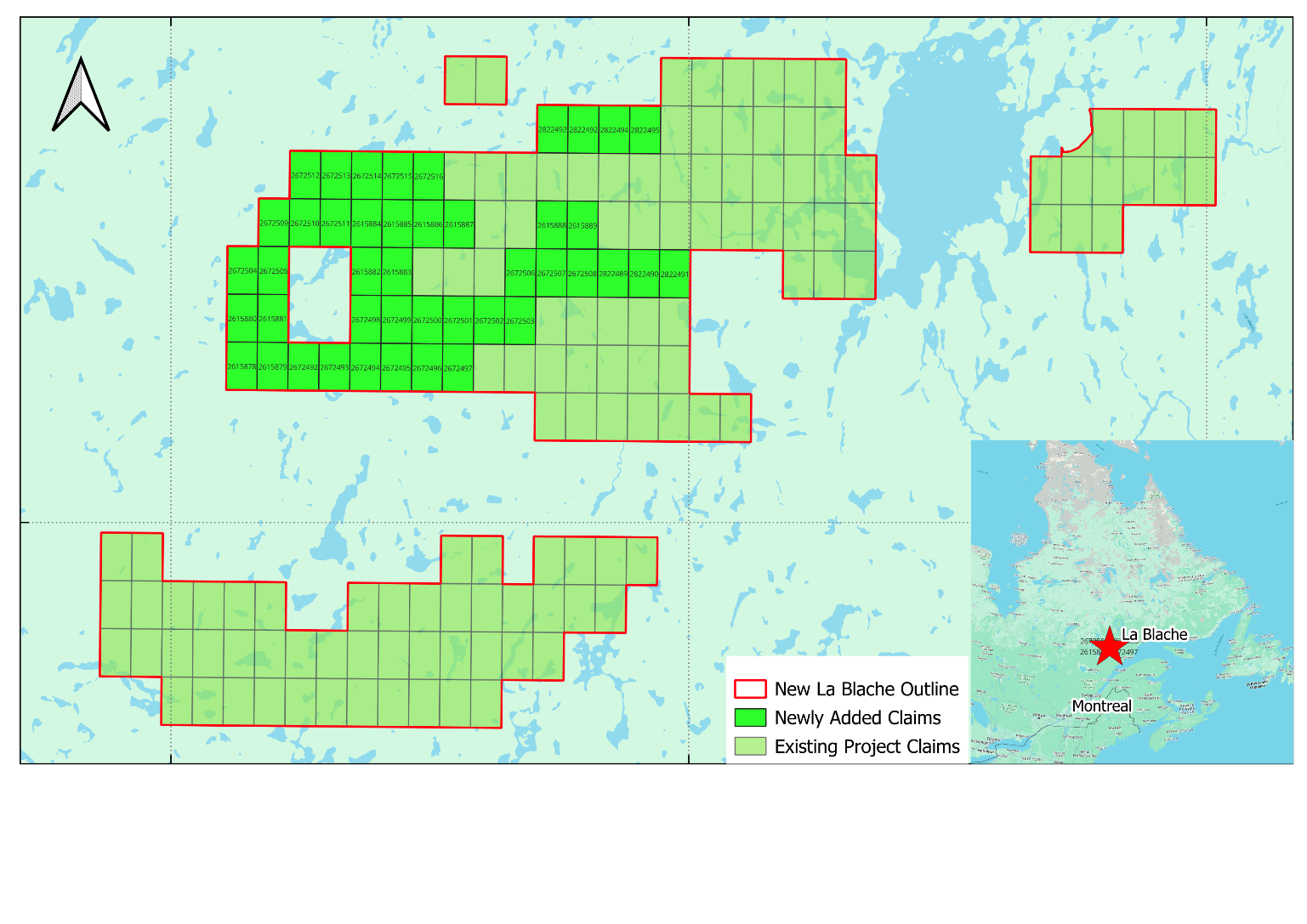

VANCOUVER, BC / ACCESSWIRE / March 27, 2024 / Temas Resources Corp. ("Temas" or the "Company") (CSE:TMAS)(OTCQB:TMASF) is pleased to report that it has entered into an option agreement (the "Option Agreement") to acquire a 100% interest in the La Blache Lake Extension Property (the "Property"). The Property is the ground immediately west and along trend from Temas's Farrell-Taylor mineralization on the La Blache property and includes the Hervieux-Est and Hervieux-Ouest mineralization.

The combination of the La Blache and the La Blache Lake Extension projects consolidates into one package the known mineralization in the trend. The Property adds 44 claims / 2,432.25 Ha to the main claim block of the La Blache project. These claims are all within the La Blache anorthosite complex, within anorthosite, leucotroctolite or leuconorite, along the fold hinge of a regional anticline. Mineralization appears to occur sub-parallel to this axis, with mineralization at Hervieux-Ouest, Hervieux-Est and Schmoo Lake being added to Farrell-Taylor and Farrell-Mason lenses already in the Temas claims.

Tim Fernback, President of Temas comments, "With the positive results of the PEA, we are excited to further refine our understanding of the best path forward for the development of the combined La Blache project. By adding the additional mineralization, optionality opens up on the best approach and overall path to development. There is still a lot of work to do on the Farrell-Taylor, but we are keen to apply what we have already learned to this part of the trend."

Pursuant to the Option Agreement, to acquire a 100% interest in the Property; Temas must issue an aggregate of $275,000 (CAD) in common shares and pay an aggregate of $350,000 (CAD) in cash over a 48th month period based on the following payment schedule.

- $50,000 cash and, $75,000 in common shares upon non-objection by the Canadian Securities Exchange of the Option Agreement (the "Approval Date").

- $75,000 cash and, $50,000 in common shares on the 12 month anniversary of the Approval Date

- $75,000 cash and, $50,000 in common shares on the 24 month anniversary of the Approval Date

- $75,000 cash and, $50,000 in common shares on the 36 month anniversary of the Approval Date

- $75,000 cash and, $50,000 in common shares on the 48 month anniversary of the Approval Date

The claims will carry with them a 2% net smelter return royalty (the "NSR"), of which NSR. 50% NSR can be purchased for $1,500,000 CAD at the election of Temas.

The Property contains historic estimates on the Hervieux-Est and Hervieux-Ouest mineralization. This historic estimate would be best approximated as comparable to an inferred resource by modern standards, but modifications to resource estimation in 2014 were not applied to the resource estimation process and may change what constitutes resource material in a current estimate. This historical estimate was not verified by a qualified person. It should only be considered as an indication of the mineral potential and not necessarily indicative of the contained mineralization on these newly optioned claims. It was previously held by Argex Titanium Inc., which in 2011 published the report "Preliminary Economic Assessment on the La Blache Fe-Ti-V Project", with an effective date of October 12 , 2011 and filed December 13, 2011. In this report, they published resource estimates on both Hervieux-Est and Hervieux-Ouest:

Volume | Tonnes | Ti % | V % | Fe | |

Hervieux-Est | |||||

Measured | 538,000 | 2,458,000 | 11.10 | 0.24 | 44.18 |

Indicated | 2,265,000 | 10,343,000 | 11.07 | 0.24 | 43.99 |

M & I | 2,803,000 | 12,801,000 | 11.08 | 0.24 | 44.02 |

Inferred | 2,189,000 | 9,883,000 | 10.93 | 0.23 | 43.41 |

Hervieux-Ouest | |||||

Measured | 1,275,000 | 5,822,000 | 1128 | 0.25 | 43.97 |

Indicated | 3,003,000 | 13,646,000 | 11.26 | 0.26 | 43.98 |

M & I | 4,278,000 | 19,470,000 | 11.27 | 0.26 | 43.98 |

Inferred | 1,034,000 | 4,700,000 | 11.17 | 0.27 | 43.36 |

Where: Price V2O5 = $14500/t, Price TiO2 = $2500/t, Recovery V = 90%, Recovery TiO2 = 85%

As this estimate was calculated in 2011, it did follow CIM Definition Standards on Mineral Resources and Mineral Reserves, but it was based on the 2005 version of the definition and standards.

QUALIFIED PERSONS

Bertrand Brassard, P.Geo is a Qualified Person as defined by NI 43-101, is a member of the Ordre des Géologues du Québec and has reviewed and approved the technical information contained within this press release.

Rory Kutluoglu, P. Geo is a Qualified Person as defined by NI 43-101 and has reviewed and approved the technical information contained within this press release.

On behalf of the Board of Directors,

Tim Fernback, President & CEO

About Temas Resources

Temas Resources Corp. (CSE:TMAS)(OTCQB:TMASF) is focused on the advanced La Blache and Lac Brule Iron-Titanium-Vanadium projects in Quebec. The critical metals the Company is exploring for are key to our national mineral independence. Additionally, the Company invests in and works to apply its green mineral recovery technologies across its mining portfolio to reduce the environmental impact and carbon footprint of metal extraction through advanced processing and patented leaching technologies.

All public filings for the Company can be found on the SEDAR+ website www.sedarplus.ca. For more information about the Company, please visit www.temasresources.com.

For further information or investor relations inquiries:

Tim Fernback

President and CEO

tfernback@shaw.ca

or

KIN Communications Inc.

Tel: 604-684-6730

tmas@kincommunications.com

Cautionary Note Regarding Forward-Looking Statements

Neither the Canadian Securities Exchange nor the Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes certain "Forward-Looking Statements" within the meaning of applicable securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward-looking statements or information. These forward-looking statements or information relate to, among other things: the exploration, development, and production at the Company's mineral projects; non-objection of the Option Agreement; and exercise of the option pursuant to the terms of the Option Agreement

Forward-looking statements and forward-looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of the Company, future growth potential for the Company and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of metals; no escalation in the severity of public health pandemics; costs of exploration and development; the estimated costs of development of exploration projects; the Company's ability to operate in a safe and effective manner.

These statements reflect the Company's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements or forward-looking information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: precious metals price volatility; risks associated with the conduct of the Company's mining activities; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of public health crises; the economic and financial implications of public health crises to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities; the speculative nature of exploration and development; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified in the Company's public disclosure documents. Readers are cautioned against attributing undue certainty to forward-looking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

SOURCE: Temas Resources Corp.

View the original press release on accesswire.com