VANCOUVER, BC / ACCESSWIRE / December 5, 2023 / Pampa Metals Corp. ("PMC" or the "Company") (CSE:PM)(FSE:FIR)(OTCQB:PMMCF) is pleased to announce the assay results from the PIU16-DDH01 diamond drillhole (920.2 m) completed at the Piuquenes Project in the 2015-2016 season (refer 30 November 2023 News Release).

Results include:

- 558.2 m (362-920.2 m EOH) @ 0.38% Cu & 0.42 g/ Au & 2.4 g/t Ag (0.73% CuEq)*

Including:

- 296 m (362-658 m) @ 0.5 % Cu & 0.5 g/t Au & 2.7 g/t Ag (0.91% CuEq)*,

- 180 m (362-542 m) @ 0.71% Cu & 0.61 g/t Au & 3.8 g/t Ag (1.22% CuEq)* and

- 130 m (362-492 m) @ 0.81% Cu & 0.6 g/t Au & 4 g/t Ag (1.31 % CuEq)*

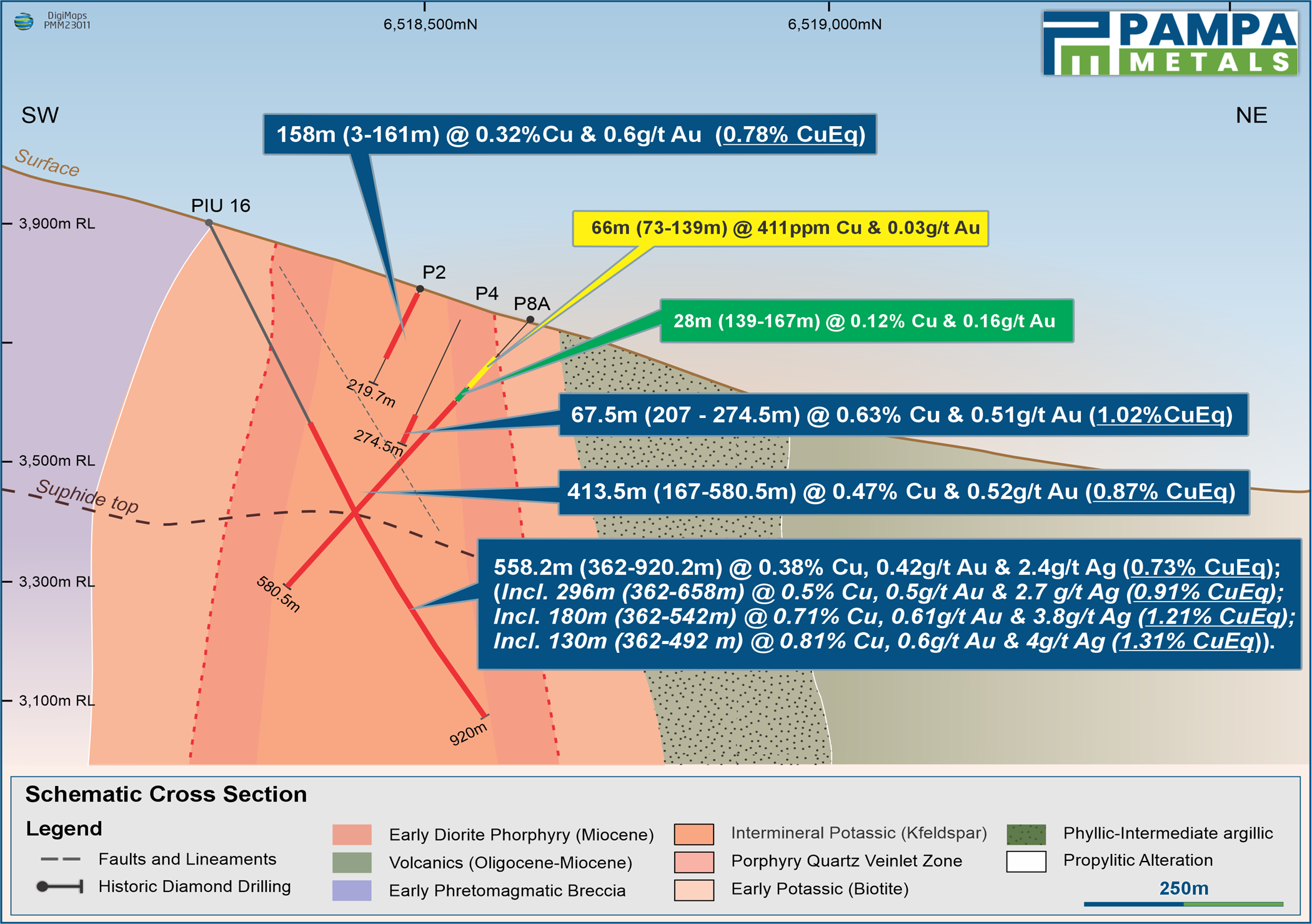

PIU16-DDH01 Diamond Drillhole (920.2 m) - (refer 30 November 2023 News Release).

As part of its Due Diligence and data validation of the Piuquenes Project, the Company relogged the PIU16-DDH01 borehole which had crossed the mineral intersections discovered by Inmet in 1995-1997 (refer 30 November 2023 News Release). A 558 m (362-920.2 m) section was sent to ALS Mendoza for Au fire 30 gram Au fire assay (Au-AA23) and ICP multi-element 4-acid digestion (ME-MS61) assays. Following review and interpretation of the assay results and a thorough Qa/Qc process, the Company is pleased to report a significant section of copper-gold-silver mineralization of:

• 558.2 m (362-920.2 m EOH) @ 0.38% Cu & 0.42 g/ Au & 2.4 g/t Ag (0.73% CuEq)*

Including:

• 296 m (362-658 m) @ 0.5 % Cu & 0.5 g/t Au & 2.7 g/t Ag (0.91% CuEq)*,

• 180 m (362-542 m) @ 0.71% Cu & 0.61 g/t Au & 3.8 g/t Ag (1.22% CuEq)* and

• 130 m (362-492 m) @ 0.81% Cu & 0.6 g/t Au & 4 g/t Ag (1.31 % CuEq)*

The re-logging and interpretation of the assays indicates that primary mineralization is related to Cu-Au porphyry hosted quartz veins and remains open at depth. The shallow overlay is associated with supergene enrichment, with some copper oxides observed at surface.

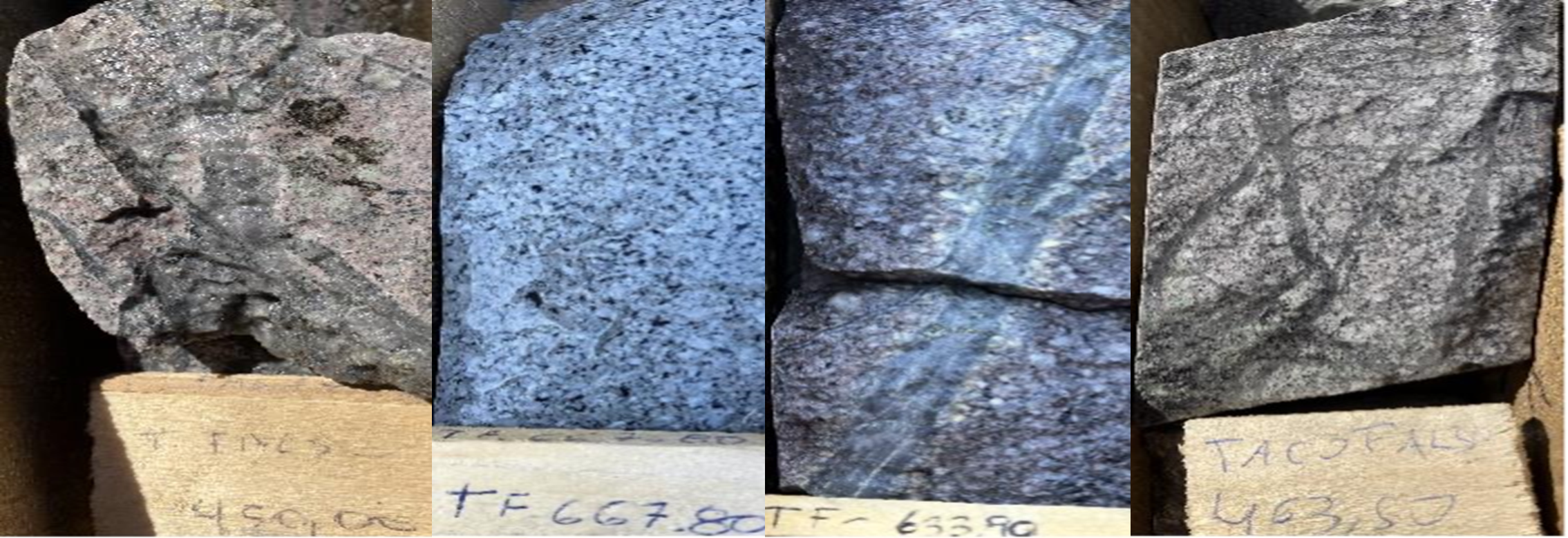

Qa/Qc procedure - PIU16-DDH01 Diamond Drillhole

Assay of the PIU16-DDH01 drillhole was based on samples of 2m intervals initially cut by Anglo-American Argentina at the drill platform using a hydraulic press. As part of Pampa Metals' data validation and due diligence, 8 batches of between 16 and 50 samples each were sent to ALS Mendoza for Au fire 30 gr (Au-AA23) and multi-element ICP 4 -acids (ME-MS61) assays. The Qa/Qc control protocol included twinned samples, coarse-grained and fine-grained duplicates, coarse quartz blanks and two types of standards, which together represented 20% (57 samples) of the 279 associated drillhole samples.

Results of the Qa/Qc procedure confirm that the samples pass the duplicate, blank and standard controls. In the case of duplicates, samples are well distributed on a linear correlation curve with only gold showing some variability, possibly due to the presence of coarse gold.

Piuquenes Porphyry Copper-Gold Project

The Piuquenes Project consists of nine mining titles that cover an area of ~1,880 ha in the San Juan Province of Argentina, adjacent (to the north) with the Altar copper-gold porphyry project (Aldebaran Resources Inc.) and approximately 190 km west of the city of San Juan. Other large porphyry copper projects in the San Juan Miocene porphyry belt include, El Pachón (Glencore), approximately 30 km to the south, the operating Los Pelambres copper mine (60% Antofagasta plc) in Chile, and Los Azules (McEwen Mining) 50 km to the northeast.

The first evidence of copper oxides at Piuquenes was reported in 1970 by MInera Aguilar, who subsequently completed the first exploration program between 1973-1975. Between 1995 and 1997, Inmet Mining Corporation (IMC) completed a heli-magnetic/radiometric survey, surface geology, rock and soil geochemistry, ground magnetics, PD-IP and eight diamond drillholes for a total of 1,894.2m. Subsequently, in 2015-2016, Anglo American Argentina (AAA) completed detailed 1:2,500 geology and geochemistry, 17.8 km of gDAS24 deep 3D PD-IP/NSMT and a single 920.2 m diamond drill hole.

Since its discovery, the Piuquenes Copper-Gold porphyry has until now remained privately held.

Inmet Mining Corporation's (IMC, subsequently acquired by First Quantum in 2013) 8 diamond drill holes for a total of 1,894.2m intersected significant copper and gold mineralization including:

• 413.5 m (167-580.5 m) @ 0.47% Cu and 0.52 g/t Au (0.87% CuEq)*;

• 67.5 m (207-274.5 m) @ 0.63% Cu and 0.51 g/t Au (1.02% CuEq)*; and

• 158 m (3-161 m) @ 0.32% Cu and 0.6 g/t Au (0.78% CuEq)*.

In November 2023, Pampa Metals assayed and re-logged Anglo-American Argentina's (AAA) 2016 single diamond borehole of 920.2 m length which had crossed the mineral zones drilled by IMC and reported the results in this news release dated 5 December, 2023.

Follow-Up drilling

Pampa Metals has designed a diamond drill program to be completed across two drilling seasons which consists of a ~2,500 diamond Phase 1 drill program designed to test the depth and lateral extension of known mineralisation, to be completed between January - April 2024 (indicative) with assays results expected progressively between March and May 2024 (indicative).

Phase 2 consists of a six-month drill program designed to significantly expand the mineralised envelope and scheduled to commence in October 2024 (indicative).

The latest Company Presentation can be accessed at https://pampametals.com/investor/.

ON BEHALF OF THE BOARD

Joseph van den Elsen | President & CEO

INVESTORS CONTACT

Joseph van den Elsen | President & CEO

Joseph@pampametals.com

ABOUT PAMPA METALS

Pampa Metals is listed on the Canadian Stock Exchange (CSE:PM), Frankfurt (FSE: FIR), and OTC (OTCQB: PMMCF) exchanges, and wholly owns a portfolio of projects highly prospective for copper, molybdenum, and gold along proven and highly productive mineral belts in Chile, the world's largest copper producer.

In November 2023, the Company announced it had entered into an Option & JV Agreement for the acquisition of an 80% interest in the Piuquenes Copper-Gold Porphyry Project in San Juan Province, Argentina.

Qualified Person

Technical information in this news release has been approved by Mario Orrego G, Geologist and a Registered Member of the Chilean Mining Commission and a Qualified Person as defined by National Instrument 43-101. Mr. Orrego is a consultant to the Company.

* %CuEq values are calculated based on copper and gold metal prices: Cu = US$3.20/lb, Au = US$1,700/oz and Ag = US$ 20/oz. The formula utilized to calculate %CuEq is: Cu Eq Grade (%) = Cu Head Grade (%) + [(Au Head Grade (g/t) / 31.104) * (Au Price (US$/oz) / Cu Price (US$/lb) / 22.04) + [(Ag Head Grade (g/t) / 31.104) * (Ag Price (US$/oz) / Cu Price (US$/lb) / 22.04)

Note: The reader is cautioned that Pampa Metals' projects are early-stage exploration projects, and reference to existing mines and deposits, or mineralization hosted on adjacent or nearby properties, is not necessarily indicative of any mineralization on Pampa Metals' properties.

Neither the CSE nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENT

This news release contains certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that Pampa Metals expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects" and similar expressions, or that events or conditions "will" or "may" occur. These statements are subject to various risks. Although Pampa Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance and actual results may differ materially from those in forward-looking statements.

SOURCE: Pampa Metals Corp.

View source version on accesswire.com:https://www.accesswire.com/813649/pampa-metals-reports-130m-from-362m-131-cueq-within-a-broader-interval-of-558m-from-362m-073-cueq-which-remains-open-at-depth