Original-Research: Havila Kystruten AS - von Montega AG

Einstufung von Montega AG zu Havila Kystruten AS

Unternehmen: Havila Kystruten AS

ISIN: NO0011045429

Anlass der Studie: Initiation of Coverage

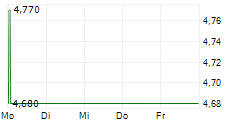

Empfehlung: Buy

seit: 05.02.2024

Kursziel: 2.80 NOK

Kursziel auf Sicht von: 12 Monaten

Letzte Ratingänderung: -

Analyst: Tim Kruse, CFA

Back on course after the perfect storm

Havila Kystruten AS is a cruise line operator from Norway. Founded in 2017, it is the only company besides the incumbent Hurtigruten Group AS mandated by the Norwegian government to serve the 130 year old post ship service from Bergen to Kirkenes. Next to the port-to-port service for locals, their four vessels offer all the amenities and activities of a modern cruise ship tailored for tourists visiting the Norwegian coast.

Shortly after winning the contract and placing a shipbuilding order with two shipyards in 2019, Havila was hit by the perfect storm with one of the shipyards going bankrupt,COVID-19, and their Russian fleet financier GTLK falling under sanctions. This brought the company to the brink of bankruptcy. Consequently, shareholders have had a rough voyage so far with depressed sales and earnings development due to substantially delayed delivery of the ships. Also, the company had to refinance under unfavourable conditions leading to a massive dilution for shareholders and high interest rates.

That said, the market for cruises in general, and the Coastal Express in particular, has seen increasing demand in the past decade, with yearly passenger numbers rising in the high single digits up until 2019. COVID hit the industry severely, but cruises have come back strongly, with passenger numbers set to surpass 2019 levels this year and growth rates expected to be in the mid to high single digits going forward.

The rising popularity of the coastal route, combined with the government's support, has enabled the incumbent, Hurtigruten Group AS, to achieve solid EBITDA margins in excess of 25% for this part of their business. However, due to Havila's brand-new and identical ships, which enable significantly leaner operations, as well as a more consistent and tailored customer experience, we see Havila in an excellent position to outperform its competitor. Additionally, the much better environmental footprint of its fleet not only attracts a more eco-friendly and younger target group, but will also serve as a strong differentiator if emission regulation is imposed for parts of the route as proposed. Due to the high investment backlog of Hurtigruten (average fleet age ~ 30years) in combination with its already crushing leverage (Net debt/EBITDA 9.6), we see Havila well positioned to not only prolong their current contract ending in 2030 but also to win additional capacity from their main rival.

2024 will be the first full year with all ships in operation, which will lead to another jump in revenue of which 50% has already been pre-sold. and a disproportionate increase in EBITDA due to the strong operating leverage exhibited by the cruise line industry. Thereafter, rising occupancy levels from increasing word-of-mouth effects and streamlined operations should further improve margins. Furthermore, the expected refinancing closer to industry spreads will be an additional driver for FCF development.

Conclusions: The disadvantageous news flow Havila had to endure so far has led to a significant mispricing of Havila's shares with a discount of 75% to our estimate of fair value indicated by all valuation models (DCF scenarios, peer group, net asset value). However, the ramp-up in operations will not only lead to a strong uptake in free cashflow, but should also pave the way for a more favourable refinancing, which should be the main catalysts for a re-rating. We therefore see current levels as a unique opportunity to invest in a profitable niche market safeguarded by monopolistic revenuestreams and initiate with a 'Buy' rating and a price target of 2.80 NOK per share.

+++ Diese Meldung ist keine Anlageberatung oder Aufforderung zum Abschluss bestimmter Börsengeschäfte. Bitte lesen Sie unseren RISIKOHINWEIS / HAFTUNGSAUSSCHLUSS unter http://www.montega.de +++

Über Montega:

Die Montega AG ist eines der führenden bankenunabhängigen Researchhäuser mit klarem Fokus auf den deutschen Mittelstand. Das Coverage-Universum umfasst Titel aus dem MDAX, TecDAX, SDAX sowie ausgewählte Nebenwerte und wird durch erfolgreiches Stock-Picking stetig erweitert. Montega versteht sich als ausgelagerter Researchanbieter für institutionelle Investoren und fokussiert sich auf die Erstellung von Research-Publikationen sowie die Veranstaltung von Roadshows, Fieldtrips und Konferenzen. Zu den Kunden zählen langfristig orientierte Value-Investoren, Vermögensverwalter und Family Offices primär aus Deutschland, der Schweiz und Luxemburg. Die Analysten von Montega zeichnen sich dabei durch exzellente Kontakte zum Top-Management, profunde Marktkenntnisse und langjährige Erfahrung in der Analyse von deutschen Small- und MidCap-Unternehmen aus.

Die vollständige Analyse können Sie hier downloaden:

http://www.more-ir.de/d/28815.pdf

Kontakt für Rückfragen

Montega AG - Equity Research

Tel.: +49 (0)40 41111 37-80

Web: www.montega.de

E-Mail: research@montega.de

LinkedIn: https://www.linkedin.com/company/montega-ag

übermittelt durch die EQS Group AG.

Für den Inhalt der Mitteilung bzw. Research ist alleine der Herausgeber bzw. Ersteller der Studie verantwortlich. Diese Meldung ist keine Anlageberatung oder Aufforderung zum Abschluss bestimmter Börsengeschäfte.

°