8 February 2024

Ad hoc announcement pursuant to Article 53 of SIX Exchange Regulation Listing Rules

ONE swiss bank SA

H2 and full-year 2023 financial results

2023 highlights

Grégoire Pennone, CEO, ONE swiss bank

2023 was another successful year for ONE swiss bank SA, brimming with achievements and culminating in healthy financial results. Our restructuring efforts in 2022 laid the groundwork for robust organic growth last year, and for the first time in a decade there were no M&A transactions. Organic growth in 2023 also reflected a collective effort. Among the many positive financial outcomes, we can highlight payment of an ordinary dividend of CHF 0.15 in April and a special dividend of CHF 0.23 per share in November. Last but not least, we undertook the required steps to delist from SIX Swiss Exchange. The last trading day will be 6 March 2024.

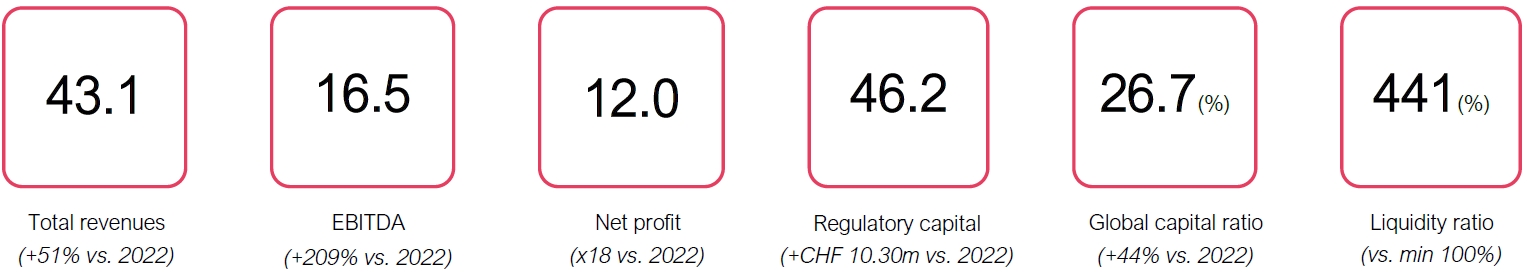

Earnings before interest, taxes, depreciation and amortisation (EBITDA) increased by 209% in the full year to CHF 16.5 million. Our cost/income ratio, excluding depreciation and amortisation, improved in a similar manner, decreasing by 24 percentage points to 61.7% in comparison with 2022. Net profit was CHF 12 million after taxes, depreciation and amortisation of CHF 4.5 million, most of which was goodwill.

Correspondingly, earnings per share (EPS) improved to CHF 0.77. As a consequence, our regulatory capital strengthened by CHF 10.4 million to CHF 46.2 million, with a comfortable global capital ratio of 26.7%, up from 18.5% in 2022.

Clients assets (AuM) grew by 12% to CHF 5.078 billion. Net new money was positive across our three business lines.

On a different note, we're pleased to report that we've continued to expand our sustainability efforts by hiring a dedicated Sustainability Officer. I'm also thrilled to announce the upcoming publication of our second Sustainability Report, with reference to the GRI Standards, alongside our 2023 Annual Report.

Having laid the foundations for our responsible investment strategy, we're confident that the steady integration of ESG analysis into our investment processes will align our commitment to delivering strong financial returns with the social and environmental values that we hold dear. It's a key goal not only for our investment team but also for our institutional and private clients.

On a less positive level, our operations in the Middle East, through our subsidiary in Dubai, did not grow as we had forecasted owing to the challenging and highly competitive business conditions in this market. We will nonetheless continue our efforts to expand our business in the region. We have also put on hold a project to develop our credit offering, preferring to maintain the liquidity level of our balance sheet.

Last year we also celebrated the grand opening of our new Geneva headquarters in the presence of two State Councillors. Having our base in this centrally located building will strengthen our footprint in Geneva and lay the foundation for strong and steady growth.

We're looking forward to continuing our efforts in 2024 and seizing new opportunities, particularly in institutional mandates. We believe that Swiss pension funds need a local, niche and independent approach, and this is what marks us out from the industry majors.

2023 financial highlights (CHF million)

2023 key financials

| Reported results (in CHF unless otherwise specified) True and fair view principle | H1 2023 | | H2 2023 | | FY2023 | | FY2022 | ? FY | |

| Income statement | |||||||||

| Revenues | |||||||||

| Net result from interest operations | 10'886'729 | 10'874'710 | 21'761'439 | 10'610'703 | 105% | ||||

| Result from commission business and services | 8'825'940 | 9'497'752 | 18'323'692 | 16'937'089 | 8% | ||||

| Result from trading activities and the fair value option | -385'048 | 141'045 | -244'003 | 2'005'648 | |||||

| Result from ordinary activities | 1'399'381 | 1'877'814 | 3'277'195 | -906'917 | |||||

| Total revenues | 20'727'002 | 22'391'321 | 43'118'323 | 28'646'523 | 51% | ||||

| Operating expenses | -12'718'031 | -13'891'969 | -26'610'000 | -23'301'353 | 14% | ||||

| Operating result (EBITDA) | 8'008'971 | 8'499'352 | 16'508'323 | 5'345'170 | 209% | ||||

| EBITDA margin | 38.6% | 38.0% | 38,3% | 18.7% | |||||

| Cost/income ratio (%) | 61.4% | 62.0% | 61.7% | 81.3% | -24% | ||||

| Depreciation, amortisation, extraordinary items & taxes (A) | -2'198'175 | -2'306'894 | -4'505'069 | -4'687'294 | -4% | ||||

| Net profit / (loss) | 5'810'796 | 6'192'458 | 12'003'254 | 657'876 | 1725% | ||||

| Earnings per share | 0.38 | 0.40 | 0.77 | 0.04 | |||||

| Balance sheet | |||||||||

| Total assets | 569'805'305 | 525'448'973 | 525'448'973 | 682'232'375 | -23% | ||||

| Total liabilities | 522'017'098 | 475'898'339 | 475'898'339 | 637'854'023 | -25% | ||||

| Total equity | 47'788'207 | 49'550'634 | 49'550'634 | 44'378'352 | 12% | ||||

| Regulatory ratio | |||||||||

| CET1 ratio (%) | 21.1% | 25.8% | 25.8% | 17.7% | 46% | ||||

| Global capital ratio (%) | 22.0% | 26.7% | 26.7% | 18.5% | 44% | ||||

| Regulatory capital (CHF thousands) | 41'145 | 46'228 | 46'228 | 35'848 | 29% | ||||

| Liquidity coverage ratio (LCR) (Q average %) | 380% | 441% | 414% | 354% | 25% | ||||

| Clients assets (AuM) - (CHF million) | 5'047 | 5'078 | 5'078 | 4'514 | 12% | ||||

(A): Including goodwill amortisation resulting from the merger of Banque Profil de Gestion SA and One Swiss Bank SA completed on 1 June 2021.

Net profit of CHF 12.0 million in 2023 resulting from:

- An 8% increase in income from commission business and services, following a rise in clients assets (AuM: +CHF 564 million),

- A 51% increase in revenue to CHF 43.1 million (vs. CHF 28.6 million in 2022) mainly due to higher income from interest operations and treasury management (positively impacted by interest rates), despite the strength of the Swiss Franc relative to major currencies (reflected in fair value option line).

- Positive inflows (NNM) across all business lines: Wealth Management (+423 million), Asset Management (+79 million) and Asset Services (+135 million).

- A 14% increase in operating expenses due to personal costs (CHF 17.9 million vs. CHF 13.9 million in 2022, including an additional employer contribution of CHF 0.5 million into the pension plan), offset by a decrease in general and administrative expenses (CHF 8.7 million vs. CHF 9.3 million in 2022).

- A positive trend in the cost/income ratio throughout 2023, which improved to 61.7% in 2023 (vs. 81.3% in 2022).

- A strong operating profit (EBITDA) of CHF 16.5 million, largely covering taxes, depreciation and amortisation of CHF 4.5 million, of which CHF 3.8 million were related to goodwill amortisation.

A healthy balance sheet with:

- Equity of CHF 49.6 million, up 12% relative to end-2022.

- A 25% decrease in liabilities to CHF 476 million (vs. CHF 638 million at end-2022), mainly arising from a drop in cash deposits as a consequence of clients' investing activities - including fiduciary deposits.

Sound regulatory ratios with:

- A global capital ratio of 26.7% (vs 18.5% end-2022), reflecting a 29% increase in regulatory capital to CHF 46.2 million at end-2023 (vs. a minimum requirement of CHF 30 million).

- A liquidity coverage ratio (LCR) of 441% versus a minimum requirement of 100%.

6-to-12 month outlook

2023 Annual Report

The 2023 Annual Report will be published at 7am) under Investor Relations.

2024 Annual General Meeting

The invitation and the agenda for our 2024 Annual General Meeting, to be held on 30 April 2024, will be published at 7am) under Investor Relations.

- END -

For further information, please contact:

Julien Delécraz, Investor Relations

+41 58 300 78 13 / investorrelations@oneswiss.com

ONE swiss bank SA

Attachment

- 20240208-ONE-H2-FY2023-results-media-release-en (https://ml-eu.globenewswire.com/Resource/Download/ffe6aeaf-9a45-4a3f-8393-e77b12b75fcc)