- BDC-1001 (trastuzumab imbotolimod) Phase 2 studies in four HER2-positive tumor types advancing toward 2024 milestones

- BDC-3042 Phase 1 study successfully cleared safety assessments in the first three dose level cohorts

- Cash balance of $128.6 million as of December 31, 2023, anticipated to fund key milestones through late 2025

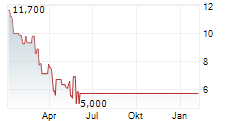

REDWOOD CITY, Calif., March 21, 2024 (GLOBE NEWSWIRE) -- Bolt Biotherapeutics (Nasdaq: BOLT), a clinical-stage biopharmaceutical company developing novel immunotherapies for the treatment of cancer, today reported financial results for the fourth quarter and full year ended December 31, 2023, and provided a business update.

"We made substantial progress advancing our two proprietary clinical-stage development programs in 2023," said Randall Schatzman, Ph.D., Chief Executive Officer. "We have now administered BDC-1001, which we have renamed trastuzumab imbotolimod, to patients in all five of the Phase 2 cohorts. BDC-3042 also continues to advance, and has now entered the fourth dose escalation cohort without a dose-limiting toxicity. Both clinical programs are on track and we look forward to providing updates later this year."

Recent Highlights and Anticipated Milestones

- Trastuzumab imbotolimod (BDC-1001) Phase 2 program continues to advance. Trastuzumab imbotolimod is a Boltbody ISAC that is currently in Phase 2 clinical development across five distinct cohorts treating patients with HER2-positive cancer. The first three cohorts evaluate monotherapy trastuzumab imbotolimod in colorectal, endometrial, and gastroesophageal cancer, and the fourth and fifth cohorts evaluate trastuzumab imbotolimod with or without pertuzumab for the treatment of HER-2 positive metastatic breast cancer. All cohorts utilize a Simon two-stage design. Roche is providing pertuzumab in support of the trial. The most recent update on trastuzumab imbotolimod was presented at the ESMO 2023 Congress in October 2023, noting a 29% objective response rate (ORR) comprising 1 complete response (CR) and 3 partial responses (PRs) in evaluable patients with HER2-positive tumors at the recommended Phase 2 dose (RP2D). BDC-1001 was well tolerated. The most common treatment-related treatment-emergent adverse events (TEAE) was Grade 1 or 2 infusion-related reactions, which were seen in 30% of patients in the study.

- BDC-3042 Phase 1 dose escalation study continues to advance. BDC-3042 is a proprietary agonist antibody that targets Dectin-2, an immune-activating receptor expressed by tumor-associated macrophages (TAMs). This dose-escalation Phase 1 clinical study will initially evaluate BDC-3042 as monotherapy in patients with a variety of solid tumors, and will then evaluate the combination of BDC-3042 with a PD-1 inhibitor. Bolt has completed the first three dosing cohorts without observing any dose-limiting toxicities and the trial is enrolling well.

- Cash, cash equivalents, and marketable securities were $128.6 million as of December 31, 2023. Cash on hand is expected to fund multiple clinical milestones in 2024 and operations through late 2025.

Fourth Quarter and Full Year 2023 Financial Results

- Collaboration Revenue - Collaboration revenue was $2.1 million for the quarter and $7.9 million for the full year ended December 31, 2023, compared to $1.4 million and $5.7 million for the same quarter and year in 2022. Revenue in the comparative periods was generated from the services performed under our R&D collaborations as we fulfill our performance obligations.

- Research and Development (R&D) Expenses - R&D expenses were $16.3 million for the quarter and $61.5 million for the full year ended December 31, 2023, compared to $16.8 million and $73.1 million for the same quarter and year ended 2022. The decrease in R&D expenses was due to lower manufacturing expenses related to the timing of batch production, offset by higher clinical expenses related to the advancement of trastuzumab imbotolimod clinical trial into Phase 2.

- General and Administrative (G&A) Expenses - G&A expenses were $5.5 million for the quarter and $22.5 million for the full year ended December 31, 2023, compared to $5.6 million and $22.9 million for the same quarter and year in 2022.

- Loss from Operations - Loss from operations was $19.8 million for the quarter and $76.2 million for the full year ended December 31, 2023, compared to $21.0 million and $90.3 million for the same quarter and year in 2022. This is in part a reflection of proactive cost-containment measures taken in June 2022.

About the Boltbody Immune-Stimulating Antibody Conjugate (ISAC) Platform

Bolt Biotherapeutics' Boltbody ISAC platform harnesses the precision of antibodies with the power of the innate and adaptive immune system to reprogram the tumor microenvironment to generate a productive anti-cancer response. Each Boltbody ISAC candidate comprises a tumor-targeting antibody, a non-cleavable linker, and a proprietary immune stimulant. The antibody is designed to target one or more markers on the surface of a tumor cell and the immune stimulant is designed to recruit and activate myeloid cells. Activated myeloid cells initiate a positive feedback loop by releasing cytokines and chemokines, chemical signals that attract other immune cells and lower the activation threshold for an immune response. This increases the population of activated immune system cells in the tumor microenvironment and promotes a robust immune response with the goal of generating durable therapeutic responses for patients with cancer.

About Bolt Biotherapeutics, Inc.

Bolt Biotherapeutics is a clinical-stage biopharmaceutical company developing novel immunotherapies for the treatment of cancer. Bolt Biotherapeutics' pipeline candidates are built on the Company's deep expertise in myeloid biology and cancer drug development. The Company's pipeline includes trastuzumab imbotolimod (formerly BDC-1001), a HER2-targeting Boltbody Immune-Stimulating Antibody Conjugate (ISAC), BDC-3042, a myeloid-modulating antibody, and multiple Boltbody ISAC collaboration programs. Trastuzumab imbotolimod is currently in Phase 2 clinical development following the successful completion of a Phase 1 dose-escalation trial that demonstrated tolerability and early clinical efficacy. BDC-3042, an agonist antibody targeting Dectin-2, is currently in a Phase 1 dose-escalation trial. In preclinical development, BDC-3042 demonstrated the ability to convert tumor-supportive macrophages to tumor-destructive macrophages. Bolt Biotherapeutics is also developing multiple Boltbody ISACs in strategic collaborations with leading biopharmaceutical companies. For more information, please visit https://www.boltbio.com/

Forward-Looking Statements

This press release contains forward-looking statements about us and our industry that involve substantial risks and uncertainties and are based on our beliefs and assumptions and on information currently available to us. All statements other than statements of historical facts contained in this press release, including statements regarding the advancement and success of our clinical trials, the timing of future updates from our clinical programs, the potential profile of BDC-1001 and BDC-3042, the potential benefits of combining BDC-1001 with pertuzumab, and our expectation that our cash on hand will fund multiple milestones and operations through late 2025, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "on track," "plan," "potential," "predict," "project," "should," "will," or "would," or the negative of these words or other similar terms or expressions. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our current beliefs, estimates and assumptions only as of the date of this press release and information contained in this press release should not be relied upon as representing our estimates as of any subsequent date. These statements, and related risks, uncertainties, factors and assumptions, include, but are not limited to: the potential product candidates that we develop may not progress through clinical development or receive required regulatory approvals within expected timelines or at all; clinical trials may not confirm any safety, potency or other product characteristics described or assumed in this press release; such product candidates may not be beneficial to patients or become commercialized; and our ability to maintain our current collaborations and establish further collaborations. These risks are not exhaustive. Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Further information on factors that could cause actual results to differ materially from the results anticipated by our forward-looking statements is included in the reports we have filed or will file with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2023. These filings, when available, are available on the investor relations section of our website at investors.boltbio.com and on the SEC's website at www.sec.gov.

Investor Relations and Media Contact:

Matthew DeYoung

Argot Partners

(212) 600-1902

boltbio@argotpartners.com

| BOLT BIOTHERAPEUTICS, INC. STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (In thousands, except share and per share amounts) | ||||||||||||||||

| For The Three Months Ended December 31, | Years Ended December 31, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Collaboration revenue | $ | 2,089 | $ | 1,411 | $ | 7,876 | $ | 5,729 | ||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | 16,322 | 16,845 | 61,542 | 73,123 | ||||||||||||

| General and administrative | 5,533 | 5,606 | 22,530 | 22,927 | ||||||||||||

| Total operating expense | 21,855 | 22,451 | 84,072 | 96,050 | ||||||||||||

| Loss from operations | (19,766 | ) | (21,040 | ) | (76,196 | ) | (90,321 | ) | ||||||||

| Other income, net | ||||||||||||||||

| Interest income | 1,863 | 1,043 | 6,999 | 2,223 | ||||||||||||

| Total other income, net | 1,863 | 1,043 | 6,999 | 2,223 | ||||||||||||

| Net loss | (17,903 | ) | (19,997 | ) | (69,197 | ) | (88,098 | ) | ||||||||

| Net unrealized gain (loss) on marketable securities | 211 | 790 | 956 | (598 | ) | |||||||||||

| Comprehensive loss | $ | (17,692 | ) | $ | (19,207 | ) | $ | (68,241 | ) | $ | (88,696 | ) | ||||

| Net loss per share, basic and diluted | $ | (0.47 | ) | $ | (0.53 | ) | $ | (1.83 | ) | $ | (2.36 | ) | ||||

| Weighted-average shares outstanding, basic and diluted | 37,941,587 | 37,552,208 | 37,811,984 | 37,358,425 | ||||||||||||

| BOLT BIOTHERAPEUTICS, INC. BALANCE SHEETS (In thousands) | ||||||||

| December 31, | ||||||||

| 2023 | 2022 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 10,810 | $ | 9,244 | ||||

| Short-term investments | 91,379 | 159,644 | ||||||

| Prepaid expenses and other current assets | 3,519 | 3,858 | ||||||

| Total current assets | 105,708 | 172,746 | ||||||

| Property and equipment, net | 4,957 | 6,453 | ||||||

| Operating lease right-of-use assets | 19,120 | 22,072 | ||||||

| Restricted cash | 1,765 | 1,565 | ||||||

| Long-term investments | 26,413 | 23,943 | ||||||

| Other assets | 1,821 | 1,028 | ||||||

| Total assets | $ | 159,784 | $ | 227,807 | ||||

| Liabilities and stockholders' equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 2,987 | $ | 3,594 | ||||

| Accrued expenses and other current liabilities | 12,486 | 15,140 | ||||||

| Deferred revenue | 2,201 | 1,993 | ||||||

| Operating lease liabilities | 2,782 | 2,391 | ||||||

| Total current liabilities | 20,456 | 23,118 | ||||||

| Operating lease liabilities, net of current portion | 17,437 | 20,220 | ||||||

| Deferred revenue, non-current | 9,107 | 12,921 | ||||||

| Other long-term liabilities | 43 | 42 | ||||||

| Total liabilities | 47,043 | 56,301 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders' equity: | ||||||||

| Preferred stock | - | - | ||||||

| Common stock | 1 | - | ||||||

| Additional paid-in capital | 476,988 | 467,513 | ||||||

| Accumulated other comprehensive gain (loss) | 37 | (919 | ) | |||||

| Accumulated deficit | (364,285 | ) | (295,088 | ) | ||||

| Total stockholders' equity | 112,741 | 171,506 | ||||||

| Total liabilities, convertible preferred stock, and stockholders' equity | $ | 159,784 | $ | 227,807 | ||||

| BOLT BIOTHERAPEUTICS, INC. STATEMENTS OF CASH FLOWS (In thousands) | ||||||||

| Years Ended December 31, | ||||||||

| 2023 | 2022 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (69,197 | ) | $ | (88,098 | ) | ||

| Adjustments to reconcile net loss to net cash used | ||||||||

| in operating activities: | ||||||||

| Depreciation and amortization | 1,854 | 1,666 | ||||||

| Stock-based compensation expense | 9,223 | 9,576 | ||||||

| Accretion of premium/discount on short-term investments | (4,493 | ) | 184 | |||||

| Non-cash lease expense | 2,952 | 3,225 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses and other assets | (454 | ) | (903 | ) | ||||

| Accounts payable and accrued expenses | (3,413 | ) | 2,768 | |||||

| Operating lease liabilities | (2,392 | ) | (2,596 | ) | ||||

| Deferred revenue | (3,606 | ) | (2,162 | ) | ||||

| Other long-term liabilities | 1 | (164 | ) | |||||

| Net cash used in operating activities | (69,525 | ) | (76,504 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchase of property and equipment | (206 | ) | (1,953 | ) | ||||

| Purchases of marketable securities | (164,988 | ) | (180,704 | ) | ||||

| Maturities of marketable securities | 236,232 | 240,519 | ||||||

| Net cash provided by investing activities | 71,038 | 57,862 | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from issuance of common stock | 253 | 503 | ||||||

| Net cash provided by financing activities | 253 | 503 | ||||||

| NET INCREASE (DECREASE) IN CASH | 1,766 | (18,139 | ) | |||||

| Cash, cash equivalents and restricted cash at beginning of year | 10,809 | 28,948 | ||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 12,575 | $ | 10,809 | ||||

| Reconciliation of cash, cash equivalents and restricted cash: | ||||||||

| Cash and cash equivalents | $ | 10,810 | $ | 9,244 | ||||

| Restricted cash | 1,765 | 1,565 | ||||||

| Total cash, cash equivalents and restricted cash | $ | 12,575 | $ | 10,809 | ||||

| Supplemental schedule of non-cash investing and financing activities: | ||||||||

| Purchases of property and equipment included in accounts payable and accrued liabilities | $ | 152 | $ | 8 | ||||

| Deferred offering costs in accounts payable and accrued liabilities | $ | 102 | $ | 102 | ||||

| Right of use assets obtained in exchange for operating lease obligations | $ | - | $ | 852 | ||||