Ferrox commences production of mini mill with delivery of first 100 metric tons of run of mine titanium ferrite production from Tivani

FISHERS, IN / ACCESSWIRE / December 22, 2023 / Royalty Management Holding Corporation (NASDAQ:RMCO) (the "Company"), an innovative royalty company building shareholder value by acquiring and developing high value assets in a sustainable market environment, is pleased to announce that Ferrox Holdings Ltd., an investment holding of the Company, has confirmed the commencement of production of titanium ferrite from its Tivani operating site.

Terry Duffy, CEO of Ferrox Holdings stated, "This is an exciting moment for the company and its shareholders, to hit our goals of commencing initial production of run of mine titanium ferrite from our Tivani site. The team has worked tirelessly to ensure that we achieved this milestone before the year end of 2023 and we have met that goal. Having the financial support of Royalty Management Holding Corporation has helped us achieve this result while also positioning our company for future success in the current market. As a team, we are focused on scaling our production while also upcycling our production in-country to benefit not only our shareholders but also the local community through job creation."

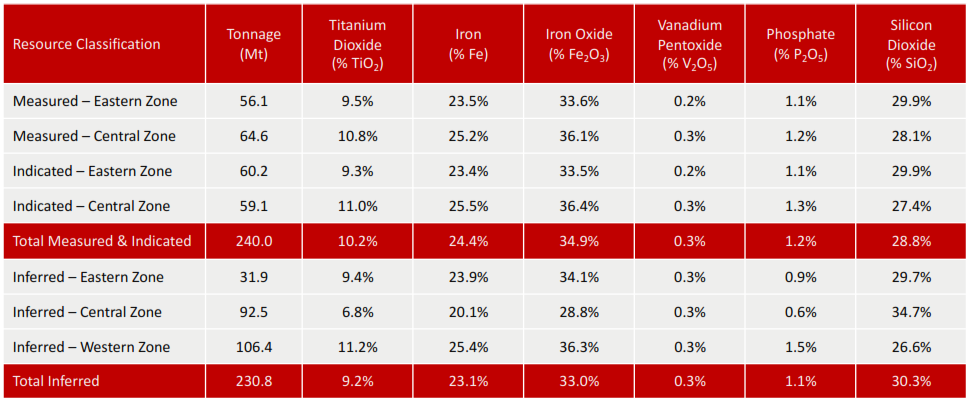

Ferrox owns the rights to the high quality Tivani mining deposit located in the Limpopo Province of South Africa. Prior to commencing production, Ferrox performed extensive preparations, studies and development with more than $70 million invested into the asset's infrastructure and processing equipment along with mine development. Through the Tivani project, Ferrox is initially focused on the production of ilmenite concentrate, titanium metal, titanium dioxide, and ferro titanium along with magnetite concentrate and pig iron, and the company has a NI 43-101 compliant resource showing 471 million tonnes of titaniferous magnetite.

Source: Obsidian Consulting Services, Tivani NI 43-101 Resource Statement

Other key features of the Tivani project includes:

- Mining rights received from the Department of Mineral Resources of South Africa on December 11, 2013.

- Large existing mineral ore body with NI 43-101 compliant resource of 471 million tonnes of titaniferous magnetite over the Tivani Project (13 square km) .

- Drilled 420 holes totaling 31,523 meters of stored core.

- Negotiations are in place to acquire neighboring Extension Properties ("EP"). Total EP is expected to add 1.0 to 1.5 billion tonnes to Tivani's existing resource.

- Existing road, rail and port infrastructure, water resources, and available power grid to support near term and long term mine plans. Power will be supported by backup generators.

Royalty Management Holding Co. remains actively engaged in pursuing investment and development prospects across a range of industries. With a specific focus on emerging and transitional sector opportunities, the Company is building a diverse portfolio of royalties, rents, and revenue shares.

About Ferrox Holdings Ltd.

Ferrox Holdings is majority owner of Tivani Project; ilmenite (TiO2), iron, vanadium (V2O5) and phosphate project which is in an advance development stage. It is located in long term mining region of the Limpopo Province in South Africa. Founded in the British Virgin Islands (BVI), Ferrox is the holding company for several South African subsidiaries including Tivani (Pty) Limited (Tivani) and Tivani-LMS (Pty) Limited (LMS). The company focus is on Sub Saharan Africa, a continent rich in mineral resources. Ferrox is fully permitted (Mining, Water Rights, Land Use Rights) and fully compliant with South African black economic empowerment legislation. The Tivani project is 26% owned by Red River Exploration and Mining (Pty) Limited (the BEE compliant vehicle) while Ferrox, through Tivani holds a 64% interest. www.ferroxholdings.com

About Royalty Management Holding Corporation

Royalty Management Holding Corporation (NASDSAQ: RMCO) is a royalty company building shareholder value to benefit both its shareholders and communities by acquiring and developing high value assets in a sustainable market environment. The model is to acquire and structure cashflow streams around assets that can support the communities by monetizing the current existing cash flow streams while identifying transitionary cash flow from the assets for the future. For more information visit royaltymgmtcorp.com.

Forward-Looking Statements

This press release contains statements that constitute "forward-looking statements," including with respect to the initial public offering. No assurance can be given that the offering discussed above will be completed on the terms described, or at all. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including those that will be set forth in the "Risk Factors" section of the Company's registration statement and proxy statement/prospectus to be filed with the SEC. Copies will be available on the SEC's website, www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

Investor Contact:

RedChip Companies Inc.

Robert Foley

1-800-RED-CHIP (733-2447)

RMCO@redchip.com

Company Contact:

Kirk P. Taylor, CPA

Chief Financial Officer

(317) 855-9926

SOURCE: Royalty Management Holding Corporation

View the original press release on accesswire.com