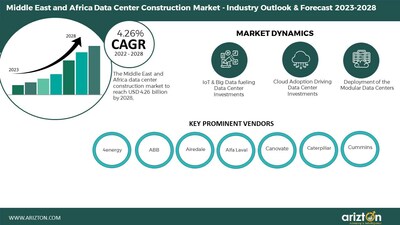

CHICAGO, May 16, 2023 /PRNewswire/ -- According to Arizton's latest research report, the Middle East & Africa data center construction market will grow at a CAGR of 8.54% from 2022-2028.

To Know More, Download the Free Sample Report: https://www.arizton.com/request-sample/3781

Countries in the Middle East & Africa will see the installation of inland and submarine network connectivity, leading to higher data center development driven by efforts from government agencies, telecommunication service providers, and utility providers. The data center construction market in the Middle East & Africa is led by countries such as the UAE, Saudi Arabia, South Africa, Kenya, Egypt, Israel, Bahrain, Oman, Kuwait, and Turkey. Telecommunication providers, enterprises, governments, cloud, and colocation service providers are the major investors in developing regional data center facilities.

Middle East and Africa Data Center Construction Market Report Scope

Report Scope | Details |

Market Size (2028) | USD 4.26 Billion |

Market Size (2022) | USD 2.60 Billion |

CAGR By Revenue (2022-2028) | 8.54 % |

Market Size - Area (2028) | 3.80 Million Square Feet |

Power Capacity (2028) | 745.5 MW |

Base Year | 2022 |

Forecast Year | 2023-2028 |

Market Segmentation | Infrastructure, Electrical Infrastructure, Mechanical Infrastructure, Cooling Systems, Cooling Technique, General Construction, Tier Standards, and Geography |

Geographic Analysis | Middle East (UAE, Saudi Arabia, Bahrain, Oman, Kuwait, Qatar, Israel, Jordan, and Other Middle Eastern Countries) and Africa (South Africa, Kenya, Nigeria, Egypt, Ethiopia, and Other African Countries) |

Market Dynamics |

|

Looking for More Information? Download the Free Sample Report: https://www.arizton.com/request-sample/3781

Investment Overview

- The Middle East & Africa data center market has witnessed data center investments from telecommunication companies, colocation data center operators, and cloud providers.

- Dubai, Abu Dhabi, Riyadh, Jeddah, Neom, Johannesburg, Nairobi, Istanbul, and Kuwait City are the major locations for data center development, whereas Doha and Sharjah were emerging as new locations for data center development.

- In terms of 5G network deployment, the UAE, Saudi Arabia, South Africa, Kenya, Kuwait, Bahrain, Nigeria, Oman, Turkey, Israel, and Qatar have witnessed 5G network deployments on a commercial and trial basis.

- The market also attracted investments from cloud service providers such as Google, Amazon Web Services, Microsoft, Oracle, and Tencent across the Middle East & Africa. Major cloud service providers are expanding in the region during the forecast period. For instance, Microsoft announced its intention to open a cloud region in Saudi Arabia

- Initiatives for developing smart cities are observed in the UAE, Saudi Arabia, Kuwait, Oman, and Bahrain. For instance, in Saudi Arabia, NEOM is a $50 million smart city project expected to reach completion by 2025.

- The rise in demand across industries has led data center operators to sign several M&A contracts and enter joint ventures (JVs) to expand their portfolios across the Middle East & Africa

- In September 2022, Khazna Data Centers and BEEAH Digital formed a JV. The JV will be termed as One Data Center SPV. The newly formed company plans to build a 9-MW data center in Sharjah, UAE

- In June 2022, G42 (Group 42) and Etisalat (e&) officially merged their data center businesses and operated them under Khazna Data Centers JV. On receiving approval, Khazna Data Centers will be the largest data center provider in the UAE, with 12 data center facilities.

- In March 2022, Equinix partnered with Omantel to build a second data center facility SN1 in Salalah, Oman.

Power Capacity Development

The UAE, Saudi Arabia, Bahrain, Kuwait, Jordan, Qatar, Oman, Turkey, South Africa, Nigeria, Kenya, Egypt, Morocco, Ethiopia, and Ivory Coast are some countries that shall witness investments in renewable energy to improve the power stability in their respective countries during the forecast period. The world is moving toward attaining sustainable energy targets, despite Middle East & African countries traditionally having low levels of renewable energy output due to their heavy reliance on fossil fuel-based energy production. Countries are taking initiatives to develop renewable energy projects to meet their carbon-neutral goals. For instance, the Israel government announced that it aims to achieve net zero emissions by 2050.

Most data center operators are investing in developing green data centers or powering their data centers with 100% renewable energy to meet the regional countries' net zero carbon emission targets. For instance, In February 2023, Moro Hub announced the launch of a green data center facility located in Mohammed bin Rashid Al Maktoum Solar Park, powered by 100% solar energy and adds up to 100 MW of power capacity once fully built. MTN, a South Africa-based telecom company, operates four data centers in Kenya and other African countries, uses renewable energy to power its data center, and targets carbon-neutral by 2040. It has introduced the "Project Zero" program. Oracle launched a cloud region in Johannesburg in January 2022 and has pledged that all its global cloud regions, including Johannesburg, will be powered by 100% renewable energy by 2025. In June 2022, Vantage Data Centers signed a 20-year-long Power Purchase Agreement (PPA) with SolarAfrica in which the company will procure solar energy of around 87MWp that will be used to power its Johannesburg data center campus.

Buy the Report Now: https://www.arizton.com/market-reports/middle-east-africa-data-center-construction-market-2025

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% of customization

The report includes the investment in the following areas:

Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- General Construction

Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgear

- PDUs

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

Cooling Systems

- CRAC and CRAH Units

- Chillers Units

- Cooling Towers, Condensers, and Dry Coolers

- Other Cooling Units

Cooling Techniques

- Air-based Cooling

- Liquid-based Cooling

General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression

- Physical Security

- DCIM/BMS Solutions

Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

Geography

- Middle East

- The UAE

- Saudi Arabia

- Bahrain

- Oman

- Kuwait

- Qatar

- Israel

- Jordan

- Other Middle Eastern Countries

- Africa

- South Africa

- Kenya

- Nigeria

- Egypt

- Ethiopia

- Other African Countries

Major Vendors

Prominent Support Infrastructure Providers

- 4energy

- ABB

- Airedale

- Alfa Laval

- Canovate

- Caterpillar

- Cummins

- Delta Electronics

- EAE Group

- EATON

- Envicool

- EVAPCO

- Enlogic

- HITEC Power Protection

- Johnson Controls

- Legrand

- Master Power Technologies

- Rittal

- Rolls-Royce

- Schneider Electric

- Siemens

- STULZ

- Vertiv

Prominent Data Center Construction Contractors

- AECOM

- AlDar Properties

- Anel Group

- Arup

- Ashi & Bushnag

- Atkins

- Abbeydale

- Advanced Vision Morocco

- ARSMAGNA

- b2 Architects

- CAP DC

- Chess Enterprises

- Copy Cat Group

- Dar Group

- DC Pro Engineering

- Deerns

- Eastra Solutions

- Edarat

- EGEC

- ENMAR Engineering

- EDS Engineers

- Egypro

- Harinsa Qatar (HQ)

- HATCO

- HHM Building Contracting

- Hill International

- H&MV Engineering

- Ingenium

- Interkel

- ICS Nett

- INT'LTEC

- ISG

- JLB Architects

- Laing O'Rourke

- Linesight

- M+W Group (Exyte)

- Mace

- Mercury Engineering

- McLaren Construction Group

- MIS

- MWK Engineering

- NDA Group

- Orascom Construction

- Prota Engineering

- Qatar Site & Power

- RED Engineering

- RW Armstrong

- Royal HaskoningDHV

- Shaker Group

- Sterling & Wilson

- Summit Technology Solutions

- Sudlows

- Telal Engineering & Contracting

- Tri-Star Construction

- Turner & Townsend

- United Egypt

- Westwood Management

Prominent Data Center Investors

- 21st Century Technology

- Africa Data Centres

- Adgar Investments and Development

- Amazon Web Services (AWS)

- Batelco

- Bynet Data Communications

- Digital Parks Africa

- Equinix

- Etisalat

- EdgeConneX

- Future Digital Data Systems

- G42

- Gulf Data Hub

- Galaxy Backbone

- icolo.io (Digital Realty)

- IXAfrica

- Khazna Data Centers

- Moro Hub

- MedOne

- MEEZA

- Mobily

- MainOne

- Medallion Communications

- Microsoft

- NTT Global Data Centers

- Oman Data Park

- Ooredoo

- Paratus Namibia

- Rack Centre

- Raxio Data Centres

- stc

- Serverfarm

- Turkcell

- Türk Telekom

- Telehouse

- Telecom Egypt

- Teraco (Digital Realty)

- Tencent Cloud

- Wingu

New Entrants

- Airtel Nigeria

- Cloudoon

- Compass Datacenters

- Digital Realty

- EDGNEX

- Global Technical Realty

- Infinity

- Kasi Cloud

- Open Access Data Centres (OADC)

- Vantage Data Centers

- Quantum Switch

- ZeroPoint DC

ARIZTON'S EXPERTISE IN THE DATA CENTER INDUSTRY

We continuously track data center investments worldwide and strive to provide accurate market analysis on investments across 20+ infrastructure categories.

Arizton's team of principal consultants and analysts work towards publishing extensive secondary and primary research that is credible, resourceful, and data-driven. With over 5+ years of experience, Arizton has helped several Fortune 500 companies with data-driven insights that enabled them to expand their businesses to niche regions, added over a billion dollars in revenues, and effective go-to-market strategies. We offer various product portfolios to meet the client's requirements, which align with their key business strategies and identify high-value growth avenues.

Exhaustive syndicated reports, databases, country-wise market analysis, & customized consulting projects are published by our exuberant and well-experienced analysts who possess exemplary skills in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research. Subscribe to our exhaustive portfolios to access premium research reports at competitive prices. Partner with Arizton for your next strategic business decision and gain a competitive advantage with real-time, data-driven research.

Check Out Some of the Top Selling Research Reports:

Africa Data Center Construction Market - Industry Outlook & Forecast 2023-2028

Middle East Data Center Construction Market - Industry Outlook & Forecast 2023-2028

South Africa Data Center Market - Investment Analysis & Growth Opportunities 2022-2027

Middle East and Africa Data Center Colocation Market - Industry Outlook & Forecast 2022-2027

Table of Content:

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

4.1 MARKET DEFINITION

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

4.4 MARKET SEGMENTS

4.4.1 MARKET SEGMENTATION BY INFRASTRUCTURE

4.4.2 MARKET SEGMENTATION BY ELECTRICAL INFRASTRUCTURE

4.4.3 MARKET SEGMENTATION BY MECHANICAL INFRASTRUCTURE

4.4.4 MARKET SEGMENTATION BY COOLING SYSTEMS

4.4.5 MARKET SEGMENTATION BY COOLING TECHNIQUE

4.4.6 MARKET SEGMENTATION BY GENERAL CONSTRUCTION

4.4.7 MARKET SEGMENTATION BY TIER STANDARDS

4.4.8 MARKET SEGMENTATION BY GEOGRAPHY

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 PREMIUM INSIGHTS

6.1 KEY HIGHLIGHTS

6.2 SEGMENTAL ANALYSIS

6.3 MARKET TRENDS

6.4 GEOGRAPHICAL ANALYSIS

6.5 KEY MARKET PARTICIPANT INITIATIVES

7 MARKET AT A GLANCE

8 INTRODUCTION

8.1 DATA CENTER SITE SELECTION CRITERIA

8.1.1 KEY

9 MARKET OPPORTUNITIES & TRENDS

9.1 RISING ADOPTION OF RENEWABLE ENERGY SOURCES

9.2 INCREASE IN 5G DEPLOYMENTS FUELING EDGE DATA CENTER INVESTMENTS

9.3 DEPLOYMENT OF SUBMARINE CABLES AND INLAND CONNECTIVITY

9.4 SMART CITY INITIATIVES DRIVING DATA CENTER INVESTMENTS

9.5 INCREASE IN AI ADOPTION

10 MARKET GROWTH ENABLERS

10.1 CLOUD ADOPTION DRIVING DATA CENTER INVESTMENTS

10.2 IOT & BIG DATA FUELING DATA CENTER INVESTMENTS

10.3 ON-PREMISES INFRASTRUCTURE MIGRATING TO COLOCATION & MANAGED SERVICES

10.4 DEPLOYMENT OF MODULAR DATA CENTERS

11 MARKET RESTRAINTS

11.1 SECURITY CHALLENGES IN DATA CENTERS

11.2 DEARTH OF SKILLED WORKFORCE

11.3 LOCATION CONSTRAINTS ON THE DEVELOPMENT OF DATA CENTERS

11.4 SUPPLY CHAIN DISRUPTIONS IN DATA CENTERS

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.2 INVESTMENT: MARKET SIZE & FORECAST

12.3 AREA: MARKET SIZE & FORECAST

12.4 POWER CAPACITY: MARKET SIZE & FORECAST

12.5 FIVE FORCE ANALYSIS

12.5.1 THREAT OF NEW ENTRANTS

12.5.2 BARGAINING POWER OF SUPPLIERS

12.5.3 BARGAINING POWER OF BUYERS

12.5.4 THREAT OF SUBSTITUTES

12.5.5 COMPETITIVE RIVALRY

13 INFRASTRUCTURE

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 ELECTRICAL INFRASTRUCTURE

13.2.1 MARKET OVERVIEW

13.2.2 MARKET SIZE & FORECAST

13.3 MECHANICAL INFRASTRUCTURE

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.4 GENERAL CONSTRUCTION

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

14 ELECTRICAL INFRASTRUCTURE

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 UPS

14.2.1 MARKET OVERVIEW

14.2.2 MARKET SIZE & FORECAST

14.3 GENERATORS

14.3.1 MARKET OVERVIEW

14.3.2 MARKET SIZE & FORECAST

14.4 TRANSFER SWITCHES & SWITCHGEAR

14.4.1 MARKET OVERVIEW

14.4.2 MARKET SIZE & FORECAST

14.5 POWER DISTRIBUTION UNITS

14.5.1 MARKET OVERVIEW

14.5.2 MARKET SIZE & FORECAST

14.6 OTHER ELECTRICAL INFRASTRUCTURE

14.6.1 MARKET OVERVIEW

14.6.2 MARKET SIZE & FORECAST

15 MECHANICAL INFRASTRUCTURE

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 COOLING SYSTEMS

15.2.1 MARKET OVERVIEW

15.2.2 MARKET SIZE & FORECAST

15.3 RACKS

15.3.1 MARKET OVERVIEW

15.3.2 MARKET SIZE & FORECAST

15.4 OTHER MECHANICAL INFRASTRUCTURE

15.4.1 MARKET OVERVIEW

15.4.2 MARKET SIZE & FORECAST

16 COOLING SYSTEMS

16.1 MARKET SNAPSHOT & GROWTH ENGINE

16.2 CRAC & CRAH UNITS

16.2.1 MARKET OVERVIEW

16.2.2 MARKET SIZE & FORECAST

16.3 CHILLER UNITS

16.3.1 MARKET OVERVIEW

16.3.2 MARKET SIZE & FORECAST

16.4 COOLING TOWERS, CONDENSERS & DRY COOLERS

16.4.1 MARKET OVERVIEW

16.4.2 MARKET SIZE & FORECAST

16.5 OTHER COOLING UNITS

16.5.1 MARKET OVERVIEW

16.5.2 MARKET SIZE & FORECAST

17 COOLING TECHNIQUE

17.1 MARKET SNAPSHOT & GROWTH ENGINE

17.2 AIR-BASED COOLING

17.2.1 MARKET OVERVIEW

17.2.2 MARKET SIZE & FORECAST

17.3 LIQUID-BASED COOLING

17.3.1 MARKET OVERVIEW

17.3.2 MARKET SIZE & FORECAST

18 GENERAL CONSTRUCTION

18.1 MARKET SNAPSHOT & GROWTH ENGINE

18.2 CORE & SHELL DEVELOPMENT

18.2.1 MARKET OVERVIEW

18.2.2 MARKET SIZE & FORECAST

18.3 INSTALLATION & COMMISSIONING SERVICES

18.3.1 MARKET OVERVIEW

18.3.2 MARKET SIZE & FORECAST

18.4 ENGINEERING & BUILDING DESIGN

18.4.1 MARKET OVERVIEW

18.4.2 MARKET SIZE & FORECAST

18.5 FIRE DETECTION & SUPPRESSION

18.5.1 MARKET OVERVIEW

18.5.2 MARKET SIZE & FORECAST

18.6 PHYSICAL SECURITY

18.6.1 MARKET OVERVIEW

18.6.2 MARKET SIZE & FORECAST

18.7 DCIM/BMS

18.7.1 MARKET OVERVIEW

18.7.2 MARKET SIZE & FORECAST

19 TIER STANDARDS

19.1 MARKET SNAPSHOT & GROWTH ENGINE

19.2 OVERVIEW OF TIER STANDARDS

19.3 TIER I & II

19.3.1 MARKET OVERVIEW

19.3.2 MARKET SIZE & FORECAST

19.4 TIER III

19.4.1 MARKET OVERVIEW

19.4.2 MARKET SIZE & FORECAST

19.5 TIER IV

19.5.1 MARKET OVERVIEW

19.5.2 MARKET SIZE & FORECAST

20 GEOGRAPHY

20.1 INVESTMENT: MARKET SNAPSHOT & GROWTH ENGINE

20.2 AREA: MARKET SNAPSHOT & GROWTH ENGINE

20.3 POWER CAPACITY: MARKET SNAPSHOT & GROWTH ENGINE

21 UAE

21.1 MARKET SNAPSHOT & GROWTH ENGINE

21.1.1 MARKET OVERVIEW

21.2 INVESTMENT: MARKET SIZE & FORECAST

21.3 AREA: MARKET SIZE AND FORECAST

21.4 POWER CAPACITY: MARKET SIZE & FORECAST

21.5 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

22 SAUDI ARABIA

22.1 MARKET SNAPSHOT & GROWTH ENGINE

22.1.1 MARKET OVERVIEW

22.2 INVESTMENT: MARKET SIZE & FORECAST

22.3 AREA: MARKET SIZE & FORECAST

22.4 POWER CAPACITY: MARKET SIZE & FORECAST

22.5 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

23 ISRAEL

23.1 MARKET SNAPSHOT & GROWTH ENGINE

23.1.1 MARKET OVERVIEW

23.2 INVESTMENT: MARKET SIZE & FORECAST

23.3 AREA: MARKET SIZE & FORECAST

23.4 POWER CAPACITY: MARKET SIZE & FORECAST

23.5 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

24 OMAN

24.1 MARKET SNAPSHOT & GROWTH ENGINE

24.1.1 MARKET OVERVIEW

24.1.2 INVESTMENT: MARKET SIZE & FORECAST

24.2 AREA: MARKET SIZE & FORECAST

24.3 POWER CAPACITY: MARKET SIZE & FORECAST

24.4 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

25 QATAR

25.1 MARKET SNAPSHOT & GROWTH ENGINE

25.1.1 MARKET OVERVIEW

25.2 INVESTMENT: MARKET SIZE & FORECAST

25.3 AREA: MARKET SIZE & FORECAST

25.4 POWER CAPACITY: MARKET SIZE & FORECAST

25.5 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

26 KUWAIT

26.1 MARKET SNAPSHOT & GROWTH ENGINE

26.1.1 MARKET OVERVIEW

26.2 INVESTMENT: MARKET FORECAST & FORECAST

26.3 AREA: MARKET SIZE & FORECAST

26.4 POWER CAPACITY: MARKET SIZE & FORECAST

26.5 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

27 JORDAN

27.1 MARKET SNAPSHOT & GROWTH ENGINE

27.1.1 MARKET OVERVIEW

27.2 INVESTMENT: MARKET SIZE & FORECAST

27.3 AREA: MARKET SIZE & FORECAST

27.4 POWER CAPACITY: MARKET SIZE & FORECAST

27.5 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

28 BAHRAIN

28.1 MARKET SNAPSHOT & GROWTH ENGINE

28.1.1 MARKET OVERVIEW

28.2 INVESTMENT: MARKET SIZE & FORECAST

28.3 AREA: MARKET SIZE & FORECAST

28.4 POWER CAPACITY: MARKET SIZE & FORECAST

28.5 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

29 OTHER MIDDLE EASTERN COUNTRIES

29.1 MARKET SNAPSHOT & GROWTH ENGINE

29.1.1 MARKET OVERVIEW

29.2 INVESTMENT: MARKET SIZE & FORECAST

29.3 AREA: MARKET SIZE & FORECAST

29.4 POWER CAPACITY: MARKET SIZE & FORECAST

29.5 SUPPORT INFRASTRUCTURE: MARKET SIZE & FORECAST

30 COMPETITIVE LANDSCAPE

30.1 SUPPORT INFRASTRUCTURE

30.2 CONSTRUCTION CONTRACTORS

30.3 DATA CENTER INVESTORS

31 PROMINENT DATA CENTER SUPPORT INFRASTRUCTURE PROVIDERS

31.1 ABB

31.1.1 BUSINESS OVERVIEW

31.1.2 PRODUCT OFFERINGS

31.2 AIREDALE

31.3 ALFA LAVAL

31.4 CANOVATE

31.5 CATERPILLAR

31.6 CUMMINS

31.7 DELTA ELECTRONICS

31.8 EAE GROUP

31.9 EATON

31.10 ENVICOOL

31.11 HITEC POWER PROTECTION

31.12 JOHNSON CONTROLS

31.13 LEGRAND

31.14 RITTAL

31.15 ROLLS-ROYCE

31.16 SCHNEIDER ELECTRIC

31.17 SIEMENS

31.18 STULZ

31.19 VERTIV

32 PROMINENT DATA CENTER CONSTRUCTION CONTRACTORS

32.1 AECOM

32.2 ALDAR PROPERTIES

32.3 ANEL GROUP

32.4 ARUP

32.5 ASHI & BUSHNAG

32.6 ATKINS

32.7 DAR GROUP

32.8 DC PRO ENGINEERING

32.9 DEERNS

32.10 EDARAT

32.11 EGEC

32.12 ENMAR ENGINEERING

32.13 HARINSA QATAR

32.14 HATCO

32.15 HHM BUILDING CONTRACTING

32.16 HILL INTERNATIONAL

32.17 ICS NETT

32.18 INT'LTEC

32.19 ISG

32.20 LAING O'ROURKE

32.21 LINESIGHT

32.22 M+W GROUP (EXYTE)

32.23 MACE

32.24 MERCURY ENGINEERING

32.25 MCLAREN CONSTRUCTION GROUP

32.26 MIS

32.27 NDA GROUP

32.28 PROTA ENGINEERING

32.29 QATAR SITE & POWER

32.30 RED ENGINEERING

32.31 RW ARMSTRONG

32.32 SUDLOWS

32.33 TELAL ENGINEERING & CONTRACTING

32.34 TURNER & TOWNSEND

33 PROMINENT DATA CENTER INVESTORS

33.1 ADGAR INVESTMENTS AND DEVELOPMENT

33.2 AMAZON WEB SERVICES

33.3 BATELCO

33.4 BYNET DATA COMMUNICATIONS

33.5 EQUINIX

33.6 EDGECONNEX

33.7 FUTURE DIGITAL DATA SYSTEMS

33.8 GULF DATA HUB

33.9 GOOGLE

33.10 KHAZNA DATA CENTERS (G42 & ETISALAT)

33.11 MORO HUB

33.12 MEDONE

33.13 MEEZA

33.14 MOBILY

33.15 MICROSOFT

33.16 OMAN DATA PARK

33.17 OOREDOO

33.18 STC

33.19 TURKCELL

33.20 TÜRK TELEKOM

33.21 TELEHOUSE

33.22 TENCENT

34 NEW ENTRANTS

34.1 COMPASS DATACENTERS

34.2 DIGITAL REALTY

34.3 DAMAC DATA CENTRES (EDGNEX)

34.4 GLOBAL TECHNICAL REALTY

34.5 INFINITY

34.6 QUANTUM SWITCH TAMASUK (QST)

34.7 SERVERFARM

34.8 ZEROPOINT DC (NEOM)

35 REPORT SUMMARY

35.1 KEY TAKEAWAYS

36 QUANTITATIVE SUMMARY

36.1 MIDDLE EAST DATA CENTER CONSTRUCTION MARKET

36.1.1 INVESTMENT: MARKET SIZE & FORECAST

36.1.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

36.2 MARKET SEGMENTATION

36.2.1 ELECTRICAL INFRASTRUCTURE: MARKET SIZE & FORECAST

36.2.2 MECHANICAL INFRASTRUCTURE: MARKET SIZE & FORECAST

36.2.3 COOLING SYSTEMS: MARKET SIZE & FORECAST

36.2.4 COOLING TECHNIQUES: MARKET SIZE & FORECAST

36.2.5 GENERAL CONSTRUCTION: MARKET SIZE & FORECAST

36.2.6 TIER STANDARDS: MARKET SIZE & FORECAST

36.3 MARKET BY GEOGRAPHY

36.3.1 INVESTMENT: MARKET SIZE & FORECAST

36.3.2 AREA: MARKET SIZE & FORECAST

36.3.3 POWER: MARKET SIZE & FORECAST

36.4 UAE

36.4.1 INVESTMENT: MARKET SIZE & FORECAST

36.4.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

36.5 SAUDI ARABIA

36.5.1 INVESTMENT: MARKET SIZE & FORECAST

36.5.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

36.6 BAHRAIN

36.6.1 INVESTMENT: MARKET SIZE & FORECAST

36.6.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

36.7 OMAN

36.7.1 INVESTMENT: MARKET SIZE & FORECAST

36.7.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

36.8 KUWAIT

36.8.1 INVESTMENT: MARKET SIZE & FORECAST

36.8.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

36.9 QATAR

36.9.1 INVESTMENT: MARKET SIZE & FORECAST

36.9.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

36.10 ISRAEL

36.10.1 INVESTMENT: MARKET SIZE & FORECAST

36.10.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

36.11 JORDAN

36.11.1 INVESTMENT: MARKET SIZE & FORECAST

36.11.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

36.12 OTHER MIDDLE EASTERN COUNTRIES

36.12.1 INVESTMENT: MARKET SIZE & FORECAST

36.12.2 INFRASTRUCTURE: MARKET SIZE & FORECAST

37 APPENDIX

37.1 ABBREVIATIONS

About Us:???????????????????????

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.?????????????????????

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.??????????????????????

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.???????????????????????

Contact Us????????????????????

Call: +1-312-235-2040???????????????????

????????? +1 302 469 0707??????????????????

Mail:?enquiry@arizton.com????????????????????

Contact Us:?https://www.arizton.com/contact-us????????????????????

Blog:?https://www.arizton.com/blog????????????????????

Website:?https://www.arizton.com/?????

Photo: https://mma.prnewswire.com/media/2077976/MEA_Data_Center_Construction_Market.jpg

Logo:?https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/arizton-predicts-a-substantial-increase-in-investment-in-the-construction-of-data-centers-in-the-middle-east--africa-by-2028--the-market-to-surpass-investment-of-4-26-billion-in-2028--301826228.html

View original content:https://www.prnewswire.co.uk/news-releases/arizton-predicts-a-substantial-increase-in-investment-in-the-construction-of-data-centers-in-the-middle-east--africa-by-2028--the-market-to-surpass-investment-of-4-26-billion-in-2028--301826228.html