Transactions Consolidate Multiple Overlapping Mineralized Systems Under Quartz Control

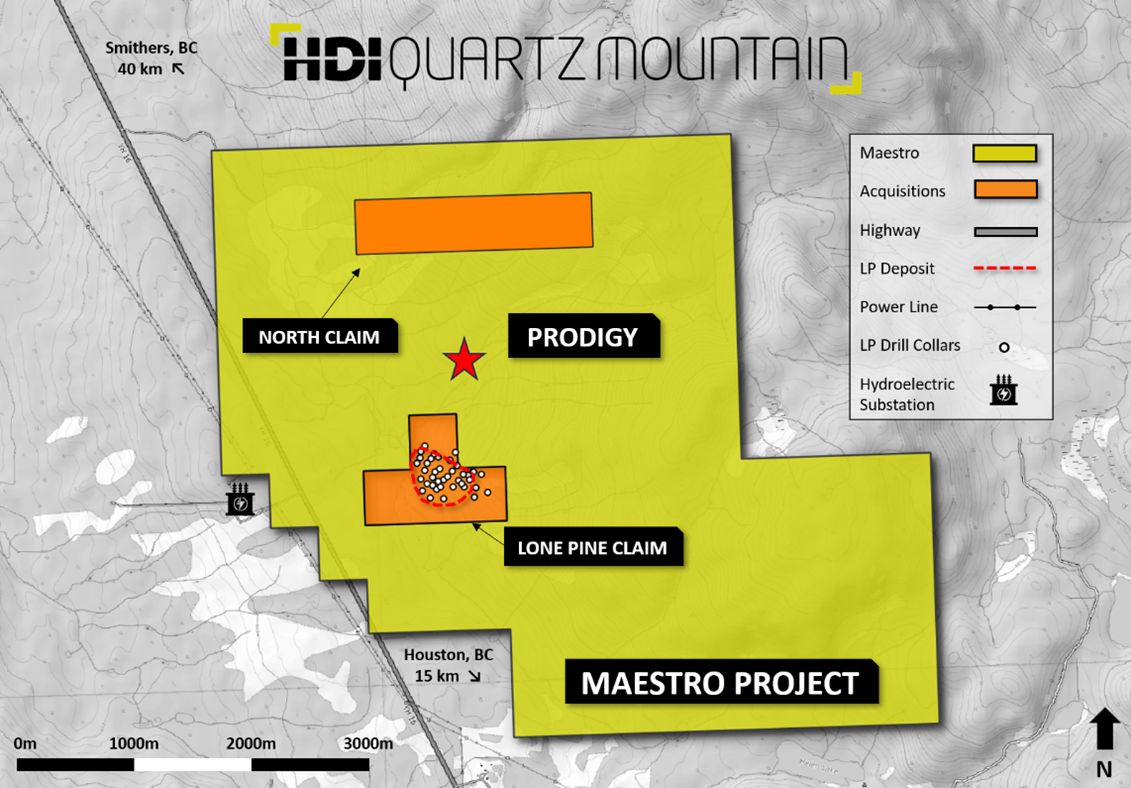

VANCOUVER, BC / ACCESSWIRE / March 19, 2024 / Quartz Mountain Resources Ltd. ("Quartz" or the "Company") (TSXV:QZM)(OTC PINK:QZMRF) is pleased to announce the Company has agreed under two separate transactions, to purchase a 100% interest in each of the Lone Pine Claim and the North Claim (the "Acquisitions"). These two mineral claims total 169 hectares and are located within the Company's 100%-owned Maestro Property located 15km north of the town of Houston, British Columbia.

Consolidation of the 2,309 -hectare Maestro Project area allows continuous, through-going access to explore the potential for multiple overlapping precious and base metal systems in their entirety. As such, they add significant value to the Company's strategic plan to develop and transact the Maestro Project. In December 2023, Quartz completed 1,445 meters of diamond drilling in two holes at the Prodigy Au-Ag-Mo-Cu epithermal target approximately 1km north of the Lone Pine porphyry deposit. In addition, Quartz also completed surface and downhole geophysical surveys over the newly drilled area immediately after completion of its two drill holes. Results from the 482 core samples collected during that drill program are being processed and expected to be announced within the next three weeks.

Bob Dickinson, Chairman of Quartz commented, "These claim acquisitions are strategically important to Quartz as they allow us to rapidly move the Maestro Project forward. Our property assessments to date indicate Maestro hosts multiple overlapping precious and base metal mineralizing events over a large area. Historical drilling of 24,300 meters at Lone Pine delineated a sizable and higher-grade molybdenum porphyry deposit. We believe this system is the heat-engine for potentially extensive, epithermal gold and silver mineralization in addition to molybdenum and copper outboard of the Lone Pine deposit."

The Lone Pine mineral claim was purchased from Eagle Plains Resources Ltd., an arms-length vendor, for 750,000 common shares of the Company and a 2% NSR royalty, of which 1.5% can be purchased at any time by payment of $5 million. The shares are subject to a 24-month contractual resale restriction and a further right for the Company to arrange purchasers of the shares in the case of resales after that period. The Lone Pine transaction is subject to customary TSX Venture Exchange acceptance and closing conditions.

The North mineral claim was purchased from Shawn Merkley, an arms-length vendor, for $24,000, 45,000 common shares of the Company, and a 2% NSR royalty which can be purchased at any time by a payment of $2 million. The cash and common shares will be paid in three equal installments ($8,000 and 15,000 common shares) over two years with the first installment due upon closing. The North transaction is subject to customary TSX Venture Exchange acceptance and closing conditions.

Historical Resource Estimate at Lone Pine Claim1

Drilling of some 24,300 meters was completed historically in 49 holes at the porphyry molybdenum deposit on the Lone Pine claim by previous owners. A historical estimate of the mineral resources was also done and comprises Measured and Indicated Resources (M+I) of 110Mt grading 0.083% Mo, and Inferred Resources of 25.8Mt grading 0.088% Mo at a 0.04% Mo cut-off described in NI-43-101 Technical Report, effective date of January 21, 2011, by P & E Mining Consultants Inc. for Bard Ventures Ltd.

A qualified person has not done sufficient work to classify the historical estimate as current mineral resources and the issuer is not treating the historical estimate as current mineral resources.

Additional work needs to be done to upgrade or verify the historical estimate as current mineral resources. Quartz has not yet conducted any drilling on the Lone Pine mineral property. Thus, the historical estimate and historical drilling are of uncertain relevance and reliability.

Qualified Person

Farshad Shirmohammad, M.Sc., P.Geo., a Qualified Person as defined under National Instrument 43-101, who is not independent of Quartz Mountain Resources Ltd., has reviewed and approved the technical content of this news release.

1 Technical Report and Preliminary Economic Assessment of the Lone Pine Project for Bard Ventures Ltd by P&E Mining Consultants Inc., effective date January 21, 2011, is filed on the profile for St James Gold Corp. (formerly Bard Ventures Ltd.) at www.sedarplus.ca.

M+I includes 33.4Mt grading 0.092% Mo in measured category and 76.98Mt grading 0.079% Mo in indicated category.

The historical estimate used ordinary kriging constrained by grade domain and lithologic solid models. Only molybdenum grades were estimated. Assay grade distribution was evaluated statistically before compositing with no cutting or capping deemed necessary. Density measurements were made on 83 core samples; density was assigned based upon the median value for each lithologic domain. "Best Fit? 10 m downhole composites were generated within a grade shell domain based on a 0.02% Mo cut-off grade. Semi-variograms were modeled in order to develop kriging parameters, search parameters and anisotropy. Block size was set at 20 x 20 x 10 m, and block grades estimated using three interpolation passes with increasing search distance. The model was validated by comparing to nearest neighbour estimated and composite grade distributions, swath plots and visual inspection of sections and plans. Classification as measured, indicated and inferred was based upon constraints including zone, drilling density and distance to nearest composite. The report states that classification was done in accordance with CIM Standards.

A preliminary open pit optimization was carried out in order to identify potential open pit resources. A number of Lerchs-Grossmann pit shell envelopes were generated by varying operating costs, metal prices and pit slope parameters. The 0.04% cutoff assumed a Mo price of US$25/lb. (85% recovery), mining cost of $2.00 per rock tonne and processing/refining/general and administration ("G&A") costs of $10.00 per tonne processed.

About Quartz

Quartz Mountain Resources Ltd. (TSXV:QZM),(OTC PINK:QZMRF) is a restructured mineral exploration company headquartered in Vancouver, Canada. It is focused on discovering and transacting high-value gold, silver, and copper projects. The Company holds 100% of the Maestro Gold-Silver-Molybdenum-Copper Property and 100% of the Jake Copper-Gold-Silver Property. Both projects have access to infrastructure and high potential for important resources and future transactions. The BC government has awarded permits for 50 drill sites for each project.

Quartz is associated with Hunter Dickinson Inc. (HDI), a company with over 35-years of successfully discovering, developing, and transacting mineral projects in Canada and internationally. Former HDI projects in BC included, Mount Milligan, Kemess South, and Gibraltar - all of which are porphyry deposits with current or former producing mines. Other well-known projects with HDI involvement include Sisson and Prosperity in Canada, Pebble and Florence in the United States, and Xietongmen in China.

Quartz is committed to the advancement of important scale, critical and essential mining assets while following responsible mineral development principles, including a mandate to employ best practice approaches in the engagement and involvement of local communities, and meeting rigorous environmental standards.

On behalf of the Board of Directors

Robert Dickinson

Chairman

For further details, contact Robert Dickinson at:

T: (604) 684-6365 or within North America at 1-800-667-2114.

E: info@quartzmountainresources.com

W: www.quartzmountainresources.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information.

This release includes certain statements that may be deemed "forward-looking-statements". All statements in this release, other than statements of historical facts are forward-looking-statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Assumptions used by the Company to develop forward-looking statements include the following: the Company's projects will obtain all required environmental and other permits, and all land use and other licenses, studies and exploration of the Company's projects will continue to be positive, and no geological or technical problems will occur. Though the Company believes the expectations expressed in its forward-looking-statements are based on reasonable assumptions, such statements are subject to future events and third party discretion such as regulatory personnel. Factors that could cause actual results to differ materially from those in forward-looking statements include variations in market prices, continuity of mineralization and exploration success, and potential environmental issues or liabilities associated with exploration, development and mining activities, uncertainties related to the ability to obtain necessary permits, licenses and tenure and delays due to third party opposition, changes in and the effect of government policies regarding mining and natural resource exploration and exploitation, and exploration and development of properties located within Aboriginal groups asserted territories that may affect or be perceived to affect asserted aboriginal rights and title, and which may cause permitting delays or opposition by Aboriginal groups, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, and the risks and uncertainties connected with its business, investors should review the Company's home jurisdiction filings as www.sedarplus.ca and its 20F filings with the United States Securities and Exchange Commission at www.sec.gov.

SOURCE: Quartz Mountain Resources Ltd.

View the original press release on accesswire.com