VANCOUVER, BC / ACCESSWIRE / March 7, 2024 / Aztec Minerals Corp. (TSXV:AZT)(OTCQB:AZZTF) announces the final results of Au and multi-element analysis for its 2023 RC drill program at the Cervantes project in Sonora, Mexico. The RC drill program comprised 1,646 meters in 13 RC drill holes testing the California porphyry gold target located in the district of Soyopa, Sonora, Mexico. Total drilling by Aztec Minerals on the Cervantes project since 2016 now totals 67 drill holes and 12,134m.

The California target of near surface, oxide gold porphyry mineralization was successfully expanded, and the presence of anomalous copper, molybdenum and silver, in addition to significant gold mineralization, corresponds well in relation to the top of large, strong IP chargeability anomaly astride an aeromagnetic low anomaly.

RC drill results at the California target returned significant gold mineralization from the 2023 RC drill program on the Cervantes property located in Sonora, Mexico. The multi-element ICP results show good, positive relationships between Au, Cu, Bi, Ag, As, W and K (potassic alteration), negative relationships with Mo, Sb and Ca. The multi-element grades support the potential for an Au-Cu porphyry deposit at depth.

2023 California Target Drill Highlights

- All drill holes intersected oxidized Au mineralization.

- The California target continues to be open.

- The California target now has an area of 1,000 m by 300m drill demonstrated.

- The California target was found to continue on strike to the east at least another 400 m.

The primary focus of the Phase 3A RC drill program at Cervantes was to expand the previously drilled California zone. This was done successfully. To-date, every hole drilled at California has intersected near surface, oxidized gold mineralization with minor copper oxides.

Reported lengths are apparent widths, not true widths, and the observed gold mineralization is hosted in the California porphyry intrusive complex and is widely distributed in disseminations, fractures and veinlets within its quartz-feldspar porphyry, feldspar porphyry stocks, quartzites and related hydrothermal breccias.

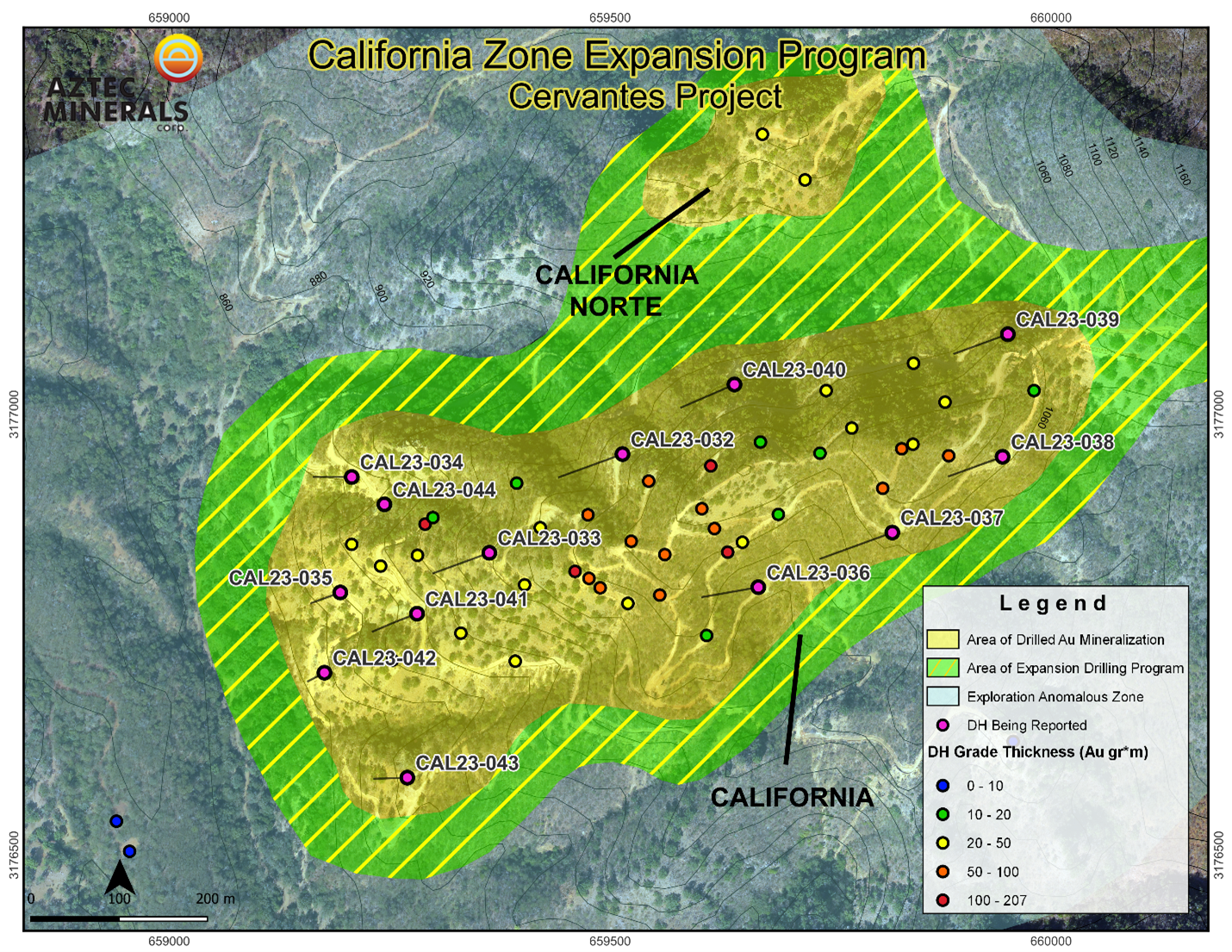

Figure 1: California Zone Drill Progress Map

Holes CAL23-32 to CAL23-44 intersected significant gold mineralization, see table below, extending the known mineralized zone at depth, and also to the north, east and south of the California zone. The RC Phase 3A drilling program has been completed. It covers an area now measuring approximately 1,000 metres long by 300 metres wide, with demonstrated, continuous anomalous mineralization up to 265 metres depth vertically. The porphyry gold-copper mineralization is still open in all directions.

The multi-element ICP results show good, positive relationships between Au, Cu, Bi, Ag, As, W and K (potassic alteration), negative relationships with Mo, Sb and Ca. This will assist in vectoring exploration targets for expanding potentially economic mineralization in a porphyry deposit model. The multi-element ICP values support the exploration model of the California zone being at the highest portion of a porphyry system, where an overlying high sulfidation zone has been eroded away.

Every 2021-23 drill hole except one of the 44 drill holes successfully completed at the California and the adjoining California Norte targets has intersected near surface, oxidized gold mineralization with minor copper values. The 2023 RC drilling exploration program has continued the expansion of the footprint and the depth of the California target Au mineralization and alteration associated with the California porphyry intrusive complex with continued intercepts of broad gold mineralization.

The drill holes were mainly placed in step-out rows subparallel to the 2017-2018 drilling, oriented with azimuths 230 - 260, generally inclined at minus 65 degrees from horizontal. The rows were spaced approximately 50m to 100m apart and along the rows the collar spacings were 70m to 150m. There were four near vertical drill holes and three drill holes with azimuth perpendicular to the pattern that were made to test that there is no drill pattern bias in the results. One metallurgical drill hole (CAL22-027) was made by twinning at 25m distance a prior RC drill hole.

Drilling has also expanded the footprint of the known extents of the mineralized and phyllically altered California porphyry intrusive complex, demonstrating alteration zoning from east to west of argillic to phyllic alteration, multiple stockwork veining and hydrothermal brecciation types and stages, and confirmed the prior IP survey chargeability anomaly was related to disseminated sulfides. The 2022 core drilling program has shown that Au mineralization is limited by the enveloping argillic alteration, and seems to prefer to be close to the argillic/phyllic alteration boundaries.

The gold mineralization is strongly positively associated with Cu, As, Ag, Bi, W and K, while Mo, Sb and Ca anomalies are as haloes distal to the gold, Hg is usually undetectable, Pb and Zn are mainly distal, and Ba has a wide distribution.

The controls on mineralization/zoning are still to be identified. However, the dioritic quartz-feldspar porphyry (Qfp) and hydrothermal breccia (Hbx) lithologic units are seemingly the preferred hosts. The Qfp, Hbx and gold mineralization may be dipping to the north into the California Norte target. The gold mineralization appears to be widely distributed in disseminations, fractures and veinlets at high levels within its quartz-feldspar porphyry, feldspar porphyry stocks, quartzites and related hydrothermal breccias.

The planned testing of the California zone of the Cervantes phase 3A RC drilling program is complete. The primary objectives of the 2021 - 2024 exploration program are to better define the open pit, heap leach gold potential of the porphyry oxide cap at California, evaluate the potential for deeper gold - copper porphyry sulfide mineralization underlying the oxide cap, test for north and west extensions of the California mineralization. In 2024, subject to available funds, it is planned for further technical studies, reconnaissance work on other targets, metallurgical testing and the Cervantes phase 3B RC drilling program of approximately 20 drillholes comprising 2,850 meters including the California North and Jasper targets.

The following is a summary tabulation of all 2021-2023 RC and Core drill hole results:

Table 1: Cervantes 2021-2023 Drilling Select Multi-Element Results with Gold

AZTEC MINERALS CORP | |||||||

CERVANTES PROJECT RC DRILLING | |||||||

Table1: Drill Hole Select Multi-Element Results with Gold | |||||||

Hole No. | From | To | Interval | Gold (gpT) | Copper (%) | Silver(gpT) | Molybdenum PPM |

m | m | m* | |||||

CAL22-001 | 16.72 | 110.96 | 94.24 | 1.038 | 54.72m/0.361 | 72.96m/4.112 | |

CAL22-002 | 4.6 | 103.36 | 98.76 | 0.374 | 16.72m/0.153 | 41.04m/1.226 | |

CAL22-003 | 45.6 | 91.2 | 45.6 | 0.422 | 63.84m/0.107 | 53.2m/2.946 | |

CAL22-004 | 0 | 165.68 | 165.68 | 1.002 | 159.6m/0.065 | 167.2m/1.908 | |

CAL22-005 | 0 | 136.8 | 136.8 | 1.486 | 118.56m/.091 | 118.56m/2.661 | |

CAL22-006 | 16.72 | 117.04 | 100.32 | 0.749 | 138m/0.103 | 165.68m/3.243 | |

CAL22-007 | 83.6 | 147.44 | 63.84 | 0.465 | 107.92m/0.079 | 89.68m/1.429 | |

CAL22-008 | 0 | 54.72 | 54.72 | 0.884 | 33.4m/0.122 | 30.4m/2.36 | |

59.28m/0.096 | 59.28m/59.65 | ||||||

CAL22-009 | 0 | 86.64 | 86.64 | 0.5 | 74.48m/0.138 | 76m/2.386 | |

CAL22-010 | 0 | 138.32 | 138.32 | 0.53 | 95.76m/0.224 | 127.7m/3.567 | |

CAL22-011 | 25.84 | 158.08 | 132.24 | 0.427 | 21.52m/0.053 | 66.88m/2.279 | |

65.36m/0.053 | 65.36m/1.502 | ||||||

CAL22-012 | 41.04 | 193.04 | 152 | 0.872 | 123.12m/0.095 | 165.68m/3.463 | |

CAL22-013 | 139.84 | 147.44 | 7.6 | 0.209 | 54.72m/0.055 | 74.48m/1.489 | |

CAL22-014 | 0 | 54.72 | 54.72 | 0.484 | 31.92m/.0615 | 27.36m/1.361 | |

CAL22-015 | 4.56 | 72.96 | 68.4 | 0.421 | 30.4m/.0622 | 21.28m/2.779 | |

CAL22-016 | 0 | 56.24 | 56.24 | 0.475 | 25.84m/.0981 | 12.16m/2.325 | |

CAL22-017 | 28.88 | 53.2 | 24.32 | 0.315 | 31.92m/0.045 | 12.16m/1.475 | 19.8m/209.8 |

50.2m/0.069 | 10.64m/2.771 | 74.48m/144.57 | |||||

CAL22-018 | 24.32 | 48.64 | 24.32 | 0.216 | 53.2m/0.078 | 86.65m/2.174 | |

191.52 | 202.16 | 10.64 | 0.273 | 68.4m/0.062 | 28.88m/1.116 | 39.52m/122.46 | |

CAL22-019 | 153.52 | 167.2 | 13.68 | 0.269 | 16.72./0.0803 | 59.28m/1.549 | 7.6m/126.6 |

Hole No. | From | To | Interval | Gold (gpT) | Copper (%) | Silver(gpT) | Molybdenum PPM |

m | m | m* | |||||

CAL22-020 | 15.2 | 18.24 | 3.04 | 0.321 | 4.56m/1.833 | ||

CAL22-021 | 100.32 | 104.88 | 4.56 | 0.409 | 3.04m/.0707 | 3.04m/2.2 | |

CAL22-022 | 97.5 | 106.5 | 9.0 | 1.72 | 36m/0.069 | 36m/1.313 | 79.5m/38.15 |

150 | 166.5 | 16.5 | 0.341 | 28.5m/0.21 | 28.5m/3.705 | ||

CAL22-023 | 12.0 | 40.5 | 28.5 | 0.537 | 4.5m/0.0857 | 33m/1.118 | |

81.7 | 89.2 | 7.5 | 0.429 | 7.5m/0.0743 | 7.5m/1.64 | ||

CAL22-024 | 0.0 | 48.0 | 48.0 | 0.444 | 49.5m/0.0521 | 51m/1.644 | |

75.0 | 81.0 | 6.0 | 0.247 | 4.5m/1.06 | |||

CAL22-025 | 0.0 | 9.0 | 9.0 | 0.203 | 90m/0.0658 | 48m/1.083 | |

51.0 | 63.0 | 12.0 | 0.26 | ||||

130.5 | 139.5 | 9.0 | 0.646 | ||||

160.5m/113 | |||||||

CAL22-026 | 0.0 | 213.0 | 210m/40 | ||||

CAL22-027 | 0.0 | 120.0 | 120.0 | 0.677 | 99m/0.1812 | 154.5m/3.499 | |

CAL22-028 | 49.5 | 54.0 | 4.5 | 0.545 | 1.5m/1.3 | ||

226.5 | 235.5 | 9.0 | 0.442 | 1.5m/1.7 | 106.5 m/18 | ||

CAL22-029 | 48.0 | 54.0 | 6.0 | 0.277 | 1.5m/0.0623 | 10.5m/1.343 | |

130.5 | 187.5 | 57.0 | 0.773 | 54m/0.0681 | 39m/1.373 | ||

CAL22-030 | 75.0 | 82.5 | 7.5 | 0.315 | 18m/0.0817 | 18m/1.425 | |

115.5 | 121.5 | 6.0 | 0.544 | 16.5m/1.955 | |||

CAL22-031 | 0.0 | 135.0 | 135.0 | 0.564 | |||

0.0 | 28.5 | 28.5 | 0.873 | 37.5m/0.0556 | 37.5m/2.615 | ||

49.5 | 135.0 | 85.5 | 0.581 | 85.5m/0.0373 | 85.5m/1.946 | ||

2023 RC | |||||||

CAL23-032 | 83.6 | 91.2 | 7.6 | 0.274 | 9.1 m/0.0154 | 10.7 m/3.01 | 9.1 m/1.33 |

CAL23-033 | 45.6 | 59.28 | 13.68 | 0.338 | 13.7 m/0.009 | 13.7 m/0.57 | 13.7 m/5.44 |

CAL23-034 | 53.2 | 83.6 | 30.4 | 1.035 | 35 m/0.1174 | 35 m/2.7 | 35 m/9.1 |

68.4 | 69.92 | 1.52 | 13.8 | 1.5 m/0.4294 | 1.5 m/41.8 | 1.5 m/10 | |

Hole No. | From | To | Interval | Gold (gpT) | Copper (%) | Silver (gpT) | Molybdenum ppm |

m | m | m* | |||||

CAL23-035 | 0 | 30.4 | 30.4 | 0.697 | 38.1 m/0.0839 | 38.1 m/0.43 | 38.1 m/1.6 |

CAL23-036 | 42.56 | 53.2 | 10.64 | 0.901 | 39.6 m/0.0605 | 35.1 m/1.83 | 29 m/8.4 |

51.68 | 53.2 | 1.52 | 5.003 | 1.52 m/0.0337 | 1.52 m/6.4 | 1.52 m/43 | |

107.92 | 115.52 | 7.6 | 0.414 | 7.6 m/0.0205 | 7.6 m/1.6 | 7.6 m/10.6 | |

CAL23-037 | 0 | 25.84 | 25.84 | 0.257 | 51.8 m/0.0369 | 45.7 m/1.1 | 48.8 m/10.3 |

91.2 | 95.76 | 4.56 | 0.658 | 12.1 m/0.0403 | 4.5 m/1.98 | 4.5 m/6.7 | |

156.56 | 164.16 | 7.6 | 0.358 | 10.7 m/0.0353 | 7.6 m/0.52 | 10.7 m/14.4 | |

CAL23-038 | 47.24 | 59.44 | 12.2 | 0.947 | 12.2 m/0.011 | 12.2 m/4.17 | 12.2 m/46 |

48.76 | 50.29 | 1.52 | 4.278 | 1.52 m/0.0419 | 1.52 m/29.4 | 1.52 m/85 | |

72.96 | 83.6 | 10.64 | 0.391 | 10.6 m/0.0029 | 10.6 m/0.12 | 10.6 m/91.3 | |

CAL23-039 | 4.56 | 25.84 | 21.28 | 0.2121 | 21.3 m/0.0094 | 21.3 m/0.65 | 21.3 m/10.8 |

7.6 | 9.12 | 1.52 | 1.352 | 1.52 m/0.0122 | 1.52 m/0.9 | 1.52 m/12 | |

CAL23-040 | 10.64 | 22.8 | 12.16 | 0.365 | 10.6 m/0.0134 | 10.6 m/1.65 | 10.6 m/3 |

CAL23-041 | 0 | 57.76 | 57.76 | 0.424 | 57.8 m/0.2059 | 57.8 m/2.63 | 57.8 m/0.3 |

CAL23-042 | 0 | 12.19 | 12.19 | 0.48 | 24.4 m/0.1758 | 21.3 m/1.82 | 12.2 m/<2 |

65.53 | 73.15 | 7.6 | 0.353 | 7.6 m/0.1768 | 7.6 m/4.3 | 7.6 m/9 | |

CAL23-043 | 0 | 6.08 | 6.08 | 0.235 | 6.1 m/0.0483 | 6.1 m/1.9 | 6.1 m/2.5 |

CAL23-044 | 0 | 59.44 | 59.44 | 0.276 | 74.7 m/0.0724 | 62.4 m/0.65 | 59.4 m/3.5 |

JAS22-001 | 10.64 | 19.76 | 9.12 | 0.332 | 69.9m/0.215 | 65.4m/2.723 | 19.76m/144.92 |

200.6m/0.117 | |||||||

JAS22-002 | 19.5m/0.041 | 87m/46.1 | |||||

7.5m/0.173 | 80m/32.2 | ||||||

PUR21-001 | 16.72 | 19.76 | 3.04 | 0.323 | 51.68m/0.069 | 83.6m/1.942 | |

PUR21-002 | 22.8 | 31.92 | 9.12 | 0.334 | 31.9m/0.168 | 3.04m/1.8 | |

13.68m/0.076 | |||||||

PUR21-003 | 18.2m/0.0518 | 3.04m/1.5 | |||||

PUR22-004 | 25.8m/325.35 | ||||||

- *All intercept interval widths are not true widths and intercept true widths are not yet estimated.

- Au grades are in grams per ton, "gpT"

Drill samples RC cuttings mainly are collected every 1.5m from all core drill holes. The samples are analyzed by Bureau Veritas for gold with a 30-gram sample size using the method FA430 followed by MA300. Over limits, when present, are analyzed by AR404 or FA550. All holes contain certified blanks, standards, and duplicates as part of the quality control program. The QA/QC has delivered excellent results to date good data integrity. The samples are shipped to and received by Bureau Veritas Minerals laboratory for the gold and multielement geochemical analysis.

Cervantes Project Overview

Cervantes is a highly prospective porphyry gold-copper project located in southeastern Sonora state, Mexico. The project lies 160 km east of Hermosillo, Sonora, Mexico within the prolific Laramide porphyry copper belt approximately 265 km southeast of the Cananea porphyry copper-molybdenum mine (Grupo Mexico). Cervantes also lies along an east-west trending gold belt 60 km west of the Mulatos epithermal gold mine (Alamos Gold), 35 km northeast of the Osisko San Antonio gold mine, 45 km west of the La India mine (Agnico Eagle), and 40 km northwest of Santana gold deposit (Minera Alamos).

View: Cervantes Project Location Map

Cervantes Project Highlights

- Large well-located property (3,649 hectares) with good infrastructure, road access, local town, all private land, water wells on property, grid power nearby

- Seven prospective mineralized zones related to high level porphyries and breccias along a 7.0km east-northeast corridor with multiple intersecting northwest structures

- Distinct geophysical anomalies, California target marked by high magnetic and low resistivity anomalies, high radiometric and chargeability anomalies responding to pervasive alteration

- Extensive gold mineralization at California target, 118 soil samples average 0.44 gpt gold over 900 m by 600 m area, trench rock-channel samples up to 0.47 gpt gold over 222 m

- Already drilled the first discovery holes at the California target, intersected gold oxide cap to a classic gold-copper porphyry system, drill results up to 1.49 gpt gold over 137 m and 1.00 gpT gold over 165m

- Excellent gold recoveries from preliminary metallurgical tests on drill core from California target; oxide gold recoveries in bottle roll tests range from 75% to 87%

- California IP geophysical anomaly wide open laterally and at depth, IP chargeability strengthens and broadens to >500m depth over an area 1100 m by 1200 m, and has been confirmed by exploration drilling

- Three-Dimensional IP Survey conducted in 2019 extends strong chargeability anomalies to the southwest covering Estrella, Purisima East, and Purisima West, coinciding well with alteration and Au-Cu-Mo soil geochemical anomalies

- Cervantes Project Aeromagnetics Survey completedin 2019 found a magnetic low associated with the California Au porphyry

California Target

In 2017-18, Aztec completed a Phase 1, 17 diamond core hole drill program, totaling 2,675 meters (m) (see news release dated June 26, 2018). Phase 1 drilling tested the California target 900m by 600m gold-in-soils anomaly that averaged 0.44gpt covering hydrothermal breccias within the Quartz feldspar porphyry stock intruding Paleozoic siliciclastic sediments.

In 2019 a series of technical studies were conducted including airbourne geophysics (Gravity, magnetics, radiometrics, and VLF, surface IP, soil and outcrop geochemistry, and geologic mapping and completing initial metallurgical studies with positive results.

Then in late 2021 and into 2022, Aztec completed a Phase 2, 26-hole, RC (reverse circulation) drill program totaling 5,267 m focused on expanding the California target with two drill hole fences parallel to and on either side of the 2017-18 Phase 1 drill hole fence. The Phase 2 RC drilling program was followed by the Phase 2 oriented core drilling program of 2,588 meters in 11 drill holes combined successfully expanded the primary California target to an area measuring approximately 1,000 meters long by 300 to 500 meters wide, with demonstrated, continuous anomalous mineralization to over 265 meters depth vertically.

The porphyry gold-copper mineralization is still open in all directions. Aztec's drilling to-date has consistently intersected an oxidized gold cap to a porphyry-type gold-copper-silver system at California, including multiple 100+ meter widths of exceeding 0.40 gpt gold.

Highlights of the 2017-18 Phase 1 diamond core and 2021-22 Phase 2 RC and Core (see news releases dated June 14, 2022 and December 27, 2022) drill programs are as follows:

- 137m @ 1.49 gpT Au incl 51.7m @ 3.42 gpT Au, 119m @ 0.091% copper in CAL22-005

- 165m @ 1.00 gpT Au incl 24.4m @ 4.25 gpT Au, 160m @ 0.065% copper in CAL22-004

- 152m @ 0.87 gpT Au, incl 33.5m @ 2.05 gpT Au, 123m @ 0.095% copper in CAL22-012

- 94m @ 1.04 gpT Au incl 15.2m @ 3.96 gpT Au, 55m @ 0.36% copper in CAL22-001

- 100m @ 0.75 gpT Au incl 9.14m @ 3.087 gpT Au, 138m @ 0.10% copper in CAL22-006

- 160m @ 0.77 gpT gold incl 80m @ 1.04 gpT gold, 0.11% copper in 18CER010

- 139m @ 0.71 gpT gold incl 20m @ 2.10 gpT gold, 0.16% copper in 17CER005

- 118m @ 0.63 gpT gold incl 43m @ 1.18 gpT gold, 0.16% copper in 17CER003

- 122m @ 0.60 gpT gold incl 62m @ 0.88 gpT gold, 0.06% copper in 18CER007

- 170m @ 0.42 gpT gold incl 32m @ 0.87 gpT gold, 0.06% copper in 18CER006

Preliminary metallurgical tests on California drill cores were conducted in 2019 (see news release dated March 12, 2019). Drill core samples were grouped into 4 separate types of mineralization: Oxide 1, Oxide 2, Mixed Oxide/Sulfide and Sulfide. The preliminary results of bottle roll tests showed excellent potential for heap leach gold recovery, as follows:

- 85.1% recovery on 2.0mm material and 94.3% on 75-micron material in sample Oxide 1

- 87.7% recovery on 2.0mm material and 94.2% on 75-micron material in sample Oxide 2

- 77.9% recovery on 2.0mm material and 89.0% on 75-micron material in sample Mixed Oxide/Sulphide

- 51.2% recovery on 2.0mm material and 78.7% on 75-micron material in sample Sulphide

Additional Exploration Targets

Purisima East - outcropping gossans, altered and mineralized diatreme breccias and porphyry intrusions marked by a 700m by 600m geochemical soil anomaly in 193 samples that average 0.25 gpt gold, a small historic 'glory hole' mine where rock chip sampling returned high-grade mineralization up to 44.6 gpt gold.

Estrella - outcrops of gossan and sulfides in silicified Paleozoic sediments near quartz porphyry dikes with rock chip samples up to 3.9 gpt gold and 2,010ppm copper.

Purisima West - a mirror image of Purisima East in size and type of gossans, altered and mineralized breccias and intrusions in association with gold and copper soil anomalies.

Jasper - 2017 trenching returned skarn/replacement-type mineralization up to 0.52% copper and 0.62 gpt gold over a 92.4 m length. In 2022 RC drilling found a broad zone of copper - gold mineralization in JAS22-001.

California North - coincident IP chargeability and gold-copper-molybdenum soil geochemical anomalies with demonstrated gold - copper mineralization by RC drilling, it may be a north extension of the California target

Other zones - porphyry alteration and geochemical soil anomalies mark the Jacobo and Brasil prospects but more work is required to expand and define these targets

Allen David Heyl, B.Sc., CPG., VP Exploration of Aztec, is the Qualified Person under NI43-101, supervised the Cervantes exploration program. Mr. Heyl has reviewed and approved the technical disclosures in this news release.

"Simon Dyakowski"

Simon Dyakowski, Chief Executive Officer

Aztec Minerals Corp.

About Aztec Minerals - Aztec is a mineral exploration company focused on two emerging discoveries in North America. The Cervantes project is an emerging porphyry gold-copper discovery in Sonora, Mexico. The Tombstone project is an emerging gold-silver discovery with high grade CRD silver-lead-zinc potential in southern Arizona. Aztec's shares trade on the TSX-V stock exchange (symbol AZT) and on the OTCQB (symbol AZZTF).

Contact Information - For more information, please contact:

Simon Dyakowski, President & CEO, Director

Tel: (604) 685-9770

Fax: (604) 685-9744

Email: info@aztecminerals.com

Website: www.aztecminerals.com

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Forward-Looking Statements:

Certain statements contained in this press release may constitute forward-looking statements under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "expects" or "it is expected", or variations of such words and phrases or statements that certain actions, events or results "will" occur. These forward-looking statements are subject to a number of risks and uncertainties. Actual results may differ materially from results contemplated by the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. When relying on forward-looking statements to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and should not place undue reliance on such forward-looking statements. The Company does not undertake to update any forward-looking statements, except as may be required by applicable securities laws.

SOURCE: Aztec Minerals Corp.

View the original press release on accesswire.com