TORONTO, March 13, 2024remains very strong at 115%, meaning that for every dollar owed in pensions, it has $1.15 in assets (all numbers in this release as at Dec. 31, 2023).

HOOPP delivered strong returns across many asset classes, including fixed income, public equities, private equity and private credit. The investment team increased exposure to bonds after yields rose in the summer and into the fall, contributing significantly to strong performance when bond and stock markets rallied late in the year.

"In 2023, there was considerable economic uncertainty resulting from several factors, including increased geopolitical tension, persistent inflationary pressures, and unsteady global growth," said Jeff Wendling, President & CEO, HOOPP. "Amidst this volatility, HOOPP delivered strong returns in support of our pension promise to the healthcare workers of Ontario."

He added: "As a pension delivery organization, we are focused on building a portfolio to best deliver on the pension promise. Last year, the market volatility provided an opportunity to increase our exposure to real return bonds at attractive valuations, protecting the Fund against inflation and generating value for the Plan."

By year-end, inflation-indexed bonds comprised roughly half of HOOPP's target portfolio allocation to bonds, which continues to align investment assets with the Plan liabilities and supported HOOPP's ability to grant a cost-of-living adjustment to retired members in 2024.

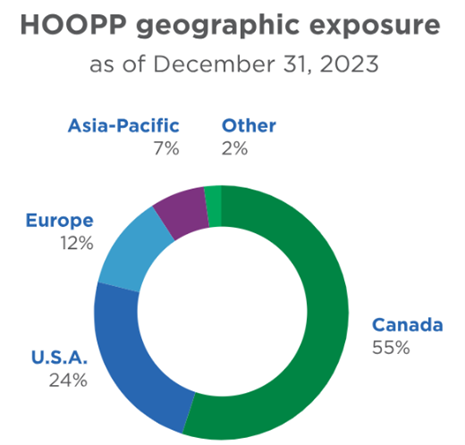

The strong 2023 return was bolstered by our strong Canadian portfolio. Over $60 billion of HOOPP's assets are invested in Canada. This includes real estate, such as major industrial and logistics parks, office towers and housing. It also includes supporting Canadian innovation and entrepreneurship by investing in home-grown companies. HOOPP is also one of the biggest investors in Canadian bonds, which comprise about half the Canadian portfolio. Money raised through government bond sales helps pay for the public services and infrastructure Canadians rely on - including hospitals, public transportation and schools.

"Our commitment to investing in Canada is strong. Canada is not only our home, but also a safe and stable country that offers attractive investment opportunities," said Michael Wissell, Chief Investment Officer, HOOPP.

He added: "The bond portfolio is the backbone of HOOPP's LDI (Liability Driven Investing) strategy and helps offset the sensitivity of the Plan's liabilities to changes in interest rates and inflation. Bonds provide government-guaranteed rates of return, serve as high-quality liquid collateral to support other investment activity, and are a diversifying asset for the Fund."

Other highlights from the year included:

- Climate Plan: Reinforced our long-standing commitment to sustainable investing with the launch of our climate change strategy (https://hoopp.com/investments/sustainable-investing/climate-change) in March, outlining our approach for achieving net-zero portfolio emissions by 2050. Progress updates can be found in the Annual Report and on hoopp.com.

- Retirement security research: Continued our research around improving retirement security outcomes for all Canadians, including commissioning a discussion paper by Former Bank of Canada Governor Stephen Poloz (https://hoopp.com/home/pension-advocacy/research/pensions-in-the-next-age-of-uncertainty-stephen-poloz/), which suggested Canada may be heading for a renaissance of defined benefit pension plans.

- Supporting healthcare through growth: Continued to expand our value to Ontario's healthcare sector by growing the number of HOOPP employers from 646 to 677, and the number of members from 439,630 to 460,381.

"HOOPP had a successful year on many fronts and I'm proud of all that the team accomplished," Wendling said. "At the core of all we do is our commitment to our pension promise to the healthcare workers of Ontario, so we are pleased to have delivered significant value to our members this past year, maintaining our strong funded status so pensions remain secure."

Performance by Asset Class

| 2023 % Return | ||

| Fixed Income | 4.28 | % |

| Public Equities | 15.71 | % |

| Credit | 4.55 | % |

| Private Equity | 15.90 | % |

| Real Estate | -6.50 | % |

| Infrastructure | 8.17 | % |

| Private Credit | 9.33 | % |

About the Healthcare of Ontario Pension Plan

HOOPP serves Ontario's hospital and community-based healthcare sector, with more than 670 participating employers. Its membership includes nurses, medical technicians, food services staff, housekeeping staff, and many others who provide valued healthcare services. In total, HOOPP has more than 460,000 active, deferred and retired members.

HOOPP is fully funded and manages a highly diversified portfolio of more than $112 billion in assets that span multiple geographies and asset classes. Over $60 billion of HOOPP's assets are invested in Canada and HOOPP is one of the biggest investors in Canadian bonds, with over $40 billion in total government bond holdings. HOOPP is also a major contributor to the Canadian economy, paying more than $3 billion in pension benefits to Ontario healthcare workers annually.

HOOPP operates as a private independent trust, and is governed by a Board of Trustees with a sole fiduciary duty to deliver the pension promise. The Board is jointly governed by the Ontario Hospital Association (OHA) and four unions: the Ontario Nurses' Association (ONA), the Canadian Union of Public Employees (CUPE), the Ontario Public Service Employees' Union (OPSEU), and the Service Employees International Union (SEIU). This governance model provides representation from both management and workers in support of the long-term interests of the Plan.

Contact:

James Geuzebroek, Director, Media & External Communications

jgeuzebroek@hoopp.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/9adcb5fa-ad80-4bd0-b390-e4c15043257d

https://www.globenewswire.com/NewsRoom/AttachmentNg/987a92e4-ab1a-4af7-bbda-62e2feb55ffa

https://www.globenewswire.com/NewsRoom/AttachmentNg/0c604015-d0f4-4b88-b1f7-8824b047e369