VANCOUVER, BC / ACCESSWIRE / April 18, 2023 / Core Assets Corp., ("Core Assets" or the "Company") (CSE:CC)(FSE:5RJ)(OTCQB:CCOOF) is pleased to announce surficial assay results from the Falcon Target ("Falcon") - a historic vein-hosted gold-silver occurrence located 950m north-northeast of the Jackie CRD Target at the Silver Lime CRD-Porphyry Project ("Silver Lime"), north-central Blue Property ("Blue"); Atlin Mining District of NW British Columbia.

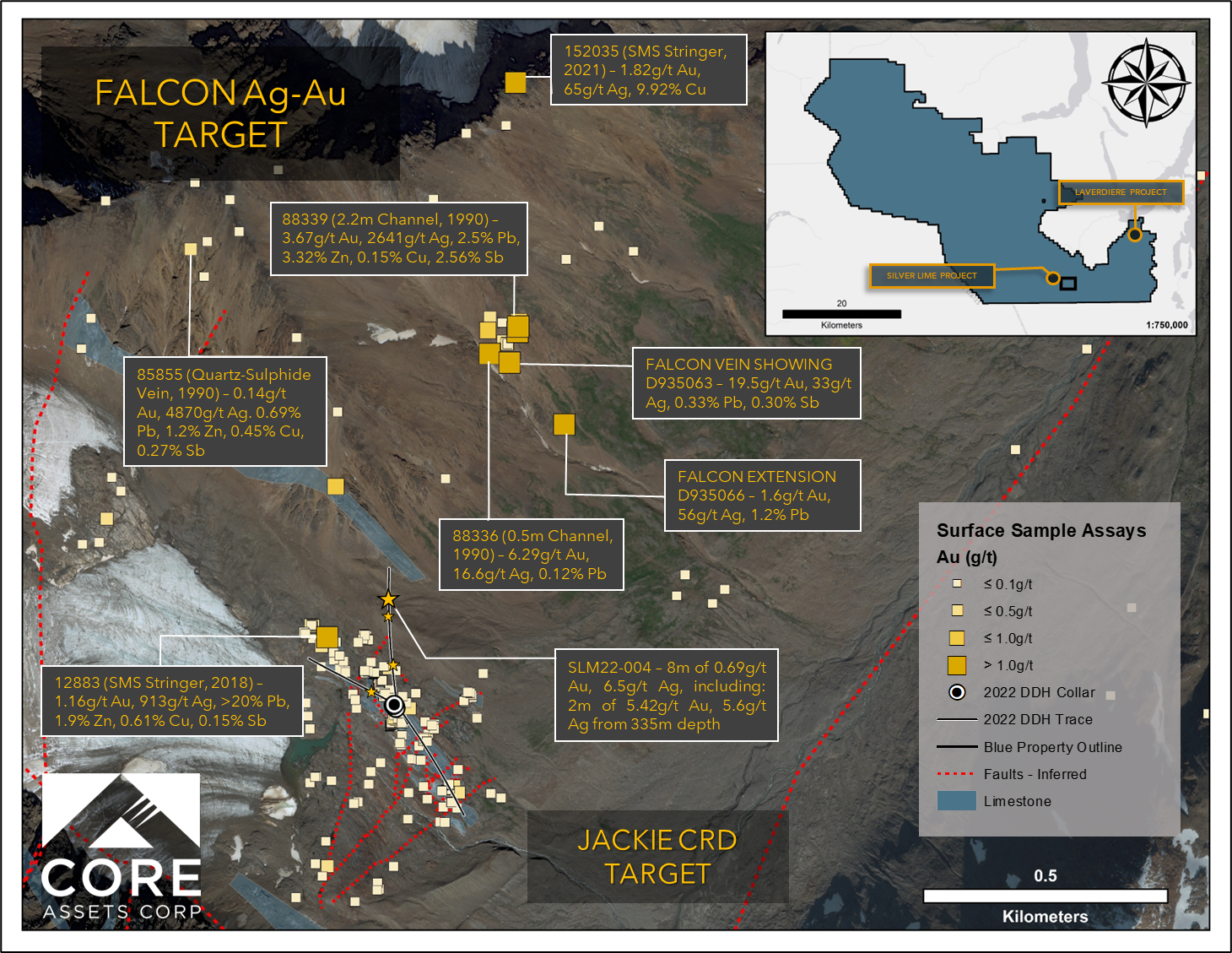

In 2022, prospecting and sampling located and extended the footprint of vein-hosted Ag-Au mineralization at the Falcon Target by 170 metres. Quartz veins sampled at the Falcon Extension in 2022 graded up to 19.5g/t Au, 33g/t Ag, 0.33% Pb, and 0.30% Sb (Figures 1, 2).

Historically, outcrop grab and chip sampling at Falcon identified two northwest trending quartz veins containing semi-massive arsenopyrite, stibnite, pyrite, and galena that returned an average grade of 3.67g/t Au, 2,641g/t Ag, 0.15% Cu, 2.50% Pb, 3.32% Zn, 5.78% As, and 2.56% Sb over a 2.2m channel sample1. This vein system is hosted in metasediments, was originally traced for 25 meters along strike and remains open under talus cover. To the northwest of the Falcon Target, smaller veins of similar composition hosted in quartz-feldspar porphyry breccia dykes historically graded up to 0.94g/t Au, 975g/t Ag, 1.2% Pb, and 0.9% Zn (Figure 2).

"In addition to the high-grade carbonate replacement occurrences discovered and sampled at the Silver Lime CRD-Porphyry Project, many historical and new high-grade vein-hosted occurrences were located and extended in 2022." said Core Assets' President & CEO, Nick Rodway. "Adding the presence of elevated vein-hosted gold and silver to the Silver Lime portfolio significantly increases our Property's metal endowment potential and exploration optionality. We are excited to continue to develop and test these high-grade targets in 2023."

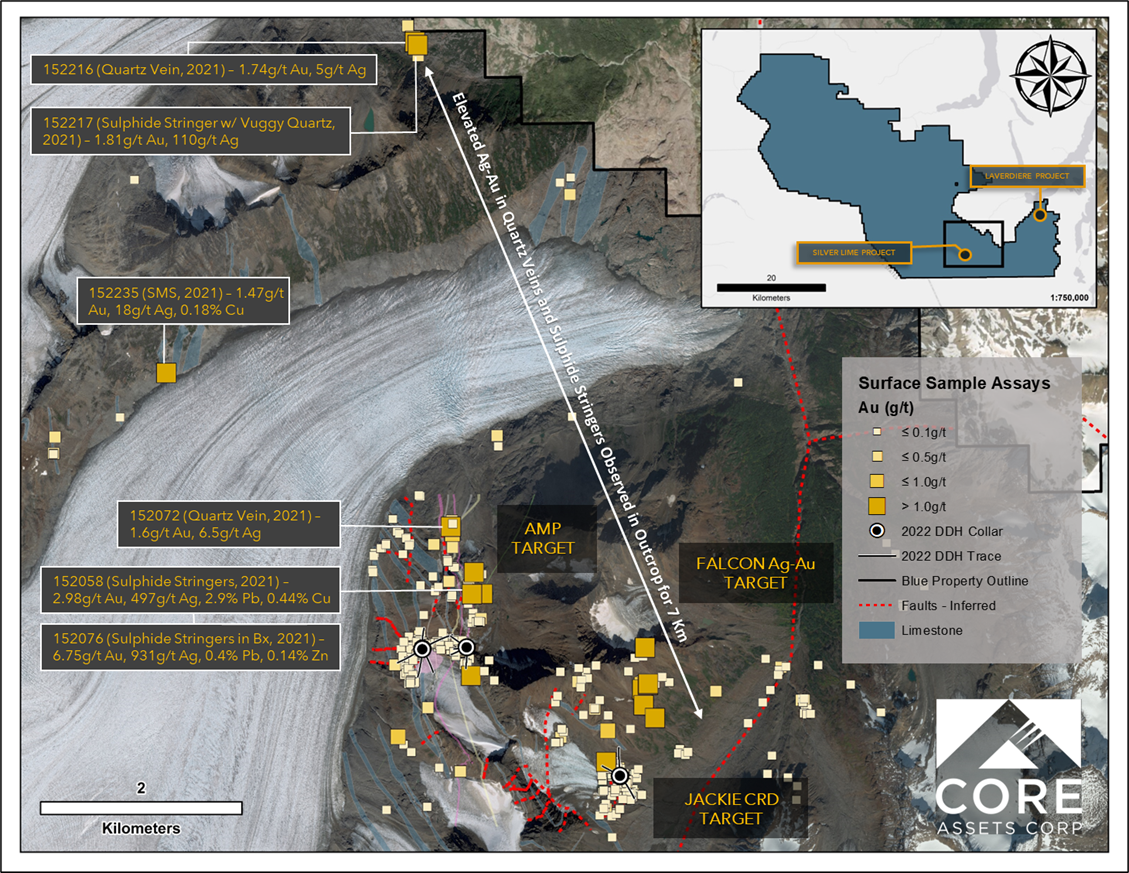

Au-bearing semi-massive sulphide-quartz stringer veins and bleeders sampled near the Falcon Target historically assayed up to 1g/t Au and carried significant Ag grades of up to 4,870g/t, in addition to variable amounts of Pb, Zn, Cu, As, and Sb (Figure 2). Similar Ag-Au-bearing vein sets have been observed up to 7KM north-northwest of the Falcon Target, as well as in Jackie Target drill hole SLM22-004. These veins were identified and sampled by the Core Assets field team in 2021 and 2022 and graded up to 931g/t Ag with 6.75g/t Au (Figure 3).

Figure 1: Photographs of the Ag-Au-bearing quartz veins at the historic Falcon Target (Core Assets, 2022).

Figure 2: Schematic plan map of the Falcon and Jackie targets at the Silver Lime CRD-Porphyry Project showing surficial grab and channel sample locations, Au (g/t) assay highlights for new and historic1 samples (digitized) and 2022 Jackie diamond drilling highlights (stars), and local geology.

About the Falcon Ag-Au Target

The historic Falcon Zone was originally worked by Carmac Resources Ltd. in 1990. It consists of two exposed, northwest trending gold (Au) and silver (Ag)-bearing quartz veins that measure up to 1.2m wide. These veins are hosted in Florence Range limestone, metasediments, and quartz-feldspar porphyry breccia dykes, and contain visual semi-massive arsenopyrite, stibnite, pyrite, and galena. Historically a 2.2m chip sample collected from the Falcon Zone averaged 3.67g/t Au, 2,641g/t Ag, 0.15% Cu, 2.50% Pb and 3.32% Zn along with 5.78% As and 2.56% Sb.

Additionally, Au-bearing quartz-semi-massive sulphide stringer veins and bleeders are also present at the Falcon Zone and could be representative of a distal expression of the wide-spread carbonate replacement mineralization observed throughout the Silver Lime Project area. Quartz-sulphide veins typically carry significant Ag grades in addition to variable Au, As, Pb, Zn, Cu, and Sb. 1Visagie (1990). Geochemical and Geological Report on the Willison Creek Claims. ARIS report 21162

Figure 3: Schematic plan map of the Silver Lime CRD-Porphyry Project showing surficial grab and channel sample locations, Au (g/t) assay highlights for new and historic samples1, and local geology.

QA/QC and Sample Preparation

Rock samples collected from the Silver Lime CRD-Porphyry Project in 2022 were bagged, tagged, and labelled prior to being shipped by ground to ALS Preparation Facility in Whitehorse, YT where they were finely crushed and sieved to <75 microns. Samples were then shipped to ALS Geochemistry in North Vancouver, BC where they were analysed for gold by fire assay with an AA finish, over limits for Ag, Pb, Cu, Zn, and additional elements were analysed using four acid digestion with an ICP-AES finish.

National Instrument 43-101 Disclosure

Nicholas Rodway, P.Geo, (Licence# 46541) (Permit to Practice# 100359) is President, CEO and Director of the Company, and qualified person as defined by National Instrument 43-101. Mr. Rodway supervised the preparation of the technical information in this news release.

About Core Assets Corp.

Core Assets Corp. is a Canadian mineral exploration company focused on the acquisition and development of mineral projects in British Columbia, Canada. The Company currently holds 100% ownership in the Blue Property, which covers a land area of114,073.93 ha (~1,140 km²). The Property lies within the Atlin Mining District, a well-known gold mining camp located in the unceded territory of the Taku River Tlingit First Nation and the Carcross/Tagish First Nation. The Blue Property hosts a major structural feature known as The Llewellyn Fault Zone ("LFZ"). This structure is approximately 140km in length and runs from the Tally-Ho Shear Zone in the Yukon, south through the Blue Property to the Alaskan Panhandle Juneau Ice Sheet in the United States. Core Assets believes that the south Atlin Lake area and the LFZ has been neglected since the last major exploration campaigns in the 1980's. The LFZ plays an important role in mineralization of near surface metal occurrences across the Blue Property. The past 50 years have seen substantial advancements in the understanding of porphyry, skarn, and carbonate replacement type deposits both globally and in BC's Golden Triangle. The Company has leveraged this information at the Blue Property to tailor an already proven exploration model and believes this could facilitate a major discovery. Core Assets is excited to become one of Atlin Mining District's premier explorers where its team believes there are substantial opportunities for new discoveries and development in the area.

On Behalf of the Board of Directors

CORE ASSETS CORP.

"Nicholas Rodway"

President & CEO

Tel: 604.681.1568

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

Statements in this document which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward looking statements in this news release include expectations regarding speculative inferences about potential copper, molybdenum, gold, silver, zinc, and lead grades based on preliminary visual observations from results of sampling at the Blue Property; that the Company's plans to further investigate the geometry and extent of the skarn and carbonate replacement type mineralization continuum at Silver Lime through additional field work and diamond drilling; the proposed diamond drilling program planned for Silver Lime in 2023; that drilling efforts will aim to confirm and extend certain targets and mineralization on the property; that the Company's exploration model could facilitate a major discovery at the Blue Property; that the Company anticipates it can become one of the Atlin Mining District's premier explorers and that there are substantial opportunities for new discoveries and development in this area. It is important to note that the Company's actual business outcomes and exploration results could differ materially from those in such forward-looking statements; that the Company may be unable to implement its plans to further explore the Blue Property and, in particular, that the proposed diamond drilling program planned for Silver Lime may not proceed as anticipated or at all; that drilling efforts may not confirm and extend any targets or mineralization on the Silver Lime; that the Company's exploration model may fail to facilitate any commercial discovery of minerals at the Blue Property; that the Company may not become one of Atlin Mining District's premier explorers or that the area may be found to lack opportunities for new discoveries and development, as anticipated; that further permits may not be granted in a timely manner, or at all; that the mineral claims may prove to be unworthy of further expenditure; there may not be an economic mineral resource; that certain exploration methods, including the Company's proposed exploration model for the Blue Property, may be ineffective or inadequate in the circumstances; that economic, competitive, governmental, geopolitical, environmental and technological factors may affect the Company's operations, markets, products and prices; our specific plans and timing drilling, field work and other plans may change; we may not have access to or be able to develop any minerals because of cost factors, type of terrain, or availability of equipment and technology; and we may also not raise sufficient funds to carry out or complete our plans. Additional risk factors are discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for its recently completed fiscal period, which is available under the Company's SEDAR profile at www.sedar.com. Except as required by law, the Company will not update or revise these forward-looking statements after the date of this document or to revise them to reflect the occurrence of future unanticipated events.

SOURCE: Core Assets Corp.

View source version on accesswire.com:https://www.accesswire.com/749625/Core-Assets-Samples-195gt-Au-at-the-Falcon-Target