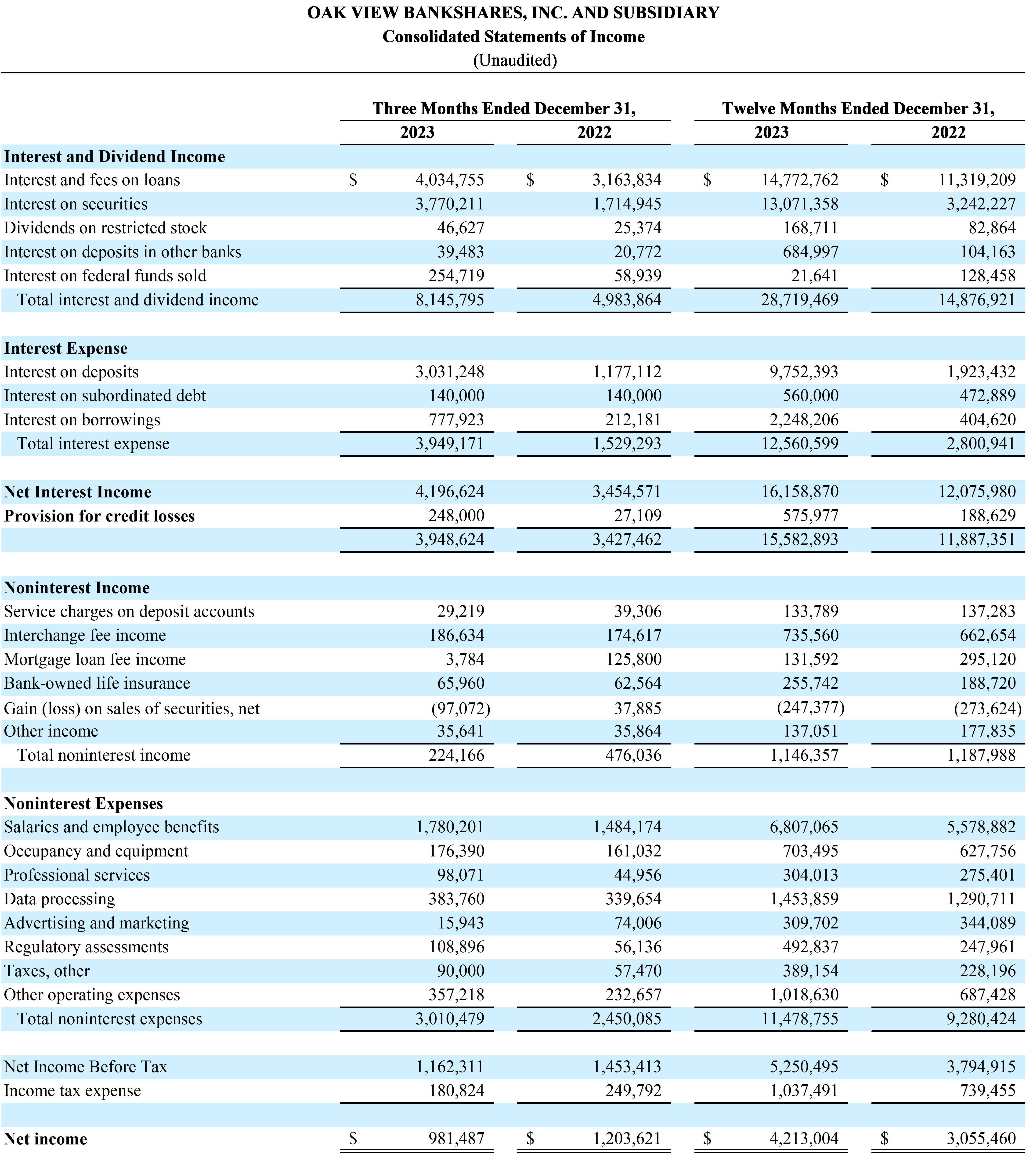

WARRENTON, VA / ACCESSWIRE / January 26, 2024 / Oak View Bankshares, Inc. (the "Company") (OTC Pink:OAKV), parent company of Oak View National Bank (the "Bank"), reported net income of $4.21 million for the twelve months ended December 31, 2023, compared to net income of $3.06 million for the twelve months ended December 31, 2022, an increase of $1.15 million or 37.58%. Basic and diluted earnings per share were $1.43 for the twelve months ended December 31, 2023, compared to $1.03 for the twelve months ended December 31, 2022.

On January 18, 2024, the Board of Directors of the Company declared an annual dividend of $0.20 per share to shareholders of record as of the close of business on February 1, 2024, payable on February 8, 2024.

Michael Ewing, CEO and Chairman of the Board said, "Our Company experienced another phenomenal year, increasing earnings by 37% during a challenging time for the banking industry. The achievement of record earnings for 2023 is the result of hard work and dedication of our entire team in navigating an unprecedented year of liquidity concerns, interest rate volatility, and uncertainty in the economic environment. Our disciplined approach in operating a safe and sound financial institution, providing the foremost customer experience, offering quality products and services, supporting our local communities, and maintaining a rewarding workplace for our employees, while doubling earnings over the last three years, is quite remarkable."

Selected Highlights:

- Return on average assets was 0.75% and return on average equity was 14.38% for the twelve months ended December 31, 2023, compared to 0.75% and 11.73%, respectively for the twelve months ended December 31, 2022.

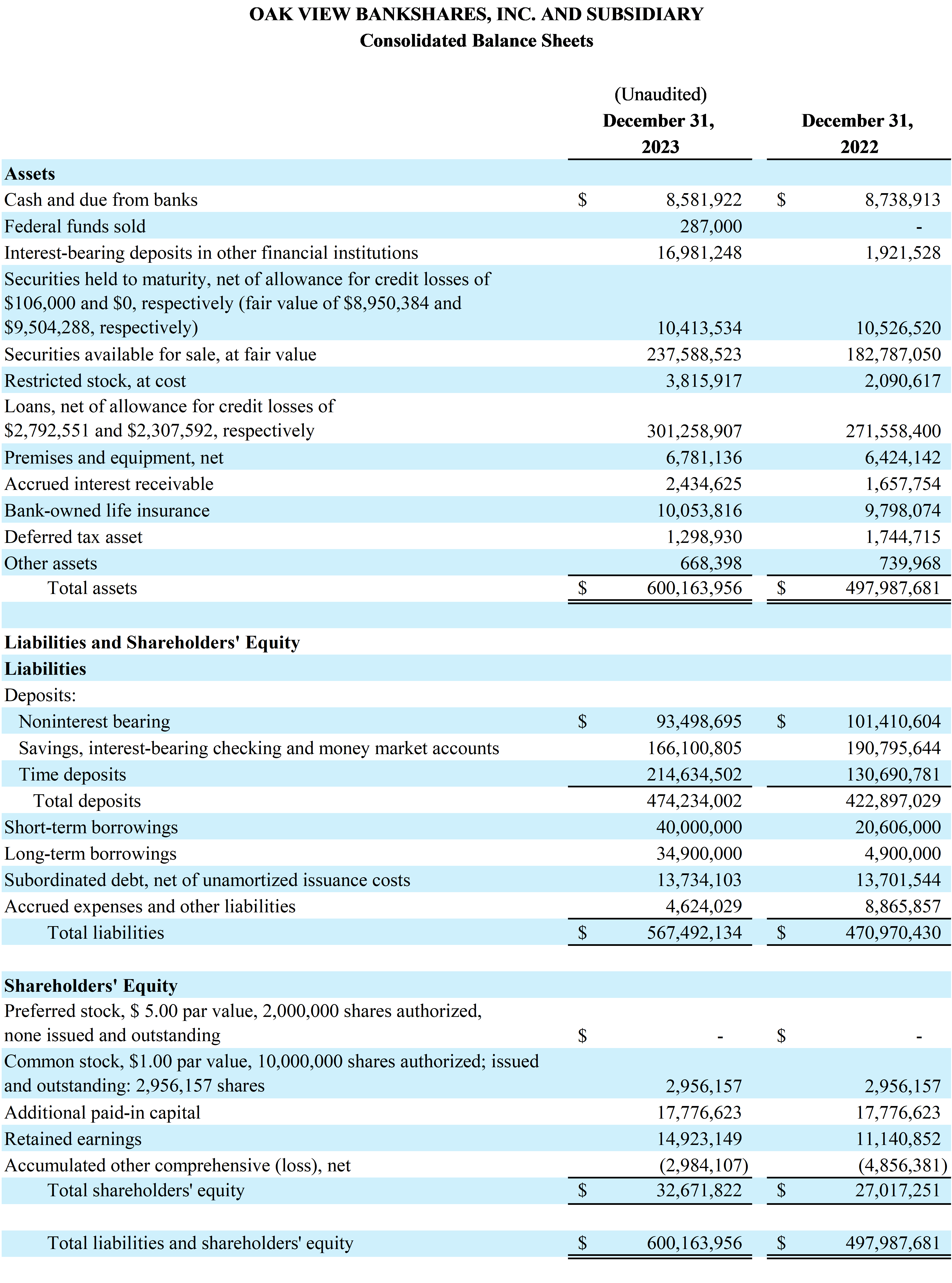

- Total assets were $600.16 million on December 31, 2023, compared to $497.89 million on December 31, 2022.

- Total loans were $304.05 million on December 31, 2023, compared to $273.87 million on December 31, 2022.

- The investment portfolio totaled $248.00 million on December 31, 2023, compared to $193.31 million on December 31, 2022.

- Total deposits were $474.23 million on December 31, 2023, compared to $422.90 million on December 31, 2022.

- Credit quality continues to be outstanding. There were no nonperforming loans as of December 31, 2023.

- Regulatory capital remains strong with ratios exceeding the "well capitalized" thresholds in all categories.

- Liquidity remains strong at $453.94 million as of December 31, 2023, compared to $379.25 million as of December 31, 2022. Liquidity includes cash, unencumbered securities available-for-sale, and available secured and unsecured borrowing capacity.

Net Interest Income

The net interest margin was 2.92% for the quarter ended December 31, 2023, compared to 3.10% for the quarter ended December 31, 2022. For the twelve months ended December 31, 2023, the net interest margin was 2.98%, compared to 3.29% for the twelve months ended December 31, 2022.

Net interest income was $4.20 million for the quarter ended December 31, 2023, compared to $3.45 million for the quarter ended December 31, 2022. Net interest income was $16.16 million and $12.08 million for the twelve months ended December 31, 2023, and 2022, respectively.

Interest income was $8.15 million and $28.72 million for the quarter and twelve months ended December 31, 2023, respectively, compared to $4.98 million and $14.87 million for the quarter and twelve months ended December 31, 2022, respectively. The increase in interest income was the result of increased volume and higher interest rates in the loan portfolio as well as continued investment opportunities to deploy capital into investments with attractive risk and return characteristics.

Interest expense was $3.95 million and $12.56 million for the quarter and twelve months ended December 31, 2023, respectively, compared to $1.53 million and $2.80 million for the quarter and twelve months ended December 31, 2022, respectively. Increases in interest expense were primarily attributable to interest expense paid on deposits resulting from increases in volume and in interest rates and interest expense paid on borrowings due to higher balances needed to deploy capital into higher yielding investment opportunities.

Noninterest Income

Noninterest income was $224,166 for the quarter ended December 31, 2023, compared to $476,036 for the quarter ended December 31, 2022. For the twelve months ended December 31, 2023, noninterest income was $1.15 million, compared to $1.19 million for the twelve months ended December 31, 2022.

Management evaluates, on an ongoing basis, the investment portfolio and continues to take advantage of opportunities to sell securities and redeploy proceeds into assets with more attractive risk and return characteristics. As part of the portfolio repositioning, the Company incurred net losses on sales of securities of $247,377 for the twelve months ended December 31, 2023.

Noninterest Expense

Noninterest expenses were $3.01 million for the quarter ended December 31, 2023, compared to $2.45 million for the quarter ended December 31, 2022. For the twelve months ended December 31, 2023, noninterest expenses were $11.48 million, compared to $9.28 million for the twelve months ended December 31, 2022.

Salaries and employee benefits were the largest category of noninterest expenses. For the quarter ended December 31, 2023, expenses related to salaries and employee benefits were $1.78 million, compared to $1.48 million for the quarter ended December 31, 2022. For the twelve months ended December 31, 2023, salaries and employee benefit expenses were $6.81 million, compared to $5.58 million for the twelve months ended December 31, 2022. Increases in salaries and employee benefit expenses were related primarily to higher levels of compensation, payroll taxes and employee benefits, which are in line with employment market conditions and industry studies, as well as, higher levels of incentive compensation paid to all employees based on the achievement of predetermined financial metrics.

Liquidity

The Company's liquidity position continues to be very strong with $453.94 million of liquid assets available which included cash, unencumbered securities available-for-sale, and secured and unsecured borrowing capacity as of December 31, 2023, compared to $379.25 million as of December 31, 2022.

The Company's deposits proved to be stable with core deposits, which are defined as total deposits excluding brokered deposits, of $443.55 million as of December 31, 2023, compared to $401.94 million as of December 31, 2022. Uninsured deposits, those deposits that exceed FDIC insurance limits, were $82.82 million as of December 31, 2023, or 17.46% of total deposits, well within industry averages.

Asset Quality

The Company adopted the recent accounting pronouncement for current expected credit losses ("CECL"), effective January 1, 2023. Prior to CECL's effective date, the Company accounted for the allowance for loan losses under the incurred loss model.

On December 31, 2023, the allowance for credit losses was $2.79 million or 0.92% of outstanding loans,net of unearned income, compared to $2.31 million or 0.84% of outstanding loans, net of unearned income, on December 31, 2022. The increase in the allowance for credit losses was primarily due to the growth in the loan portfolio as well as adjustments for current economic conditions and the related impact on collateral values. There were no nonperforming loans, nonaccrual loans or past due loans as of December 31, 2023.

The provision for credit losses was $248,000 for the quarter ended December 31, 2023, compared to $27,109 for the quarter ended December 31, 2022. The provision for credit losses was $575,977 for the twelve months ended December 31, 2023, compared to $188,629 for the twelve months ended December 31, 2022.

Shareholders' Equity

Shareholders' equity was $32.67 million on December 31, 2023, compared to $27.02 million on December 31, 2022. Unrealized losses related to market adjustments arising from changes in interest rates were $2.98 million as of December 31, 2023, compared to $4.86 million as of December 31, 2022.

About Oak View Bankshares, Inc. and Oak View National Bank

Oak View Bankshares, Inc. is the parent bank holding company for Oak View National Bank, a locally owned and managed community bank serving Fauquier, Culpeper, Rappahannock, and surrounding Counties. For more information about Oak View Bankshares, Inc. and Oak View National Bank, please visit our website at www.oakviewbank.com. Member FDIC.

For additional information, contact Tammy Frazier, Executive Vice President & Chief Financial Officer, Oak View Bankshares, Inc., at 540-359-7155.

SOURCE: Oak View Bankshares, Inc. VA

View the original press release on accesswire.com