COLORADO SPRINGS, CO / ACCESSWIRE / February 7, 2024 / Fortitude Gold (OTCQB:FTCO) (the "Company") today announced it has acquired 100% interest in two separate gold properties within Nevada's Walker Lane Mineral Belt. The first being the Dauntless gold property, which includes the historic Weepah gold mine, located in Esmeralda County, Nevada, approximately 30 kilometers southwest of Tonopah, Nevada. The second being the Intrepid claim package, located in Mineral County, Nevada, approximately 10 kilometers northwest of Mina, Nevada. Fortitude Gold is a gold producer, developer, and explorer with operations in Nevada, U.S.A. offering investors exposure to both gold production and dividend yield.

The Dauntless claim package was purchased from Nevada Select Royalty Inc, a wholly owned subsidiary of Gold Royalty Corp. The approximate 2,105-acre land package has seen historic high-grade gold production from both open pit and underground workings with undeveloped drill intercepts including 16 meters of 3.36 grams per tonne (g/t) gold. Fortitude Gold staked 129 additional unpatented claims around the property to strengthen the land position and exploration potential.

Dauntless acquisition highlights include:

- 100% ownership

- Historic gold production grade estimated at 3.1 grams per tonne (g/t) gold (Sunshine Mining Company)

- Open pit heap leach project potential

- Surface and near surface gold drill intercepts*

- Historic drill intercepts include 38.1 meters of 1.18 g/t gold from surface*

- Historic drill intercept over 16 meters of 3.36 g/t gold ~70 meters deep*

- Rock chip samples up to 60 g/t gold*

- Proximity to Company's producing Isabella Pearl mine (~100 kilometers)

- Potential equipment and processing facility synergies with Company's Isabella Pearl project

- 105 unpatented lode mining claims; 1 patented mining claim

- 129 additional claims staked surrounding property

- 4,680 acres total acquired and staked high-grade gold exploration property

- Mining friendly jurisdiction, Nevada, U.S.A.

*Third party drill intercepts and rock chip samples

The Company purchased 100% interest in the Dauntless claim package for total consideration of US$725,000. Nevada Select Royalty Inc retained a maximum net smelter return royalty (NSR) of 3% on future production from the property claims.

The property warranted acquisition for reasons including surface and near surface high-grade gold, historic high-grade gold production, exploration potential, and its location in the Walker Lane Mineral Belt within trucking distance to the Company's Isabella Pearl gold processing facility. Historic mining records indicate during the mid-1980's a small portion of the claims were mined by Sunshine Mining Company who reported 60,000 ounces of gold mined at an average grade of 3.1 grams per tonne (g/t) and a 1:1 strip ratio. Low historic metal prices closed the mine though it was estimated more mineralization remained.

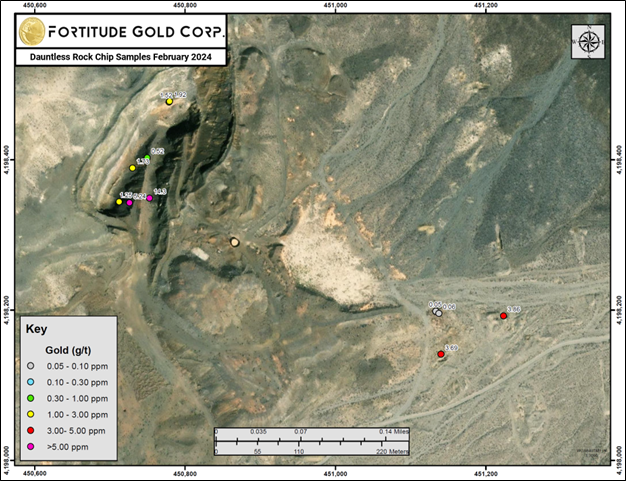

Gold mineralization at Dauntless is believed to occur within two broad shear zones. The western shear zone hosts all historic production with a small open pit and adjacent underground workings, while the eastern shear zone was exploited by modest exploratory workings. Both shear zones have been traced for hundreds of meters along strike and down dip and appear to be open to the south. The Company's rock check samples confirmed widespread surface gold grades as high as 14 grams per tonne (g/t) gold (see map below).

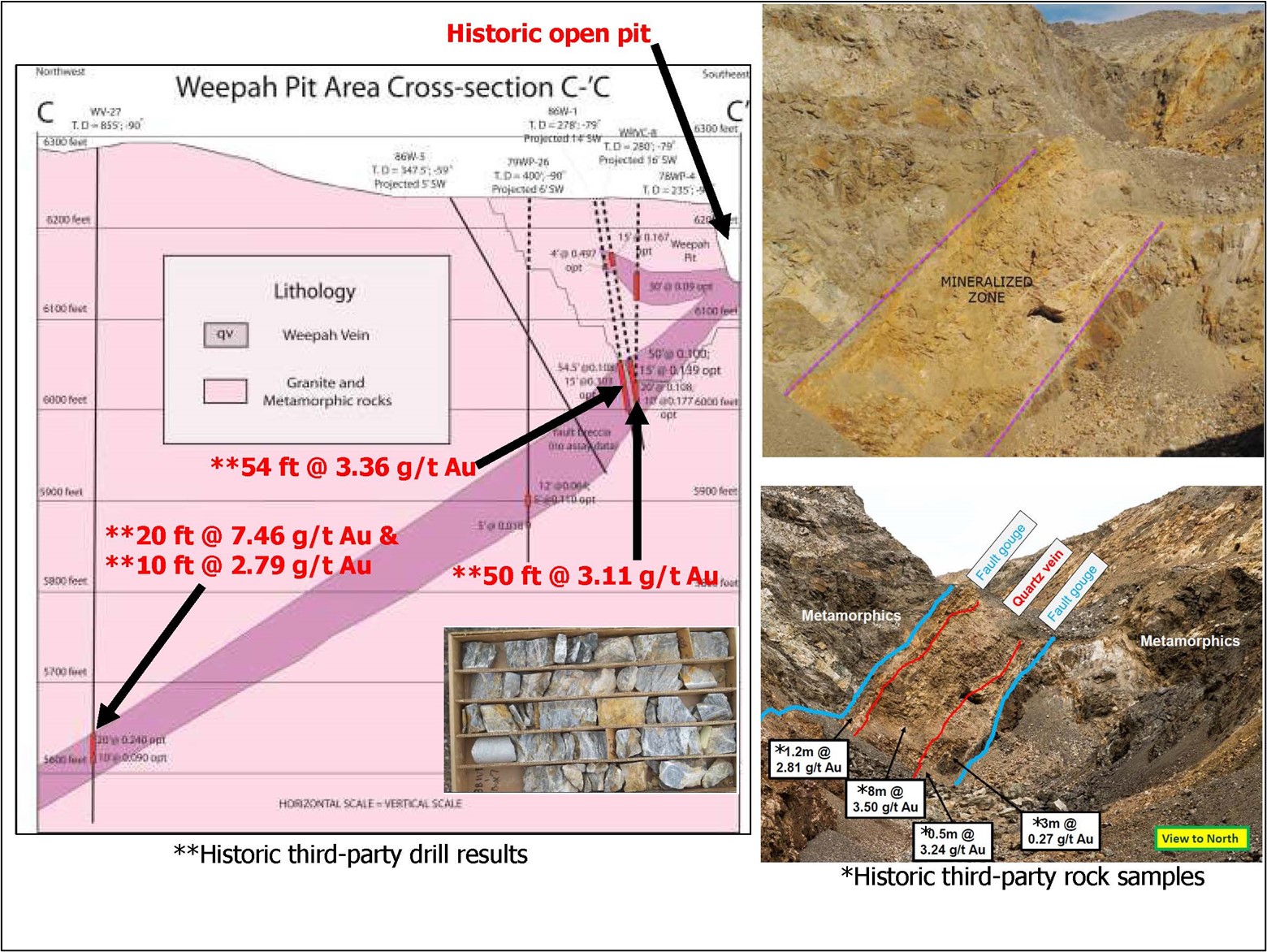

Mineralization reported by third parties, including drill results upwards of 16.5 meters (54 feet) of 3.36 g/t gold, as a potential extension to the historic open pit warrant additional exploration to confirm, expand, and identify mineralized potential remaining. Zones sampled in the pit, coupled with historic third-party drilling, indicate high-grade gold continuity in at least one dominate mineralized structure.

Historic third-party drill highlights include (m=meters, g/t=grams per tonne) (see cross section below):

- 16.5 m (54 feet) of 3.36 g/t gold

- 15.2 m (50 feet) of 3.11 g/t gold

- 6.1 m (20 feet) of 7.46 g/t gold

- 3.0 m (10 feet) of 2.79 g/t gold

Intrepid acquisition highlights include:

- 100% ownership

- Rock chip samples up to 2.55 g/t gold

- Proximity to Company's producing Isabella Pearl mine (24 kilometers)

- Potential equipment and processing facility synergies with Company's Isabella Pearl project

- 157 unpatented lode mining claims

- Mining friendly jurisdiction, Nevada, U.S.A.

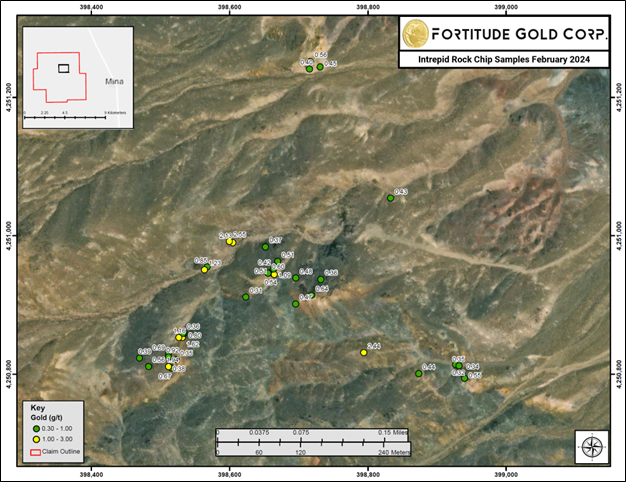

The Company acquired 100% interest in Intrepid and a larger claim package by staking claims and issuing a maximum NSR of 3% to an individual on future production. No cash payment was made to the claim holder in association with the Intrepid acquisition. Gold mineralization at the property is hosted by silicified volcanics and sediments. A Notice of Intent to drill Intrepid has been submitted to the Bureau of Land Management.

Rock chip samples include:

- 2.55 g/t gold

- 2.44 g/t gold

- 2.13 g/t gold

"These two exciting acquisitions checks all the boxes for us including the presence of high-grade surface and near surface gold, substantial exploration potential on both brownfield and greenfield exploration targets, and their proximity to our Isabella Pearl facility for potential synergistic future ore feed and processing," stated Mr. Jason Reid, CEO and President of Fortitude Gold. "It is very positive that the historic Weepah mine, now located on the larger Dauntless property, extracted high-grade gold back in the nineteen eighties and fortunately for us, the pressure of low market metal prices forced them to walk away from high-grade mineralization in both the bottom and potential expansion of the historic pit."

Mr. Reid continued, "These properties fit well into our portfolio of now eight high-grade gold properties in Nevada, seven of which are strategically located in the Walker Lane Mineral Belt. Our near-term initial objective for the Dauntless includes drilling the mineralized structure to evaluate open pit expansion potential, as well as vector in on additional high-grade targets that have yet to be drilled. While we need to first confirm the historic third-party drill intercepts, twenty feet of over seven grams per tonne gold and fifty feet of over three grams per tonne gold is very exciting and warrants a drill campaign to test, confirm, and expand on this potential high-grade mineralization. Intrepid' s high-grade gold rock chip samples and proximity to our Isabella Pearl process facilities warranted acquisition as well. We are very excited to add these prospective properties to our growing Nevada land portfolio, all eight of which have surface and near surface high-grade gold."

About Fortitude Gold Corp.:

Fortitude Gold is a U.S. based gold producer targeting projects with low operating costs, high margins, and strong returns on capital. The Company's strategy is to grow organically, remain debt-free and distribute substantial dividends. The Company's Nevada Mining Unit consists of five high-grade gold properties located in the Walker Lane Mineral Belt and a sixth high-grade gold property in west central Nevada. The Isabella Pearl gold mine, located on the Isabella Pearl mineralized trend, is currently in production. Nevada, U.S.A. is among the world's premier mining friendly jurisdictions.

Cautionary Statements: This press release contains forward-looking statements that involve risks and uncertainties. If you are risk-averse you should NOT buy shares in Fortitude Gold Corp. The statements contained in this press release that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. When used in this press release, the words "plan", "target", "anticipate," "believe," "estimate," "intend" and "expect" and similar expressions are intended to identify such forward-looking statements. Such forward-looking statements include, without limitation, the statements regarding the Company's strategy, future plans for production, future expenses and costs, future liquidity and capital resources, and estimates of mineralized material are forward-looking statements. All forward-looking statements in this press release are based upon information available to the Company on the date of this press release, and the Company assumes no obligation to update any such forward-looking statements. Forward looking statements involve a number of risks and uncertainties, and there can be no assurance that such statements will prove to be accurate. The Company's actual results could differ materially from those discussed in this press release.

Contact:

Greg Patterson

719-717-9825

greg.patterson@fortitudegold.com

www.Fortitudegold.com

SOURCE: Fortitude Gold Corporation

View the original press release on accesswire.com