STOCKHOLM, Feb. 15, 2024 /PRNewswire/ -- "Starbreeze stands strong, with a strong cash position and a balance sheet largely free of debt. Our biggest focus now, and going forward, is PAYDAY 3."

Fourth quarter 2023

- Net sales amounted to SEK 69.2 million (33.6).

- PAYDAY 2 accounted for SEK 18.3 million (32.4).

- PAYDAY 3 accounted for SEK 36.2 million (0).

- EBITDA* amounted to SEK -20.6 million (19.4).

- Cashflow from operating activities amounted to 62.7 MSEK (10.1).

- Depreciation, amortization and impairment amounted to SEK 74.4 million (15.0).

- Profit/loss before taxes amounted to SEK -91.5 million (-12.3).

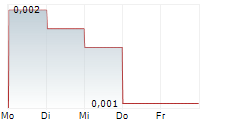

- Basic and diluted earnings per share amounted to

SEK -0.06 (-0.02).

Full-year 2023

- Net sales amounted to SEK 633.5 million (127.6),

- PAYDAY 2 accounted for SEK 139.1 million (121.9),

- PAYDAY 3 accounted for SEK 477.0 million (0).

- EBITDA* amounted to SEK 439.3 million (66.4).

- Cashflow from operating activities amounted to 114.6 MSEK (57.8).

- Depreciation, amortization, and impairment amounted to SEK 249.0 million (59.6).

- Profit/loss before taxes amounted to SEK 207.7 million (-54.4).

- Basic and diluted earnings per share amounted to SEK 0.19 (-0.08).

- Cash and cash equivalents amounted to SEK 347.8 million (108.2).

- In line with the company's dividend policy, the Board of Directors proposes that no dividend is paid for the 2023 financial year.

- October 26, launch of Turtle vs Turtle, a Fortnite island.

- November 3, Starbreeze announced that it will publish GodsTV.

- November 7, Roboquest 1.0 was launched on Steam®, Xbox Series X|S, Xbox Game Pass and Epic Games Store.

- November 10, Chairman of the Board of Directors Torgny Hellström announced that he will not be available for re-election at the 2024 Annual General Meeting.

- November 30, two free heists were released for PAYDAY 3.

- December 4, Starbreeze announced that it had licensed the world's greatest role-playing game - Dungeons & Dragons® for Project Baxter.

- December 12, launch of first DLC for PAYDAY 3, Syntax Error.

- January 9, Starbreeze announced changes in Group management.

- January 10, the Starbreeze Nomination Committee announced the proposal to appoint Jürgen Goeldner as the new Chairman of the Board of Directors at the 2024 Annual General Meeting.

- January 17, Starbreeze announced the Early Access launch of The Tribe Must Survive on Steam on February 22, 2024.

CEO's message

Long-term focus on PAYDAY 3

PAYDAY 3's sales and player activity are currently at significantly lower levels than we would like. Our biggest focus and absolute priority, both during and after the quarter, are the efforts needed to ensure that the game lives up to expectations. We are working closely with our co-publishing partner Plaion to identify the changes that we will implement, in both the short- and long-term, that add the most value to the gaming experience. The PAYDAY team will in February announce the changes and improvements that are prioritized for implementation.

There are many examples from the game industry, where a problematic initial time on the market is turned into long-term success. There is no simple recipe available, but a common thread from the positive examples is to take players' criticism to heart, dare to support your game and keeping an open and honest dialogue with your stakeholders. That is exactly what we are now doing with PAYDAY 3. Few companies are blessed with a brand as strong as PAYDAY. At a time when our most recent game is lagging, PAYDAY 2 has fared slightly better than expected financially and with more than 400,000 active players in single months during the quarter. It shows the strength of the brand, and our potential to convert these to PAYDAY 3 as we deliver on our commitments.

Our long-term strategy is set; to build a strong and diversified Starbreeze. We will do this by developing games on our own IPs, on licensed IPs and as publisher for other studios' games. In December, we were able to reveal that our next major internal project, Baxter, will be based on Dungeons & Dragons® - the world's premiere role-playing game. Within our third-party publishing, Roboquest 1.0 was successfully launched with positive impact on both net sales and earnings. We now have more than six million registered users in our portal, Starbreeze Nebula.

RESULTS & FINANCIAL POSITION

Net sales during the quarter amounted to SEK 69.2 million, primarily driven by PAYDAY 3 and revenues linked to the launch of Roboquest 1.0. The results are partly weighed down by depreciation of the PAYDAY 3 asset in accordance with plan, and by significantly higher costs for external services related to game servers during the first part of the quarter. At the end of the quarter, these services were at a significantly better cost level, but we still see opportunities for further efficiencies. During the quarter we invested approximately SEK 41 million in our own game and technology development, mainly PAYDAY 3 and Project Baxter. At the end of the quarter, cash and short-term receivables totaled over SEK 500 million.

PAYDAY 3

In November, we launched a free DLC with two popular heists from PAYDAY 2 along with improvements and new functionality. Early December, the first premium DLC was launched, "Syntax Error", with a new heist, new enemies and new content among other things. The entire development team will now pivot to deliver on the initiatives to improve the game.

PROJECT 'BAXTER'

In early December, we were finally able to reveal that we licensed Dungeons & Dragons® for use in our next game title. It is a brand that was always on the top of our lists of potential licenses to develop an action-adventure-game on. The Baxter team is currently in full pre-production and on track to launch in 2026.

THIRD PARTY PUBLISHING

Our business as a publisher of other studios' games continues to grow in a controlled manner, in line with our strategy. We will continue to leverage the experience, skills and capabilities we have at Starbreeze to help others bring their games to market. The portfolio currently consists of four projects, with Roboquest launched during the quarter to very warm reception from both players and industry media.

ORGANIZATION

During the quarter, the number of employees increased by nine, primarily new recruitment of specific skills for the development of Project Baxter. At the end of the year, the number of employees amounted to 196 people.

CLOSING WORDS

As a company, Starbreeze stands strong, with a strong cash position and a balance sheet largely free of debt. Our biggest focus now, and going forward, is PAYDAY 3. We know what needs to be done for the game to be a success over time, and we have the financial muscles, the community and brand in PAYDAY and the skills required to execute our plan. We continue to work towards our long-term strategy to have two Games as a Service games on the market by 2026 - PAYDAY 3 and Project Baxter - and a portfolio of projects within our third-party publishing.

TOBIAS SJÖGREN, VD

Webcast

Time: 10.00 CET

Participation: To connect to the webcast- click here.

For more information, please contact:

Tobias Sjögren, CEO

Mats Juhl, CFO

Tel: +46 0(8) - 209 229

Email: [email protected]

This information is information that Starbreeze AB is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, via the contact persons set out above, at 6:45 am CET on February 15, 2024.

About Starbreeze

Starbreeze is an independent developer, publisher, and distributor of PC and consoles targeting the global market, with studios in Stockholm, Barcelona, Paris and London. Housing the smash hit IP PAYDAYTM, Starbreeze develops games based on proprietary and third-party rights, both in- house and in partnership with external game developers. Starbreeze shares are listed on Nasdaq Stockholm under the tickers STAR A and STAR B.

Read more at www.starbreeze.com and corporate.starbreeze.com.

The following files are available for download:

https://mb.cision.com/Main/14632/3928979/2606306.pdf | Starbreeze Interim report Q4 2023 |

SOURCE Starbreeze AB