TSX:ORV

TORONTO, Jan. 16, 2024 /PRNewswire/ -- Orvana Minerals Corp. (TSX: ORV) (the "Company" or "Orvana") is pleased to report production and drilling updates from Orovalle, Spain, for the first quarter of fiscal year 2024 ("Q1 FY2024), ending December 31, 2023.

Highlights- Production of 9,550 Gold Equivalent Ounces (7,994 gold ounces, 0.7 million copper pounds and 20,393 silver ounces).

- Orovalle-Spain successfully concluded negotiations regarding its 2023-2025 Collective Bargain Agreement ("CBA") with basic terms ratified by the mine workers last week. Upon agreement to the basic terms of the new CBA, the 3-hour stoppages per shift strike, that commenced in mid November 2023, were halted, and labour attendance and operational conditions were returned back to normal.

- OroValle-Spain Drilling:

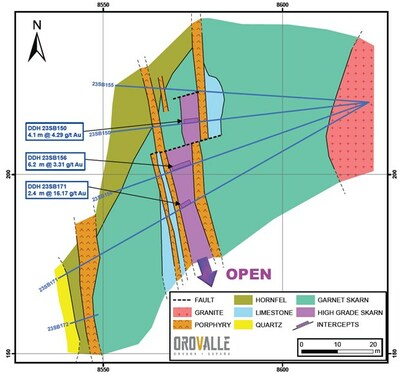

- 2,659 m of Infill and Brownfield drilling, with key intercepts in South Boinas as follows:

- DDH 23SB162: 6.10 m @ 12.18 g/t Au

- DDH 23SB163: 3.00 m @ 14.82 g/t Au and 4.35 m @ 5.38 g/t Au

- DDH 23SB169: 5.10 m @ 21.40 g/t Au

- DDH 23SB171: 2.40 m @ 16.17 g/t Au

- 445 m of Greenfield Drilling

- 2,659 m of Infill and Brownfield drilling, with key intercepts in South Boinas as follows:

Juan Gavidia, CEO of Orvana stated: "Although negotiations with the labour unions were challenging, management strongly believes Orovalle's long term sustainability requires detailed attention to its costing and operational frameworks which were adequately addressed in the agreed basic terms with the workers. As a result of the strikes, Orovalle is currently re-assessing production estimates for the fiscal year, while continuing to work on the operational efficiencies planned for the year. We are satisfied with the agreement of the basic terms of the new Collective Agreement, which will provide stability to labour relations until the end of 2025".

Q1 FY2024 Production Results

- 7,794 gold ounces produced, on track to meet fiscal year 2024 guidance of 41,000 - 45,000 Oz.

- 0.7 million copper pounds produced, on track to meet fiscal year 2024 guidance of 3,300 - 3,700 K lbs.

Q1 FY2024 | Q4 FY2023 | Q1 FY2023 | FY 2024 Guidance | ||

Ore milled (tones) | 130,267 | 189,527 | 156,681 | ||

Gold equivalent (oz)(1) | 9,550 | 15,567 | 13,815 | ||

Gold | |||||

Grade (g/t) | 2.09 | 2.23 | 2.30 | ||

Recovery (%) | 91.5 | 91.3 | 92.5 | ||

Production (oz) | 7,794 | 12,427 | 10,711 | 41,000 - 45,000 | |

Copper | |||||

Grade (%) | 0.32 | 0.40 | 0.43 | ||

Recovery (%) | 76.3 | 81.2 | 82.6 | ||

Production (K lbs) | 702 | 1,356 | 1,216 | 3,300 - 3,700 | |

Silver | |||||

Grade (g/t) | 6.77 | 8.38 | 10.98 | ||

Recovery (%) | 72.0 | 76.1 | 81.2 | ||

Production (oz) | 20,393 | 38,861 | 44,903 |

(1) Gold Equivalent Ounces ("GEO") were calculated using the following average market prices: |

Q1 FY2024: $1,975.87/oz Au, $23.23/oz Ag, $3.71/lb Cu, |

Q4 FY2023: $1,928.61/oz Au, $23.57/oz Ag, $3.79/lb Cu |

Q1 FY2023: $1,729.21/oz Au, $21.18/oz Ag, $3.63/lb Cu |

GEO is a Non-GAAP Financial Performance Measure. For further information and detailed reconciliations, please see the "Non-GAAP Financial Performance Measures" section of the Company's FY2023 MD&A.

Q1 FY2024 Drilling Update - Orovalle

Drilled Meters | Infill | Brownfield | Greenfield | TOTAL |

El Valle Boinás | ||||

Boinas South (SB) | 2,355 | 304 | - | 2,659 |

Ortosa-Godán | - | - | 61 | 61 |

Lidia | - | - | 384 | 384 |

TOTAL | 2,355 | 304 | 445 | 3,104 |

2,659 m were drilled continuing with the mineral definition in garnet skarn between 180 and 230 levels, completing 12 drill holes. DDH 23SB162 intersected 6.10 m @ 12.18 g/t Au; DDH 23SB163 intersected 3.00 m @ 14.82 g/t Au and 4.35 m @ 5.38 g/t Au, DDH 23SB169 intersected 5.10 m @ 21.40 g/t Au and DDH 23SB171 intersected 2.40 m @ 16.17 g/t Au; converting indicated resources into measured resources using 10 * 10 m drilling grid (See Figure 1). Six drill holes were executed to define mineralization between Boinas South and Black Skarn orebodies and three drill holes to look for skarn in the same area. The drilling program will continue during the second quarter in order to define the mineralization continuity to the North.

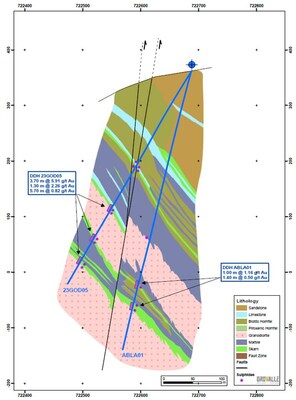

Ortosa-Godán

This Project is located three kilometers northwest of our Carlés mine, and within the same gold belt. The exploration program is focused on two areas: Ortosa and Godán. In both cases, the mineral potential is in relation to intrusives. A drilling program was executed in Godán from November 2022 to October 2023 totalling 2,544 meters in 8 drill holes. The drilling campaign proved the presence of mineralization in the contact between the intrusive and sedimentary rocks with calcic skarn bands dipping 60-70º ESE over 200 meters of strike potential. See Figure 2.

According to current drilling information and based on the dip and mineralization of the skarn, as depicted in Figure 2 and 3, there is a potential connection with Carlés skarn. Next steps are currently under reassessment.

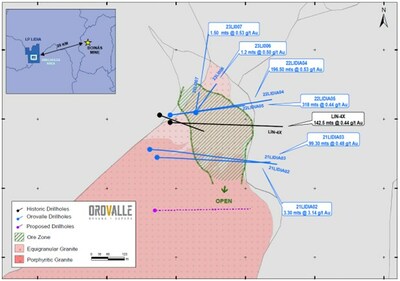

Lidia

This Project is located in Navelgas Gold Belt, 20 km west from El Valle mine. This gold porphyry occurs within the easternmost part of Navelgas fracture systems. A granodiorite intrusive outcrops over an area of approximately 1 km2. It is dissected by a set of northeast trending mineralized quartz veins and affected by different alteration phases. The drilling program completed between fiscal years 2021-2022 confirmed the presence of gold in the granodiorite (see PR April 17, 2023).

Two drill holes were completed in Q1 FY2024 targeting to define mineralization in the North part of the orebody. Upon reviewing the drilling results from the Q1 FY2024 campaign, it is evident that the boundary of mineralization to the north is well-defined, while remaining open to the south and at depth. The strategy in the area will be redefined to target higher-grade zones based on the available drillhole information.

Quality Control

Greenfield drill hole samples were sent to an external laboratory (ALS Laboratory) for analyses. Infill and brownfield drill holes samples were analyzed in Orovalle's Laboratory.

Sample preparation was carried out at the El Valle facility. All diamond core samples have been prepared using the following procedure, once split:

The core samples are dried at a temperature of 105ºC and then crushed through a jaw crusher to 95%<6 mm. The coarse-crushed sample is further reduced to 95%<425 microns using an LM5 bowl-and-puck pulverizer. An Essa rotary splitter is used to take a 450 g to 550 g sub-sample of each split for pulverizing. The remaining reject portion is bagged and stored. The sample is reduced to a nominal -200 mesh using an LM2 bowl-and-puck pulverizer. 140 g sub-samples are split using a special vertical-sided scoop to cut channels through the sample which has been spread into a pancake on a sampling mat. Samples are then sent to the laboratory for gold and base metal analysis. Leftover pulp is bagged and stored.

After sample preparation, 30g samples are analyzed for Au by fire assay with an atomic absorption spectroscopy (AAS) finish and two-gram samples for Ag, As, Bi, Cu, Hg, Pb, Sb, Se, and Zn by ICP-optical emission spectroscopy (ICP-OES) after an aqua regia digestion.

In case of the samples sent to an external laboratory, 30 g samples are analyzed for Au by fire assay with an atomic absorption (Au AA-25) and 35 elements by ICP (ME-ICP41) after an aqua regia digestion. When Au and Ag values are >100 ppm and Cu and As values are >10,000 ppm, specific analysis methods are used to determinate the final grade.

The reported work has been completed using industry standard procedures, including a quality assurance/quality control ("QA/QC") program consisting of the insertion of certified reference material, blanks and duplicates samples into the sample stream.

The exploration update was prepared under the supervision of Guadalupe Collar Menéndez, a qualified person for the purposes of NI 43-101 and an employee of Orovalle Minerals S.L., a subsidiary of Orvana.

Financial Performance:Q1 FY2024 financial highlights will be released with the first quarter financials, expected mid-February, 2024.

ABOUT ORVANA - Orvana is a multi-mine gold-copper-silver company. Orvana's assets consist of the producing El Valle and Carlés gold-copper-silver mines in northern Spain, the Don Mario gold-silver property in Bolivia, currently in care and maintenance, and the Taguas property located in Argentina. Additional information is available at Orvana's website (www.orvana.com).

Cautionary Statements - Forward-Looking InformationCertain statements in this presentation constitute forward-looking statements or forward-looking information within the meaning of applicable securities laws ("forward-looking statements"). Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, potentials, future events or performance (often, but not always, using words or phrases such as "believes", "expects", "plans", "estimates" or "intends" or stating that certain actions, events or results "may", "could", "would", "might", "will", "are projected to" or "confident of" be taken or achieved) are not statements of historical fact, but are forward-looking statements.

The forward-looking statements herein relate to, among other things, Orvana's ability to achieve improvement in free cash flow; the ability to maintain expected mining rates and expected throughput rates at El Valle Plant; the potential to extend the mine life of El Valle and Don Mario beyond their current life-of-mine estimates including specifically, but not limited to, Orvana's ability to optimize its assets to deliver shareholder value; estimates of future production (including without limitation, production guidance), operating costs and capital expenditures; mineral resource and reserve estimates; statements and information regarding future feasibility studies and their results; future transactions; future metal prices; the ability to achieve additional growth and geographic diversification; and future financial performance, including the ability to increase cash flow and profits; future financing requirements; mine development plans; and the possibility of the conversion of inferred mineral resources to mineral reserves.

Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies, which includes, without limitation, as particularly set out in the notes accompanying the Company's most recently filed financial statements. The estimates and assumptions of the Company contained or incorporated by reference in this news release, which may prove to be incorrect, include, but are not limited to the various assumptions set forth herein and in Orvana's most recently filed Management's Discussion & Analysis and Annual Information Form in respect of the Company's most recently completed fiscal year (the "Company Disclosures") or as otherwise expressly incorporated herein by reference as well as: there being no significant disruptions affecting operations, whether due to labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; permitting, development, operations, expansion and acquisitions at El Valle, Don Mario and Taguas being consistent with the Company's current expectations; political developments in any jurisdiction in which the Company operates being consistent with its current expectations; certain price assumptions for gold, copper and silver; prices for key supplies being approximately consistent with current levels; production and cost of sales forecasts meeting expectations; the accuracy of the Company's current mineral reserve and mineral resource estimates; labour and materials costs increasing on a basis consistent with Orvana's current expectations; and the availability of necessary funds to execute the Company's plan. Without limiting the generality of the foregoing, this news release also contains certain "forward-looking statements" within the meaning of applicable securities legislation, including, without limitation, references to the results of the Company's exploration activities, including but not limited to, drilling results and analyses, mineral resource estimation, conceptual mine plan and operations, internal rate of return, sensitivities, taxes, net present value, potential recoveries, design parameters, operating costs, capital costs, production data and economic potential; the timing and costs for production decisions; permitting timelines and requirements; exploration and planned exploration programs; and the Company's general objectives and strategies.

A variety of inherent risks, uncertainties and factors, many of which are beyond the Company's control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include: the potential impact of global health and global economic conditions on the Company's business and operations, including: our ability to continue operations; and our ability to manage challenges presented by such conditions; the general economic, political and social impacts of the continuing conflict between Russia and Ukraine, our ability to support the sustainability of our business including through the development of crisis management plans, increasing stock levels for key supplies, monitoring of guidance from the medical community, and engagement with local communities and authorities; fluctuations in the price of gold, silver and copper; the need to recalculate estimates of resources based on actual production experience; the failure to achieve production estimates; variations in the grade of ore mined; variations in the cost of operations; the availability of qualified personnel; the Company's ability to obtain and maintain all necessary regulatory approvals and licenses; Orovalle's ability to complete the permitting process of the El Valle Tailings Storage Facility increasing the storage capacity; Orovalle's ability to complete the stabilization project of the legacy open pit wall; the Company's ability to use cyanide in its mining operations; risks generally associated with mineral exploration and development, including the Company's ability to continue to operate the El Valle and/or ability to resume long-term operations at the Carlés Mine; the Company's ability to successfully implement a sulphidization circuit and ancillary facilities to process the current oxides stockpiles at Don Mario; the Company's ability to successfully carry out development plans at Taguas; sufficient funding to carry out development plans at Taguas and to process the oxides stockpiles at Don Mario; EMIPA's ability to complete the issuance of the Bonds Program at Bolivia and any additional required financing to commence the OSP; the Company's ability to acquire and develop mineral properties and to successfully integrate such acquisitions; the Company's ability to execute on its strategy; the Company's ability to obtain financing when required on terms that are acceptable to the Company; challenges to the Company's interests in its property and mineral rights; current, pending and proposed legislative or regulatory developments or changes in political, social or economic conditions in the countries in which the Company operates; general economic conditions worldwide; the challenges presented by global health conditions; fluctuating operational costs such as, but not limited to, power supply costs; current and future environmental matters; and the risks identified in the Company's disclosures. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements and reference should also be made to the Company's Disclosures for a description of additional risk factors.

Any forward-looking statements made herein with respect to the anticipated development and exploration of the Company's mineral projects are intended to provide an overview of management's expectations with respect to certain future activities of the Company and may not be appropriate for other purposes. Forward-looking statements are based on management's current plans, estimates, projections, beliefs and opinions and, except as required by law, the Company does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change. Readers are cautioned not to put undue reliance on forward-looking statements. The forward-looking statements made in this information are intended to provide an overview of management's expectations with respect to certain future operating activities of the Company and may not be appropriate for other purposes.

CONTACT: Nuria Menéndez, Chief Financial Officer, E: nmenendez@orvana.com

Photo - https://mma.prnewswire.com/media/2319120/Orvana_Minerals_Corp__ORVANA_REPORTS_Q1_FY2024_PRODUCTION_AND_EX.jpg

Photo - https://mma.prnewswire.com/media/2319121/Orvana_Minerals_Corp__ORVANA_REPORTS_Q1_FY2024_PRODUCTION_AND_EX.jpg

Photo - https://mma.prnewswire.com/media/2319122/Orvana_Minerals_Corp__ORVANA_REPORTS_Q1_FY2024_PRODUCTION_AND_EX.jpg

Photo - https://mma.prnewswire.com/media/2319123/Orvana_Minerals_Corp__ORVANA_REPORTS_Q1_FY2024_PRODUCTION_AND_EX.jpg

Logo - https://mma.prnewswire.com/media/2319124/Orvana_Minerals_Corp__ORVANA_REPORTS_Q1_FY2024_PRODUCTION_AND_EX.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/orvana-reports-q1-fy2024-production-and-exploration-update-302035476.html

View original content:https://www.prnewswire.co.uk/news-releases/orvana-reports-q1-fy2024-production-and-exploration-update-302035476.html