VANCOUVER, British Columbia, Feb. 14, 2024 (GLOBE NEWSWIRE) -- Glorious Creation Limited ("Glorious" or the "Company") (CSE: GCIT.X) is pleased to announce that the Company has entered into a definitive purchase and sale agreement (the "Definitive Agreement") dated February 12, 2024 with Stallion Uranium Corp. ("Stallion"), a British Columbia mineral exploration company with its common shares listed for trading on the TSX Venture Exchange (the "TSXV"). Pursuant to the Definitive Agreement, the Company will acquire three separate mineral properties comprised of an aggregate of seven mineral claims, covering a total of 10,874 hectares (approximately 100 square kilometers), located in Eastern Athabasca Basin of Saskatchewan (collectively, the "Properties") from Stallion (the "Transaction").

The Transaction is subject to the approval of the Canadian Securities Exchange ("CSE") and is intended to constitute a Fundamental Change of Glorious as defined in CSE Policy 8 - Fundamental Changes and Changes of Business. Subject to CSE approval, upon the closing of the Transaction (the "Closing"), the business of the Company resulting from the Transaction will primarily be the exploration for uranium on the Properties.

Trading in the Company's common shares (the "Shares") on the CSE was halted in connection with this news release. Trading in the Shares will remain halted pending the review of the Transaction by the CSE and satisfaction of any conditions of the CSE for resumption of trading. It is likely that that the Shares will not resume trading until the Closing.

The Properties

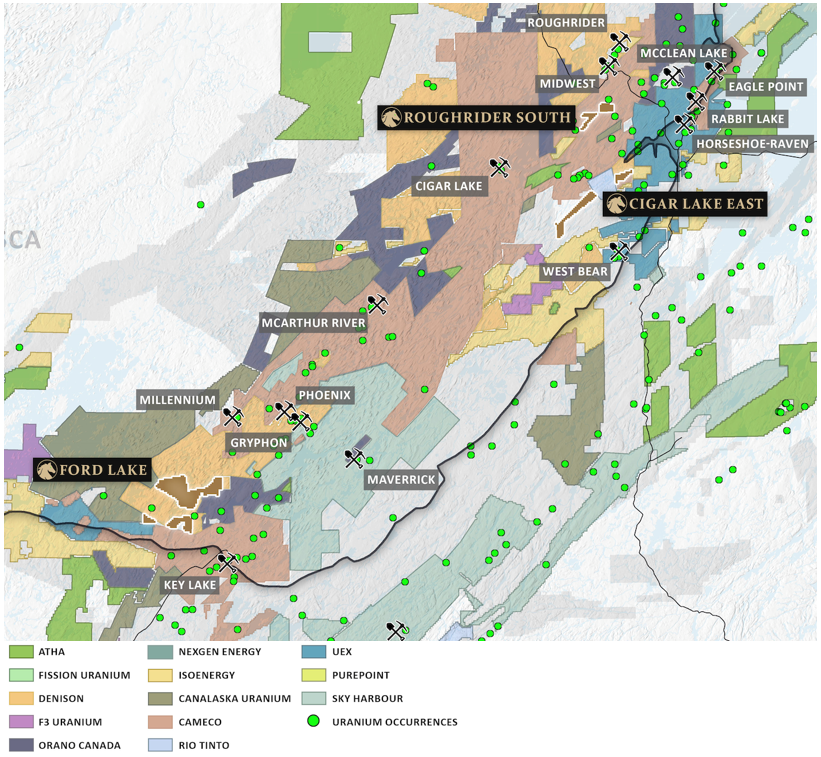

The Ford Lake project consists of three claims covering an area of 7,431 hectares in the prolific Eastern Athabasca Basin near the margin of the Mudjuik and Wollaston Domains. Ford Lake is prospectively highlighted by the recent CanAlaska Uranium Ltd. high-grade discovery hole at Moon Lake only 10km to the northeast. The uranium endowment of the area is proven by the significant deposits of the Key Lake Mine only 15km to the southeast and less than 20km from Cameco Corp.'s Millennium deposit, and less than 20km from Denison Mines Corp.'s Gryphon and Phoenix deposits with uranium mineral reserves of 106.4 Mlbs (Million Pounds) U3O8.12

_____________________________

1 NI 43-101 Technical Report on the Wheeler River Project Athabasca Basin, Saskatchewan, Canada dated June 20, 2023

2 Denison Mines Corp. - Core Projects - Wheeler River Project

Each of the Cigar Lake East and Roughrider South projects are located in the Eastern Athabasca Basin in northwest Saskatchewan. The Cigar Lake East and Roughrider South projects consists of four claims covering a total area of 3,443 hectares in the Wollaston Domain in the Eastern Athabasca Basin.

Drew Zimmerman, CEO of Stallion Uranium Corp stated "We are excited to see our three eastern basin projects move into the hands of Glorious, while still being able to benefit from their success. These projects warrant, and will now receive, a committed uranium exploration program led by our world class technical and geological team at a time when the world needs meaningful uranium discoveries. All three projects are located in the heart of the world-renowned Eastern Athabasca Basin and hold significant potential for discovery."

CEO Nicholas Luksha expressed enthusiasm stating, "Today marks a significant milestone for our shareholders as we secure a strategic land position in one of the most renowned Uranium regions in the world. The full control of this acquisition adds up to approximately 100 square kilometers, and is situated in a significant area with recent Uranium discoveries. This exciting opportunity has generated enthusiasm amongst our team and operating partners at Stallion Uranium. Collaborating on this turnkey operation, we aim to establish robust leadership and harness the expertise of the existing technical team to commence drilling on the most promising targets as soon as this summer. The ambitious strategy we have in motion is poised to substantially enhance shareholder value."

Exhibit #1. Ford Lake, Cigar Lake East, and Roughrider South shown above with all other Uranium activity in the general region.

The Transaction

The Definitive Agreement provides that the Company will acquire the Properties from Stallion for the following consideration:

- concurrently with the signing the Definitive Agreement, a cash payment of $100,000.00 (the "Deposit"), which one half of the Deposit ($50,000) will be refundable by Stallion to Glorious if Glorious does not obtain approval from the CSE;

- on the date of the Closing (the "Closing Date"), a cash payment of $300,000.00;

- an aggregate of 2,500,000 Shares to be issued by the Company to Stallion as follows:

- 500,000 Shares on the date which is six (6) months following the Closing Date,

- 500,000 Shares on the date which is twelve (12) months following the Closing Date,

- 500,000 Shares on the date which is eighteen (18) months following the Closing Date, and

- 1,000,000 Shares on the date which is twenty-four (24) months following the Closing Date; and

- a 3.0% net smelter return royalty on the Properties in favour of Stallion (the "Royalty").

The terms of the Royalty will be governed by a net smelter return royalty agreement (the "Royalty Agreement") to be entered into between the Company and Stallion at Closing. The parties agreed to negotiate in good faith to settle the terms of the Royalty Agreement promptly following the execution of the Definitive Agreement. The Royalty Agreement will include a 1.5% buy-back right in favour of the Company which can be exercised at any point prior to commercial production as follows: (a) $500,000 for 0.5%; (b) $750,000 for a second 0.5%; and (c) $1,000,000 for a third 0.5%.

The Company and Stallion have also agreed to enter into an operating agreement (the "Operating Agreement") pursuant to which Stallion will conduct an agreed upon exploration program on one or more of the Properties.

The completion of the Transaction is subject to the satisfaction of various conditions as are standard for a transaction of this nature, including, but not limited to: (i) receipt of all requisite consents, waivers and approvals for the Transaction, including the approval of the CSE, the approval by the holders of at least 50.1% of the issued and outstanding Shares and approval of the TSXV; (ii) the absence of any material adverse change in the status of the Properties; (iii) entry into of the Royalty Agreement and the Operating Agreement; (iv) the delivery of a National Instrument 43-101 - Standards of Disclosure for Mineral Properties compliant technical report with respect to one or more of the Properties; (v) the Company meeting the qualifications for listing under CSE Policy 2 - Qualification for Listing ("Policy 2") by filing all of the documents and following the procedures set out in Policy 2; and (vi) Stallion, if applicable, having received the requisite approvals from its shareholders for the Transaction.

The Company expects to pay a finder's fee in connection with the Transaction to the party that introduced the acquisition target to the Company, subject to applicable securities laws and the policies of the CSE. There is no change of control of the Company expected to occur as a result of the Transaction.

Qualifying Statement

The foregoing scientific and technical disclosures for Glorious Creations Limited have been reviewed by Darren Slugoski, P.Geo., a registered member of the Professional Engineers and Geoscientists of Saskatchewan. Mr. Slugoski is a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Glorious Creation Limited

Glorious is incorporated under the provisions of the Business Corporations Act (British Columbia) with its registered and head office in Vancouver, British Columbia. Glorious is a "reporting issuer" in the provinces of Ontario, British Columbia and Alberta.

For further information, please contact:

Glorious Creation Limited

Attention: Nicholas Luksha, CEO and Director

Phone: (604) 838-0184

Cautionary Note

Completion of the Transaction is subject to a number of conditions, including but not limited to, CSE acceptance and shareholder approval. There can be no assurance that the Transaction will be completed as proposed or at all.

Investors are cautioned that, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of the Company should be considered highly speculative. The CSE has in no way passed upon the merits of the proposed Transaction and has neither approved nor disapproved the contents of this news release.

This news release also includes references with respect to CanAlaska Uranium Ltd.'s Moon Lake project, Cameco Corp.'s Millennium deposit and Denison Mines Corp.'s Gryphon and Phoenix deposits (collectively, the "Adjacent Properties"), which are located near the Properties in the Eastern Athabasca Basin. The Company advises that, notwithstanding their proximity of location, discoveries of minerals on the Adjacent Properties and any promising results thereof are not necessarily indicative of the mineralization of, or located on the Properties or the Company's ability to commercially exploit the Properties or to locate any commercially exploitable deposits therefrom.

All technical information contained in this press release with respect to Denison Mine's Corp's Gryphon and Phoenix deposits, was provided by the sources noted in footnotes (1) and (2) above without independent review and investigation by the Company, and the Company has relied on the information contained in the respective sources exclusively in providing the information about the Denison Mine's Corp's Gryphon and Phoenix deposits. The Company cautions investors on relying on this information as the Company has not confirmed the accuracy or reliability of the information.

Disclaimer for Forward-Looking Information

Certain statements in this press release are forward-looking statements, which reflect the expectations of management regarding the Company's completion of the Transaction and related transactions. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future, including, but not limited to: that the Company will obtain the requisite approvals with respect to the Transaction, including that of the CSE and the shareholders of the Company, as applicable; that all other conditions for completion of the Transaction will be satisfied for completion of the Transaction; that the Shares will remain halted until the Closing; that the Company and Stallion will successfully negotiate and enter into the Royalty Agreement and the Operating Agreement; that the Company will commence drilling on the Properties and the expected timing thereof; that the Company will complete the name change as proposed; and that the Company will pay a finder's fee in connection with the Transaction. Such statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements, including risks related to factors beyond the control of the Company. The risks include the following: that the requisite corporate approvals of the directors and shareholders of the Company may not be obtained; that the CSE may not approve the Transaction; and other risks that are customary to transactions of this nature. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3c35fb36-08b7-4726-8410-91dedbac698e