CALGARY, AB / ACCESSWIRE / March 13, 2024 / Avila Energy Corporation ("AVILA" or the "Company") announces that it has appointed Kenway Mack Slusarchuk Stewart LLP Chartered Professional Accountants (""KMSS") as the Company's independent auditor to hold office until the next Annual General Meeting of Shareholders.

Change in auditor.

Effective March 5, 2024, at the request of the Company, Avila's predecessor WDM Chartered Professional Accountants ("WDM") resigned as auditors and KMSS was appointed to fill their vacancy for the fiscal year ended December 31, 2023.

In accordance with the requirements of National Instrument 51-102, a notice of change in auditor ("Notice of Change") dated March 5,2024, with an effective date of March 5, 2024, was sent to KMSS and WDM, each of whom have provided a letter confirming their agreement with the statement in the Notice of Change.

Appointment of new Chief Financial Officer

The Company is also pleased to announce the appointment of Donica Ingot-Candia, CPA (Philippines) as Avila's new Chief Financial Officer.

Ms. Igot-Candia brings over ten years of combined experience in finance and leadership experience. She was formerly a controller with a private Company in Calgary Alberta and has held various accounting positions with companies in the Philippines. Her areas of expertise include corporate finance, M&A, modeling, capital markets, financial reporting, and strategic planning.

About Avila Energy Corporation

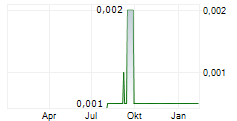

The Company is an emerging CSE listed corporation trading under the symbol ('VIK'), and in combination with an expanding portfolio of 100% Owned and Operated oil and natural gas production, pipelines and facilities is a licensed producer, explorer, and developer of Energy in Canada. The Company's long-term vision is to achieve through the implementation of a closed system of carbon capture and sequestration, an established path towards the material reduction of Tier 1, Tier 2 and Tier 3 emissions and continues to work towards becoming a vertically integrated Carbon Neutral Energy Producer. The Company's goals are to be achieved by focusing on the application of proven geological, geophysical, engineering, and production techniques in combination with the delivery of Direct-to Consumer energy sales to both residential and commercial consumers.

| For further information, please contact: | Leonard B. Van Betuw, President & CEO | |

| leonard.v@avilaenergy.com | ||

| Peter Nesveda, Investor Relations, International | ||

| peter@intuitiveaustralia.com.au |

ON BEHALF OF THE BOARD

Leonard B. Van Betuw

President & CEO

Contact Phone Number: 1-403-451-2786

Abbreviations

bbls/d - barrels per day

BOE/d- barrels oil equivalent per day NGLs - Natural Gas Liquids

Mboe - Thousands of barrels of oil equivalent MMboe - Millions of barrels of oil equivalent PDP - Proved Developed Producing

TP - Total Proved Reserves

TPP - Total Proved and Probable Reserves

IFRS - International Financial Reporting Standards as issued by the International Accounting Standards Board

WTI - West Texas Intermediate, the reference price paid in U.S. dollars at Cushing, Oklahoma for the crude oil standard grade

Forward-Looking Information & Forward-Looking Statements Cautionary Statement

Certain information in this news release, including the operations at the Company's properties, constitute forward-looking statements under applicable securities laws. Although Avila Energy Corporation believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them because Avila Energy Corporation can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherentrisks and uncertainties. The forward-looking statements contained in this news releaseare made as at the date of this news release and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a resultof new information, future eventsor otherwise, exceptas may be required by applicable securities laws. This release includescertain statements that may be deemed "forward-looking statements." All statements in this release, other than statements of historical facts, that address future production, reserve potential, exploration drilling, exploitation activities and eventsor developments that the Companyexpects are forwardlooking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual resultsor developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploitation, and exploration successes, continued availability of capital and financing, and general economic, market or business conditions. It should not be assumed that theestimates of net present value of future net revenue attributable to the Company'sreserves presented aboverepresent the fair market value of the reserves. The recovery and reserve estimates of the Company's oil, NGL, and natural gas reserves provided herein are estimates only and there is no guarantee that the estimated reserves will be recovered. Further, there is no assurance that the forecast prices and cost assumptions will be attained, and variances couldbe material. Investors are cautioned that any such statements are not guarantees of future performance and those actualresults or developments may differ materially from those projected in the forward-looking statements. Barrel("bbl") of oil equivalent ("boe") amounts may be misleading particularly if used in isolation. All boe conversions in this report are calculated using a conversion of six thousand cubic feet of natural gas to one equivalent barrel of oil (6 mcf=1 bbl) and is based on an energyconversion method primarily applicable at the burner tip and does not represent a value equivalency at the well head. This news release shall not constitute an offer to sell or the solicitation of any offer to buy, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended,and may not be offeredor sold in the United States absent registration or applicable exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws. Trading in the securities of Avila Energy Corporation should be considered highly speculative. Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Stock Exchange) accepts responsibility for the adequacy or accuracy of this release. For more information on the Company, Investors should review the Company's registered filings which are available at www.sedarplus.ca.

SOURCE: Avila Energy Corporation

View the original press release on accesswire.com