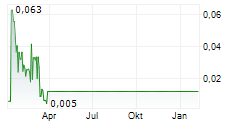

On January 23, 2024, Resqunit AB (publ) (the "Company") was given observation status with reference to material adverse uncertainty in respect of the Company's financial position and the Company's intention to delist its financial instruments from Nasdaq First North Growth Market. On March 20, 2024, the Company issued a press release with information that the Company has entered into a conditional agreement under which the Company will acquire IP rights from Bio Vitos Norge AS through a directed share issue, after which Bio Vitos Norge AS will hold 90 percent of the total number of shares in the Company. According to item 2.5.1 of the Nasdaq First North Growth Market Rulebook, the Exchange may for an issuer that undergoes substantial changes initiate a renewed review process of the issuer's fulfilment of applicable admission requirements. With reference to the above, the Exchange has decided that the Company shall undergo such a review process, after which the Exchange will decide whether to admit the Company's shares for continued trading on Nasdaq First North Growth Market. The rules of Nasdaq First North Growth Market also state that an issuer may be given observation status if it has been the subject of a reverse take-over or otherwise plans to make or has been subject to an extensive change in its business or organization so that the issuer upon an overall assessment appears to be an entirely new company. With reference to the above, Nasdaq Stockholm AB decides to update the observation status for the shares (RESQ, ISIN code SE0017131220, order book ID 241339) in Resqunit AB (publ). For further information concerning this exchange notice please contact Enforcement & Investigations, telephone + 46 8 405 70 50.

© 2024 GlobeNewswire