Many states, provinces and countries have set aggressive emission targets aimed at drastically reducing carbon emissions and reaching net zero by mid-century (or even sooner).

NORTHAMPTON, MA / ACCESSWIRE / January 19, 2024 / To meet these goals, government agencies have been challenged to investigate and implement innovative measures to cut greenhouse gas (GHG) emissions while also maintaining a competitive business environment for their local companies.

According to the US EPA, one of the largest contributors to GHG emissions in the U.S. is the transportation sector (29%). Magnifying this problem, it is projected that transportation demand will continue to grow as the global population increases over time.

To help mitigate increases in transportation emissions, several North American jurisdictions have turned to compliance market-based mechanisms interrupting the status quo for transportation fuels. These compliance instruments have several names including "Low Carbon Fuel Standards", "Clean Fuel Standards" or "Clean Fuel Programs" (CFPs). All of these instruments follow the same general principle: incentivize the reduction of carbon embedded in fuels used for transportation over time.

Clean fuel market basics

All CFPs follow a simplified set of rules:

- The regulating body of the respective jurisdiction sets a decarbonization goal for their transportation fuel mix (gasoline, diesel, electricity, CNG, LNG, hydrogen, bio-CNG/LNG, sustainable aviation fuel, biomass-based gasoline or diesel, and ethanol blended fuels) with annual declining targets for different fuel types. Fuel emissions are expressed as the total GHGs produced over a fuel's lifecycle, from well-to-wheels, divided by the energy consumed in megajoules, (gCO2e/MJ). This is referred to as carbon intensity (CI).

- Fuel producers selling to the jurisdiction must then meet or exceed the CI reductions required during the annual period. If a company does not meet these requirements, they must purchase CFP credits fulfilling a strict eligibility criteria to comply with the regulation. Conversely, if a producer exceeds the CI reduction benchmark, they start generating credits (Each clean fuel credit is equivalent to a reduction of one metric ton of GHG emissions). See below for a graphical representation of this relationship, using Washington's CFP target set by their Department of Ecology (DoE) as an example.

- Credits can then be sold to other market participants within their jurisdiction to help meet their compliance obligations, or banked for future use. These credits create an ongoing source of revenue for the participant, as long as they keep producing low CI fuels and selling into the market.

Washington State Carbon Intensity Standard

There are several ways for fuel suppliers to achieve compliance with CFPs and their declining CI targets, including:

- Improving the efficiency of their fuel production processes.

- Producing and/or blending low-carbon biofuels into the fuel they sell.

- Purchasing credits generated by low-carbon fuel providers, including electric-vehicle charging providers.

CFP adoption is growing

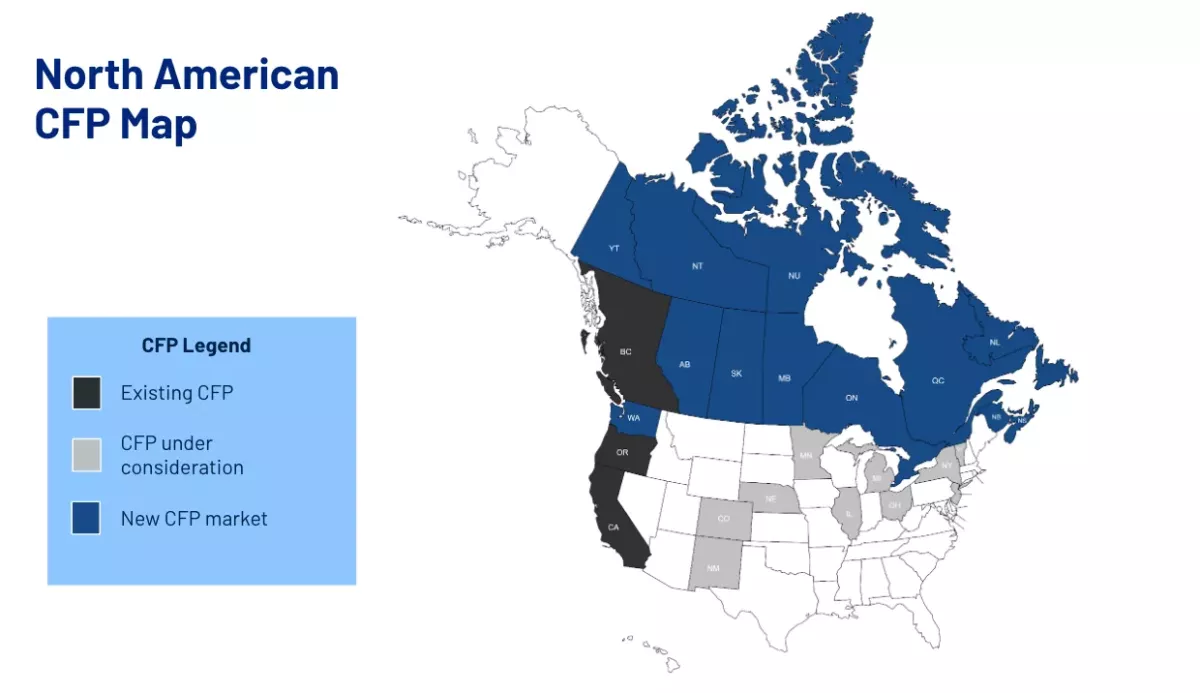

In North America, there are currently five clean fuel market programs, with several being active for over a decade (California's Low Carbon Fuel Standard began in 2011 and British Columbia's in 2013). At the beginning of 2023, two new markets emerged - the state of Washington and a national program launched in Canada. Interest in this type of compliance scheme is gaining popularity in other parts of North America as well. Several states including Illinois, Massachusetts, Michigan, Minnesota, New Mexico, New York, and Vermont are investigating or have considered such markets for their own transportation decarbonization efforts. Since these programs are fuel-agnostic and allow healthy competition, while contributing to state emission goals, it's not surprising that additional states are interested.

What does this mean for Program Credit Prices?

Program credit prices have historically been influenced by several forces, including market demand and ratcheting down of CI benchmarks, resulting in varying credit values over the years. Currently, credit prices in California, Oregon, British Columbia and Washington are being traded for $70, $97, $367 and $95, respectively (all in USD). Adding new markets will drive higher demand for low carbon fuels as these new markets will compete with existing demand. On top of that, the need for low carbon fuels will grow as each market is continually requiring greater reductions to CI. If adequate supply of low carbon fuels to support these markets cannot be maintained, it could inflate credit prices in either the existing markets, the new emerging markets, or both.

What does this mean for fuel producers?

With more locations joining this compliance scheme, low carbon fuel producers will have increased outlets for their products, allowing them to choose their target market or diversify their distribution to multiple markets. It should be noted that selling to various markets does come with additional complexities, as each market can have different compliance requirements and processes to maintain. Receiving help from a CFP expert, such as South Pole, can help alleviate such challenges.

New low-carbon fuel production facilities can also benefit from additional markets by helping to de-risk project development. New suppliers require a purchaser of their fuels to unlock credit generation potential and these added markets offer new opportunities to secure offtake agreements for their supply. This can help producers secure investment capital, which in turn, helps accelerate commercialization of their supply.

Geographically, CFPs are currently limited to the West Coast of the US or in Canada, making it challenging for liquid fuel producers in the Midwest and East Coast to join these markets without transporting their fuels over long distances. Not only does this increase the complexity of their fuel supply chains, but also affects the final carbon intensity score of the fuel - potentially reducing credit generation potential. Creating closer markets for them to join will increase supply chain efficiency, lower carbon intensity scores and allow for fuel diversity more broadly across North America.

Final Thoughts

CFPs offer a market based solution to transportation emissions. Given the success and popularity of these programs, we anticipate that additional states will adopt such regulations in the coming years, creating more opportunities for low carbon fuel producers to ramp up production and/or develop new supply. In addition, regulations such as the recently enacted Inflation Reduction Act can help bolster clean fuels in the US, providing production and investment tax credits to strengthen revenue generation potential and long term viability of these operations.

North American CFP Map

View additional multimedia and more ESG storytelling from South Pole on 3blmedia.com.

Contact Info:

Spokesperson: South Pole

Website: https://www.3blmedia.com/profiles/south-pole

Email: info@3blmedia.com

SOURCE: South Pole

View the original press release on accesswire.com