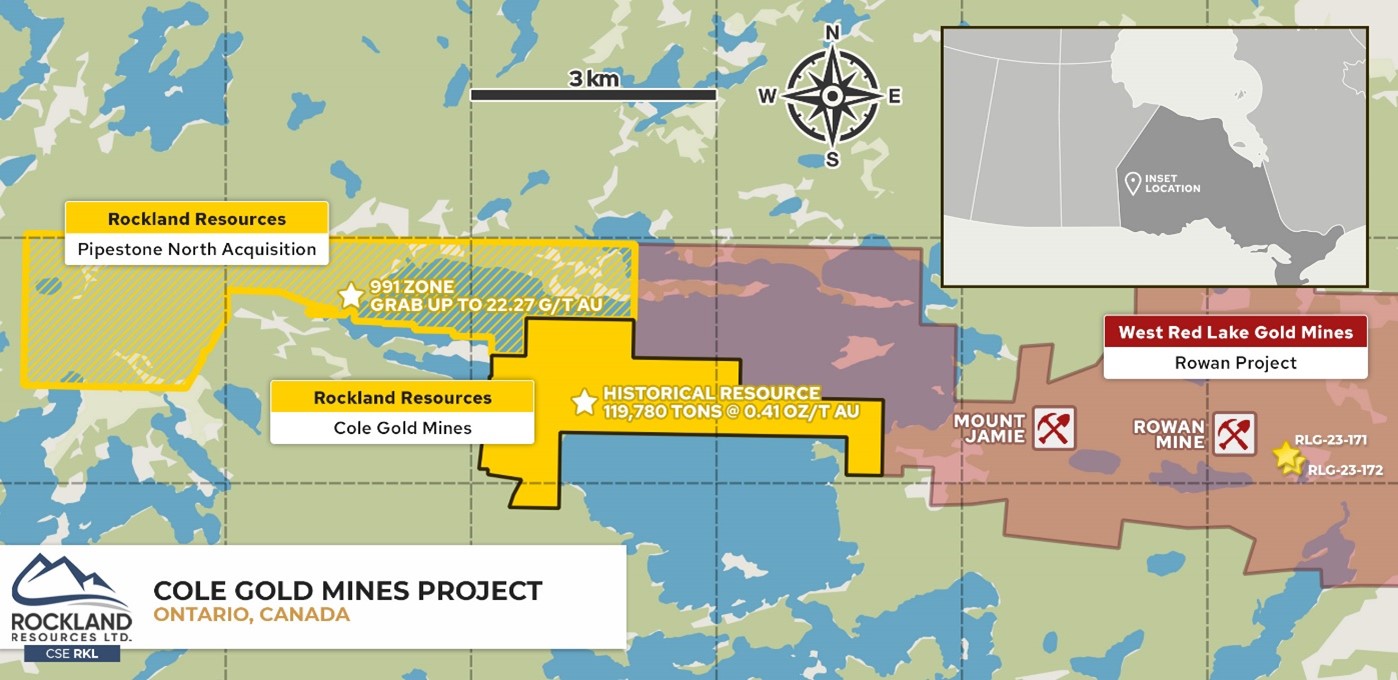

VANCOUVER, BC / ACCESSWIRE / January 31, 2024 / Rockland Resources Ltd. (the "Company" or "Rockland") (CSE:RKL) announces the signing of an option agreement to earn a 100% interest in the "Pipestone North Property" ("PN Property"), located contiguous, and north and northwest, of the Company's 100% owned Cole Gold Mines Property, located in the western portion of the prolific Red Lake gold district of northwestern Ontario.

"Red Lake is known to be one of the most prolific gold camps in the world and we are excited to have expanded our position in the camp." stated Mike England, CEO of Rockland Resources.

Located approximately 32 kilometres (km) west of the town of Red Lake, the 1,015-hectare Pipestone North Property is contiguous on its eastern boundary with West Red Lake Gold Mines Ltd.'s ("WRLG") Rowan property (Mount Jamie portion). The acquisition of the PN Property increases the Company's holdings to 1,583 ha covering approximately 3.0 km strike length of the east-west trending Pipestone Bay St Paul Deformation Zone ("PBDZ"). On West Red Lake Gold Mines' properties to the east, three former gold mines - Rowan Mine, Mount Jamie Mine, and Red Summit Mine - are all situated along the PBDZ structural zone.

*The historical estimates do not meet current standards as defined by NI 43-101 and therefore should not be relied upon.

The Pipestone North property is significantly underexplored compared to many properties and prospects in the Red Lake district, due to limited road access, and the distance from the principal Red Lake gold mines. The most significant recent exploration was completed by Redstar Gold Corp. ("Redstar"), from 2002-2004. Highlights on the Pipestone North property include:

- 991 Zone Occurrence - Located near the center of the PN property, exploration work by Redstar uncovered narrow pyrite, chalcopyrite bearing quartz veins within a brecciated felsic volcanic unit in contact with a folded ultra-mafic horizon. Redstar reported visible gold in several veins with grab samples yielding 22.27 grams per tonne (g/t) Au. In 2004, Redstar drilled a single hole (WRL04-004) that was collared into an ultramafic unit north of the 991 Zone and drilled to the south and intersected a 200-metre-wide zone of strongly quartz and sericite altered felsic stratigraphy with pyrite and chalcopyrite stringer mineralization and anomalous gold values. The zone consists of numerous intersections of copper up to 0.23 percent over 5.5 metres with isolated gold values up to 228 parts per billion. This is the widest zone of anomalous copper mineralization observed on the property, and Redstar reported that previous work indicated a correlation between gold grades and copper mineralization. Redstar also reported that the hole was designed to test stratigraphy and therefore did not test the north to south oriented gold bearing quartz veins previously sampled on surface. Sampling completed on the 991 Zone by GoldON confirmed high-grade gold mineralization with seven grab samples ranging in value from 0.006 g/t Au to 44.9 g/t Au (GoldOn website, grab samples are selected samples and are not necessarily representative of the mineralization hosted on the property). Additional drilling is planned to test these veins, as the 200-metre-wide zone confirms the presence of a large mineralized system.

- Induced Polarization Targets - In March 2003, Redstar completed an IP (Induced Polarization) / resistivity survey over a portion of the Pipestone North Property center over the 991-occurrence area. A total of 6.1-line kilometres were completed and filed as an assessment report; "Two significant zones of high resistivity and anomalous chargeability that extend across the survey grid at an approximate bearing of 080° to 110°. These zones are dominantly high resistivity anomalies, which may be due to silicification or quartz veining. The most significant anomaly extends from about 9550N on line 10500E to about 9450N beneath line 10900E… The zone is coincident with the 991 showing at line 10700E."

- Airborne Magnetic Targets - In 2020 GoldON completed a heliborne high-resolution magnetometer survey, and Orix Geoscience completed a data compilation and reinterpretation study incorporating the magnetometer survey data with all known lithological and mineralogical information and structural measurements. The Orix study is summarized as:

- A wide zone of low magnetic intensity occurs at the contact of mafic/ultramafic units with northern felsic intrusive rocks in the western continuation of the Pipestone Bay/St. Paul Bay Deformation Zone, with possible dextral shearing.

- Two phases of deformation (D1 and D2) have been identified in the surface reinterpretation causing the F1 and F2 folds. Late faults and shear zones dominantly strike north-northwest and north-northeast, crosscut and locally displace the early structures.

- The 991 showing is possibly controlled by an early east-west structure that is likely a second-order structure to the Pipestone Bay/St. Paul Bay deformation zone.

- Other notable mineralization occurs in iron formation units or proximal to fault intersections.

The Company will compile the historical geophysical and geological data over the Pipestone North property in preparation of a summer field program, in association with activities on the Cole Gold Mines property.

To acquire a 100% interest in the Pipestone North property Rockland will pay a cumulative $60,010 cash, issue 1,000,000 shares and spend $1,000,000 over a 4 year period.

Matthew Long, P. Geo., a qualified person under National Instrument 43-101, is the qualified person responsible for reviewing and approving the geological contents of this news release as they pertain to the Cole Gold Mines property.

About Rockland Resources Ltd.

Rockland Resources is engaged in the business of mineral exploration and the acquisition of mineral property assets for the benefit of its shareholders.

On Behalf of the Board of Directors

Michael England, CEO & Director

For further information, please contact:

Mike England

Email: mike@engcom.ca

Neither the Canadian Stock Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS: This news release contains forward-looking statements, which relate to future events or future performance and reflect management's current expectations and assumptions. Such forward-looking statements reflect management's current beliefs and are based on assumptions made by and information currently available to the Company. Investors are cautioned that these forward-looking statements are neither promises nor guarantees and are subject to risks and uncertainties that may cause future results to differ materially from those expected. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances. All of the forward-looking statements made in this press release are qualified by these cautionary statements and by those made in our filings with SEDAR in Canada (available at WWW.SEDAR.COM).

SOURCE: Rockland Resources Ltd.

View the original press release on accesswire.com