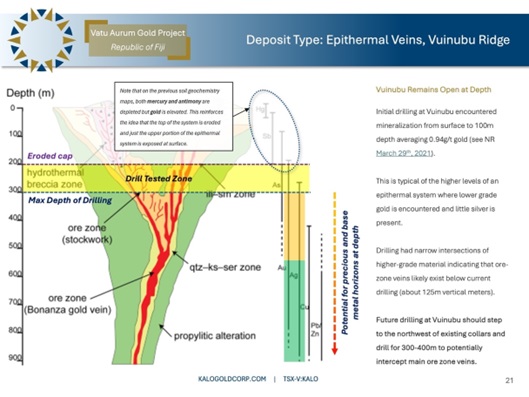

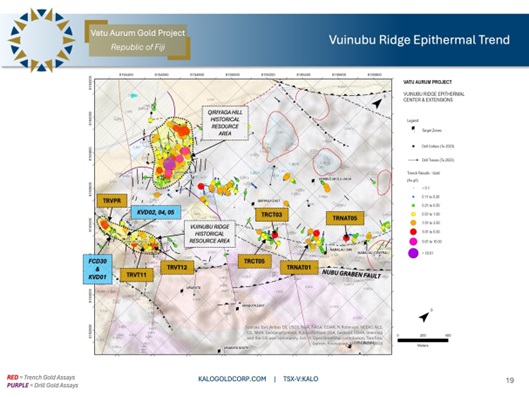

VANCOUVER, BC / ACCESSWIRE / February 15, 2024 / KALO GOLD CORP. ("Kalo", "Kalo Gold" or the "Company") has identified Vuinubu Ridge to Namalau as a >1,900 meter ("m") northeast trending priority epithermal gold target located along the deep seated Nubu Graben Fault (Figure 1). A combination of geology, structure, geochemistry and geophysics indicates that the upper 100 to 150m of the epithermal system has been eroded and it is interpreted that subsequent trenching and shallow drilling has intersected only the upper portion of the precious metal horizon. Shallow drill testing of Vuinubu Ridge has tested approximately 500m strike length of the trend and trenching has tested over 1,900m to the northeast (Figure 2) to Namalau. Given that Vuinubu Ridge represents the top of the precious metal horizon (Figure 3) it is estimated that drilling within 300m of the surface, targeting the main gold mineralized zones which are interpreted to underly the current trench and drill tested zone, are the priority for the next phase of exploration work.

Terry L. Tucker, Kalo Gold President and CEO stated, "Over the past 30 plus years, exploration by the likes of Placer Dome, Camelot, TVI Pacific and Kalo Gold has collected well in excess of CAD$30M of exploration data. A thorough, painstaking, and methodical compilation of this work, by the professional team at SGDS Hive and in particular Andy (Andrew) Randell, P.Geo., has been ongoing for the past 5 months. The SGDS Hive team has extensive experience in historical database compilations. Other projects, in particular an ongoing large epithermal gold exploration project in British Columbia, have benefited from their experience resulting in new discoveries and the successful advancement of epithermal gold systems much like those located on the Vatu Aurum Gold Project. Highly prospective epithermal gold targets have become clear in the ongoing compilation work at Vatu Aurum and will be the focus of the 2024 exploration and diamond drilling program. This will include drilling the priority targets identified in this release along the Vuinubu Ridge Trend and several other targets, including Qiriyaga Hill, which will be summarized in further news releases as the compilation work continues."

Several trench and drill results from Vuinubu Ridge to Namalau are summarized in Table 1 and located on Figure 4. Fifteen holes have been drilled in Vuinubu Ridge to a maximum vertical depth of 115m. Mineralization is open at depth and along strike for over 1900m and the interpreted zonation of this epithermal system indicates higher-grade gold potential within 300m of the surface.

Trench | Target | From (m) | To (m) | Trench Intercept (m) | Gold (g/t)*** | Grade x Width (g-m) |

TRVPR | Vuinubu Ridge | 412 | 508 | 96 | 1.46 | 140 |

and | Vuinubu Ridge | 472 | 500 | 28 | 2.64 | 73 |

TRVT11 | Vuinubu Ridge | 10 | 72 | 62 | 0.45 | 28 |

TRVT12 | Vuinubu Ridge | 0 | 20 | 20 | 0.87 | 17 |

TRNAT05 | Namalau | 22 | 68 | 46 | 0.42 | 19 |

TRNAT01 | Namalau | 26 | 62 | 36 | 0.43 | 15 |

TRCT05 | Namalau | 8 | 92 | 84 | 0.44 | 37 |

TRCT03 | Namalau | 44 | 108 | 64 | 0.38 | 24 |

Drill Hole* | From (m) | To (m) | Drill Intercept (m)** | Gold (g/t)*** | Grade x Width (g-m) | |

FCD30 | Vuinubu Ridge | 28.0 | 86.0 | 58.0 | 1.17 | 68 |

KVD01 | Vuinubu Ridge | 0.0 | 14.0 | 14.0 | 1.34 | 19 |

KVD02 | Vuinubu Ridge | 43.0 | 76.0 | 33.0 | 0.67 | 22 |

KVD04 | Vuinubu Ridge | 24.0 | 65.0 | 41.0 | 0.74 | 30 |

KVD05 | Vuinubu Ridge | 20.0 | 52.0 | 32.0 | 0.48 | 15 |

and | Vuinubu Ridge | 83.0 | 96.0 | 13.0 | 0.91 | 12 |

* Drill hole locations can be found in Table 2 below.

** True widths of mineralized intercepts are estimated to be approximately 90% of the reported interval width.

*** Assay results assume 100% recovery as no metallurgical testing has been undertaken on this mineralization.

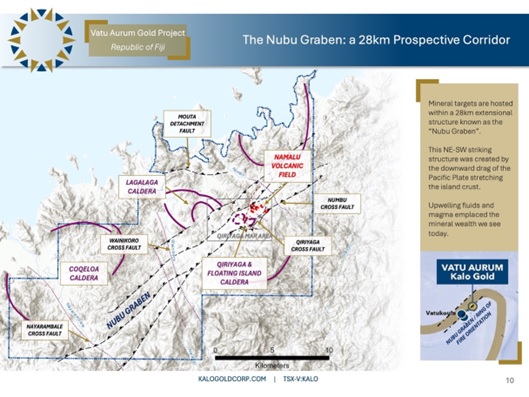

Compilation work has shown that Vuinubu Ridge sits on the southern bounding extensional fault of the Nubu Graben (Figure 1). The Nubu Graben, an extremely important deep seated regional scale NE-SW striking structure was formed by the downward drag of the Pacific Plate stretching crust resulting in rifting. The Nubu Graben lies along the Viti Levu Lineament, sometimes referred to as Fiji's Mineralized Gold Belt which hosts large gold deposits such at Vatukoula / Emperor and Tuvatu (Figure 4). These types of faults extend at depth into the crust and act as conduits for the mineralizing fluids and gases to rise to the surface, which then deposit their mineral content as the system cools and condenses.

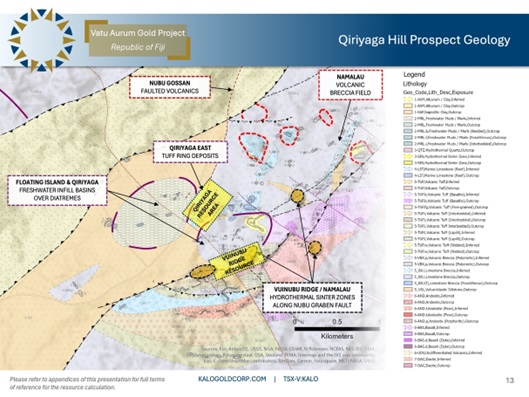

Evidence is emerging through the current reinterpretation work and compilation of historical data that the Nubu Graben Fault may host additional untested epithermal centres, highlighted by their geochemical fingerprint at surface or the occurrence of rocks such as silica sinters which are associated with the hot spring environments that sit at the subaerial interface of epithermal / hydrothermal systems as noted in Figure 2.

SHARES FOR DEBT SETTLEMENT

The Company also announces that it has entered into debt settlement agreements (the "Settlement Agreements") with certain insiders of the Company (the "Creditors") to settle an aggregate of $261,000 in debt (the "Debt") for services provided by the Creditors to the Company (the "Services"). In settlement and full satisfaction of the Debt in connection with the Services, the Company has agreed to issue to the Creditors an aggregate of 10,440,000 common shares in the capital of the Company (the "Debt Shares") at a deemed issue price of $0.025 per Debt Share (the "Debt Settlement"). The issuance of the Debt Shares is subject to receipt of TSX Venture Exchange approval and disinterested shareholders' approval. All Debt Shares issued in connection with the Debt Settlement are subject to a statutory hold period of four months plus a day from the date of issuance of the Debt Shares in accordance with applicable securities legislation.

The issuance of the Debt Shares to the Creditors constitutes a related party transaction within the meaning of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transaction ("MI 61-101") as the Creditors are directors and/or officers of the Company. The Company is relying on the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(b) and 5.7(1)(a) of MI 61-101, as the Company is not listed on a specified market and the fair market value of the Debt Shares issued to the Creditors does not exceed 25% of the market capitalization of the Company in accordance with MI 61-101.

ABOUT KALO GOLD CORP.

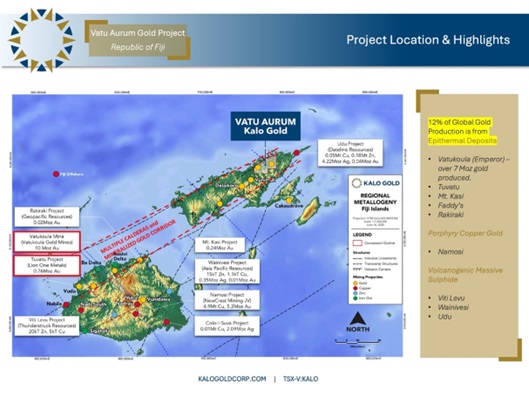

Kalo Gold Corp, a gold exploration company, is focused on exploration for low sulphidation epithermal gold deposits of the Vatu Aurum Gold Project on the island of Vanua Levu (North Island) in the Republic of Fiji. Kalo holds a 100% interest in two Special Prospecting Licenses, covering 367 km2 that hosts a minimum of seven volcanic arc related calderas ranging between 1 km to 10 km in diameter. Historical exploration work concentrated on the Qiriyaga Hill and Vuinubu Ridge Gold Deposits and resulted in the identification of over fourteen priority epithermal gold exploration targets.

Both Viti Levu, (South Island), and Vanua Levu are on the prolific Pacific "Ring of Fire", a trend that has produced numerous large deposits, including Porgera, Lihir and Grasberg and on Viti Levu, the exceptional Vatukoula Gold Mine. The Vatukoula Gold Mine has produced more than 7 million ounces of gold since 1937. The island of Viti Levu also hosts the fully permitted Tuvatu Alkaline Gold Project, where Lion One Metals is fast tracking a high-grade underground gold mining operation. Tuvatu is now operating and targeting production expansion and additional growth through exploration.

Qualified Person

The technical information in this news release was reviewed and approved by Andrew Randell, P. Geo a qualified person as defined by National Instrument 43-101 of the Canadian Securities Administrators.

On behalf of the Board of Directors of Kalo Gold Corp.

Terry L. Tucker, P.Geo.

President and Chief Executive Officer

Kevin Ma, CPA, CA

Executive Vice President, Capital Markets and Director

For more information, please write to info@kalogoldcorp.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Forward Looking Statements Disclaimer

Certain statements in this release are forward-looking statements, which are statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward looking statements in this news release include statements relating to the Company's proposed drilling timeline and the proposed expansion of the exploration program, and the Company's plans for future exploration on the Vatu Aurum Gold Project. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements included in this news release, other than statements of historical fact, are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include quality and quantity of any mineral deposits that may be located, the Company's inability to obtain any necessary permits, consents or authorizations required for its activities, the Company's inability to raise the necessary capital to be fully able to implement its business strategies, and other risks and uncertainties disclosed in the Company's filing statement dated February 9, 2021 and latest interim Management Discussion and Analysis filed with certain securities commissions in Canada.

The reader is cautioned that assumptions used in the preparation of any forward-looking statements herein may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect, and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements as expressly required by Canadian securities law.

Figure 1: The Nubu Graben: a 28km Prospective Corridor

Figure 2: Qiriyaga Hill Prospect Geology

Figure 3: Deposit Type: Epithermal Veins, Vuinubu Ridge

Figure 4: Vuinubu Ridge Epithermal Trend - Drill hole and Trench Locations from Table 1

Figure 5: Fijis Mineralized Gold Belt

Referenced Geospatial Data, Sampling and Laboratory

| Drill Hole | Year | Easting | Northing | Elevation (m asl) | Zone | Azimuth | Dip | Length (m) |

FCD30 | 1992 | 779065 | 8193419 | 84 | WGS84 60S | 302.6 | -60 | 213.25 |

KVD01 | 2011 | 779025 | 8193440 | 120 | WGS84 60S | 142 | -60 | 120.70 |

KVD04 | 2019 | 779406 | 8193633 | 89 | WGS84 60S | 142 | -60 | 130.50 |

KVD05 | 2020 | 779059 | 8193479 | 94 | WGS84 60S | 142 | -50 | 150.00 |

Table 2: Drill hole collar information.

All rock and drill core samples collected by the Company since 2023 have been sent to Australian Laboratory Services Pty. Ltd. in Brisbane, Australia for sample preparation and analysis. Upon receipt at the lab, all samples were dried in an oven at a temperature of 80°C (DRY-24), coarse crushed (CRU-21) and then pulverised to 85% passing 75 microns (PUL-23). The preparation has a very low likelihood of producing inadequate or non-representative samples. Gold grades are obtained by method code Au-AA24 which is a 50-gram fire assay with an AA finish and detection range of 0.005 to 10ppm gold. Samples which return greater than 10.0 parts per million gold are resubmitted with method code Au-AA26 which is a 50-gram fire assay with an AA finish and detection range of 0.01 to 100 ppm gold. The fire assay analysis is considered a total analysis for gold. Additional analyses for 48 other elements were carried out using a 4-acid digestion and ICP-MS finish under the method code ME-MS61m including trace Hg by ICP-MS (Hg-MS42). Quality control procedures are followed for all samples submitted to the laboratory for assay, including strict chain of custody protocols. Quality control comprises of OREAS standards, blank materials and field or preparation duplicate material for testing. Insertion rate is at a minimum of one quality control sample per shipment but in sections of mineralized drill core a standard is inserted at the beginning of the section to establish calibration, a duplicate in the middle of the sequence to test repeatability (for field duplicates) or homogeneity (for preparation duplicates). Mineralized sections are then completed with the insertion of blank material to ensure equipment has been cleaned rigorously and no "smearing" or contamination of grade occurs. Quality control is monitored on each assay certificate as it arrives from the laboratory and then all data is compiled annually. Any discrepancies are immediately addressed accordingly.

No quality assurance / quality control (QA/QC) reporting is available for FCD30. From 2011 to 2022 QA/QC protocols were conducted by ALS including internal blanks, standards and duplicates.

SOURCE: Kalo Gold Corp.

View the original press release on accesswire.com