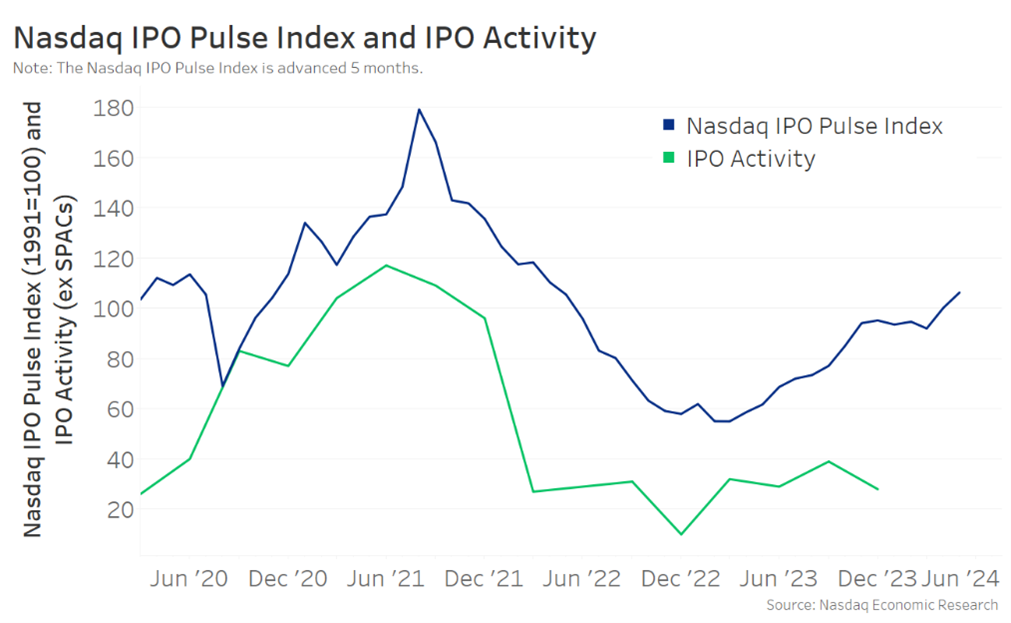

NEW YORK, Jan. 23, 2024 (GLOBE NEWSWIRE) -- Nasdaq (Nasdaq: NDAQ) today announced its Capital Access Platforms division launched a new leading indicator to provide corporates and investors with an outlook for the direction of initial public offering (IPO) activity with a high degree of predictability six months out. The "Nasdaq IPO Pulse Index" suggests an upswing in potential IPO activity when it is in an uptrend - it is now at its highest level since 2021 - compared to a pullback in IPO activity when the index is trending in the other direction.

"Companies analyzing an initial public offering are always looking for key indicators and metrics to help them plan for the most optimal time to list," said Karen Snow, Global Head of Listings at Nasdaq. "We developed the Nasdaq IPO Pulse Index to empower them with a data-driven forecast of where we believe the listings market will be in the future. It also provides unique information for institutional and retail investors to factor into their decisions about investing in new issuances."

The Nasdaq IPO Pulse Index is driven by six leading indicators of IPO market activity including:

- Year-over-year changes in the Fed Funds Rate

- Year-over-year changes in the VIX Index

- Recent returns (S&P 500 Price Annual Growth)

- Valuations (S&P 500 Enterprise Value to Sales Ratio Annual Growth)

- Investor sentiment

- Nasdaq's proprietary IPO data

More than 50 candidate series were rigorously backtested over the last three decades to arrive at these six indicators, which we believe have proved to consistently lead directional shifts in IPO activity. Combined, the Nasdaq IPO Pulse Index anticipates turns in IPO activity by about six months on average.

Caption: With the Nasdaq IPO Pulse Index at a two-year high, it's likely IPO activity will remain in an uptrend at least through the first half of the year.

"The Nasdaq IPO Pulse Index is updated each quarter and is now at a current two-year high, which historically means IPO activity should remain in an uptrend through the first half of this year," said Phil Mackintosh, Chief Economist at Nasdaq. "We carefully curated the index methodology that blends industry and proprietary Nasdaq data to provide corporates and investors with a pulse of how receptive the markets may be to new issuances in the near-term."

To learn more about the Nasdaq IPO Pulse Index, please visit our website or read a detailed whitepaper (https://www.nasdaq.com/solutions/IPO-Pulse#download) about the innovative indicator for IPO activity.

About Nasdaq:

Nasdaq (Nasdaq: NDAQ) is a leading global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions, and career opportunities, visit us on LinkedIn, on X @Nasdaq, or at www.nasdaq.com.

Nasdaq Media Contact

| Peter Gau (201) 388-9682 Peter.gau@nasdaq.com | Sophia Weiss (646) 483-6960 Sophia.weiss@nasdaq.com |

The IPO Pulse indicator is provided for educational purposes only and should not be construed as investment advice. Nasdaq does not recommend or endorse any securities offering or investment strategy. Before making any investments you are urged to read the relevant company's SEC filings, undertake your own due diligence, and carefully evaluate the company. Advice from a securities professional is strongly advised.

-NDAQG-

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/6ae3015e-6f09-40e2-ab21-b8108e3a5dfc