TORONTO, Jan. 30, 2024 (GLOBE NEWSWIRE) -- Xanadu Mines Ltd (ASX: XAM, TSX: XAM) (Xanadu, XAM or the Company) is pleased to provide an update on exploration drilling at the Kharmagtai Project in Mongolia, being developed with the Company's joint venture partner Zijin Mining Group Co., Ltd. (Zijin). Exploration drilling continues to expand upon the new zone of higher-grade copper and gold mineralisation at the White Hill deposit, demonstrating progressive growth in higher-grade material at the base of the previously optimised open pits.

Highlights

- Latest extensional and exploration drilling results expand upon the recently identified higher-grade zone (core) at White Hill1, located below the previous Scoping Study pit designs2 and outside the 2023 Mineral Resource Estimate (MRE) 3. Best drilling results include:

- KHDDH808 - 64.45m @ 0.74% CuEq (0.61% Cu & 0.26/t Au) from 516,

Including 24.45m @ 1.41% CuEq (1.14% Cu & 0.53g/t Au) from 634m

Including 13.8m @ 1.99% CuEq (1.64% Cu & 0.70g/t Au) from 558m - KHDDH806 - 50m @ 0.73% CuEq (0.25% Cu & 0.94g/t Au) from 545m

Including 22m @ 1.34% CuEq (0.26% Cu & 2.10g/t Au) from 549

- KHDDH808 - 64.45m @ 0.74% CuEq (0.61% Cu & 0.26/t Au) from 516,

- Expanding higher-grade core (>1% CuEq) at White Hill is expected to enhance & enlarge the 2023 MRE and to increase scale & deepen 2022 Scoping Study2 pit shells, capturing additional higher-grade over longer period.

- Step-out drilling at Golden Eagle returns grades more than double the MRE grade and extends mineralisation. Best results include:

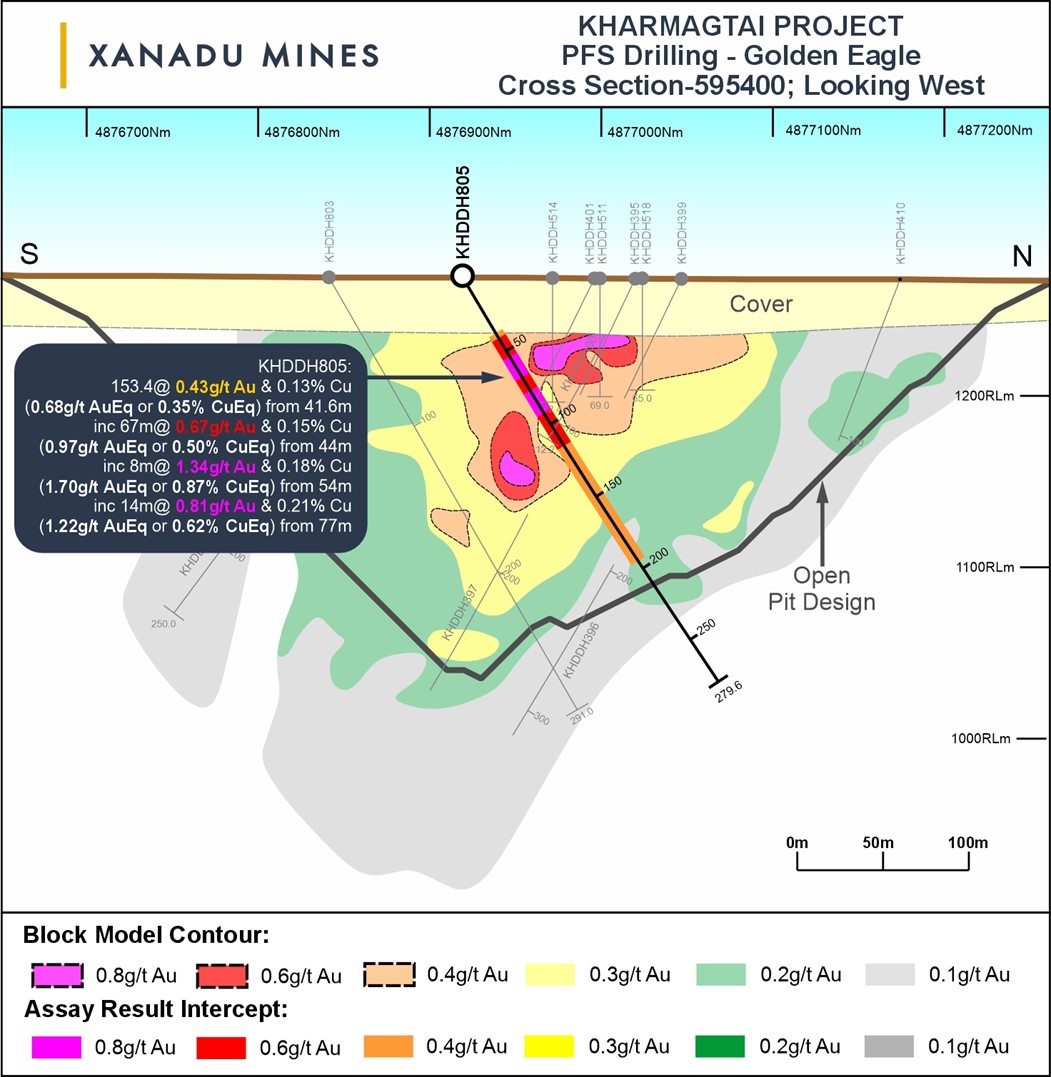

- KHDDH805 - 153.4m @ 0.68g/t AuEq (0.43g/t Au and 0.13% Cu) from 41.6m

Including 67m @ 0.97g/t AuEq (0.67g/t Au and 0.15% Cu) from 44m

Including 8m @ 1.7g/t AuEq (1.34g/t Au and 0.18% Cu) from 54m

And 14m @ 1.22g/t AuEq (0.81g/t Au and 0.21% Cu) from 77m

- KHDDH805 - 153.4m @ 0.68g/t AuEq (0.43g/t Au and 0.13% Cu) from 41.6m

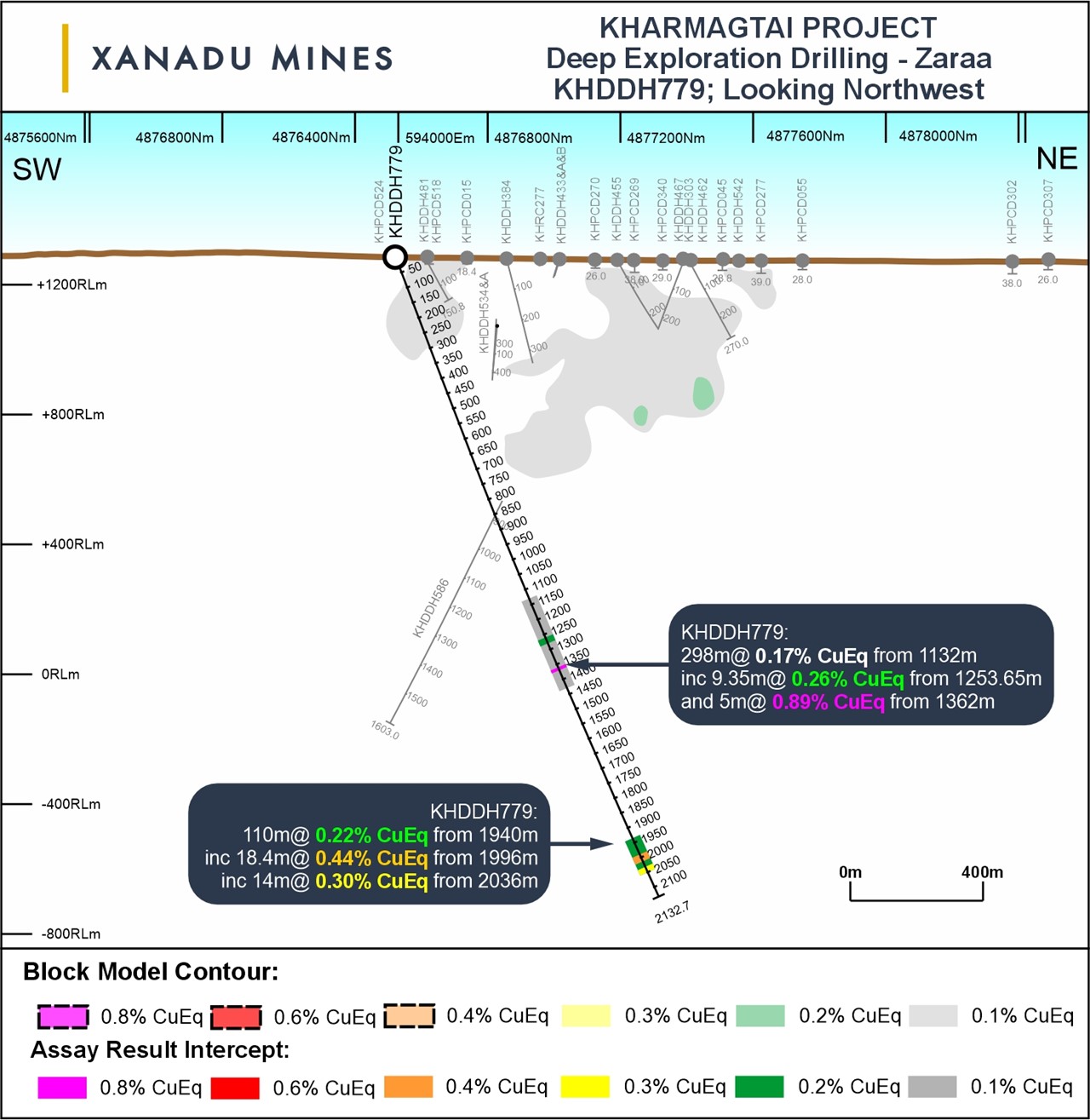

- Deep drilling hole KHDDH779 encounters two broad zones of porphyry and tourmaline breccia style mineralisation between Stockwork Hill and Zaraa, potentially indicating the edges of a very large-scale Cu-Au System.

- Growth-focused discovery exploration drilling at Kharmagtai continues to discover new, shallow mineralisation with potential to enhance open pit mining and deep mineralisation with potential for future underground mining.

- Further assays from deep exploration drilling are pending; we look forward to sharing over the coming months.

- Kharmagtai JV is funding US$35M4 for both PFS completion and discovery exploration, aiming towards decision to mine in Q4 CY2024.

______________

1 ASX/TSX Announcement 7 June 2023 - New Higher-Grade Zones Found in Kharmagtai Infill Drilling

2 ASX/TSX Announcement 6 April 2022 - Scoping Study - Kharmagtai Copper-Gold Project

3 ASX/TSX Announcement 8 December 2023 - Kharmagtai Mineral Resource Grows by 13% CuEq; including >25% increase in higher-grade core

Xanadu's Executive Chairman and Managing Director, Mr Colin Moorhead, said "Latest drilling results provide more evidence for continued growth and improvement at the Kharmagtai deposit. Importantly, we are expanding the +1% CuEq zone at White Hill and expending higher-grade mineralisation closer to surface. Our current geological interpretation suggests that mineralisation is faulted upwards, towards surface as we expand the deposit southwards.

"Bulking up the White Hill higher-grade core will improve the new open pit designs and yield additional copper within range of open pit mining."

______________

4 ASX/TSX Announcement 13 March 2023 - Zijin & Xanadu Transaction Completed & Kharmagtai PFS Underway

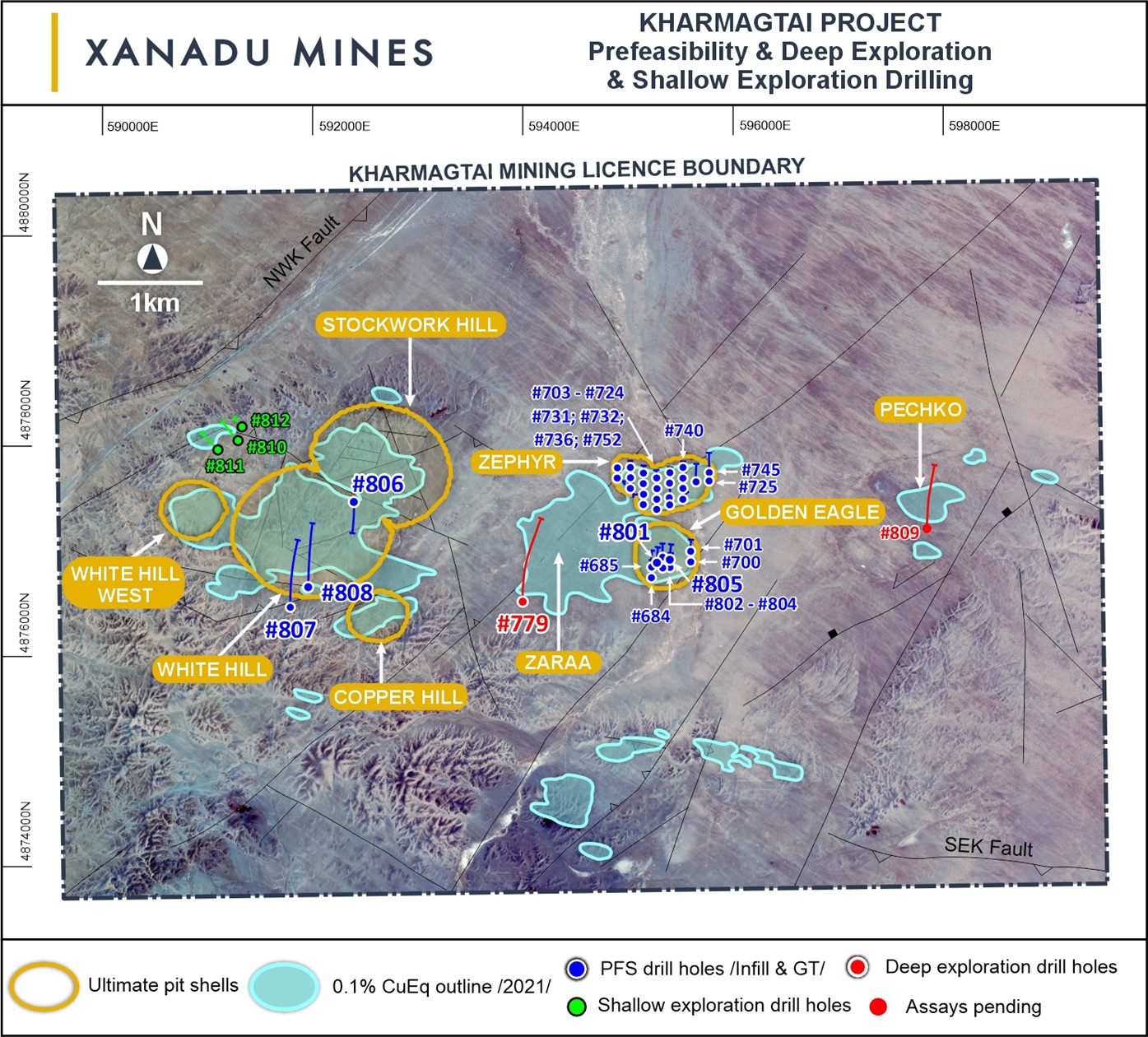

Figure 1: Kharmagtai copper-gold district showing defined mineral deposits and completed infill drill holes, deep exploration drill holes, and shallow exploration drill holes since the last announced drilling results5.

______________

5 ASX/TSX Announcement 16 November 2023 - Kharmagtai Drilling Achievements Update

Since the last Drilling Market Release (included in 2023 MRE Update), a total of 5,307m infill diamond drilling has been completed at Golden Eagle and Zephyr, and 9,320m extensional and exploration drilling, with both drill core collars and assay results for each, provided in Tables 1 and 2 (see Appendix 1).

Step-out Drilling Expands Higher-Grade Core at White Hill

Three drill holes were collared at White Hill, and designed to extend the recently discovered higher-grade core, beneath the 2022 Scoping Study open pits.

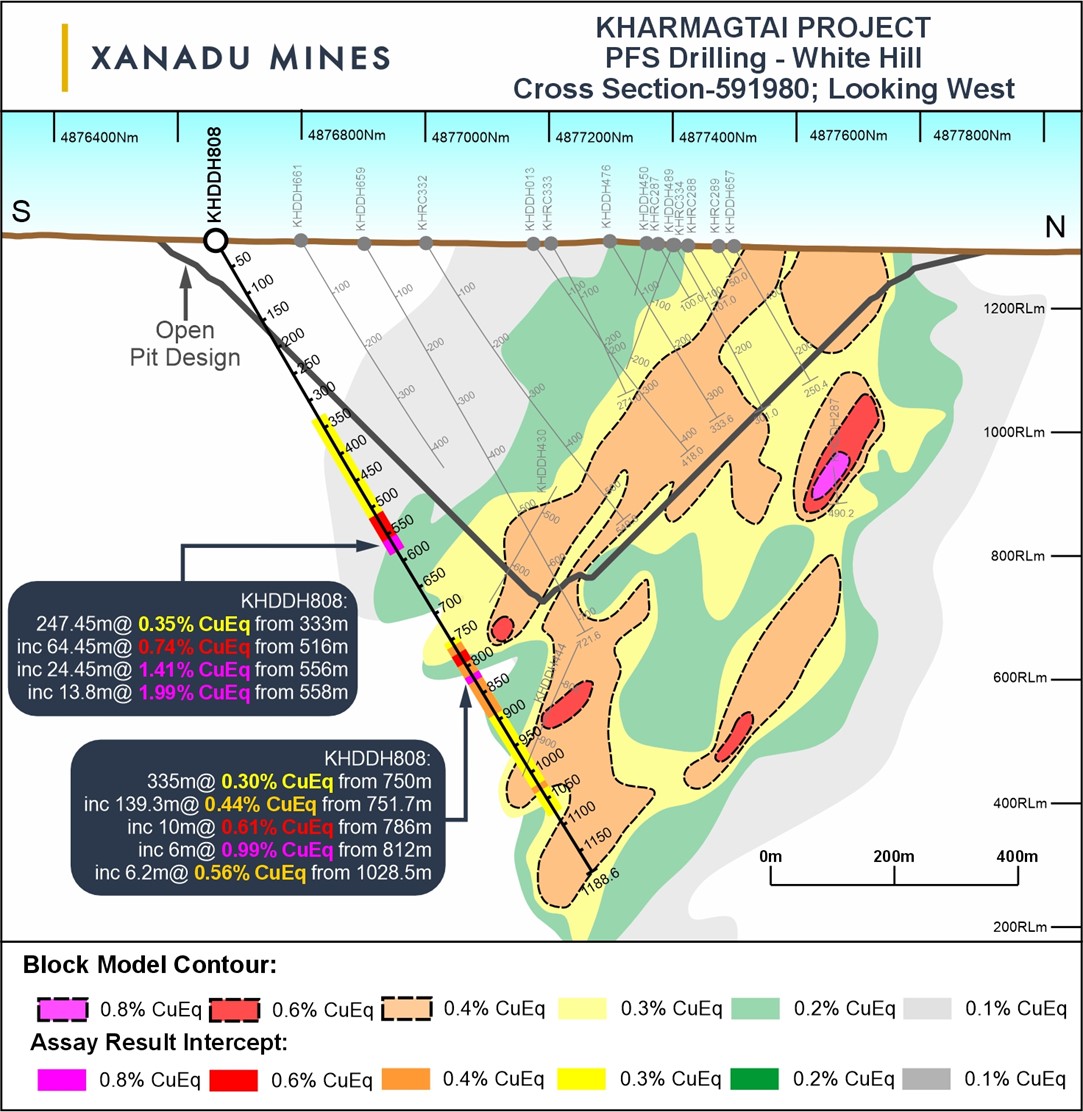

Drill hole KHDDH808 was designed as a 150 to 200m step back from previous drilling (Figure 2). KHDDH808 intercepted a moderate grade halo (+0.3% CuEq) over 350m shallower than expected, and encountered two zones of higher-grade (+1% CuEq) mineralisation.

| Hole ID | Interval (m) | Cu (%) | Au (g/t) | CuEq (%) | From (m) |

| KHDDH808 | 64.45 | 0.61 | 0.26 | 0.74 | 516 |

| including | 24.45 | 1.14 | 0.53 | 1.41 | 634 |

| including | 13.8 | 1.64 | 0.70 | 1.99 | 558 |

Figure 2: Cross section 591980mE through the White Hill deposit.

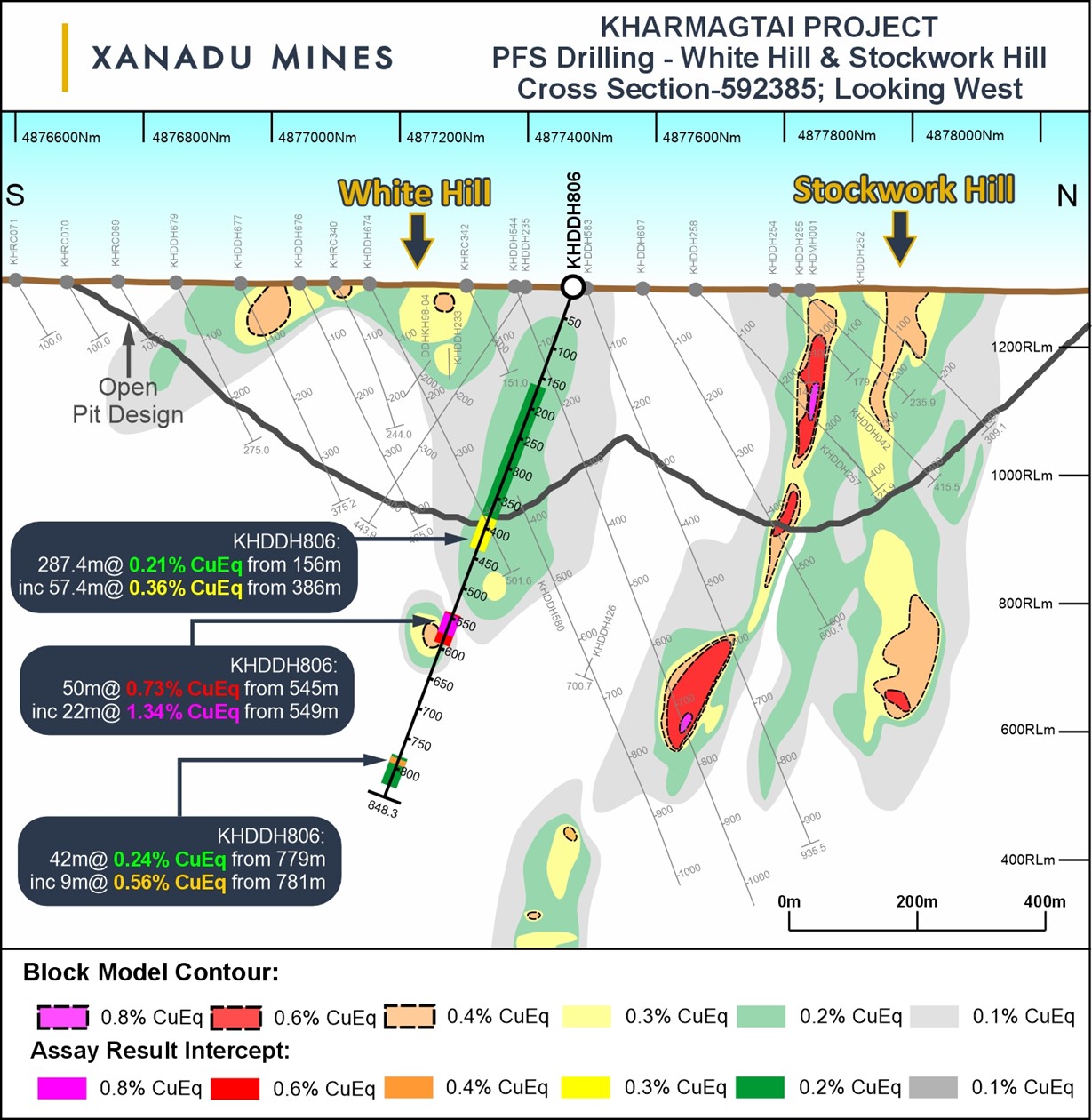

Drill hole KHDDH806 was designed to test for higher-grade extensions beneath eastern end of the White Hill open pit (Figure 3). KHDDH806 extended moderate grade mineralisation for 150m beneath deepest portion of the previously planned pit, encountering a narrow zone of higher-grade mineral at the expected depth.

| Hole ID | Interval (m) | Cu (%) | Au (g/t) | CuEq (%) | From (m) |

| KHDDH806 | 287.4 | 0.18 | 0.07 | 0.21 | 156 |

| and | 50 | 0.25 | 0.94 | 0.73 | 545 |

| including | 22 | 0.26 | 2.10 | 1.34 | 549 |

Figure 3: Cross section 592385mE through the White Hill and Stockwork Hill deposits

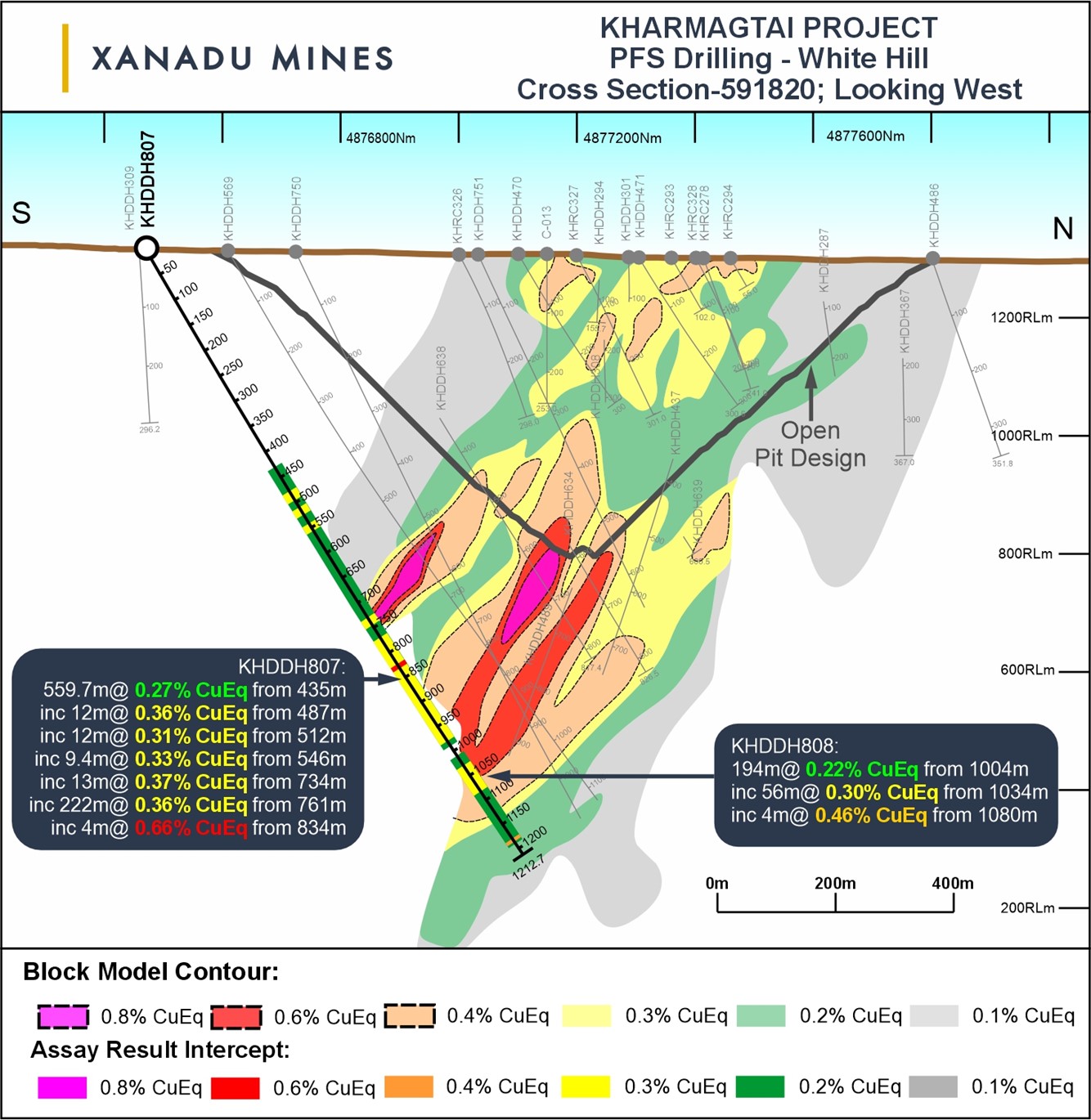

Drill hole KHDDH807 was designed as a 150m step back from previous drilling (Figure 4) and intercepted low to moderate grade halo (+0.2% CuEq) over 270m shallower than expected. KHDDH807 returned very broad intercept of 559.7m @ 0.27% CuEq from 435m, including 222m @ 0.36% CuEq from 761m.

Figure 4: Cross section 591820mE through the White Hill deposit

Infill Drilling Expands Higher-Grade Gold at Golden Eagle

Five drill holes were collared at Golden Eagle and designed to extend the new higher-grade gold zone (+1g/t Au) at Golden Eagle6.

Drill hole KHDDH805 was designed to join two lobes of higher grade. KHDDH805 intercepted broad zone of moderate grade gold with a higher-grade zone at the expected interval (Figure 5). Importantly, the grades encountered were more than double those defined in the new 2023 Mineral Resource.

| Hole ID | Interval (m) | Au (g/t) | Cu (%) | AuEq (g/t) | From (m) |

| KHDDH805 | 153.4 | 0.43 | 0.13 | 0.68 | 41.6 |

| including | 67 | 0.67 | 0.15 | 0.97 | 44 |

| including | 8 | 1.34 | 0.18 | 1.7 | 54 |

| and | 14 | 0.81 | 0.21 | 1.22 | 77 |

Figure 5: Cross section 595400mE through the Golden Eagle deposit.

______________

6 ASX/TSX Announcement - New Gold Zone Discovered at the Golden Eagle

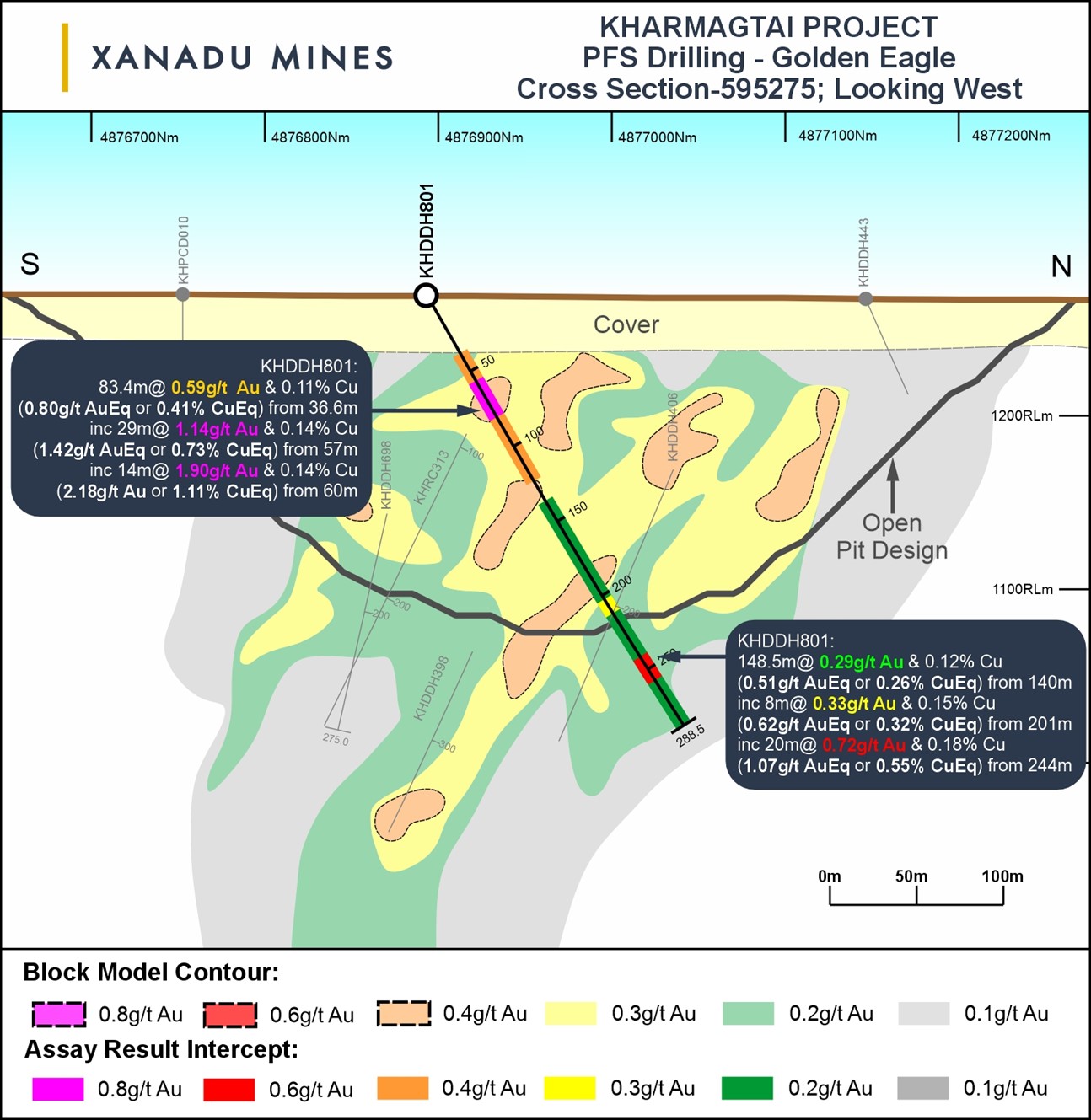

Drill hole KHDDH801 was designed to extend the higher-grade zone and has returned a broad zone of moderate grade gold with a higher-grade zone at the expected interval (Figure 6).

| Hole ID | Interval (m) | Au (g/t) | Cu (%) | AuEq (g/t) | From (m) |

| KHDDH801 | 83.4 | 0.59 | 0.11 | 0.8 | 36.6 |

| including | 29 | 1.14 | 0.14 | 1.42 | 57 |

| including | 14 | 1.9 | 0.14 | 2.18 | 60 |

Figure 6: Cross section 595275mE through the Golden Eagle deposit.

Deep Exploration Drilling Encounters Broad Mineralised Zone

A single deep diamond drill hole was collared between Zaraa and Stockwork Hill, designed to test for a large-scale porphyry deposit. KHDDH779 encountered two broad zones of porphyry and tourmaline breccia style mineralisation between Stockwork Hill and Zaraa (Figure 7). This hole appears to have encountered the edges of a very large-scale Cu-Au System. Additional work is being planned once full interpretations are completed and the BoxScan dataset (vein densities, SWIR, sulphide distribution etc) are incorporated into the broader exploration model.

Figure 7: Cross section drill hole KHDDH779

About Xanadu Mines

Xanadu is an ASX and TSX listed Exploration company operating in Mongolia. We give investors exposure to globally significant, large-scale copper-gold discoveries and low-cost inventory growth. Xanadu maintains a portfolio of exploration projects and remains one of the few junior explorers on the ASX or TSX who jointly control a globally significant copper-gold deposit in our flagship Kharmagtai project. Xanadu is the Operator of a 50-50 JV with Zijin Mining Group in Khuiten Metals Pte Ltd, which controls 76.5% of the Kharmagtai project.

For further information on Xanadu, please visit: www.xanadumines.com or contact:

Colin Moorhead

Executive Chairman & Managing Director

E: colin.moorhead@xanadumines.com

P: +61 2 8280 7497

This Announcement was authorised for release by Xanadu's Board of Directors.

Appendix 1: Drilling Results

Note that true widths will generally be narrower than those reported. See disclosure in JORC explanatory statement attached.

Table 1: Drill hole collar

| Hole ID | Prospect | East | North | RL | Azimuth (°) | Inc (°) | Depth (m) |

| KHDDH684 | Golden Eagle | 595224 | 4876746 | 1270 | 359 | -60 | 341.0 |

| KHDDH685 | Golden Eagle | 595226 | 4876847 | 1269 | 360 | -60 | 325.0 |

| KHDDH700 | Golden Eagle | 595598 | 4876901 | 1269 | 0 | -60 | 267.0 |

| KHDDH701 | Golden Eagle | 595597 | 4877002 | 1268 | 0 | -60 | 220.0 |

| KHDDH703 | Zephyr | 594899 | 4877696 | 1265 | 0 | -60 | 52.7 |

| KHDDH704 | Zephyr | 594900 | 4877796 | 1264 | 0 | -60 | 72.7 |

| KHDDH705 | Zephyr | 595023 | 4877598 | 1265 | 0 | -60 | 100.0 |

| KHDDH706 | Zephyr | 595024 | 4877698 | 1265 | 0 | -60 | 175.0 |

| KHDDH707 | Zephyr | 595146 | 4877446 | 1266 | 0 | -60 | 75.0 |

| KHDDH709 | Zephyr | 595147 | 4877646 | 1265 | 0 | -60 | 100.0 |

| KHDDH710 | Zephyr | 595148 | 4877746 | 1264 | 0 | -60 | 140.0 |

| KHDDH711 | Zephyr | 595274 | 4877399 | 1266 | 0 | -60 | 100.0 |

| KHDDH712 | Zephyr | 595023 | 4877697 | 1265 | 240 | -60 | 150.0 |

| KHDDH713 | Zephyr | 595273 | 4877598 | 1265 | 0 | -60 | 189.4 |

| KHDDH714 | Zephyr | 595274 | 4877697 | 1265 | 0 | -60 | 150.0 |

| KHDDH715 | Zephyr | 595023 | 4877800 | 1264 | 0 | -60 | 125.1 |

| KHDDH716 | Zephyr | 595149 | 4877544 | 1266 | 0 | -60 | 75.0 |

| KHDDH717 | Zephyr | 595275 | 4877498 | 1266 | 0 | -60 | 235.0 |

| KHDDH718 | Zephyr | 595397 | 4877445 | 1267 | 0 | -60 | 125.0 |

| KHDDH719 | Zephyr | 595146 | 4877544 | 1266 | 270 | -55 | 160.0 |

| KHDDH720 | Zephyr | 595399 | 4877750 | 1265 | 0 | -60 | 100.0 |

| KHDDH721 | Zephyr | 595523 | 4877497 | 1266 | 0 | -60 | 400.0 |

| KHDDH722 | Zephyr | 595524 | 4877698 | 1265 | 0 | -60 | 150.0 |

| KHDDH723 | Zephyr | 595649 | 4877663 | 1266 | 0 | -60 | 205.0 |

| KHDDH724 | Zephyr | 595275 | 4877497 | 1266 | 190 | -75 | 190.0 |

| KHDDH725 | Zephyr | 595773 | 4877664 | 1269 | 0 | -60 | 75.0 |

| KHDDH731 | Zephyr | 595394 | 4877512 | 1266 | 170 | -60 | 160.0 |

| KHDDH732 | Zephyr | 595397 | 4877651 | 1266 | 0 | -60 | 200.0 |

| KHDDH736 | Zephyr | 595524 | 4877596 | 1265 | 0 | -60 | 214.0 |

| KHDDH740 | Zephyr | 595525 | 4877797 | 1265 | 0 | -60 | 125.0 |

| KHDDH745 | Zephyr | 595774 | 4877744 | 1270 | 0 | -60 | 100.0 |

| KHDDH752 | Zephyr | 595524 | 4877595 | 1265 | 140 | -75 | 210.0 |

| KHDDH779 | Exploration | 593999 | 4876523 | 1285 | 0 | -70 | 2400.0 |

| KHDDH801 | Golden Eagle | 595277 | 4876894 | 1269 | 0 | -60 | 288.5 |

| KHDDH802 | Golden Eagle | 595332 | 4876839 | 1270 | 0 | -60 | 285.5 |

| KHDDH803 | Golden Eagle | 595401 | 4876841 | 1269 | 0 | -60 | 291.0 |

| KHDDH804 | Golden Eagle | 595328 | 4876942 | 1269 | 0 | -60 | 279.5 |

| KHDDH805 | Golden Eagle | 595399 | 4876919 | 1269 | 0 | -60 | 279.6 |

| KHDDH806 | White Hill | 592393 | 4877472 | 1293 | 180 | -70 | 848.3 |

| KHDDH807 | White Hill | 591788 | 4876469 | 1317 | 0 | -60 | 1212.7 |

| KHDDH808 | White Hill | 591959 | 4876661 | 1310 | 0 | -60 | 1200.0 |

| KHDDH809 | Exploration | 597845 | 4877219 | 1265 | 0 | -70 | 1200.0 |

| KHDDH810 | Altan Shand | 591291 | 4878056 | 1296 | 318 | -60 | 444.6 |

| KHDDH811 | White Hill | 591099 | 4877967 | 1296 | 315 | -60 | 450.8 |

| KHDDH812 | White Hill | 591328 | 4878186 | 1291 | 318 | -60 | 230.0 |

Table 2: Significant drill results

| Hole ID | Prospect | From (m) | To (m) | Interval (m) | Au (g/t) | Cu (%) | CuEq (%) | AuEq (g/t) |

| KHDDH684 | Golden Eagle | 49 | 248 | 199 | 0.15 | 0.09 | 0.17 | 0.34 |

| including | 186 | 220 | 34 | 0.33 | 0.17 | 0.34 | 0.67 | |

| and | 282.5 | 341 | 58.5 | 0.09 | 0.16 | 0.20 | 0.39 | |

| KHDDH685 | Golden Eagle | 34 | 325 | 291 | 0.22 | 0.14 | 0.25 | 0.49 |

| including | 70 | 74 | 4 | 1.26 | 0.14 | 0.78 | 1.53 | |

| including | 124 | 133.6 | 9.6 | 0.18 | 0.16 | 0.25 | 0.50 | |

| including | 144.95 | 240 | 95.05 | 0.35 | 0.16 | 0.34 | 0.66 | |

| KHDDH700 | Golden Eagle | 43.5 | 196 | 152.5 | 0.22 | 0.09 | 0.20 | 0.39 |

| including | 96 | 106 | 10 | 0.35 | 0.14 | 0.32 | 0.63 | |

| including | 168 | 182 | 14 | 0.59 | 0.15 | 0.46 | 0.89 | |

| including | 172 | 176 | 4 | 1.10 | 0.24 | 0.80 | 1.56 | |

| KHDDH701 | Golden Eagle | 40.25 | 123 | 82.75 | 0.16 | 0.09 | 0.18 | 0.34 |

| including | 42 | 46 | 4 | 0.46 | 0.16 | 0.39 | 0.76 | |

| KHDDH703 | Zephyr | 14.75 | 18.8 | 4.05 | 0.33 | 0.00 | 0.17 | 0.34 |

| KHDDH704 | Zephyr | No significant intercepts | ||||||

| KHDDH705 | Zephyr | 14 | 42 | 28 | 0.28 | 0.03 | 0.18 | 0.35 |

| and | 58 | 64 | 6 | 0.40 | 0.05 | 0.25 | 0.50 | |

| and | 78 | 86 | 8 | 0.11 | 0.02 | 0.08 | 0.15 | |

| KHDDH706 | Zephyr | No significant intercepts | ||||||

| KHDDH707 | Zephyr | 23.9 | 74 | 50.1 | 0.19 | 0.04 | 0.14 | 0.27 |

| including | 48 | 64 | 16 | 0.47 | 0.04 | 0.28 | 0.55 | |

| KHDDH708 | Zephyr | 40.3 | 157 | 116.7 | 0.18 | 0.09 | 0.18 | 0.35 |

| including | 52 | 58 | 6 | 0.49 | 0.09 | 0.34 | 0.66 | |

| and | 171 | 187.1 | 16.1 | 0.26 | 0.04 | 0.17 | 0.33 | |

| and | 223 | 227.2 | 4.2 | 0.50 | 0.03 | 0.29 | 0.56 | |

| KHDDH709 | Zephyr | 16 | 20 | 4 | 0.22 | 0.00 | 0.12 | 0.23 |

| and | 51 | 58 | 7 | 0.20 | 0.03 | 0.14 | 0.27 | |

| KHDDH710 | Zephyr | No significant intercepts | ||||||

| KHDDH711 | Zephyr | 32 | 100 | 68 | 0.09 | 0.10 | 0.15 | 0.29 |

| KHDDH712 | Zephyr | 19 | 28 | 9 | 0.14 | 0.02 | 0.09 | 0.17 |

| and | 41.9 | 57.6 | 15.7 | 0.42 | 0.02 | 0.24 | 0.46 | |

| and | 121 | 132 | 11 | 0.05 | 0.05 | 0.07 | 0.14 | |

| KHDDH713 | Zephyr | 18.5 | 56 | 37.5 | 0.25 | 0.08 | 0.20 | 0.40 |

| including | 40 | 48 | 8 | 0.74 | 0.16 | 0.54 | 1.06 | |

| and | 76 | 107.2 | 31.2 | 0.14 | 0.06 | 0.13 | 0.26 | |

| and | 129 | 140.7 | 11.7 | 0.14 | 0.06 | 0.13 | 0.26 | |

| and | 152 | 189.4 | 37.4 | 0.17 | 0.07 | 0.15 | 0.30 | |

| KHDDH714 | Zephyr | 30 | 38 | 8 | 0.19 | 0.02 | 0.12 | 0.23 |

| and | 48 | 52 | 4 | 0.31 | 0.03 | 0.18 | 0.35 | |

| and | 113 | 121 | 8 | 0.27 | 0.01 | 0.15 | 0.29 | |

| and | 135 | 142 | 7 | 0.22 | 0.01 | 0.12 | 0.24 | |

| KHDDH715 | Zephyr | No significant intercepts | ||||||

| KHDDH716 | Zephyr | 15.9 | 75 | 59.1 | 0.09 | 0.10 | 0.14 | 0.28 |

| KHDDH717 | Zephyr | 16.2 | 235 | 218.8 | 0.20 | 0.13 | 0.23 | 0.45 |

| including | 47 | 73 | 26 | 0.46 | 0.24 | 0.47 | 0.93 | |

| including | 138 | 144 | 6 | 0.27 | 0.17 | 0.31 | 0.60 | |

| including | 205 | 223 | 18 | 0.21 | 0.22 | 0.33 | 0.64 | |

| KHDDH718 | Zephyr | 49 | 67 | 18 | 0.25 | 0.04 | 0.16 | 0.32 |

| and | 149 | 153 | 4 | 0.19 | 0.05 | 0.14 | 0.28 | |

| and | 171 | 356 | 185 | 0.21 | 0.12 | 0.22 | 0.44 | |

| including | 211 | 215 | 4 | 0.42 | 0.17 | 0.38 | 0.75 | |

| including | 265 | 276 | 11 | 0.86 | 0.16 | 0.60 | 1.17 | |

| including | 269.5 | 276 | 6.5 | 1.29 | 0.15 | 0.81 | 1.59 | |

| including | 304 | 338 | 34 | 0.33 | 0.20 | 0.37 | 0.72 | |

| KHDDH719 | Zephyr | 45 | 49 | 4 | 0.19 | 0.04 | 0.14 | 0.27 |

| and | 91 | 160 | 69 | 0.13 | 0.07 | 0.13 | 0.26 | |

| KHDDH720 | Zephyr | 38 | 62 | 24 | 0.16 | 0.09 | 0.17 | 0.33 |

| KHDDH721 | Zephyr | 104 | 120 | 16 | 0.16 | 0.05 | 0.13 | 0.25 |

| and | 139.5 | 336.9 | 197.4 | 0.13 | 0.16 | 0.23 | 0.45 | |

| including | 166 | 172 | 6 | 0.10 | 0.30 | 0.35 | 0.68 | |

| including | 193 | 221 | 28 | 0.15 | 0.26 | 0.34 | 0.66 | |

| including | 273 | 311 | 38 | 0.19 | 0.21 | 0.31 | 0.60 | |

| including | 327 | 336 | 9 | 0.24 | 0.17 | 0.29 | 0.57 | |

| and | 347 | 395 | 48 | 0.11 | 0.14 | 0.19 | 0.38 | |

| including | 369 | 389 | 20 | 0.11 | 0.21 | 0.27 | 0.52 | |

| KHDDH722 | Zephyr | 23.2 | 144 | 120.8 | 0.26 | 0.18 | 0.32 | 0.62 |

| including | 23.2 | 87 | 63.8 | 0.44 | 0.25 | 0.47 | 0.93 | |

| including | 25 | 45 | 20 | 0.89 | 0.25 | 0.70 | 1.37 | |

| including | 65 | 76.8 | 11.8 | 0.36 | 0.42 | 0.60 | 1.18 | |

| KHDDH723 | Zephyr | 43 | 246 | 203 | 0.18 | 0.16 | 0.25 | 0.50 |

| including | 83 | 103 | 20 | 0.13 | 0.33 | 0.39 | 0.77 | |

| including | 121 | 129 | 8 | 0.14 | 0.22 | 0.29 | 0.57 | |

| including | 141 | 149 | 8 | 0.31 | 0.30 | 0.45 | 0.89 | |

| including | 163 | 189 | 26 | 0.23 | 0.18 | 0.30 | 0.59 | |

| including | 199 | 219 | 20 | 0.55 | 0.16 | 0.44 | 0.85 | |

| including | 201 | 211 | 10 | 0.89 | 0.16 | 0.62 | 1.21 | |

| including | 232.7 | 242.3 | 9.6 | 0.23 | 0.09 | 0.20 | 0.40 | |

| and | 268 | 272 | 4 | 0.10 | 0.07 | 0.12 | 0.24 | |

| and | 312 | 316 | 4 | 0.16 | 0.05 | 0.13 | 0.25 | |

| KHDDH724 | Zephyr | 13.6 | 118.5 | 104.9 | 0.21 | 0.16 | 0.27 | 0.52 |

| including | 13.6 | 66 | 52.4 | 0.35 | 0.19 | 0.36 | 0.71 | |

| including | 26 | 38 | 12 | 0.31 | 0.34 | 0.50 | 0.97 | |

| and | 165 | 188 | 23 | 0.22 | 0.05 | 0.16 | 0.32 | |

| KHDDH725 | Zephyr | No significant intercepts | ||||||

| KHDDH731 | Zephyr | 59 | 65 | 6 | 0.22 | 0.03 | 0.14 | 0.28 |

| and | 89 | 101 | 12 | 0.22 | 0.03 | 0.14 | 0.27 | |

| KHDDH732 | Zephyr | 21.6 | 62 | 40.4 | 0.10 | 0.12 | 0.17 | 0.34 |

| and | 74 | 200 | 126 | 0.13 | 0.22 | 0.29 | 0.57 | |

| including | 74 | 88 | 14 | 0.23 | 0.20 | 0.32 | 0.63 | |

| including | 98 | 108.2 | 10.2 | 0.23 | 0.25 | 0.37 | 0.72 | |

| including | 119.4 | 171 | 51.6 | 0.12 | 0.29 | 0.35 | 0.69 | |

| KHDDH736 | Zephyr | 48 | 54 | 6 | 0.07 | 0.08 | 0.12 | 0.23 |

| and | 68 | 264 | 196 | 0.25 | 0.12 | 0.25 | 0.48 | |

| including | 128 | 163.8 | 35.8 | 0.33 | 0.17 | 0.34 | 0.67 | |

| including | 184.2 | 211 | 26.8 | 1.00 | 0.16 | 0.68 | 1.32 | |

| including | 184.2 | 188.9 | 4.7 | 1.23 | 0.37 | 1.00 | 1.96 | |

| including | 200 | 209 | 9 | 1.77 | 0.17 | 1.07 | 2.10 | |

| KHDDH740 | Zephyr | 31.2 | 59 | 27.8 | 0.04 | 0.10 | 0.12 | 0.23 |

| KHDDH745 | Zephyr | 38.8 | 104.9 | 66.1 | 0.10 | 0.21 | 0.26 | 0.51 |

| including | 60 | 80 | 20 | 0.13 | 0.27 | 0.33 | 0.65 | |

| and | 171 | 179.2 | 8.2 | 0.16 | 0.06 | 0.15 | 0.29 | |

| and | 242 | 256 | 14 | 0.25 | 0.03 | 0.16 | 0.31 | |

| including | 242 | 252 | 10 | 0.32 | 0.03 | 0.20 | 0.38 | |

| and | 270 | 351 | 81 | 0.14 | 0.09 | 0.17 | 0.33 | |

| including | 270 | 277.3 | 7.3 | 0.53 | 0.07 | 0.34 | 0.66 | |

| including | 293 | 299 | 6 | 0.22 | 0.21 | 0.32 | 0.62 | |

| KHDDH752 | Zephyr | 27.5 | 40 | 12.5 | 0.08 | 0.03 | 0.07 | 0.15 |

| and | 111.1 | 118 | 6.9 | 0.07 | 0.07 | 0.10 | 0.20 | |

| and | 142 | 210 | 68 | 0.08 | 0.19 | 0.23 | 0.45 | |

| including | 156 | 160 | 4 | 0.29 | 0.24 | 0.39 | 0.76 | |

| including | 202 | 208 | 6 | 0.08 | 0.28 | 0.32 | 0.62 | |

| KHDDH779 | Exploration | 66 | 78 | 12 | 0.13 | 0.08 | 0.14 | 0.28 |

| and | 320 | 326 | 6 | 0.35 | 0.13 | 0.31 | 0.60 | |

| and | 499 | 505 | 6 | 0.01 | 0.11 | 0.11 | 0.22 | |

| and | 557 | 577 | 20 | 0.09 | 0.12 | 0.16 | 0.32 | |

| and | 587 | 595 | 8 | 0.02 | 0.11 | 0.12 | 0.23 | |

| and | 611 | 621 | 10 | 0.02 | 0.08 | 0.09 | 0.18 | |

| and | 661 | 673 | 12 | 0.04 | 0.08 | 0.11 | 0.21 | |

| and | 782 | 788 | 6 | 0.06 | 0.07 | 0.10 | 0.19 | |

| and | 810 | 820 | 10 | 0.05 | 0.07 | 0.10 | 0.19 | |

| and | 874 | 1118 | 244 | 0.03 | 0.13 | 0.15 | 0.29 | |

| including | 980 | 984 | 4 | 0.09 | 0.28 | 0.33 | 0.64 | |

| including | 1087 | 1098 | 11 | 0.05 | 0.19 | 0.22 | 0.42 | |

| and | 1132 | 1430 | 298 | 0.07 | 0.13 | 0.17 | 0.33 | |

| including | 1253.65 | 1263 | 9.35 | 0.06 | 0.23 | 0.26 | 0.51 | |

| including | 1362 | 1367 | 5 | 1.11 | 0.32 | 0.89 | 1.73 | |

| and | 1442 | 1486 | 44 | 0.06 | 0.08 | 0.11 | 0.22 | |

| and | 1496 | 1517 | 21 | 0.01 | 0.09 | 0.10 | 0.19 | |

| and | 1577 | 1585 | 8 | 0.16 | 0.15 | 0.23 | 0.44 | |

| and | 1649 | 1658 | 9 | 0.02 | 0.04 | 0.05 | 0.10 | |

| and | 1724 | 1730 | 6 | 0.03 | 0.15 | 0.17 | 0.33 | |

| and | 1756 | 1831 | 75 | 0.07 | 0.08 | 0.11 | 0.22 | |

| and | 1885 | 1930.8 | 45.8 | 0.05 | 0.10 | 0.13 | 0.25 | |

| including | 1925 | 1930.8 | 5.8 | 0.08 | 0.24 | 0.28 | 0.55 | |

| and | 1940 | 2050 | 110 | 0.08 | 0.18 | 0.22 | 0.44 | |

| including | 1996 | 2014.4 | 18.4 | 0.13 | 0.37 | 0.44 | 0.85 | |

| including | 2036 | 2050 | 14 | 0.16 | 0.22 | 0.30 | 0.59 | |

| and | 2068 | 2078.1 | 10.1 | 0.04 | 0.09 | 0.11 | 0.22 | |

| KHDDH799 | Exploration | No significant intercepts | ||||||

| KHDDH800 | Exploration | No significant intercepts | ||||||

| KHDDH801 | Golden Eagle | 36.6 | 120 | 83.4 | 0.59 | 0.11 | 0.41 | 0.80 |

| including | 57 | 86 | 29 | 1.14 | 0.14 | 0.73 | 1.42 | |

| including | 60 | 74 | 14 | 1.90 | 0.14 | 1.11 | 2.18 | |

| including | 106 | 114.2 | 8.2 | 0.46 | 0.12 | 0.35 | 0.69 | |

| and | 140 | 288.5 | 148.5 | 0.29 | 0.12 | 0.26 | 0.51 | |

| including | 201 | 209 | 8 | 0.33 | 0.15 | 0.32 | 0.62 | |

| including | 244 | 264 | 20 | 0.72 | 0.18 | 0.55 | 1.07 | |

| KHDDH802 | Golden Eagle | 35.5 | 285.5 | 250 | 0.37 | 0.12 | 0.31 | 0.60 |

| including | 84 | 180 | 96 | 0.55 | 0.14 | 0.41 | 0.81 | |

| including | 206 | 212 | 6 | 0.41 | 0.11 | 0.32 | 0.63 | |

| including | 232 | 252 | 20 | 0.39 | 0.15 | 0.35 | 0.68 | |

| KHDDH803 | Golden Eagle | 36.8 | 244 | 207.2 | 0.20 | 0.11 | 0.21 | 0.42 |

| including | 88 | 98 | 10 | 0.29 | 0.16 | 0.30 | 0.59 | |

| including | 170 | 200 | 30 | 0.34 | 0.12 | 0.30 | 0.58 | |

| and | 254 | 270.2 | 16.2 | 0.07 | 0.06 | 0.10 | 0.19 | |

| KHDDH804 | Golden Eagle | 38.1 | 88 | 49.9 | 0.40 | 0.10 | 0.30 | 0.59 |

| including | 38.9 | 58.8 | 19.9 | 0.61 | 0.16 | 0.47 | 0.92 | |

| and | 99.25 | 277 | 177.75 | 0.23 | 0.11 | 0.23 | 0.44 | |

| including | 113.8 | 178 | 64.2 | 0.42 | 0.14 | 0.35 | 0.69 | |

| including | 236 | 244.6 | 8.6 | 0.25 | 0.15 | 0.27 | 0.54 | |

| KHDDH805 | Golden Eagle | 41.6 | 195 | 153.4 | 0.43 | 0.13 | 0.35 | 0.68 |

| including | 44 | 111 | 67 | 0.67 | 0.15 | 0.50 | 0.97 | |

| including | 54 | 62 | 8 | 1.34 | 0.18 | 0.87 | 1.70 | |

| including | 54 | 60 | 6 | 1.43 | 0.18 | 0.91 | 1.78 | |

| including | 77 | 91 | 14 | 0.81 | 0.21 | 0.62 | 1.22 | |

| including | 127 | 133 | 6 | 0.37 | 0.15 | 0.34 | 0.66 | |

| and | 267 | 278 | 11 | 0.06 | 0.05 | 0.08 | 0.15 | |

| KHDDH806 | White Hill | 2 | 146 | 144 | 0.06 | 0.13 | 0.16 | 0.32 |

| and | 156 | 443.4 | 287.4 | 0.07 | 0.18 | 0.21 | 0.41 | |

| including | 386 | 443.4 | 57.4 | 0.15 | 0.29 | 0.36 | 0.71 | |

| and | 545 | 595 | 50 | 0.94 | 0.25 | 0.73 | 1.42 | |

| including | 549 | 571 | 22 | 2.10 | 0.26 | 1.34 | 2.62 | |

| and | 779 | 821 | 42 | 0.03 | 0.22 | 0.24 | 0.46 | |

| including | 781 | 790 | 9 | 0.05 | 0.53 | 0.56 | 1.09 | |

| KHDDH807 | White Hill | 295 | 353 | 58 | 0.04 | 0.09 | 0.11 | 0.22 |

| and | 367 | 425 | 58 | 0.04 | 0.12 | 0.14 | 0.27 | |

| including | 381 | 385 | 4 | 0.09 | 0.36 | 0.40 | 0.79 | |

| and | 435 | 994.7 | 559.7 | 0.07 | 0.23 | 0.27 | 0.53 | |

| including | 457 | 477 | 20 | 0.09 | 0.19 | 0.23 | 0.46 | |

| including | 487 | 499 | 12 | 0.11 | 0.31 | 0.36 | 0.71 | |

| including | 512 | 524 | 12 | 0.10 | 0.26 | 0.31 | 0.61 | |

| including | 546 | 555.4 | 9.4 | 0.13 | 0.26 | 0.33 | 0.65 | |

| including | 685 | 712 | 27 | 0.05 | 0.26 | 0.28 | 0.55 | |

| including | 734 | 747 | 13 | 0.08 | 0.33 | 0.37 | 0.72 | |

| including | 761 | 983 | 222 | 0.10 | 0.31 | 0.36 | 0.70 | |

| including | 834 | 838 | 4 | 0.22 | 0.55 | 0.66 | 1.28 | |

| and | 1004 | 1198 | 194 | 0.06 | 0.19 | 0.22 | 0.42 | |

| including | 1034 | 1090 | 56 | 0.10 | 0.25 | 0.30 | 0.59 | |

| including | 1180 | 1184 | 4 | 0.08 | 0.43 | 0.46 | 0.91 | |

| KHDDH808 | White Hill | 238 | 242 | 4 | 0.05 | 0.18 | 0.20 | 0.39 |

| and | 282.5 | 319 | 36.5 | 0.07 | 0.15 | 0.18 | 0.36 | |

| including | 305 | 311 | 6 | 0.09 | 0.32 | 0.36 | 0.70 | |

| and | 333 | 580.45 | 247.45 | 0.11 | 0.29 | 0.35 | 0.68 | |

| including | 341 | 346 | 5 | 0.07 | 0.24 | 0.27 | 0.53 | |

| including | 465 | 500 | 35 | 0.09 | 0.31 | 0.36 | 0.70 | |

| including | 516 | 580.45 | 64.45 | 0.26 | 0.61 | 0.74 | 1.44 | |

| including | 556 | 580.45 | 24.45 | 0.53 | 1.14 | 1.41 | 2.75 | |

| including | 558 | 571.8 | 13.8 | 0.70 | 1.64 | 1.99 | 3.90 | |

| and | 608 | 626 | 18 | 0.19 | 0.05 | 0.14 | 0.28 | |

| including | 620 | 624 | 4 | 0.50 | 0.05 | 0.31 | 0.60 | |

| and | 644 | 652 | 8 | 0.19 | 0.03 | 0.12 | 0.24 | |

| and | 664 | 672 | 8 | 0.10 | 0.15 | 0.20 | 0.39 | |

| and | 750 | 1085 | 335 | 0.08 | 0.25 | 0.30 | 0.58 | |

| including | 751.7 | 891 | 139.3 | 0.12 | 0.38 | 0.44 | 0.86 | |

| including | 786 | 796 | 10 | 0.13 | 0.54 | 0.61 | 1.19 | |

| including | 812 | 818 | 6 | 0.27 | 0.85 | 0.99 | 1.94 | |

| including | 918 | 926 | 8 | 0.08 | 0.26 | 0.30 | 0.59 | |

| including | 958 | 962 | 4 | 0.08 | 0.29 | 0.33 | 0.65 | |

| including | 980 | 989 | 9 | 0.22 | 0.22 | 0.33 | 0.64 | |

| including | 1028.8 | 1035 | 6.2 | 0.12 | 0.50 | 0.56 | 1.10 | |

| and | 1115 | 1127 | 12 | 0.03 | 0.12 | 0.14 | 0.27 | |

| and | 1142 | 1172 | 30 | 0.02 | 0.11 | 0.12 | 0.24 | |

| and | 1182 | 1186 | 4 | 0.02 | 0.13 | 0.14 | 0.27 | |

| KHDDH809 | Exploration | 52.8 | 81 | 28.2 | 0.16 | 0.05 | 0.13 | 0.25 |

| and | 207 | 246 | 39 | 0.13 | 0.09 | 0.15 | 0.30 | |

| including | 209 | 220 | 11 | 0.22 | 0.16 | 0.27 | 0.53 | |

| and | 256 | 265.7 | 9.7 | 0.19 | 0.09 | 0.19 | 0.36 | |

| And | 290 | 295 | 5 | 0.07 | 0.15 | 0.19 | 0.37 | |

| and | 328 | 342 | 14 | 0.05 | 0.05 | 0.07 | 0.14 | |

| Assays pending | ||||||||

| KHDDH810 | Altan Shand | 276.1 | 310 | 33.9 | 0.25 | 0.10 | 0.23 | 0.46 |

| KHDDH811 | White Hill | 164 | 168 | 4 | 0.11 | 0.10 | 0.16 | 0.31 |

| and | 301.63 | 315 | 13.37 | 0.14 | 0.08 | 0.15 | 0.29 | |

| and | 418 | 422 | 4 | 1.81 | 0.09 | 1.02 | 1.99 | |

| KHDDH812 | White Hill | No significant intercepts | ||||||

Appendix 2: Statements and Disclaimers

Competent Person Statement

The information in this announcement that relates to Mineral Resources is based on information compiled by Mr Robert Spiers, who is responsible for the Mineral Resource estimate. Mr Spiers is a full time Principal Geologist employed by Spiers Geological Consultants (SGC) and is a Member of the Australian Institute of Geoscientists. He has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity he is undertaking to qualify as the Qualified Person as defined in the CIM Guidelines and National Instrument 43-101 and as a Competent Person under JORC Code 2012. Mr Spiers consents to the inclusion in the report of the matters based on this information in the form and context in which it appears.

The information in this announcement that relates to exploration results is based on information compiled by Dr Andrew Stewart, who is responsible for the exploration data, comments on exploration target sizes, QA/QC and geological interpretation and information. Dr Stewart, who is an employee of Xanadu and is a Member of the Australasian Institute of Geoscientists, has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity he is undertaking to qualify as the Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting Exploration Results, Mineral Resources and Ore Reserves and the National Instrument 43-101. Dr Stewart consents to the inclusion in the report of the matters based on this information in the form and context in which it appears.

Mineral Resources and Ore Reserves Reporting Requirements

The 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code 2012) sets out minimum standards, recommendations and guidelines for Public Reporting in Australasia of Exploration Results, Mineral Resources and Ore Reserves. The Information contained in this Announcement has been presented in accordance with the JORC Code 2012.

The information in this Announcement relates to the exploration results previously reported in ASX Announcements which are available on the Xanadu website at:

https://www.xanadumines.com/site/investor-centre/asx-announcements

The Company is not aware of any new, material information or data that is not included in those market announcements.

Copper Equivalent Calculations

The copper equivalent (CuEq) calculation represents the total metal value for each metal, multiplied by the conversion factor, summed and expressed in equivalent copper percentage with a metallurgical recovery factor applied.

Copper equivalent (CuEq) grade values were calculated using the formula: CuEq = Cu + Au * 0.60049 * 0.86667.

Where Cu - copper grade (%); Au - gold grade (g/t); 0.60049 - conversion factor (gold to copper); 0.86667 - relative recovery of gold to copper (86.67%).

The copper equivalent formula was based on the following parameters (prices are in USD): Copper price 3.4 $/lb; Gold price 1400 $/oz; Copper recovery 90%; Gold recovery 78%; Relative recovery of gold to copper = 78% / 90% = 86.67%.

Forward-Looking Statements

Certain statements contained in this Announcement, including information as to the future financial or operating performance of Xanadu and its projects may also include statements which are 'forward-looking statements' that may include, amongst other things, statements regarding targets, estimates and assumptions in respect of mineral reserves and mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions. These 'forward-looking statements' are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Xanadu, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward-looking statements.

Xanadu disclaims any intent or obligation to update publicly or release any revisions to any forward-looking statements, whether as a result of new information, future events, circumstances or results or otherwise after the date of this Announcement or to reflect the occurrence of unanticipated events, other than required by the Corporations Act 2001 (Cth) and the Listing Rules of the Australian Securities Exchange (ASX) and Toronto Stock Exchange (TSX). The words 'believe', 'expect', 'anticipate', 'indicate', 'contemplate', 'target', 'plan', 'intends', 'continue', 'budget', 'estimate', 'may', 'will', 'schedule' and similar expressions identify forward-looking statements.

All 'forward-looking statements' made in this Announcement are qualified by the foregoing cautionary statements. Investors are cautioned that 'forward-looking statements' are not guarantee of future performance and accordingly investors are cautioned not to put undue reliance on 'forward-looking statements' due to the inherent uncertainty therein.

For further information please visit the Xanadu Mines' Website at www.xanadumines.com.

Appendix 3: Kharmagtai Table 1 (JORC 2012)

Set out below is Section 1 and Section 2 of Table 1 under the JORC Code, 2012 Edition for the Kharmagtai project. Data provided by Xanadu. This Table 1 updates the JORC Table 1 disclosure dated 8 December 2023.

JORC TABLE 1 - SECTION 1 - SAMPLING TECHNIQUES AND DATA

(Criteria in this section apply to all succeeding sections).

| Criteria | Commentary |

| Sampling techniques |

|

| Drilling techniques |

|

| Drill sample recovery |

|

| Logging |

|

| Sub-sampling techniques and sample preparation |

|

| Quality of assay data and laboratory tests |

|

| Verification of sampling and assaying |

|

| Location of data points |

|

| Data spacing and distribution |

|

| Orientation of data in relation to geological structure |

|

| Sample security |

|

| Audits or reviews |

|

JORC TABLE 1 - SECTION 2 - REPORTING OF EXPLORATION RESULTS

(Criteria in this section apply to all succeeding sections).

| Criteria | Commentary |

| Mineral tenement and land tenure status |

|

| Exploration done by other parties |

|

| Geology |

|

| Drill hole Information |

|

| Data Aggregation methods |

Copper equivalent (CuEq) grade values were calculated using the following formula: CuEq = Cu + Au * 0.62097 * 0.8235, Gold Equivalent (AuEq) grade values were calculated using the following formula: AuEq = Au + Cu / 0.62097 * 0.8235. Where: Cu - copper grade (%) Au - gold grade (g/t) 0.62097 - conversion factor (gold to copper) 0.8235 - relative recovery of gold to copper (82.35%) The copper equivalent formula was based on the following parameters (prices are in USD):

|

| Relationship between mineralisation on widths and intercept lengths |

|

| Diagrams |

|

| Balanced reporting |

|

| Other substantive exploration data |

|

| Further Work |

|

JORC TABLE 1 - SECTION 3 - ESTIMATION AND REPORTING OF MINERAL RESOURCES

Mineral Resources are not reported so this is not applicable to this Announcement. Please refer to the Company's ASX Announcement dated 8 December 2023 for Xanadu's most recent reported Mineral Resource Estimate and applicable Table 1, Section 3.

JORC TABLE 1 - SECTION 4 - ESTIMATION AND REPORTING OF ORE RESERVES

Ore Reserves are not reported so this is not applicable to this Announcement.

| AUSTRALIA c/o Company Matters Pty Limited Level 12, 680 George Street Sydney NSW 2000 T: +612 8280 7497 | MONGOLIA Suite 23, Building 9B Olympic St, Sukhbaatar District Ulaanbaatar, Mongolia T: +967 7012 0211 | Xanadu Mines Ltd ACN 114 249 026 www.xanadumines.com |

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/d0c0d20a-a92b-4ff6-80dd-08499758aa40

https://www.globenewswire.com/NewsRoom/AttachmentNg/e2b8bd8f-647f-4fb7-9245-c52232eb696e

https://www.globenewswire.com/NewsRoom/AttachmentNg/f97eb87c-ab0e-4973-9650-6cb46de6308b

https://www.globenewswire.com/NewsRoom/AttachmentNg/84c8967f-62f7-45a1-ab8a-3995f474071d

https://www.globenewswire.com/NewsRoom/AttachmentNg/e85dfd4d-a546-4c1d-8f88-75510896144b

https://www.globenewswire.com/NewsRoom/AttachmentNg/753a6653-2653-4e7c-9d2d-552c0c2d5ce4

https://www.globenewswire.com/NewsRoom/AttachmentNg/81c8fa69-6222-4e06-b836-f3528c6b94ba