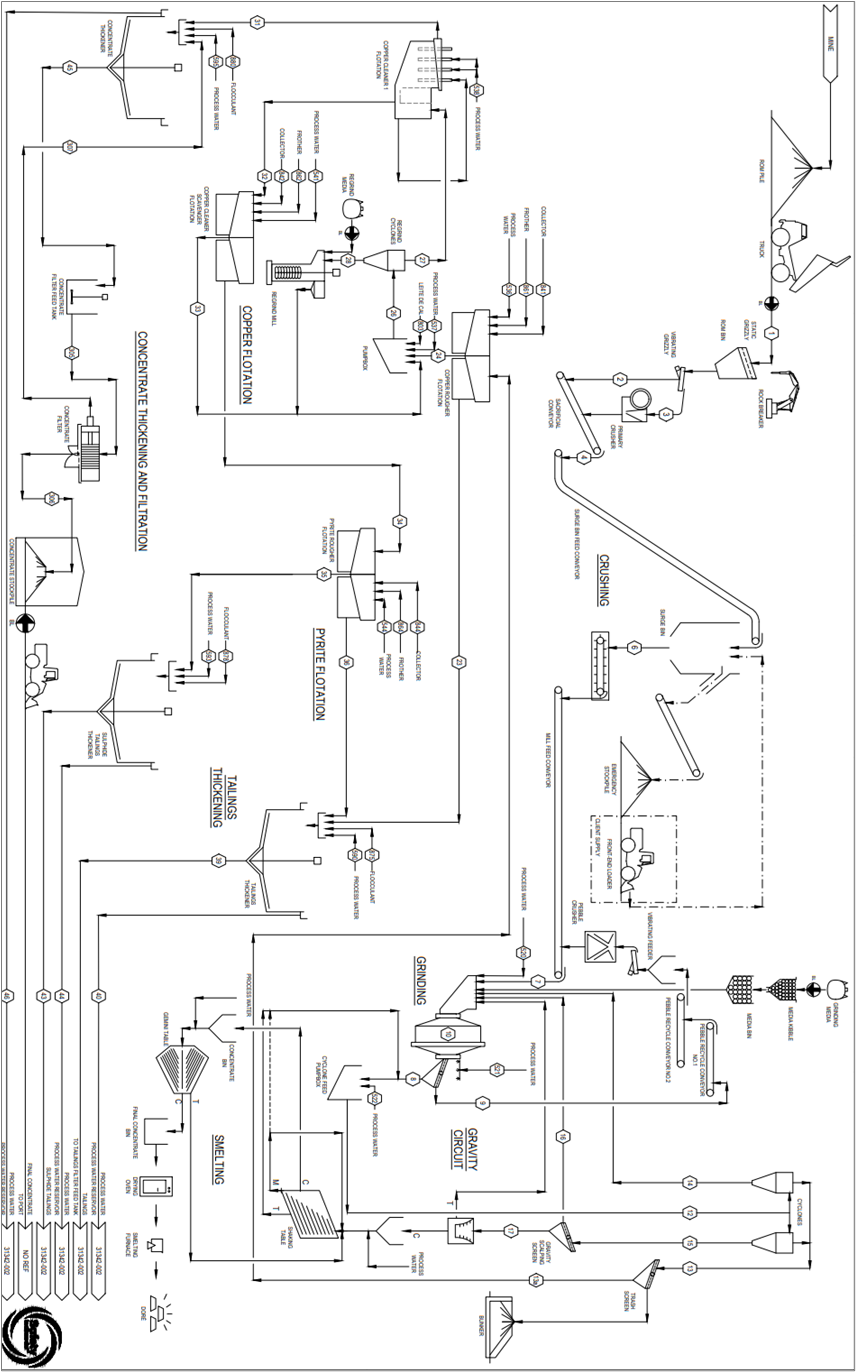

A gravity circuit recovers the free gold which is converted to a doré product for sale. The sulphide minerals including copper, in the form of chalcopyrite, and associated gold and silver will be recovered by rougher flotation. The rougher concentrate is reground to 40 microns to separate the gangue material and lime is added to suppress the pyrite. The rougher and cleaner tails are expected to be low in sulphides, therefore non-acid generating and are combined for disposal together in a dry stacked facility. The pyrite float will either be sold or separately stored.

Mineral Processing

- 2.5Mtpa mill capacity designed with conventional flowsheet;

- P80 grind size of 200 micron and moderate to soft rock hardness requires only a SAG mill and 1 stage crushing.

Based on the SGS testwork results, Ausenco designed a new process plant to process 2.5Mtpa of run-of-mine (ROM) feed from the Cabaçal open pit. The process comprises crushing and grinding to reduce the RoM material to a characteristic grind (P80) of 200 microns (µ). Cleaning then occurs in a Jameson cell followed by a single stage cleaner flotation cell. The Process flowsheet is illustrated in Figure 6.

Figure 6: Cabaçal Process flowsheet diagram

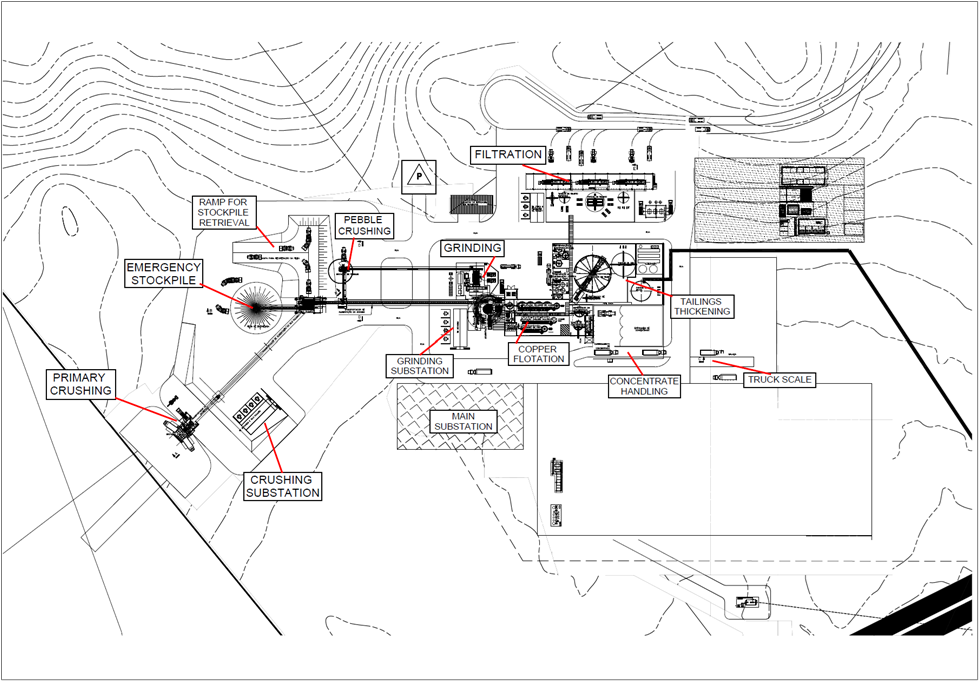

Figure 7: Cabaçal process plant layout

Access and infrastructure

Infrastructure associated with the historic Cabaçal Mine has been removed from site, aside from some old buildings which are being converted to field offices and core processing / storage facilities. The PEA therefore assumes that the new Cabaçal mine is effectively a greenfields project.

Cabaçal is well supported by existing public infrastructure. It is located in the State of Mato Grosso, Brazil. It is accessed by sealed roads approximately 320 km west-north-west of the state capital Cuiabá, then a 30km all-weather gravel road from the Company's administrative base in the town of São José dos Quatro Marcos.

The region is currently supplied by a high-voltage 34.5kV power line. Several hydroelectric power stations operate in the region. A potential route for the construction of an electric line of sufficient capacity for the Cabaçal project from the Araputanga substation to the Project area has been identified, extending over 21 km.

Subject to permitting, water is potentially available from the nearby Cabaçal river. The process facility aims to recover and re-use as much process water as possible. All rainwater that comes in contact with mining operations is planned to be collected and either used on site or treated to required standards then released.

Mine services and labour are readily available, primarily from nearby towns.

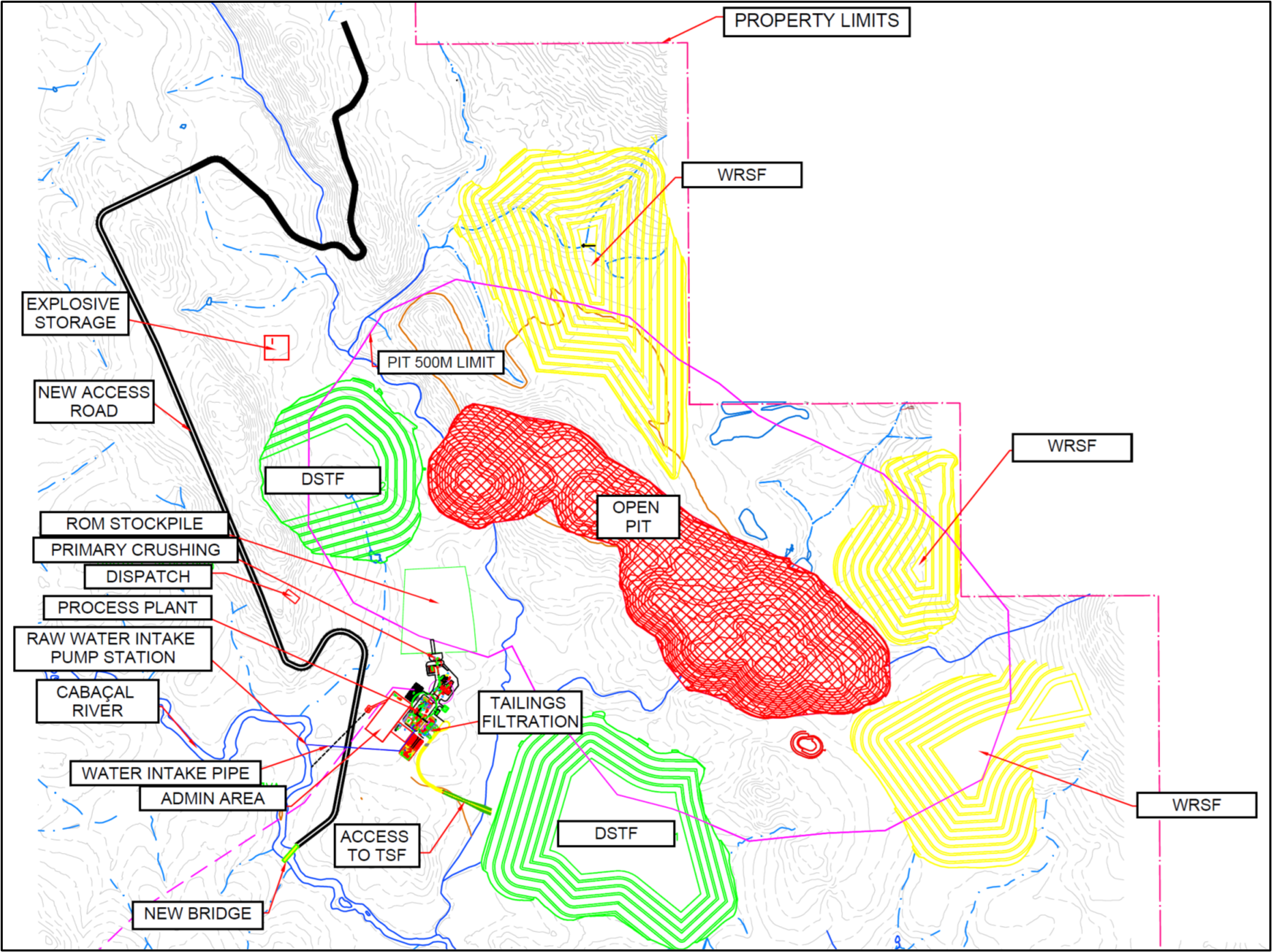

The Cabaçal site plan is shown in Figure 8. The major project facilities include the open pit mines, tailings management facility (TMF), waste rock facilities, mine services and access roads. Site selection took into consideration the following factors:

- Locate the process plant on competent flat ground and in an area with minimal potential to be mineralized;

- Locate the process plant and other facilities at a safe distance from the mine pit and blasting operations; and

- Locate the process plant and waste storage facilities to minimise transport distances.

Figure 8: Cabaçal mine site layout

Several areas have been identified to store waste rock from the mine. Three waste rock storage facilities (WRSF) have been identified in the PEA. The tailings will be filtered to produce a dry cake that will be trucked from the filter plant and stacked in two DSTFs. The DSTFs have been design to international standards for the PEA. Initial studies indicate that waste rock and tailings are potentially non-acid generating. Detailed waste material characterisation studies are planned for optimization of the long-term storage facility design for construction, safe operation and eventual closure.

Environmental, Permitting & Stakeholder Engagement

Meridian commenced baseline environmental and social impact data collection in January 2022. Meridian has engaged the Sete Soluções e Tecnologia Ambiental Ltda to undertake environmental studies, Hidrovia Hidrogeologia e Meio Ambiente Ltda has been engaged to undertake hydrogeological studies and Totem Consultoria em Arqueologia Ltda has been engaged to perform archaeological studies of the Cabaçal project area. These studies are ongoing and expected to be completed this year to enable the permitting application process to commence later this year.

Meridian also undertakes its own stakeholder engagement processes which commenced on acquiring the Cabaçal project in 2021. The Cabaçal project is located within farming land, with no artisanal mining activity. Aside from local farmhouses, there are no settlements or population clusters within the project's active area. The nearest indigenous land is located 80km distant from Cabaçal to the northwest (Terra Indígena Figueiras). The project is located more than 25 km away from areas classified as Quilombolas (settlements first established by escaped slaves in Brazil, whose descendants have recognized land rights). No areas classified as of special tourist importance are present. Since commencement of activities, the Company has established written or verbal exploration access agreements with thirty-one landowners and continues to engage with others progressively along the trend of the licences.

Upside and optimisation

The PEA results provide a high-level estimate of the potential economic value of the mineral resources discovered to August 2022. In completing the PEA a number of opportunities were identified that would potentially enhance the Cabaçal project, subject to completing the necessary assessment. Some of this work is already underway These include:

- Resource infill and extensional drilling has been underway since the cut off for the initial resource in August 2022. The primary aim is to improve the confidence of the Mineral Resource estimate and to test zones that currently have little information;

- The Cabaçal resource is open to the NW and SE and sits in a corridor of 11km of prospective ground with numerous targets. Exploration drilling will progressively test the targets generated and geophysics and geochemistry will be used to identify additional targets;

- A Geotechnical study of the proposed Cabaçal pit will be conducted to enhance knowledge of the competency of the rock mass in which the Cabaçal deposit is hosted. Conservative pit wall slopes were assumed for the PEA and subject to the results of the geotechnical study these angles may be made steeper, thereby reducing the quantity of waste rock needing to be mined;

- A Geotechnical study for the proposed infrastructure (Process Plant, DSTF, WRSF and other ancillary facilities will be conducted to enhance knowledge of the subgrade and foundation conditions for the proposed facilities. Conservative assumptions were assumed for the PEA and subject to the results of the geotechnical study these may change based on the geotechnical program;

- The PEA did not have the opportunity to undertake a processing scale optimisation study. The Mineral Resource estimate published in September 2022 was more than 2 times larger than the previous historic resource, producing a 22 year mine life for the PEA. An optimisation study would determine if processing at a higher rate would further improve the project economics; and

- 24.7Mt @ 0.22g/t AuEq of mineralized material between 0.15 to 0.3 g/t gold equivalent was categorised as waste rock for the purposes of the PEA. Further study is warranted to establish if this could be economically processed, thereby reducing the amount of waste requiring disposal.

Non-International Financial Reporting Standards ("IFRS") Financial Measures

The Company has included certain non-IFRS financial measures in this news release, such as initial capital cost, sustaining capital cost, total capital cost, AISC, and capital intensity, which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. As a result, these measures may not be comparable to similar measures reported by other corporations. Each of these measures used are intended to provide additional information to the user and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Non-IFRS financial measures used in this news release and common to the gold mining industry are defined below.

Total Cash Costs and Total Cash Costs per Ounce

Total cash costs are reflective of the cost of production. Total cash costs reported in the PEA include mining costs, processing and water treatment costs, general and administrative costs of the mine, off-site costs, refining costs, transportation costs and royalties. Total cash costs per ounce is calculated as total cash costs divided by payable gold ounces.

AISC and AISC per Ounce

AISC is reflective of all of the expenditures that are required to produce an ounce of gold from operations. AISC reported in the PEA includes total cash costs, sustaining capital, closure costs and salvage, but excludes corporate general and administrative costs. AISC per ounce is calculated as AISC divided by payable gold ounces.

Qualified Person Statement

The PEA Study has an effective date of 01 March, 2023. It was authored by independent Qualified Persons and is in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects. The following Qualified Persons ("QPs") are responsible for the PEA Study and have reviewed the information in this news release that is summarized from the PEA Study in their areas of expertise:

- Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering) is responsible for project infrastructure, recovery methods, capital and operating costs relating to processing, and economic analysis.

- Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering) is responsible for tailings infrastructure, capital and operating costs relating tailings infrastructure and environmental.

- Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&S Consultants Pty Ltd, is responsible for the geological setting, deposit type, exploration, drilling, sample preparation, data verification, Mineral Resource estimation, and adjacent properties.

- Joseph Keane (Mineral Processing Engineer; P.E), of SGS North America Inc, is responsible for the project laboratory testing methodology and interpretation.

- Guilherme Gomides Ferreira (Mine Engineer MAIG), of GE21 Consultoria Mineral, is responsible for mining method, capital and operating costs related to the mine.

Dr Adrian McArthur, Chief Executive Officer of Meridian Mining UK, a QP as defined in NI 43-101, has reviewed the PEA Study on behalf of the Company and has approved the technical disclosure contained in this news release. The PEA Study is summarized into a technical report that will be filed on the Company's website at www.meridianmining.co and on SEDAR at www.sedar.com in accordance with NI 43-101 within 45 days of this news release.

Technical Notes

Gold equivalents are calculated as: AuEq(g/t) = (Au(g/t) * %Recovery) + (1.492*(Cu% * %Recovery)) + (0.013*(Ag(g/t) * %Recovery)), where:

- Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856

- Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

- Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield.

Cautionary Statement on Forward-Looking Information

All statements, other than statements of historical fact, contained in this press release constitute "forward-looking information" and "forward-looking statements" within the meaning of certain securities laws and are based on expectations and projections as of the date of this press release. Forward-looking statements contained in this press release include particularly, but without limitation, those related to the PEA Study results (as such results are set out in the various graphs and tables featured above, and are commented in the text of this press release), such as the Project's production profile, LOM, construction and payback periods, NPV, IRR, (direct/indirect, before/after tax) capital costs, contingency, industry leading operating costs, AISC, sustaining capital costs, free cash flows, M&I resources, open pit mineralization and waste extraction, mill feed, milling process and recovery, power supply arrangements and power consumption, and closure costs.

- Forward-looking statements are based on expectations, estimates and projections as of the time of this press release. Forward-looking statements are necessarily based upon several estimates and assumptions that, while considered reasonable by the Company as of the time of such statements, are inherently subject to significant business and economic uncertainties and contingencies. These estimates and assumptions may prove to be incorrect.

Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, actual results to differ materially from those expressed or implied in any forward-looking statements. As future events and results could differ materially what is currently anticipated by the Company, notably (but without limitation) in the PEA Study, there can be no assurance that the PEA Study results will prove to be accurate as actual results and future events can differ materially from those anticipated in the PEA Study.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. Forward-looking statements are provided for the purpose of providing information about management's expectations and plans relating to the future. Readers are cautioned not to place undue reliance on these forward-looking statements as several important risk factors and future events could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions, and intentions expressed in such forward-looking statements.

All forward-looking statements made in this press release are qualified by these cautionary statements and those made in the Company's other filings with the securities regulators of Canada including, but not limited to, the cautionary statements made in the relevant section of the Company's Management Discussion & Analysis. The Company cautions that the foregoing list of factors that may affect future results is not exhaustive, and new, unforeseeable risks may arise from time to time. The Company disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law.

About Cabaçal

In November 2020, Meridian signed a Purchase Agreement to acquire 100% ownership of certain licences covering the historical Cabaçal and Santa Helena mines and the along-strike licences, from two private Brazilian companies ("Vendors"). Subsequently, Meridian expanded its land tenure to today's 50km of strike length. Cabaçal had two historical, shallow, high-grade selectively mined underground mines that cumulatively produced ~34 million pounds of copper, ~170,108 ounces of gold, ~1,033,532 ounces of silver and ~103 million pounds of zinc via conventional flotation and gravity metallurgical processes.

Meridian has defined an open trend of shallow copper-gold mineralization centred on the Cabaçal Mine. This mineralization trends Northwest-Southeast, sub-crops along its Northeast limits, dips to the southwest at 26° and is up to 90m thick; presenting excellent open-pit geometry and mineral endowment. Meridian is currently focused on infill drilling along a 2,000m corridor along this trend.

Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within units of deformed metavolcanic-sedimentary rocks ("VMS"). A later-stage sub-vertical gold overprint event has emplaced high-grade gold mineralization truncating the dipping VMS layers. It was explored and developed by BP Minerals/Rio-Tinto from 1983 to 1991 and then by the Vendors in the mid-2000's. This historical exploration database includes over 83,000 metres of drilling, extensive regional mapping, soil surveys, metallurgy from production reports, and both surface and airborne geophysics. The majority of Cabaçal's prospects remain to be tested.

Cabaçal has excellent infrastructure with access by all-weather roads, clean electricity provided by nearby hydroelectric power stations, and local communities provide mining services and employees. Cabaçal consists of 1 mining license, 1 mining lease application, and 7 exploration claims which total 44,265 hectares. The September 2022 Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9Mt @ 0.6g/t Au, 0.3% Cu and 1.4g/t Ag and Inferred resources of 9.0Mt @ 0.7g/t Au, 0.2% Cu & 1.1g/t Ag2, with strong optionality for targeting higher grade mineralization for the future development studies.

About Meridian

Meridian Mining UK S is focused on the acquisition, exploration, and development activities in Brazil. The Company is currently focused on resource development of the Cabaçal VMS gold-copper project, the regional scale exploration of the Cabaçal VMS belt, the exploration in the Jaurú & Araputanga Greenstone belts all located in the state of Mato Grosso and exploring the Espigão polymetallic project in the State of Rondônia Brazil.

About Ausenco Engineering

Ausenco is a global company 'redefining what's possible'. Its team is based across 26 offices in 14 countries, with projects in over 80 locations worldwide. Combining their deep technical expertise with a 30-year track record, Ausenco provides innovative, value-add consulting and engineering studies and project delivery, asset operations and maintenance solutions to the mining & metals, oil & gas, and industrial sectors.

On behalf of the Board of Directors of Meridian Mining UK S

Dr. Adrian McArthur

CEO and Director

Meridian Mining UK S

Email: info@meridianmining.net.br

Ph: +1 (778) 715-6410 (PST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

1See Meridian news release September 26, 2022 https://meridianmining.co/press-releases/

2Meridian Mining News Release of September 26, 2022

SOURCE: Meridian Mining UK S

View source version on accesswire.com:https://www.accesswire.com/742083/Meridian-Delivers-Strong-Economics-for-Cabaals-PEA