Historical Drilling Returned 131 Metres Of 2.55 g/t Gold

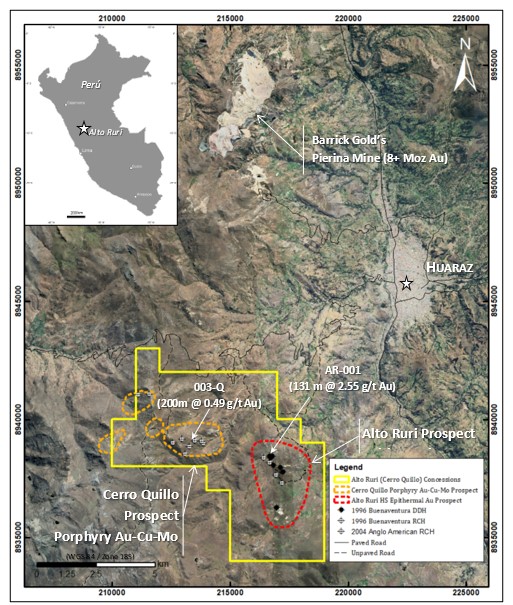

VANCOUVER, BC / ACCESSWIRE / March 4, 2024 / Forte Minerals Corp. ("Forte" or the "Company") (CSE:CUAU)(OTCQB:FOMNF)(Frankfurt:2OA), has finalized the acquisition of the Alto Ruri high sulphidation epithermal gold ("Au") prospect and the Cerro Quillo porphyry Au-copper ("Cu")-molybdenum ("Mo") prospect from its strategic partner Globetrotters Resource Group Inc. ("GlobeTrotters"). Both are situated on a contiguous 4700 ha block of concessions that were initially acquired by Globetrotters from Compañía Minera Ares S.A.C. ("Ares") in exchange for a 1.0% NSR royalty interest. These concessions were transferred to Forte's Peruvian subsidiary, Cordillera Resources Perú S.A.C., in exchange for a one-time cash payment of US$25,000.

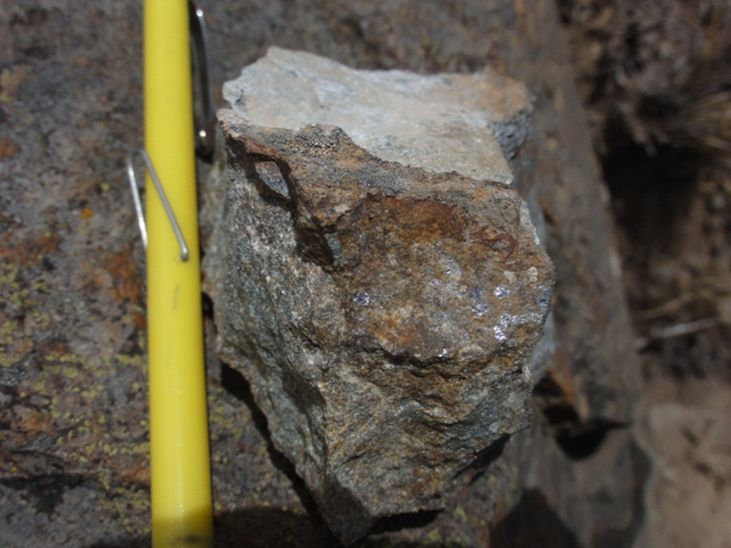

The Alto Ruri prospect was drill tested by Compañía de Minas Buenaventura ("Buenaventura") in 1997 who completed a two-stage, 12-hole drill program that included eight (8) NQ core and a four (4) reverse circulation ("RC") drill holes totalling 2254.5 m. GlobeTrotters' then subsidiary Rio Marañon Minerals S.A.C. ("Rio Marañon") re-analysed portions of the core from the eight (8) diamond drill holes in 2011 with hole 001-97 returning significant Au values averaging 2.55 g/t Au over 131 m starting from surface, including 54 m of 5.39 g/t Au1 (Tables 1 and 2). The Au mineralization is associated with the vuggy silica replacement of quartz-clay altered volcanoclastic rocks typical of high sulphidation epithermal Au alteration (Figure 2) but true widths are unknown.

Table 1: Assay results from diamond drill hole 001-97 at Alto Ruri.

| Hole ID | Interval (m) | From (m) | To (m) | Au (g/t) |

| 001-97 | 131 | 0 | 131 | 2.55 |

| including | 54 | 0 | 54 | 5.39 |

| including | 10 | 10 | 20 | 11.96 |

| including | 2.4 | 23.95 | 26.35 | 37.30 |

The Cerro Quillo prospect was drill tested by Anglo American Exploration Perú S.A. in 2004 who completed a nine (9) hole RC drill program for a total of 2684.90 m. The holes were drilled in the vicinity of the Cerro Quillo Porphyry Complex located three (3) km to the west of Alto Ruri. The historical assay results from hole 003-Q returning 200 m of 0.49 g/t Au, 0.09% Cu, and 0.007% Mo but true widths are unknown (Table 2). The Cerro Quillo Porphyry Complex is a series of mineralized diorite porphyry dikes intruding Miocene aged intermediate to felsic volcanic and volcanoclastic rocks. The system is potassic altered with secondary biotite alteration, A-type and B-type veins, and local magnetite stringers overprinted by a larger 2.5 km x 1.5 km phyllic-argillic alteration zone comprised of pervasive sericite-clay alteration, D-type veins and locally disseminated tourmaline.

Table 2: Reported drill hole collar information (WGS84 Zone 18S).

Hole ID | East | North | Elevation | Azimuth | Dip | Length |

001-97 | 216890 | 8938804 | 4215 | 45 | -70 | 158.1 |

003-Q | 213500 | 8939210 | 4340 | 325 | -60 | 350.75 |

The original source of the historical assay results in RC drill hole 003-Q is from a 2011 technical report prepared by Rio Marañon. The information suggests that porphyry Au-Cu-Mo mineralization may be present in this area. The rock chip and geochemical sample reject materials from 003-Q are no longer available for re-assaying purposes. For that reasons, the historical Au assay results from RC drill hole 003-Q have not been verified by the Company.

The Project is located just 15 km due south of the Pierina Au Mine ("Pierina") owned by Barrick Gold Corp in central Perú which has produced over 8 million ounces ("Oz") of Au since commercial production in 1999 (Figure 1). As with Pierina, these prospects are situated along the Cordillera Negra and associated with Miocene aged volcanic and volcanoclastic rocks forming part of the Tertiary Volcanic Arc which is known to host several large Miocene aged epithermal Au deposits including Newmont's (Minas Buenaventura-Sumitomo) Yanacocha and Minas Congas deposits as well as several large Miocene aged porphyry Cu-Mo-(+Au) deposits including Chinalco's Toromocho, Southern Copper's Michiquillay and Rio Tinto's (First Quantum Minerals) La Granja deposits.

Patrick Elliott, President, and CEO, remarked, "This acquisition is a strategic win for Forte, thanks to the decade-long persistence and determination of our partner, Globetrotters, in securing these prospects. Both lie in the highly prospective Tertiary Volcanic Arc of north-central Peru. This region actively hosts some of South America's largest epithermal Au and porphyry Cu-Mo-Au deposits. Adding these assets to our portfolio enhances our copper and gold asset base. It significantly mitigates the risks associated with the early stages of exploration and discovery in a premier mining jurisdiction."

Exploration Manager, Manuel Montoya comments, "Both the Alto Ruri and Cerro Quillo prospects exhibit large zones of intense hydrothermal alteration and mineralization similar to other large Miocene aged epithermal Au and porphyry Cu-Mo-Au deposits that occur in this prolific mineral belt. The results from the historical drilling on both prospects were very encouraging with significant Au values returned over sizeable widths. We are excited to hopefully continue advancing this project with further drilling."

Additionally, as GlobeTrotters is the beneficial owner of more than 10% of Forte's outstanding shares, it is a "related party" to the Company within the meaning of Multilateral Instrument 61-101- Protection of Minority Security Holders in Special Transactions ("MI 61-101"). As such, the acquisition of the Alto Ruri prospect and the Cerro Quillo prospect constitutes a "related party transaction" within the meaning of MI 61-101.

The Company has relied on exemptions from formal valuation and the minority shareholder approval requirements of MI 61-101 found in sections 5.5(a) and 5.7(1)(a) of MI 61-101 as the fair market value of the transaction does not constitute more than the 25% of the Company's market capitalization.

Qualified Person and NI 43-101 Disclosure

Richard Osmond, P.Geo., is the Company's Qualified Person ("Qualified Person") as defined by National Instrument 43-101 and has reviewed and approved the technical information contained in this news release.

REFERENCE TO HISTORICAL DATA

The data disclosed in this news release is related to historical drilling results. Forte has not undertaken any independent investigation of the sampling, nor has it independently analyzed the results of the historical exploration work in order to verify the results. Forte considers these historical drill results relevant as the Company considers this data to be a significant indication of the exploration potential of the Alto Ruri and Cerro Quillo prospects. Any future exploration work by the Company's will include the verification of the historical data through drilling. Rio Marañon supervised the historical geochemical sampling of portions of the drill core from the eight (8) diamond drill holes completed by Buenaventura at Alto Ruri. The core was logged and sampled by Rio Marañon at a secure storage facility located 27 km to the southeast of Lima, Perú where the core is currently stored. The individual core samples collected for analysis ranged in length from 0.5 m to 10.20 m averaging of 1.94 m and where previously sampled by Buenaventura, the core was quarter cut using a rotary diamond blade saw. The samples were then sealed at the storage facility and transported to ALS Peru S.A.C. ("ALS") an independent analytical laboratory in Lima. ALS analyzed the samples by fire assay on a 30-gram sample with an AAS finish (Au-AA23). Where the Au-AA23 analysis returned greater than 10 ppm Au, a 30-gram split was reanalysed by fire assay fusion with a gravimetric finish (Au-GRA21). In addition to ALS laboratory protocols, Rio Marañon employed an internal QA/QC program that included the insertion of reference standards (source unknown) on site and is not aware of any drilling, sampling, recovery, or other factors that could have materially affected the accuracy or reliability of the data reported. The Qualified Person has reviewed the technical data and the original assay certificate provided by ALS and has verified these results.

ABOUT FORTE MINERALS CORP.

Forte Minerals Corp., a junior exploration company that has blended assets in partnership with GlobeTrotters Resources Perú S.A.C., has built a robust portfolio of high-quality Cu and Au assets in Perú. The Company aims to generate significant value growth by strategically situating early-stage and drill-ready targets alongside a historically discovered and drilled porphyry system for Cu and Au resource development. Notwithstanding its resource focus, Forte is deeply committed to community engagement, environmental stewardship, and fulfilling its societal responsibilities.

On behalf of FORTE MINERALS CORP.

(signed) "Patrick Elliott"

Chief Executive Officer

For further information, please contact:

Forte Minerals Corp.

office: 604-983-8847

info@forteminerals.com

www.forteminerals.com

Certain statements included in this press release constitute forward-looking information or statements (collectively, "forward-looking statements"), including those identified by the expressions "anticipate", "believe", "plan", "estimate", "expect", "intend", "may", "should" and similar expressions to the extent they relate to the Company or its management. The forward-looking statements are not historical facts but reflect current expectations regarding future results or events. This press release contains forward looking statements. These forward-looking statements and information reflect management's current beliefs and are based on assumptions made by and information currently available to the company with respect to the matter described in this new release. Forward-looking statements involve risks and uncertainties, which are based on current expectations as of the date of this release and subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Additional information about these assumptions and risks and uncertainties is contained under "Risk Factors and Uncertainties" in the Company's latest management's discussion and analysis, which is available under the Company's SEDAR+ profile at www.sedarplus.ca, and in other filings that the Company has made and may make with applicable securities authorities in the future..

Forward-looking statements are not a guarantee of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Factors that could cause the actual results to differ materially from those in forward-looking statements include the continued availability of capital and financing, and general economic, market or business conditions. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by such statements. Although such statements are based on management's reasonable assumptions, there can be no assurance that the statements will prove to be accurate or that management's expectations or estimates of future developments, circumstances or results will materialize. The Company assumes no responsibility to update or revise forward-looking information to reflect new events or circumstances unless required by law. Readers should not place undue reliance on the Company's forward-looking statements.

Neither the Canadian Securities Exchange (the "CSE") nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Forte Minerals Corp

View the original press release on accesswire.com