- Prioritizing and focusing on highest-value opportunities NC410 (ovarian and CRC) and LNCB74 (B7-H4 ADC)

- Based on early evidence of clinical activity with NC410 combo, expanding ovarian and CRC cohorts with data updates in 2024

- LNCB74, in collaboration with LegoChem, planned filing of an IND by year-end 2024

- Restructuring of our operations, including a reduction in workforce to better align resources toward prioritized programs

- Cash of approximately $108 million, combined with the restructuring, now expected to fund operations into the second half of 2026

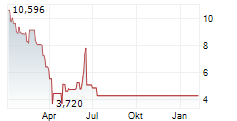

BELTSVILLE, Md. - March 21, 2024, March 21, 2024 (GLOBE NEWSWIRE) -- NextCure, Inc. (Nasdaq: NXTC), a clinical-stage biopharmaceutical company committed to discovering and developing novel, first-in-class and best-in-class therapies to treat cancer today provided a business update and reported full year 2023 financial results.

"Clinical data generated in 2023 enabled us to objectively assess each program and set our priorities for 2024. Based on that assessment, we will prioritize NC410 combo and LNCB74 in 2024, while seeking to partner our other portfolio assets," said Michael Richman, NextCure's president and chief executive officer. "These strategic decisions have led to restructuring our workforce reflecting our reduced need for internal GMP manufacturing operations. We believe we have sufficient inventory to support our currently planned clinical trials. I wish to thank those employees who are impacted today for their contributions and dedication to our mission."

Mr. Richman continued, "We are excited to focus on NC410 combo, which is demonstrating clinical responses in ovarian and colorectal cancers. We are advancing LNCB74 in collaboration with LegoChem Biosciences, a differentiated ADC directed to B7-H4, a clinically validated cancer target. Given our current cash position and revised runway to the second half of 2026, we believe we can advance our two programs through important near-term clinical milestones."

Business Highlights and Near-Term Milestones

Prioritized Programs

NC410 (LAIR-2 fusion)

- The multi-center, multi-arm, first-in-human Phase 1b combination trial is evaluating the efficacy of NC410 in combination with pembrolizumab. Indications include: (i) ICI Naïve and refractory ovarian cancer and (ii) microsatellite stable (MSS) / microsatellite instability low (MSI-L) immune checkpoint inhibitor (ICI) Naïve and refractory colorectal cancer (CRC). The combination has been shown to be well tolerated up to 200 mg of NC410 with Grade 3 or higher Treatment Related Adverse Events of 3.7%.

NC410 for Ovarian Cancer

- Evidence of early clinical activity and biomarker observations support the proposed mechanism of action for NC410 in relapsed/refractory ICI Naïve ovarian cancer, with/without active liver metastasis for subjects in the 100 mg and 200 mg cohorts. As of February 23, 2024, the findings of the initial 7 evaluable patients based on RECIST 1.1 are summarized in the table below:

Relapsed/Refractory ICI Naïve Ovarian, 100 mg and 200 mg cohorts

| Evaluable Patients as of February 23, 2024 | n=7 |

| Overall Response rate (ORR) | 42.8%, n=3 |

| Disease Control Rate (DCR) | 42.8%, n=3 |

| Evidence supporting mechanism of action | Observed in biomarker data |

- Additional observations from the initial 7-patient data set as of February 23, 2024, include:

- 3 partial responses (PR) were observed at the initial 9-week scan.

- 1 confirmed PR observed in the 200 mg cohort continues on study beyond 6 months.

- The 2 PRs at the 100 mg cohort are pending confirmatory scans at week 18.

- Biomarker data on blood samples drawn from patients in both the prior NC410 monotherapy trial and, the current NC410 combo trial support our hypothesis regarding the mechanism of action (MOA) and activity in PR patients as follows:

- Decrease in peripheral Granzyme B-expressing CD8+ T cells, which supports our mechanism of action (MOA) that NC410 remodels the extracellular matrix (ECM) allowing activated immune cells to infiltrate into the tumor microenvironment (TME). Generation of collagen-derived product 4GZ fragments is mediated by Granzyme B-expressing T cells and provides direct evidence of ECM remodeling and correlates with responses.

- Decrease in peripheral myeloid-derived suppressor cells reduces suppressive effects and enhances activation of immune cells and anti-tumor activity.

- Decrease in peripheral CCR7+ DC+ T cells which is consistent with chemokine guided migration of immune cells to the TME.

- Taken together, the data demonstrate that NC410 mediates activation of immune cells and migration into the TME through remodeling of the ECM. We believe NC410 combo results in anti-tumor activity and clinical responses in patients that have been shown to respond poorly to or are resistant to checkpoint inhibitors.

- In March 2024, we commenced enrolling an additional 18 patients among the 100 mg and 200 mg cohorts. We plan to present the data from the ovarian cancer patients in the second half of 2024.

NC410 Colorectal Cancer (CRC)

- Preliminary evidence of clinical activity in the 100 mg cohort of patients with MSS/ MSI-L ICI naïve CRC without active liver metastasis (LM-). The findings as of February 23, 2024, of the initial 19 evaluable patients are summarized based on RECIST 1.1 guideline in the table below:

MSS/MSI-L ICI Naïve CRC, LM-, 100 mg cohort

| Evaluable Patients as of February 23, 2024 | n=19 | |

| Overall Response rate (ORR) | 10.5%, n=2 | |

| Disease Control Rate (DCR) | 47.3%, n=9 | |

| Median Progression Free Survival (mPFS) | 8.1 months | |

- Additional observations from the 19-patient data set as of February 23, 2024:

- Both responses were observed at the initial 9-week scan in the 100 mg cohort.

- Subjects enrolled had a median of 5 lines of prior treatment.

- The 2 responders remain as PRs, and continue on study for over 10 months and 5 months, respectively.

- Completed enrollment in January 2024 of an additional 20 patients in the 100 mg cohort. We plan to present the data of the CRC patients at a scientific conference within the second quarter of 2024.

LNCB74 (B7-H4 ADC)

- Selected our first antibody drug conjugate (ADC) candidate of a potential of three from our collaboration with LegoChem Biosciences, Inc. (LegoChem). Under the terms of the Agreement, both parties equally share the costs of developing the molecules and profits on commercialized products.

- Commenced development of LNCB74 utilizing a NextCure B7-H4 antibody and LegoChem's ConjuAllTM ADC technology.

- Differentiated approach leveraging:

- B7-H4 specific antibody with an Fc modification that protects immune cells to improve safety

- Use of a glucuronidase cleavable linker that offers cancer-selective payload release to minimize toxicity in non-tumor cells, and

- Use of a monomethyl auristatin E (MMAE) payload with a drug-to-antibody ratio (DAR) of 4, that has the advantage of bystander killing of surrounding tumor cells.

- Pre-clinical experiments in vitro and in vivo demonstrating potent tumor killing and pilot toxicology studies have been completed.

- Pre-filing feedback from the FDA supports moving forward to planned submission of an IND application by this year-end.

- Ongoing activities associated with GLP toxicity studies, GMP manufacturing, and clinical development planning are in progress.

Assets We Intend to Partner

- NC525 is a novel LAIR-1 antibody that selectively targets Acute Myeloid Leukemia (AML) blast cells and leukemic stem cells, and currently is in a Phase 1a monotherapy dose escalation and safety study evaluating NC525 in AML patients. The trial is now in the fifth dose escalation cohort, and we plan to complete the dose-finding portion of the study to arrive at a predicted biologically active dose and further assess development plans by the fourth quarter of 2024.

- NC605 is an antibody that targets Siglec-15 and has the potential as a treatment for bone disease. Preclinical data show that NC605 treatment reduced bone loss and enhanced bone quality in mice with osteogenesis imperfecta (OI). OI is a rare disorder that results in high bone turnover, abnormal bone formation, bone fragility, and recurrent fractures. NC605 could also have applications in chronic bone diseases such as osteoarthritis and non-union fractures. We are currently conducting toxicology studies in preparation for partnering.

- NC181 is a humanized antibody targeting ApoE4 for the treatment of Alzheimer's disease (AD). In preclinical AD animal models, NC181 has demonstrated amyloid clearance, prevention of amyloid deposition, plaque clearance and neuroinflammation reduction. Preclinical studies have demonstrated that it reduces microhemorrhages, improves cerebral vascular function and lowers risk of Amyloid Related Imaging Abnormalities (ARIA).

Restructuring of Operations

- Implemented a restructuring plan to reduce operating costs and better align our workforce with the needs of our business. Under the plan, we paused our internal manufacturing operations and reduced our workforce by approximately 37%. We estimate that we will incur one-time restructuring charges of approximately $0.8 million including employee severance, benefits and related termination costs, the majority of which we expect to pay in the second quarter of 2024.

Financial Guidance

- NextCure expects its existing cash, cash equivalents and marketable securities will enable it to fund operating expenses and capital expenditures into the second half of 2026.

Financial Results for Full Year Ended December 31, 2023

- Cash, cash equivalents, and marketable securities as of December 31, 2023, were $108.3 million as compared to $159.9 million as of December 31, 2022. The decrease of $51.6 million was primarily due to cash used to fund operations, and cash used to purchase fixed assets.

- Research and development expenses were $47.9 million for the year ended December 31, 2023, as compared to $54.2 million for the year ended December 31, 2022. The decrease of $6.3 million was primarily due to lower costs related to our clinical programs.

- General and administrative expenses were $19.7 million for the year ended December 31, 2023, as compared to $21.7 million for the year ended December 31, 2022. The decrease of $2.0 million was primarily related to lower personnel-related costs, including $1.2 million of stock compensation, and lower insurance and professional costs.

- Net loss was $62.7 million for the year ended December 31, 2023, as compared with a net loss of $74.7 million for the year ended December 31, 2022. Lower research and development expenses, lower general and administrative expenses and higher other income contributed to the lower net loss.

About NextCure, Inc.

NextCure is a clinical-stage biopharmaceutical company that is focused on advancing innovative medicines that treat cancer patients that do not respond to, or have disease progression on, current therapies, through the use of differentiated mechanisms of actions including antibody-drug conjugates, antibodies and proteins. We focus on advancing therapies that leverage our core strengths in understanding biological pathways and biomarkers, the interactions of cells, including in the tumor microenvironment, and the role each interaction plays in a biologic response. www.nextcure.com

Forward-Looking Statements

Some of the statements contained in this press release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including with respect to funding for our operations, objectives and expectations for our business, operations and financial performance and condition, including the progress and results of clinical trials, development plans and upcoming milestones regarding our therapies. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "aim," "anticipate," "assume," "believe," "continue," "could," "should," "due," "estimate," "expect," "intend," "hope," "may," "objective," "plan," "predict," "potential," "positioned," "seek," "target," "towards," "forward," "later," "will," "would" and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or similar language.

Forward-looking statements involve substantial risks and uncertainties that could cause actual results to differ materially from those projected in any forward-looking statement. Such risks and uncertainties include, among others: positive results in preclinical studies may not be predictive of the results of clinical trials; NextCure's limited operating history and not having any products approved for commercial sale; NextCure's history of significant losses; NextCure's need and ability to obtain additional financing on acceptable terms or at all; risks related to clinical development, marketing approval and commercialization; and NextCure's dependence on key personnel. More detailed information on these and additional factors that could affect NextCure's actual results are described under the heading "Risk Factors" in NextCure's most recent Annual Report on Form 10-K and in NextCure's other filings with the Securities and Exchange Commission. You should not place undue reliance on any forward-looking statements. Forward-looking statements speak only as of the date of this press release, and NextCure assumes no obligation to update any forward-looking statements, even if expectations change.

| Selected Financial Information | ||||||||

| Selected Statement of Operations Items: | Year Ended | |||||||

| December 31 | ||||||||

| (in thousands, except share and per share amounts) | 2023 | 2022 | ||||||

| Operating expenses: | ||||||||

| Research and development | $ | 47,931 | $ | 54,199 | ||||

| General and administrative | 19,706 | 21,710 | ||||||

| Loss from operations | (67,637 | ) | (75,909 | ) | ||||

| Other income, net | 4,914 | 1,176 | ||||||

| Net loss | $ | (62,723 | ) | $ | (74,733 | ) | ||

| Net loss per common share - basic and diluted | $ | (2.25 | ) | $ | (2.69 | ) | ||

| Weighted-average shares outstanding - basic and diluted | 27,836,584 | 27,744,209 | ||||||

| Selected Balance Sheet Items: | ||||||||

| December 31, | December 31, | |||||||

| (in thousands) | 2023 | 2022 | ||||||

| Cash, cash equivalents, and marketable securities | $ | 108,299 | $ | 159,911 | ||||

| Total assets | $ | 128,038 | $ | 184,161 | ||||

| Accounts payable and accrued liabilities | $ | 6,883 | $ | 9,127 | ||||

| Total stockholders' equity | $ | 114,421 | $ | 167,530 | ||||

Investor Inquiries

Timothy Mayer, Ph.D.

NextCure, Inc.

Chief Operating Officer

(240) 762-6486

IR@nextcure.com