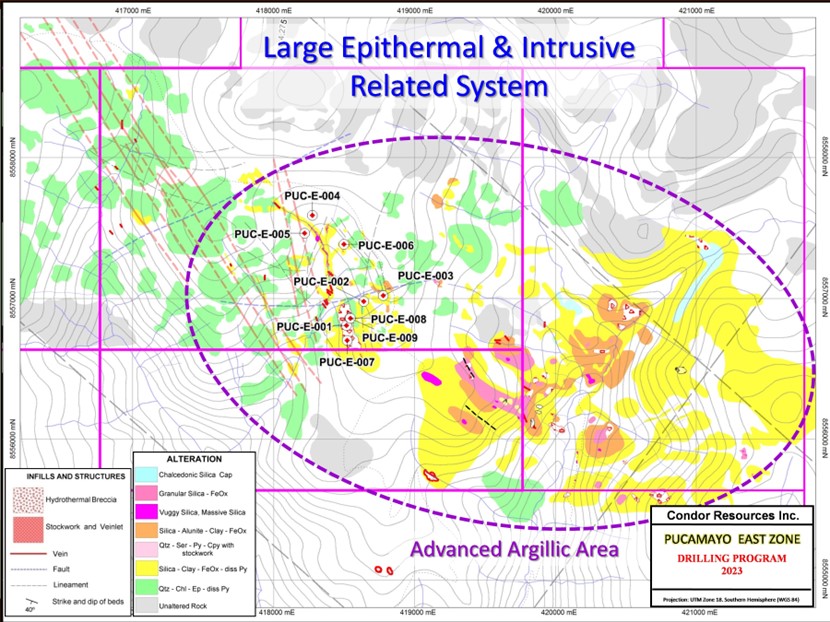

VANCOUVER, BC / ACCESSWIRE / February 13, 2024 / Condor Resources Inc. - ("Condor" or the "Company") (TSXV:CN) is pleased to announce encouraging assay results from the maiden diamond drill program that concluded in December at the Pucamayo East project in Peru. A total of 2,353m was drilled in nine diamond drillholes, testing a 600m by 900m (0.54 sq km) area of the four square kilometer advanced argillic alteration zone exposed on the Pucamayo property. (Figure 1)

Highlights of mineralized intercepts include:

- 0.83 g/t AuEq over 72.5m including a sub-interval of 18.96 g/t AuEq over 2.0m in hole PUC-E005,

- 1.11 g/t AuEq over 11.8m and a second interval of 0.53 g/t AuEq over 52.2m in hole PUC-E-001,

- 0.63 g/t AuEq over 10.3m in hole PUC-E-004,

- 1.42 g/t AuEq over 2.0m and a second interval of 8.26 g/t AuEq over 2.0m in hole PUC-E-006,

- 1.62 g/t AuEq over 3.8m in hole PUC-E-007,

- 1.06 g/t AuEq over 20m in hole PUC-E-008, and

- 0.44 g/t AuEq over 32.8m in hole PUC-E-009.

A table detailing significant results is presented below.

SUMMARY OF DIAMOND DRILL RESULTS FROM PUCAMAYO EAST

Drillhole | AZ | DIP | DEPTH | *Interval | length | Au | Ag | Cu | Pb | Zn | **AuEq | |

from | to | m | g/t | g/t | % | % | % | g/t | ||||

PUC-E-001 | 20° | 75° | 393.0m | 4.5 45.3 110.5 | 16.3 97.5 118.5 | 11.8 52.2 8.0 | 0.22 0.20 0.26 | 33.0 19.8 9.0 | 0.19 - - | 0.32 0.19 0.12 | 0.47 0.15 - | 1.11 .53 .30 |

PUC-E-002 | 70° | 70° | 288.0m | no significant results | ||||||||

PUC-E-003 | 60° | 75° | 119.0m | no significant results | ||||||||

PUC-E-004 | 150° | 60° | 442.0m | 106.0 304.5 | 109.1 314.8 | 3.1 10.3 | 0.10 0.19 | 23.5 17.2 | - 0.12 | - 0.13 | 1.28 0.15 | 0.85 0.63 |

PUC-E-005 Includes Includes | 140° | 55° | 488.0m | 172.0 190.0 228.5 238.5 322.5398.5 | 178.0 262.5 240.5 240.5 336.5 404.5 | 6.0 72.5 12.0 2.0 14.0 6.0 | 0.18 0.45 2.05 11.43 0.20 0.10 | - 30.0 152.0 687.0 - 36.0 | - - 0.24 - - 0.45 | 0.24 - - 0.11 - - | 0.30 0.14 0.13 0.21 - 0.47 | 0.37 0.83 4.05 18.96 0.20 1.25 |

PUC-E-006 | 210° | 60° | 226.0m | 35.6 143.5 | 37.6 145.5 | 2.0 2.0 | 0.45 7.97 | 90.0 20.9 | - - | - - | - 0.16 | 1.42 8.26 |

PUC-E-007 | 70° | 55° | 150.0m | 2.0 45.0 | 7.0 48.8 | 5.0 3.8 | 0.18 0.20 | 17.8 43.4 | - - | 0.21 2.12 | - 0.68 | 0.44 1.62 |

PUC-E-008 | 270° | 55° | 110.8m | 26.9 | 46.9 | 20.0 | 0.27 | 33.7 | 0.26 | 0.26 | - | 1.06 |

PUC-E-009 | 225° | 60° | 136.5m | 58.7 | 91.5 | 32.8 | 0.19 | 9.4 | - | 0.17 | 0.25 | 0.44 |

* True widths are unknown.

**AuEq assumes US $2,040/oz gold, US $22.00/oz silver, US $3.85/lb copper, US $0.98/lb lead, US $1.12/lb zinc. No metallurgical testing has been conducted, so 100% metal recoveries are assumed in the AuEq calculation. The AuEq formula is Au (g/t) + Ag (g/t)x(Ag price/Au price) + Cu (g/t) x (Cu price per troy ounce/Au price) + Pb (g/t )x( Pb price per troy ounce/Au price) + Zn (g/t) x( Zn price per troy ounce/Au price). Prices in pounds converted to prices per troy ounce. One pound = 453.6 grams; one troy ounce = 31.10 grams.

"We are pleased with the results of this first drill program at the Pucamayo East project" stated Ever Marquez, Condor's VP Exploration. "Our maiden drill program has identified a substantial mineralized and altered area with locally elevated precious and base metals with some of the best values coming near surface. Intercepts include both long intervals of low grade precious and base metal mineralization as well as local high-grade structures, notably 18.96 g/t AuEq over 2.0m. We have tested only a small part of Pucamayo and are excited by the potential that remains in what appears to be a much larger mineralized system."

Six of the nine drillholes tested the extent of high sulphidation type epithermal gold and silver bearing outcropping ledges of breccia and four of these (PUC-E-001, 007, 008 and 009) intersected near surface gold-silver-poly metallic intervals ranging from 3.8m to 52.2m, and grades from 0.1 to 1.1 g/t AuEq. Two holes (PUC-E-002 and 003) drilled to the east and collared higher in elevation encountered barren steam heated host rocks interpreted to lie above the mineralized zones intersected in PUC-E-001, 007, 008 & 009. A detailed drill hole location map is available on the Company website.

(https://condorresources.com/site/assets/files/3982/pucamayo_east_drillhole_map_and_details.jpg)

Three deeper holes (PUC-E-004, 005, and 006) tested an outcropping area of multi phase stockwork and alteration associated with anomalous gold and copper with associated IP chargeability and resistivity anomalies interpreted to be an intrusive related system. The best of these, PUC-E-005 intersected a 72.5 interval from 190-262.5m grading 0.45 g/t Au, 30 g/t Ag (0.83 g/t AuEq) including a 2 m high grade interval of 11.43 g/t Au, 687 g/t Ag (18.96 g/t AuEq). PUC-E-006 intersected a 2m interval grading 7.97 g/t Au, 20.9 g/t Ag (8.26 g/t AuEq). All three of these holes encountered extensive amounts of pyrite and discontinuous zinc, copper, and lead mineralization associated with argillic/phyllic altered andesitic/dioritic host rocks.

Condor recognizes that the inaugural drill program has tested a relatively small portion of the 4 sq km area of argillic/silicic alteration zone present on the property. This large alteration zone is interpreted to represent a halo or high level-lithocap lying above a potentially mineralized porphyry system at depth to the southeast of the drilled area. (Please refer to Figure 1) This area lies within the Company's concessions, but requires an expansion of the permitted (DIA) work area. Mineralogical (Terraspec) studies to evaluate alteration zoning are currently underway on material collected from the recent drilling program to assist in vectoring towards future potential target areas.

FIGURE 1: Area of argillic/silicic alteration interpreted to represent a halo or high level lithocap southeast of 2023 drilled area

Condor is an active explorer focused exclusively on Peru, supplemented by a project generator and royalty model designed to generate exploration capital whilst minimizing shareholder dilution. The Company's objective in advancing our portfolio of projects is the discovery of a major new precious metals or base metals deposit in Peru. Project acquisition and exploration activities are managed by the Company's Lima based exploration team.

Qualified Person/QA/QC

David W. Moore, P. Geo. (BC) who serves on the Advisory Board of Condor is a non-independent qualified person as defined by NI-43-101. Mr. Moore has reviewed and approved the technical disclosure contained in this news release.

Condor employs industry standard QA/QC and data verification protocols. Drilling was performed by Energold Drilling Peru SAC. The drill core was cut lengthwise into halves using a diamond-bladed saw, with one-half used for the assay sample and the other half retained in core boxes and archived at site. Mineralized zones were generally sampled on 2m intervals. Each core sample was placed into a bag with a unique numbered sample identification tag. Quality control samples including standards, blanks and duplicates were inserted between core samples using the same numbering sequence. Then samples were grouped into batches for shipping and laboratory submissions. Chain of custody records are maintained for sample shipments and the custody is transferred from Condor to the laboratory upon delivery.

Samples were shipped to and assayed by SGS del Perú S.A.C. in Lima, Peru, a laboratory whose quality control system complies with International Standards OHSAS 18001, ISO14001 and ISO 9001. Samples were analyzed using a customary four-acid digestion system with 50 element ICP-MS analysis was conducted on all samples, with silver, copper, lead and zinc being re-analyzed with atomic absorption spectrometry method when analyzing over the ICP limits. Gold is assayed using a fire assay with an atomic absorption spectrometry finish.

ON BEHALF OF THE BOARD

Lyle Davis,

President & Chief Executive Officer

For further information please contactthe Company at 1-866-642-5707, or by email at info@condorresources.com

Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of applicable securities law. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur.

Although the Company believes that the expectations reflected in applicable forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in such statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: Condor Resources Inc.

View the original press release on accesswire.com