TORONTO, ON / ACCESSWIRE / February 28, 2024 / Magna Terra Minerals Inc. (the "Company" or "Magna Terra") (TSX-V:MTT) is pleased to announce results of an exploration program completed in fall 2023 on its 100% owned flagship Great Northern Project ("Great Northern" or the "Project"), located in western Newfoundland. The exploration program comprised a 246-line kilometre drone magnetic survey, collection of 25 rock grab samples, and 1,388 B-horizon soil samples covering unexplored areas of the Project. The program was partially funded by the Government of Newfoundland and Labrador through the Junior Mining Assistance Program (JEA).

Great Northern is a proven gold environment with existing Mineral Resources and numerous untested gold trends over a cumulative 30+ kilometre strike with the potential to host multi-million-ounce gold deposits (Figure 1).

Highlights of the Exploration Program include:

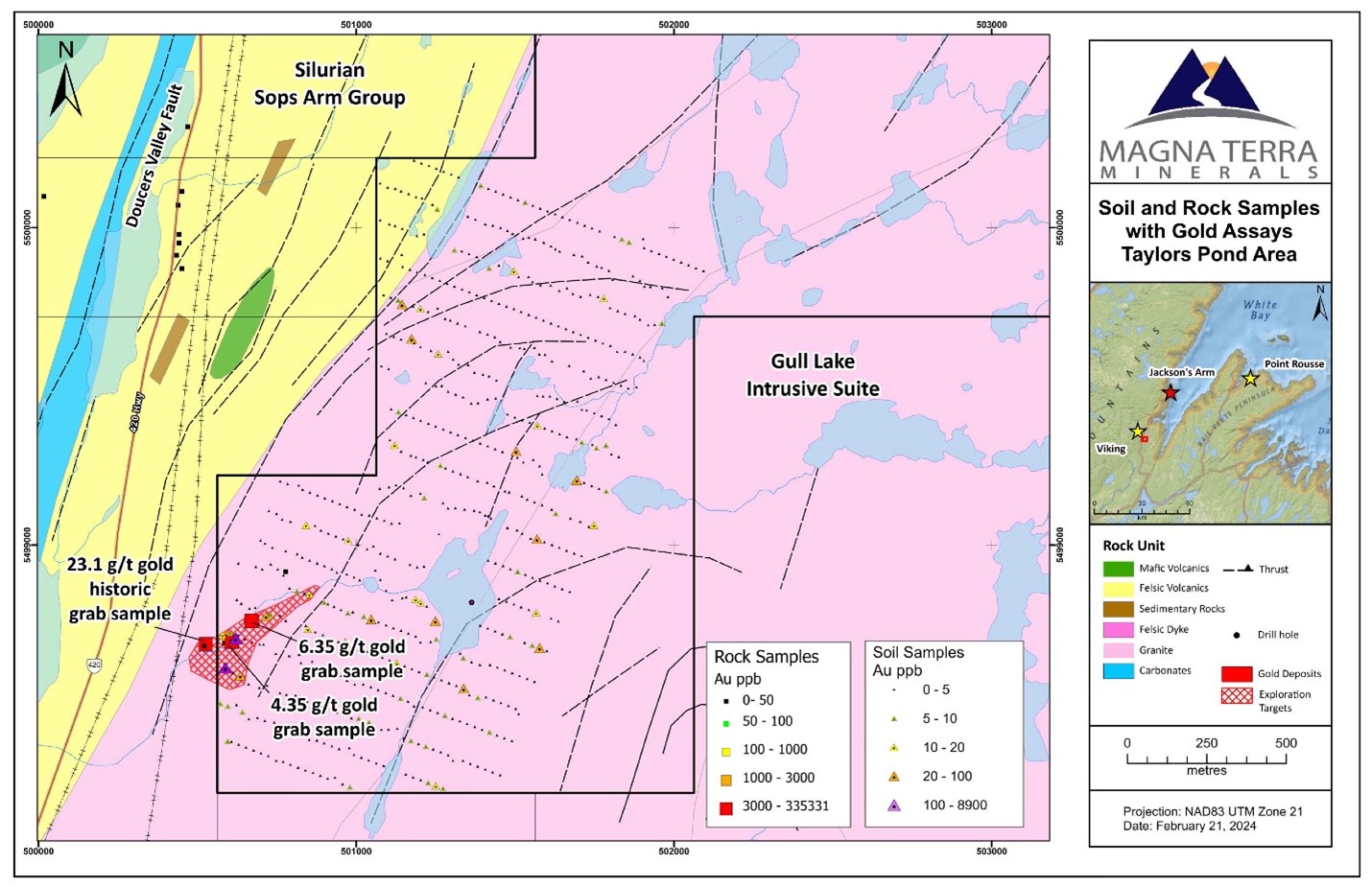

- Discovery of a new zone of gold mineralization assaying up to 6.35 g/t gold from grab samples at the Taylors Pond Prospect (Figure 2) coincident with a 300-metre long soil geochemical anomaly with assays up to 273 ppb gold (see details below);

- Identification of a 2.0-kilometre long gold-in-soil anomaly known as the Loki Trend (Figure 3) with assays up to 143 ppb gold;

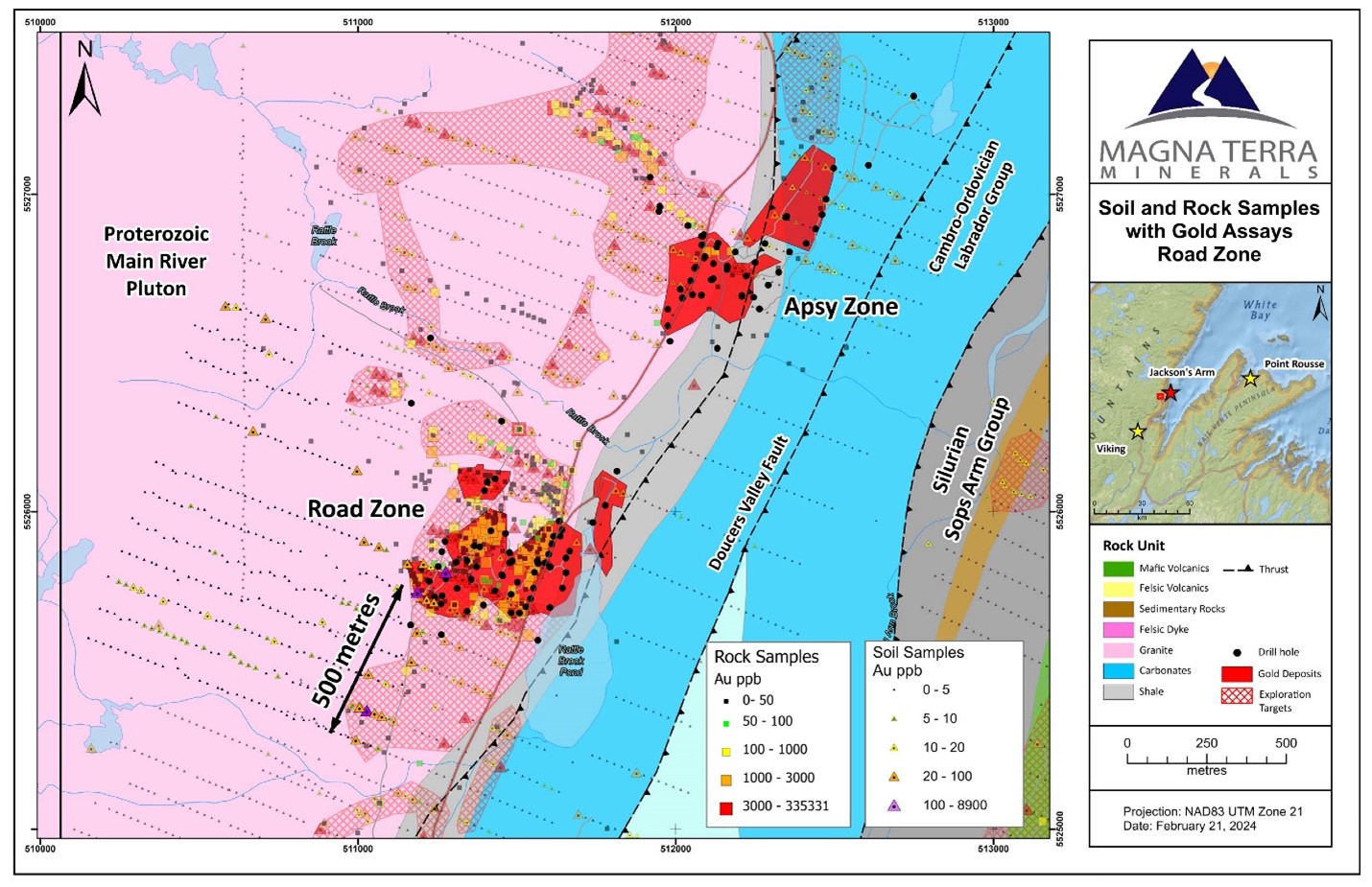

- Discovery of a 500-metre long gold anomaly along trend with the Road Zone mineral resource (Figure 4) and including assays up to 196 ppb gold; and

- Identification of several targets for follow-up exploration based on a suite of low-magnetic-intensity geophysical anomalies from the drone magnetic survey - features commonly associated with gold mineralization in this area.

"In the late fall of 2023 we conducted a modest exploration program that focused on key areas identified for their discovery potential based on existing information and were able to discover several new gold trends. Soil sampling and prospecting outlined new zones of gold mineralization, proximal to existing resources at the Road Zone indicating there is potential to expand the deposit an additional 500-metres southward. Soil sampling led to the discovery of the new 2.0-kilometre long Loki Trend, and the discovery of bedrock mineralization at Taylors Pond opens up new opportunities for mineralization in that area. With more than 30+ cumulative kilometres of strike potential, our Great Northern Project includes an impressive number and expanding scale of high-priority drill ready targets and underscores the potential of the Project to host multiple large gold systems."

~ Lew Lawrick, President and CEO, Magna Terra Minerals Inc.

The Company will be presenting at the upcoming Canada's Atlantic Edge mining investment forum during PDAC 2024 in Toronto, Ontario at 1:50PM on Tuesday March 5th, 2024.

Exploration Program Details

Taylors Pond Area

Prospecting was completed to follow-up on an area of altered and mineralized felsic intrusive rocks assaying up to 23.1 g/t gold initially sampled in 2009 by Spruce Ridge Resources Limited and Delta Uranium Inc. The area is underlain by late Devonian Gales Brook Granite of the Gull Lake Intrusive Suite approximately 1 kilometre east of Taylors Pond and the contact with Sops Arm Group volcanic rocks. Rock samples collected from this area returned assays of 6.35 and 4.35 g/t gold from bedrock grab samples to the northeast of the Spruce Ridge/Delta Uranium sample site. The mineralized rock is comprised of pyrite (2-5%; cubic and subhedral in quartz veins) bearing, moderately altered massive biotite, K-feldspar granodiorite (Gull Lake) with pervasive silica, sericite alteration and 1 to 4 cm quartz veins (Figure 2).

A total of 603 samples from reconnaissance soil lines were collected over the area of bedrock mineralization described above. Soil sampling shows a strong 4-line (300 m minimum; >20 ppb gold) gold soil anomaly assaying 273, 108 and 36 ppb gold, coincident with gold-bearing rock samples in the area. Of the 603 samples collected on the Taylors Pond Area, 3 samples assayed over 50 ppb gold and 16 assayed over 20 ppb gold.

Kramer Soil Grid

A total of 114 samples were collected along infill soil lines designed to cover the north end of the Kramer Trend, hosted within Precambrian granodiorite and monzogranite and its tectonized unconformable contact with overlying Cambro-Ordovician quartzite, calcareous shales and marbles.

The infill soil sampling lines continued to highlight two distinct zones of anomalous gold (>20 ppb gold); the first coinciding with the Precambrian granodiorite/Cambrian quartzite contact at the north end of the Kramer Trend, and the second covering a sequence of Cambro-Ordovician carbonaceous shales 500 metres east of and subparallel to the Kramer Trend, the Loki Trend. Together with the results of previous soil sampling these new results form a 2-kilometre long trend of anomalous soils overlying the Cambro-Ordovician carbonaceous shales. A sample taken from a trenched exposure of altered and mineralized granodiorite proximal to the unconformable contact with Cambrian quartzite at the northeastern end of the Kramer Trend returned an assay of 143 ppb gold (Figure 3). Overall, 5 of the 114 samples assayed over 50 ppb gold and 11 assayed over 20 ppb gold.

Road Zone Soil Grid

A total of 348 soil samples were collected to the immediate northwest of the Road Zone mineral resource. A maximum gold value of 196 ppb was returned with 7 samples assaying over 50 ppb gold and 22 samples assaying over 20 ppb gold. Of note is a 7-line, northeast oriented, combined gold soil anomaly (> 20 ppb gold) over 500 metres to the immediate southwest of the Road Zone mineral resource (Figure 4). This zone of anomalous soils is proximal to rock grab samples from 2021 that assay up to 650 ppb gold from altered granodiorite and coincident with an area of low magnetic susceptibility from the drone magnetic survey. These soils represent an opportunity to expand the Road Zone footprint and form a priority target for follow-up drilling.

Drone Magnetic Survey

The drone magnetic survey was completed over the Rattling Brook Deposit area to further characterize the magnetic nature of host rocks where previous work in the area (1980s ground magnetic survey of the Road Zone) including several airborne surveys have shown that zones of gold-bearing hydrothermal alteration are associated with zones of low magnetic intensity. These zones are interpreted to result from destruction of disseminated magnetite within largely host granodiorite during hydrothermal alteration and sulphide replacement.

Several areas of low magnetic intensity are apparent from the drone magnetic survey including:

- An area measuring 1.0 by 1.7 kilometres to the immediate southwest of the Road Zone;

- An area measuring 1.0 by 3.0 kilometres to the northwest of the Apsy Zone;

- An area between the Incinerator Trail and Furnace trends measuring roughly 750 metres by 1.0 kilometre; and

- Numerous zones of discrete magnetic low following interpreted fault zones from LiDAR and topographic data that are in places coincident with anomalous soil samples.

- ^An Inferred Mineral Resource Estimate of 5,460,000 tonnes at an average grade of 1.45 g/t gold containing 255,000 contained ounces at a cut-off grade of 1.0 g/t gold at the Rattling Brook Deposit; and

About the Viking and Great Northern Projects

The Viking and Great Northern Projects are comprised of two separate claim blocks totalling 13,950 hectares, located near the communities of Sops Arm, Pollard's Point, and Jackson's Arm, Newfoundland and Labrador.

The Projects are centered along a 30-kilometre section of the Doucers Valley Fault, a significant geological control on, and host to, several gold deposits and untested prospects, including the Rattling Brook and Thor Deposits plus the Incinerator, Furnace, Jacksons Arm, Viking, Kramer, Viking North, and Little Davis Pond mineralized trends. This proven gold environment with existing Mineral Resources and numerous untested gold trends occurs over a cumulative 30+ kilometre strike length. Gold mineralization is hosted within a variety of rock types that include Precambrian or Ordovician granites as well as younger volcanic and sedimentary rocks, typically along splays off the Doucers Valley Fault. This is a similar geological/structural environment to Calibre Mining Corporation's (formerly Marathon Goldold Corp.) Valentine Gold Project. Alteration consists of mesothermal style quartz ± iron carbonate ± sulfide veins and stockworks with 2 to 5% total sulfides consisting of pyrite, galena, chalcopyrite, or sphalerite. These mineralized veins locally show trace amounts of visible gold.

The Viking and Great Northern Projects are host to significant Current Mineral Resources, including:

- ^^An updated open-pit constrained Indicated Mineral Resource Estimate of 817,000 tonnes at an average grade of 1.70 g/t gold for 45,000 ounces and open-pit constrained Inferred Mineral Resources of 44,000 tonnes at an average grade of 1.27 g/t gold for 1,800 ounces at a cut-off grade of 0.46 g/t gold at the Thor Deposit. The Thor Deposit also includes underground constrained Indicated Mineral Resources of 62,000 tonnes at an average grade of 2.98 g/t gold, containing 5,900 ounces, and underground constrained Inferred Mineral Resources of 23,000 tonnes at an average grade of 3.31 g/t gold, containing 2,400 ounces at a cut-off grade of 2.14 g/t gold.

Several drill targets and specific opportunities for mineral resource expansion and discovery have been identified by the Company based on recent field programs and a comprehensive review of historical and current exploration data. This work, in conjunction with that of previous operators on the Projects, has identified the importance of fault control on gold mineralization. These major target areas for near-term drill testing are:

- The Apsy Zone - Existing Mineral Resource area with potential for minimum 800 metre extension.

- Incinerator Trend - 1.8-kilometre-long gold-bearing east-west fault only tested by four historical drill holes that intersected gold mineralization: 2.32 g/t gold over 4.1 metres (drill hole RB-41 from 33.1 m downhole); 1.06 g/t gold over 15.6 metres (drill hole RB-39 from 66.8 m downhole); 1.00 g/t gold over 9.7 metres (drill hole RB-37 from 32.1 m downhole); and 1.78 g/t gold over 4.0 metres (drill hole RB-35 from 47.2 m downhole).

- Furnace Trend - 1.7-kilometre long trend with rock grab samples assaying up to 5.60 g/t gold along east-west fault zone.

- Kramer Trend - 1.5-kilometre long northeast striking zone of gold mineralization centred on the contact between granites and quartzites. Highlight assays from previous drill holes KR-10-07 and KR-10-08 include 1.12 g/t gold over 20.05 metres (from 53.5 m downhole) and 1.50 g/t gold over 14.4 metres (from 66.85 m downhole), respectively.

- Viking Trend - 6.4 kilometre long by up to 40-metre wide deformation and alteration zone with gold grades of 0.45 g/t gold over 20.0 metres in drill hole VK-16-154 (from 48.0 m downhole), as well as local high grades as indicated by 7.43 g/t gold over 1.0 metre in drill hole VK-16-155 (from 36.0 m downhole).

- Viking North Trend - 8-kilometre long east-west striking fault zone, sub-parallel to the Viking Trend, that is host to gold mineralized rocks and soils from reconnaissance sampling assaying up to 2.12 g/t gold and 380 ppb gold, respectively.

- Jacksons Arm Trend - 2.4-kilometre-long gold zone defined by numerous gold bearing rock and soil samples and from drilling in late 2020.

Qualified Person and Technical Reports

This news release has been reviewed and approved by David A. Copeland, P.Geo., Chief Geologist with Signal Gold Inc., a "Qualified Person", under National Instrument 43-101 - Standard for Disclosure for Mineral Projects.

"Grab samples" are selected samples and are not necessarily indicative of gold grade at a larger scale.

Soil samples were collected with soil augers at pre-determined locations at a sample spacing of 25 metres and along 100 metre spaced lines. Soil samples comprised approximately 250-300 grams of soil that was submitted to Eastern Analytical Limited in Springdale, NL. Rock grab and soil samples were assayed via standard 30-gram fire assay and 34-element ICP analysis.

^The existing Mineral Resources referenced in this press release regarding the Great Northern Project refers to the technical report: "NI 43-101 Technical Report and Updated Mineral Resource Estimate on the Rattling Brook Gold Deposit, Great Northern Project, White Bay Area, Newfoundland, Canada", (the "Great Northern Report") with an effective date of January 23, 2019, and authored by Matthew Harrington, P.Geo. (Independent Qualified Person) and Michael Cullen, P.Geo. (Independent Qualified Person).

^^The Thor Deposit Updated Mineral Resource Estimate quoted in this press release refers to the technical report: "NI 43-101 Technical Report And Updated Mineral Resource Estimate On The Thor Deposit, Viking Project, White Bay Area, Newfoundland, Canada", (the "Viking Report") with an effective date of October 24, 2023, and authored by Independent Qualified Persons Matthew Harrington, P.Geo., Rochelle Collins, P.Geo., and Lawrence Elgert, P.Eng.

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Mineral Resources were prepared in accordance with the CIM Definition Standards (May 2014) and the CIM MRMR Best Practice Guidelines (November 2019).

About Magna Terra

Magna Terra Minerals Inc. is a precious metals focused exploration company, headquartered in Toronto, Canada. Magna Terra owns two district-scale, resource stage gold exploration projects in the top-tier mining jurisdictions of New Brunswick and Newfoundland and Labrador. Further, the Company maintains a significant exploration portfolio in the province of Santa Cruz, Argentina which includes its Boleadora Project being advanced by Newmont Corp. under an option to purchase agreement; a precious metals discovery on its Luna Roja Project proximal to Cerrado Gold's operating Don Nicholas Project, as well as several additional district scale drill ready projects available for purchase or option / joint venture.

Forward Looking Statements

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian legislation. All statements in this news release that are not purely historical are forward-looking statements and include statements regarding beliefs, plans, expectations and orientations regarding the future including, without limitation, the ability of the Company to file a report that complies with Regulation 43-101. Although the Company believes that such statements are reasonable and reflect expectations of future developments and other factors which management believes to be reasonable and relevant, the Company can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: "believes", "expects", "anticipates", "intends", "estimates", "plans", "may", "should", "would", "will", "potential", "scheduled" or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, and the ability of the author of the Technical Reports to finalize same.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include the inability of the Company to execute its proposed business plan and carry out planned future activities. Other factors may also adversely affect the future results or performance of the Company, including general economic, market or business conditions, future prices of gold, changes in the financial markets and in the demand for precious metals, changes in laws, regulations and policies affecting the mineral exploration industry, and the Company's investment and operation in the mineral exploration sector, as well as the risks and uncertainties which are more fully described in the Company's annual and quarterly management's discussion and analysis and in other filings made by the Company with Canadian securities regulatory authorities under the Company's profile at www.sedar.com. Readers are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly, are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements.

These forward-looking statements are made as of the date of this news release and, unless required by applicable law, the Company assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in these forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Magna Terra Minerals Inc.

Lewis Lawrick

President and CEO, Director

647-478-5307

Email: info@magnaterraminerals.com

Website: www.magnaterraminerals.com

SOURCE: Magna Terra Minerals Inc.

View the original press release on accesswire.com