Arco, Italy, March 14, 2024 (GLOBE NEWSWIRE) --

FINANCIAL YEAR 2023

COMPLETED THE START-UP ACTIVITIES

OF ENGINEERING PLASTICS IN EMEA

ECONYL® BRANDED AND REGENERATED PRODUCTS ACCOUNTED

FOR 49,6% OF REVENUES GENERATED FROM FIBERS

SLIGHT DECLINE IN VOLUMES COMPAREDO TO 2022

MAINLY RELATED TO FIBERS FOR GARMENTS IN EMEA

DECLINE IN MARGINS IN 2023

DUE TO THE HIGH UNIT VALUE OF THE INVENTORIES STOCKED IN 2022

COMPARED TO THE MARKET VALUE OF RAW MATERIALS

MAIN 2023 INDICATORS:

- Revenues: €571.8 million, -16.4% compared to €684.1 million for 2022;

- EBITDA: €47.5 million, -48.5% compared to €92.3 million for 2022;

- Net result: €25.8 million loss compared to a €29.2 million profit for 2022;

- Net Debt/EBITDA ratio at x5.23 at December 31, 2023 compared to x2.69 at December 31, 2022.

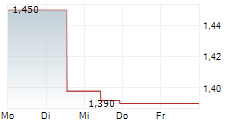

Arco, March 14, 2024 - The Board of Directors of Aquafil S.p.A. [ECNL:IM] [ECNLF:OTCQX], chaired by Prof. Chiara Mio, met today and approved the Company's consolidated operating and financial results at December 31, 2023.

Giulio Bonazzi, Chief Executive Officer, stated:

"The year 2023 was characterized by a strong volatility of the reference market. The trends anticipated during the presentation of the Company's targets last November were confirmed by the Group's consolidated results.

Overall, the year just ended showed a modest volume decline compared to the previous one, though with different dynamics across the various product lines.

In the fourth quarter, demand in EMEA exceeded that recorded in the same period of the previous year for both fibers for carpets and polymers. As for the product line relating to fibers for garments, the strong weakness that characterized the whole year continued.

In terms of volumes sold, the United States showed a slightly weak performance in the markets of fibers for carpets and for garments.

In Asia Pacific, volumes sold remained substantially aligned to the 2022.

The Engineering Plastics project in EMEA reached the objectives set for 2023, thus confirming the growth expectations for the next two-year period.

Margins significantly decreased as a result of the sharp decline in 2023 of the high unit value of inventories stocked in 2022, with an effect on the year of €24 million.

Volumes sold of ECONYL® branded products exceeded the previous year's levels.

The Group confirms the operating and financial results previously announced, while continuing to pursue the strategic goals of increasing productivity and energy efficiency, as well as reducing costs and containing debt."

Outlook

As stated during the previous events, in 2023 Europe witnessed a sharp, important decline in the prices of raw materials. This entailed a significant mismatch between the unit values of inventories stocked in 2022 and the market price, with a temporary, yet significant impact on the Group's margins. The results reported were negatively impacted by these trends, but they are in line with our previous announcements to the market.

Despite the uncertainty associated with the raw materials trends, the Company expects an increase in volumes across all three product lines for the 2024-2025 period. It also expects a recovery in the market of fibers for garments in EMEA and the United States following the sharp reduction witnessed in 2023, as well as new prospects for polymers thanks to the contribution of Engineering Plastics and a constantly growing market of fibers for carpets in Asia Pacific.

Our target to reduce net financial position by 2025 of approximately €50-60 million remains confirmed. This result will be obtained through a higher EBITDA generated and the efficiency measures implemented during the period.

The Company continues to monitor the achievement of the business targets, also in light of the ongoing macro-economic instability due to the current global geopolitical uncertainty.

The first months of the year confirm the guidance presented last November.

* * *

The full press release is available at: https://www.aquafil.com/investor-relations/press-releases/

* * *

Aquafil is a pioneer in the circular economy also thanks to the ECONYL® regeneration system, an innovative and sustainable process able to create new products from waste and give life to an endless cycle. The nylon waste is collected in locations all over the world and includes industrial waste but also products - such as fishing nets and rugs - that have reached the end of their useful life. Such waste is processed to obtain a raw material - caprolactam - with the same chemical and performance characteristics as those from fossil sources. The polymers produced from ECONYL® caprolactam are distributed to the Group's production plants, where they are transformed into yarn for rugs carpet flooring and for clothing.

Founded in 1965, Aquafil is one of the main producers of nylon in Italy and worldwide. The Group is present on three different continents, employing about 2,650 people at 19 production sites located in Italy, Slovenia, Unites States, China, Croatia, Chile, Thailand and Japan.

For further information

Investors Contact

Giulia Rossi

investor.relations@aquafil.com

+39 327 0820 268

U.S. Contact:

Joe Hassett

joeh@gregoryfca.com

610-787-0464 (Cell)