HIGHLIGHTS

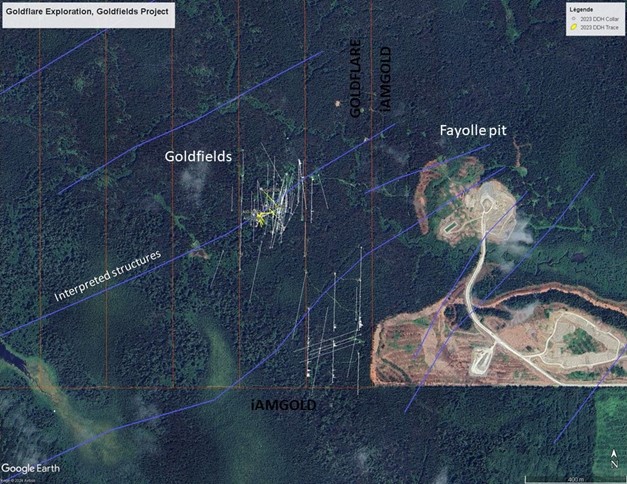

- Goldflare completes a 9-holes short drill program (934 metres) on the Goldfields Zone, 700 metres west of Iamgold's Fayolle mining pit.

- Best result: 1.3 g/t gold over 22.8 metres including a higher-grade interval of 5.8 g/t gold over 2.4m in hole AIG-23-26.

- Drilling confirmed extension over 100 metres along strike, open at depth, leading to resume work in the coming weeks. Field observations demonstrated similarities between the geology interpreted at Goldfield and the Fayolle deposit.

PIEDMONT, QC / ACCESSWIRE / February 6, 2024 / Goldflare Exploration inc. (TSXV:GOFL) ("Goldflare" or "the Company") is pleased to announce new gold results on the Goldfields property which successfully complete the 2023 program. Drill hole AIG-23-26 intersected a continuous interval of mineralization over 22.8 meters at a grade of 1.3 grams of gold per tonne, including a higher-grade interval of 5.83 grams of gold per tonne over 2.4 meters.

The Goldfields property is adjacent to Iamgold's Fayolle pit operation. A total of nine (9) holes for a total of 934 metres were completed with this program. Seven of the nine drill holes intersected the mineralized zone with grades ranging from 0.7 to 1.7 grams per tonne of gold over core lengths ranging from 4.8 metres to 22.8m for an average width of 12.7m.

The drilled area is located 700 metres from the Fayolle deposit. The drill results support the model and approach developed by the company to define a mineralized zone in the vicinity of the Fayolle pit.

The Goldlfields mineralization is in the Porcupine-Destor structural break, hosted in syenite and lamprophyre intrusions. At Goldfields, north-east cross-fractures zones were identified in relation with gold bearing fractured intrusions carrying minor amount of pyrite, magnetite, and chalcopyrite.

Drill results

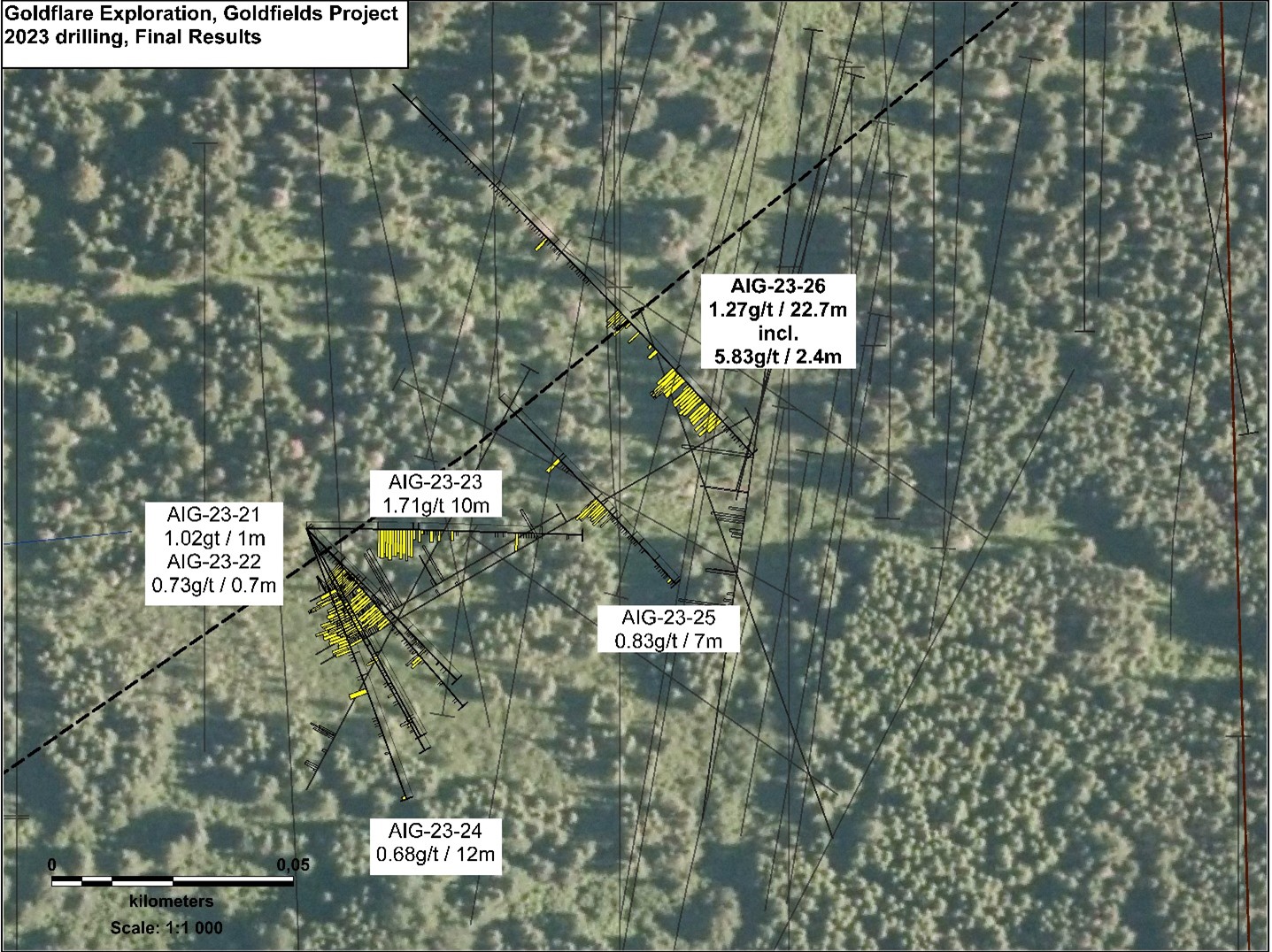

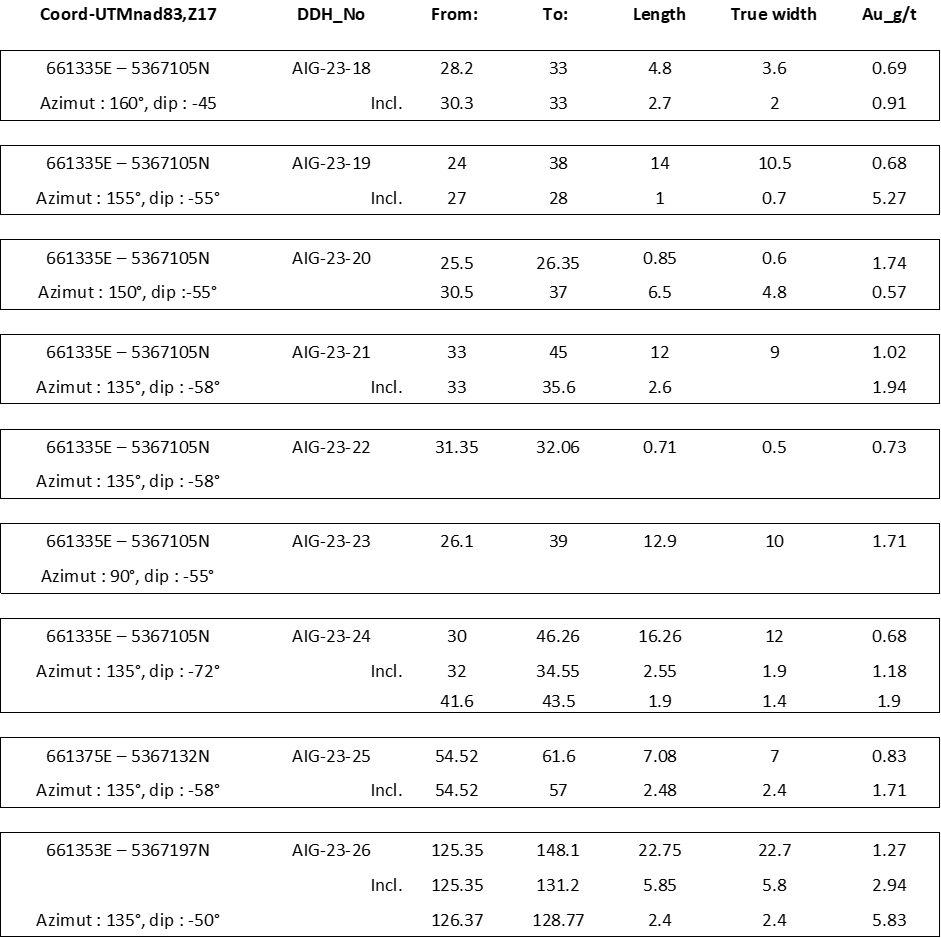

The results of the last six drilled holes are communicated following the last Goldflare press release of November 11, 2023 are as follow:

- Four holes were drilled from the same base as previously released holes AIG-23-18, AIG-23-19 and AIG-23-20 using southeast to east-west orientations with different dips. The objective was to intercept northeast-trending mineralized structures based on interpretation. Holes AIG-23-21, AIG-23-23 and AIG-23-24 returned mineralized intervals of 1.0 g/t over 12m, 1.7 g/t over 12.9m and 0.7 g/t over 16.3m, respectively, while hole AIG-23-22 returned an isolated result of 0.7 g/t over 0-.7m. The mineralized zone was intercepted close to the bedrock contact.

- Hole AIG-23-25 returned 0.8 g/t over 7.1 metres, including 1.7 g/t over 2.5 metres. The mineralized interval was obtained approximately 25 metres below bedrock surface.

- Hole AIG-23-26 crossed cut an altered and intensely fractured syenite sequence that averaged 1.3 g/t over 22.8 metres length. The vertical depth of interception varies between 60 and 80 meters. A higher-grade interval of 5.8 g/t over of 2.4 meters length was obtained close to the upper contact, associated with more intense pyritization.

The interpretation of the mineralized structure shows a general northeasterly orientation, which was confirmed laterally by drilling for approximately 100 metres. The dip variation interpreted is between 65° and 75° to the northwest while the interpreted true thickness shows variations between 3.5 and 22 meters.

Gold values obtained are hosted in altered lamprophyre and syenite intrusions in fault contact between sheared ultramafic volcanic rocks and basalts. The mineralization takes the form of free gold trapped in a network of quartz joints and veinlets. The volume of sulphides (pyrite, chalcopyrite) is minor, and magnetite can be observed in association. These observations are consistent with the geology of the Fayolle deposit as documented in an extensive literature of assessment report and based on experience as previous manager of the Fayolle property.

Model

Geological modelling based on 86 historical holes indicates a general orientation of the northeast mineralized structure. Drilling planned for winter 2024 is expected to define the mineralized contour at an average depth of 100 metres, and then continue to drill to depth. The distribution of the historical drilling allows for the extrapolation of both lateral extensions and vertical continuities below 200 metres vertically.

President and CEO Ghislain Morin says: ' With these results, we have reached a new milestone. The Goldfields mineralization was discovered by previous operators, and we followed by a series of shallow holes that will be used to define a zone. Thus, the lateral and depth extension will be tested. We are confident that the model developed internally will lead to the identification of other gold target along north-east cross fractures in the Company's claims. '

Results table (Table 1)

**The true width is based on the geological interpretation.

QAQC

Drill positions were recorded by a handheld Garmin GPS. A Reflex EZ-TRAC instrument was used to route boreholes. Examination, description, and sampling are carried out on the property. The samples were delivered to Laboratoire Expert Inc. in Rouyn-Noranda for assaying.

The mineralized zone was assayed using 100 mesh metallic sieve. Fractions smaller and larger than 100 meshes are analyzed separately by fire assay with gravimetric finish. The result is a weighted average of the two fractions. Mineralization walls were analysed by standard 30 grams fire assay with atomic absorption spectrometry (AAS) finish.

Blank samples, certified standards, preparation duplicates, and sample duplicates are inserted into the sampling.

The technical information contained in this press release has been reviewed by Martin Demers, P.Geo. (OGQ No. 770), consultant for Goldflare Exploration and Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

For more information:

| Ghislain Morin CEO 819-354-9439 ghislainmorin@goldflare.ca | Serge Roy Chairman of the Board 819-856-8435 sergeroy@goldflare.ca |

SOURCE: Goldflare Exploration Inc.

View the original press release on accesswire.com