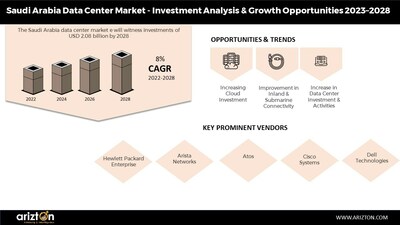

CHICAGO, May 10, 2023 /PRNewswire/ -- According to Arizton's latest research report, the Saudi Arabia data center market will grow at a CAGR of 8% during 2022-2028.

To Know More, Download the Free Sample Report:

https://www.arizton.com/request-sample/3796

Data center investments in Saudi Arabia over the next 2-3 years are expected to be aggressive due to investments from local operators and the entry of several new operators. The market is attracting hyperscale operators to open their cloud regions in the country. The wholesale colocation revenue will likely increase in Saudi Arabia due to the entry of major cloud operators such as Microsoft, Google, Alibaba, Oracle, and Huawei. These companies have announced plans to open cloud regions in Saudi Arabia in the upcoming years.

Saudi Arabia Data Center Market Report Scope | |

Report Attributes | Details |

Market Size | USD 2.08 Billion (2028) |

Market Size (Area) | 610 thousand sq. Feet (2028) |

Market Size (Power Capacity) | 120 MW (2028) |

CAGR Investment (2022-2028) | 7.98 % |

Colocation Market Size (Revenue) | USD 440 Million (2028) |

Historic Year | 2021-2022 |

Base Year | 2022 |

Forecast Year | 2023-2028 |

Market Dynamics |

|

Looking for More Information? Download the Free Sample Report:

https://www.arizton.com/request-sample/3796

Investment Opportunities in Saudi Arabia

- Saudi Arabia, one of the largest ICT markets in the Middle East region in terms of capital volume and spending, is a developed data center market in the Middle East region.

- In 2022, Dammam, Riyadh, and Jeddah were the major data center investment destinations in Saudi Arabia. Other cities such as Neom, Qassim, Al Khobar, and others also witness data center investments.

- The rising adoption of cloud-based services is helping the growth of retail and wholesale colocation services in the market. The market is witnessing increased demand for colocation spaces across existing and upcoming data centers.

- In September 2022, the company announced that it had secured full funding from Natixis Corporate & Investment Banking for its first data center that is under development in Dammam. The facility was expected to be online by Q4 2022. However, as of February 2023, the facility is yet to open.

Over 60% of Future Demand to Come from Cloud Service Providers

Saudi Arabia's data center market has the presence of on-premise data centers operated by financial services, educational institutions, and governments, such as the National Commercial Bank, National Center for Security Operations, Qassim University Medical City, Saudi Credit Bureau, Saudi National Bank, and others. In the next 3-5 years, we will see a significant decline in on-premise owing to the increase in digitalizing initiatives across sectors, the implementation of a cloud-first strategy, and the demand for colocation and cloud. In addition, most existing service providers offer managed solutions to enterprise customers, which will likely grow in the market from 2023 to 2028.

The market is witnessing the entry of all the global cloud operators such as Google, Microsoft, Alibaba, Huawei, and Oracle. This will increase the demand for wholesale colocation services. Through continuous expansion by these service providers, the cloud segments will likely dominate the capacity over the next five years. Amazon Web Services (AWS) will also likely enter the market in 1-2 years. In addition, we believe the market will witness the entry of multiple global organizations to service customers through a local presence.

Why Should You Buy This Research?

- Market size available in the investment, area, power capacity, and the Saudi Arabia colocation market revenue.

- An assessment of the investment in Saudi Arabia by colocation and enterprise operators.

- Investments in the area (square feet) and power capacity (MW) across locations in the country.

- During the forecast period, a detailed study of the existing market landscape, an in-depth industry analysis, and insightful predictions about the Saudi Arabia data center market size.

- Snapshot of existing and upcoming third-party data center facilities in Saudi Arabia

- Facilities Covered (Existing): 21

- Facilities Identified (Upcoming): 40

- Coverage: 6 Cities

- Existing vs. Upcoming (Area)

- Existing vs. Upcoming (IT Load Capacity)

- Data center colocation market in Saudi Arabia

- Market Revenue & Forecast (2021-2027)

- Wholesale vs. Retail Revenue & Forecast (2021-2027)

- Retail Colocation Pricing

- Wholesale Colocation Pricing

- The Saudi Arabia market landscape investments are classified into IT, power, cooling, rack cabinets, and general construction services with sizing and forecast.

- A comprehensive analysis of the latest trends, growth rate, potential opportunities, growth restraints, and prospects for the industry.

- Business overview and product offerings of prominent IT infrastructure providers, construction contractors, support infrastructure providers, and investors operating in the industry.

- A transparent research methodology and the analysis of the demand and supply aspects of the market.

Additional Benefit Post-Purchase

- 1hr of free analyst discussion

- 10% of customization

Customization Available???

If our report does not include the information you are searching for, you may contact us to have a report tailored to your specific business needs https://www.arizton.com/customize-report/3796

The report includes the investment in the following areas:

- IT Infrastructure

- Servers

- Storage Systems

- Network Infrastructure

- Electrical Infrastructure

- UPS Systems

- Generators

- Switches & Switchgears

- PDUs

- Other Electrical Infrastructure

- Mechanical Infrastructure

- Cooling Systems

- Rack Cabinets

- Other Mechanical Infrastructure

- Cooling Systems

- CRAC and CRAH Units

- Chillers Units

- Cooling Towers, Condensers, and Dry Coolers

- Other Cooling Units

- General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression

- Physical Security

- Data Center Infrastructure Management (DCIM)

- Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

- Geography

- Riyadh

- Other Cities

Major Vendors

IT Infrastructure Providers

- Arista Networks

- Atos

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise

- Huawei Technologies

- IBM

- Lenovo

- NetApp

Data Center Construction Contractors & Sub-Contractors

- Ashi & Bushnag

- Al-Latifia Trading and Contracting

- Atkins

- Capitoline

- DC PRO BV

- Edarat Group

- EGEC

- Gensler

- HATCO

- ICS Arabia

- ICS Nett

- IDP Engineering

- Environment and Architecture

- INT'LTEC Group

- Juffali Airconditioning, Mechanical, and Electrical Company (JAMED)

- Linesight

- RED

- SANA Creative Systems

Support Infrastructure Providers

- ABB

- Alfa Laval

- Canovate

- Caterpillar

- Cummins

- Eaton

- Enrogen

- Grundfos

- Legrand

- Mitsubishi Electric

- Rolls-Royce

- Schneider Electric

- Siemens

- STULZ

- Vertiv

Data Center Investors

- Gulf Data Hub

- Saudi Telecom Company (STC)

New Entrants

- EDGNEX

- Quantum Switch

- Zeropoint DC (NEOM)

Table of Content

- Existing & Upcoming Third-Party Data Centers in Saudi Arabia

- Historical Market Scenario

- 20+ Unique Data Center Properties

- Data Center IT Load Capacity

- Data Center White Floor Area

- Existing Vs Upcoming Data Center Capacity by Cities

- Cities Covered

- Dammam

- Other Cities

- List of Upcoming Data Center Facilities

- Investment Opportunities in Saudi Arabia

- Microeconomic and Macroeconomic factors of the Saudi Arabia Market

- Investment Opportunities in the Saudi Arabia

- Investment by Area

- Investment by Power Capacity

- Data Center Colocation Market in Saudi Arabia

- Colocation Services Market in the Saudi Arabia

- Retail vs Wholesale Data Center Colocation

- Colocation Pricing (Quarter Rack, Half Rack, Full Rack) & Add-ons

- Market Dynamics

- Market Drivers

- Market Trends

- Market Restraints

- Market Segmentation

- IT Infrastructure: Market Size & Forecast

- Electrical Infrastructure: Market Size & Forecast

- Mechanical Infrastructure: Market Size & Forecast

- General Construction Services: Market Size & Forecast

- Tier Standard Investment

- Tier I & II

- Tier III

- Tier IV

- Geography

- Dammam

- Other Cities

- Key Market Participants

- IT Infrastructure Providers

- Data Center Construction Contractors & Sub-Contractors

- Support Infrastructure Providers

- Data Center Investors

- New Entrants

- Appendix

- Market Derivation

- Quantitative Summary

Check Out Some of the Top-Selling Research Reports:

United Arab Emirates Data Center Market - Investment Analysis & Growth Opportunities 2022-2027: The United Arab Emirates data center market to reach USD 1.72 billion by 2027. Over 115 MW of power capacity will be added across the United Arab Emirates from 2022 to 2027.

Kuwait Data Center Market - Investment Analysis & Growth Opportunities 2022-2027: Cloud adoption is driving data center demand in the data center market in Kuwait. In Kuwait, the spending on public cloud services is expected to reach around USD 112 million by 2024.

Africa Data Center Market - Industry Outlook & Forecast 2022-2027: Africa data center market will witness investments of USD 5 billion by 2027.All countries in the Africa will see more and more installations of inland and submarine network connectivity, leading to higher data center development driven by efforts from government agencies, telecommunication service providers, and colocation providers. This will provide ample number of opportunities for data center vendors in Africa.

Middle East Data Center Market - Industry Outlook & Forecast 2022-2027: The Middle east data center market will witness investments of USD 6.73 billion in 2027. In 2021, the UAE will be one of the preferred data center locations in the Middle East, with more than 10 data center facilities investments. In 2021, Amazon Web Services announced the development of a new data center region in Abu Dhabi, which consists of three availability zones in the UAE. It is expected to be opened in the first half of 2022.

About Us:??????????????????

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.????????????????

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.?????????????????

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.??????????????????

Contact Us???????????????

Call: +1-312-235-2040??????????????

????????? +1 302 469 0707?????????????

Mail:?enquiry@arizton.com???????????????

Contact Us:?https://www.arizton.com/contact-us???????????????

Blog:?https://www.arizton.com/blog???????????????

Website:?https://www.arizton.com/????????

Photo - https://mma.prnewswire.com/media/2073781/Saudi_Arabia_Data_Center.jpg

Logo - https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/saudi-arabia-data-center-market-to-surpass-investment-of-2-billion-by-2028-the-region-is-witnessing-major-cloud-investments-from-microsoft-google-alibaba-oracle--huawei---arizton-301820773.html

View original content:https://www.prnewswire.co.uk/news-releases/saudi-arabia-data-center-market-to-surpass-investment-of-2-billion-by-2028-the-region-is-witnessing-major-cloud-investments-from-microsoft-google-alibaba-oracle--huawei---arizton-301820773.html