TORONTO, ON / ACCESSWIRE / August 2, 2023 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG)(OTCQX:JAGGF) is pleased to announce it has entered into a share purchase agreement dated August 1, 2023 (the "Agreement"), pursuant to which the Company has agreed to purchase and assume (the "Transaction") from a subsidiary of IAMGOLD Corporation (NYSE: IAG) (TSX: IMG) ("IAMGOLD"), AGEM Ltd. (the "Vendor"), the Pitangui Project and the Vendor's interest in the Acurui Project.

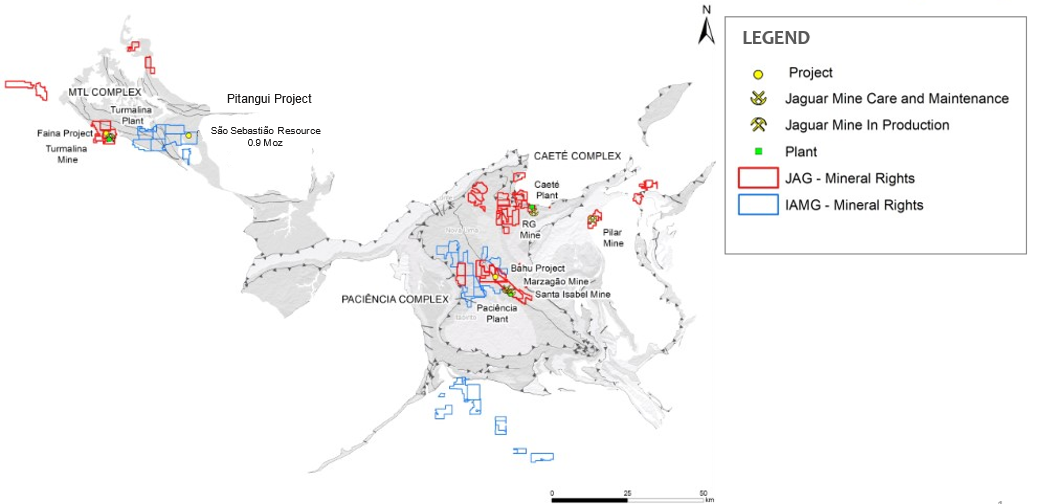

Figure 1. Location of Jaguar's and IAMGOLD's Tenements which are consolidated under the share purchase agreement

The Transaction

As consideration for acquiring a 100% interest in the Pitangui Project and the Vendor's interest in the Acurui Project, the Company has agreed to the following:

(a) the issuance to the Vendor of 6,331,713 common shares in the capital of the Company (the "Consideration Shares"), having an aggregate value of USD$9 million based on the volume weighted average closing price per share for the thirty (30) calendar days preceding the date of the Agreement, which was CAD$1.873 per share; and

(b) the grant to the Vendor of a net smelter returns royalty (the "Royalty"), which will be calculated as follows with respect to the Pitangui Project and the Acurui Project:

- in the case of gold (not including silver or other metals) from the Pitangui Project, the Company will pay the Vendor a Royalty of US$80 per ounce for the initial 250,000 ounces of gold sold from the Pitangui Project,

- following the initial 250,000 ounces of gold sold pursuant to the Pitangui Project, the amount of the Royalty payable to the Vendor in respect of the Pitangui Project for any applicable calendar quarter will be the result obtained by multiplying the net smelter returns for such calendar quarter by 1.5%,

- the amount of the Royalty payable to the Vendor in respect of the Acurui Project for any applicable calendar quarter will be the result obtained by multiplying the net smelter returns for such calendar quarter by 1.5%, and

- no Royalty shall be payable for, or with respect to, such reasonable quantities of product which are used by the Vendor exclusively for assaying, non-bulk sampling, treatment, amenability, metallurgical, test work, piloting or other analytical processes or procedures in respect of the Pitangui Project or the Acurui Project.

The Transaction is an arm's length transaction for purposes of the policies of the Toronto Stock Exchange ("TSX") and remains subject to customary closing conditions, including the approval of the TSX. No finder fees are payable in connection with, and no change of control of the Company will result from, the Transaction. The Transaction is expected to close in late August 2023, or such other time as the parties may mutually agree.

Regarding the Consideration Shares, the Vendor has agreed to hold and to not transfer or trade the Consideration Shares for a period of twelve (12) months following the closing date of the Transaction. In addition, the Vendor has agreed to notify and inform Jaguar if the Vendor intends to sell all or any of the Consideration Shares.

Vern Baker, President and CEO of Jaguar Mining stated: "We are very pleased to announce that we have reached this agreement to purchase IAMGOLD's Brazilian Assets which includes the Pitangui Project, which is close to our MTL Complex and the Acurui Tenements Package contiguous with our Paciencia Complex. This transaction furthers our corporate strategy to leverage our extensive existing infrastructure to drive production growth via increased plant throughput. The incorporation of the Pitangui mineral property adds approximately 9,000 kHa of prospective mining and exploration tenements to our Iron Quadrangle portfolio. The combination of Pitangui and our Faina Development Project now provide a long runway of low capital intensity, high return on invested capital growth at our MTL Complex for many years to come. This announcement supports our ongoing strategy to increase the utilization of our existing processing capacity, both through exploration on our land and potential arrangements with neighbors to fill our mills".

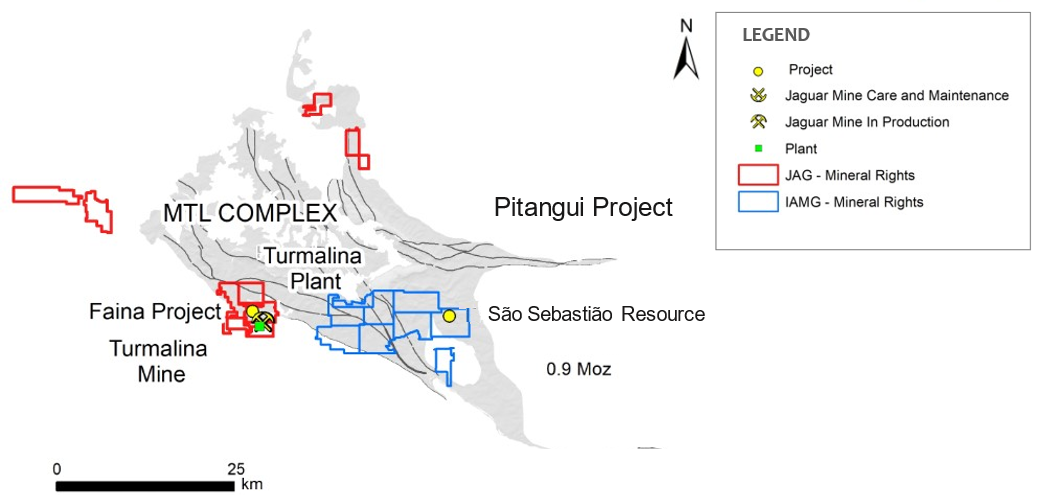

The Pitangui Project

The Pitangui Project is located approximately 110 kilometres northwest of the city of Belo Horizonte in Minas Gerais State, Brazil, and it comprises mineral exploration licenses and license applications covering the Archean-aged Pitangui greenstone belt, located near the Company's principal operating assets in the "Iron Quadrangle".

Gold mineralization is hosted by a series of parallel and complexly folded horizons of banded iron formation (BIF) separated by mafic volcanic and minor sedimentary units within the lower greenstone belt stratigraphy. Within the iron formations, gold mineralization is associated with sulphide replacement of primary magnetite bands, characterized by the presence of pyrrhotite and lesser amounts of arsenopyrite, pyrite, and chalcopyrite. Drilling to date has identified two main mineralized horizons, referred to as "Biquinho" and "Pimentao", which occur approximately 100 metres apart vertically. On February 5, 2020, IAMGOLD filed a National Instrument 43-101 - Standards of Disclosure for Mineral Projects technical report for the Pitangui Project on SEDAR (the "Pitangui Project Report").

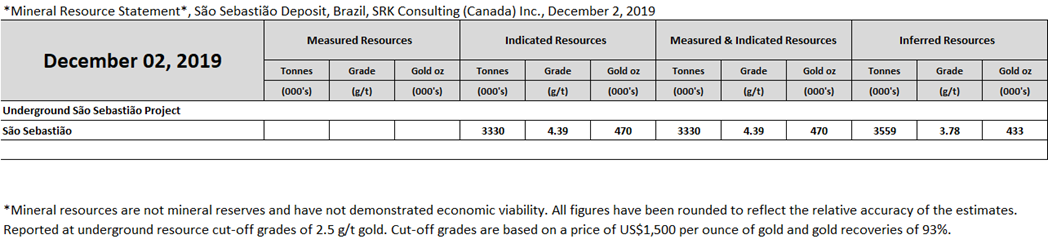

Table 1. Mineral Resources at the Pitangui Project as at February 5, 2020

The information in the table above is a "historical estimate" since it is contained in the Pitangui Project Report, which was prepared before Jaguar entered into the Agreement. Jaguar has not done sufficient work to classify the historical estimate as current mineral resources; and Jaguar is not treating the historical estimate as current mineral resources. However, Jaguar has reviewed the Pitangui Project Report and considers the historical estimate to be relevant and reasonably reliable. The key assumptions, parameters, and methods used to prepare the historical estimate are described in the Pitangui Project Report and the report appears to appropriately use the terms "mineral resource", "inferred mineral resource", "indicated mineral resource" and "measured mineral resource" only as those terms have been defined by the Canadian Institute of Mining, Metallurgy and Petroleum in the CIM Definition Standards on Mineral Resources and Mineral Reserves (as amended), as adopted by the CIM Council. Some work will need to be done by Jaguar in order to upgrade or verify the historical estimate as current mineral resources for Jaguar. Accordingly, some confirmatory technical work will be undertaken by Jaguar in the near term to validate and incorporate the historical mineral resource estimate previously published for the Pitangui Project into Jaguar's published mineral resources and mineral reserves (MRMR) inventories.

Figure 2. Location of the Pitangui Project relative to Jaguar's Turmalina Complex (MTL)

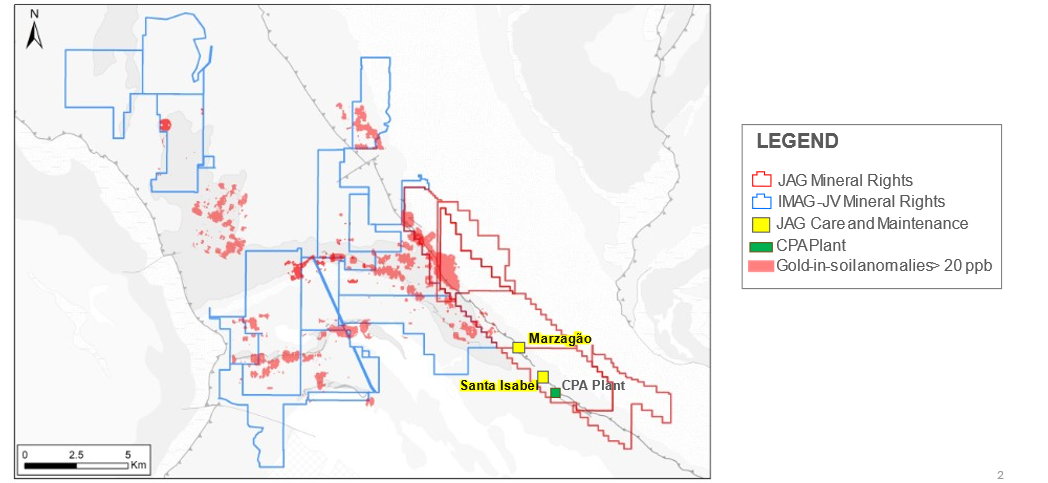

The Acurui Project

The Acurui Project is currently an exploration joint venture between Jaguar and IAMGOLD, where Jaguar is the operator. The project is comprised of exploration tenements located near the Company's Paciência plant in the Iron Quadrangle. For further information regarding the Acurui Project, please refer to the Company's news releases dated August 26, 2020 and August 30, 2021, respectively, which are available on SEDAR.

Figure 3. Location of the Acuri Project Tenements relative to Jaguar's Tenements and Paciencia Complex (CPA)

Qualified Person

Scientific and technical information contained in this news release has been reviewed and approved by Jonathan Victor Hill, BSc (Hons) (Economic Geology - UCT), FAUSIMM, Vice President Geology and Exploration, who is also an employee of Jaguar Mining Inc., and is a "qualified person" as defined by NI 43-101.

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold contaminated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá and São Bento. Jaguar holds the third largest gold land position in the Iron Quadrangle with over 50,000 hectares.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the Turmalina Gold Mine Complex and Caeté Mining Complex (Pilar and Roça Grande Mines, and Caeté Plant). The Company also owns the Paciência Gold Mine Complex, which has been on care and maintenance since 2012. The Roça Grande Mine has been on temporary care and maintenance since April 2019. Additional information is available on the Company's website at www.jaguarmining.com.

For further information please contact

Vernon Baker

Chief Executive Officer

Jaguar Mining Inc.

vernon.baker@jaguarmining.com

416-847-1854

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, the ability of the Company to complete the Transaction, the conditions and timing of the Transaction, and the Company's plans and expectations for the Pitangui Project and the Acurui Project. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, the Company's ability to obtain the final acceptance of the TSX for the Transaction and the issuance of the Consideration Shares in connection therewith.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including receipt of necessary approvals, risks inherent in the mining industry and the other risks described in the public disclosure of the Company which is available under the profile of the Company on SEDAR at www.sedar.com, including without limitation, the Company's most recent Annual Information Form and Management's Discussion and Analysis. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information.

The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

THE TSX HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ACCURACY OF THIS NEWS RELEASE.

SOURCE: Jaguar Mining Inc.

View source version on accesswire.com:https://www.accesswire.com/771703/Jaguar-Mining-Announces-Agreement-to-Acquire-the-Pitangui-Project-and-Remaining-Interest-in-the-Acurui-Project-From-IAMGOLD