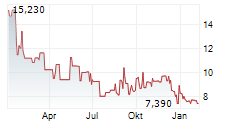

FLOWER MOUND, Texas--(BUSINESS WIRE)--Mannatech, Incorporated (NASDAQ: MTEX), a global health and wellness company committed to transforming lives to make a better world, today announced financial results for its fourth quarter and year ended December 31, 2023.

Fourth Quarter Highlights

- Fourth quarter 2023 net sales were $32.7 million, a decrease of $1.6 million, or 4.7%, as compared to $34.3 million in the fourth quarter of 2022.

- Gross profit as a percentage of net sales improved to 75.4% as compared to 69.0% for the same period in 2022. Reduced supply chain shipping costs more than offset price increases in certain raw materials.

- Operating loss in the fourth quarter was $0.9 million, improved from an operating loss of $2.7 million in the fourth quarter of 2022.

- Net loss was $1.8 million, or $0.94 per diluted share, for the fourth quarter 2023, as compared to net loss of $6.5 million, or $3.50 per diluted share, for the fourth quarter 2022.

J. Stanley Fredrick, Chairman of the Board of Mannatech, stated, "Demand remained weak in the fourth quarter as reflected in our sales decline from last year's fourth quarter. However, our revenues were essentially flat to our third quarter this year. Although we incurred an operating loss in the current quarter, we mitigated our loss through active supply chain management and reduction of selling and administrative expenses."

"We incurred a foreign exchange loss of approximately $1.0 million in the fourth quarter, reflected in 'Other Expense' in our Statement of Operations. We had a similar experience in the fourth quarter last year. We are a multinational company and therefore we are subject to fluctuations in the value of the U.S. Dollar versus other currencies in the countries we operate. These losses had a significant impact on our net loss in the fourth quarter of this year and last year," said Mr. Fredrick.

Total Year 2023 Highlights

- Net sales for the year ended December 31, 2023 was $132.0 million, as compared to $137.2 million for the year ended December 31, 2022. Net sales decreased $5.2 million, or 3.8%, for 2023, as compared to 2022. Our 2023 net sales were unfavorably affected by $2.3 million due to the effect of foreign exchange rates. Excluding this impact, Net Sales on a Constant dollar basis (see Non-GAAP Financial Measures, below) declined $2.9 million, or 2.1%, as compared to 2022 GAAP net sales.

- Operating loss was $1.0 million for the year ended December 31, 2023, as compared to $0.4 million for the same period last year. Our 2023 operating loss, on a Constant dollar basis (see Non-GAAP Financial Measures, below), was $0.4 million.

- In June 2023, the Company launched a tiered affiliate program in the United States under the brand name, "Trulu." The Trulu brand is operated by our wholly owned subsidiary, "NEMO", and is separate from our network marketing business. For the year ended December 31, 2023, we incurred an operating loss of $1.1 million in connection with the start-up of our NEMO business.

Excluding the startup loss of NEMO from the consolidated operating loss on a Constant dollar basis, we would have generated an operating profit of approximately $0.7 million in 2023, as compared to an operating loss of $0.4 million in 2022.

- Net loss for 2023 was $2.2 million, or $1.20 per diluted share, as compared to net loss of $4.5 million, or $2.35 per diluted share, for 2022.

- As of December 31, 2023, the company's cash and cash equivalents decreased to $7.7 million from $13.8 million as of December 31, 2022. Operating the business was a use of $2.4 million in cash. The company invested approximately $0.7 million in back-office software projects and equipment, reported as property and equipment. It used $1.0 million to pay long-term liabilities and finance lease obligations. Finally, shareholder value was returned with $0.7 million for dividends to shareholders and the Company repurchased $0.2 million in common stock.

- The approximate number of new and continuing independent associate and preferred customer positions held by individuals in Mannatech's network and associated with purchases of its packs or products as of December 31, 2023 and 2022 remained constant at approximately 145,000. Recruiting increased 4.4% in the fourth quarter of 2023 as compared to the fourth quarter of 2022. The number of new independent associate and preferred customer positions in the company's network for the fourth quarter of 2023 was 18,156 as compared to 17,398 in 2022.

"Careful supply chain cost controls, price adjustments and favorable product mix contributed to a 210 basis point improvement in gross profit margin in the current year as compared to last year," said Mr. Fredrick.

Mr. Fredrick continued, "We overcame economic challenges throughout our world-wide footprint in 2023, as well as issues and significant start-up costs related to a new product launch. We believe we are emerging from the severe economic decline of the past few years and the long-term outlook for our business is favorable. In the short term, we expect that we will continue to face challenges of a slow rate of growth in demand in certain markets we operate while other regions will recover at a faster rate. However, we are resolved to continue to focus on growing our customer and associate base, as well as improving our revenues and profitability in 2024."

Non-GAAP Measures

In addition to results presented in accordance with GAAP, this press release and related tables include certain non-GAAP financial measures, including a presentation of constant dollar measures. The company discloses operating results that have been adjusted to exclude the impact of changes due to the translation of foreign currencies into U.S. dollars, including changes in: Net Sales, Gross Profit, and Income from Operations.

The company believes that these non-GAAP financial measures provide useful information to investors because they are an indicator of the strength and performance of ongoing business operations. The constant currency figures are financial measures used by management to provide investors an additional perspective on trends. Although it believes the non-GAAP financial measures enhance investors' understanding of their business and performance, these non-GAAP financial measures should not be considered an exclusive alternative to accompanying GAAP financial measures. Please see the accompanying table entitled "Non-GAAP Financial Measures" for a reconciliation of these non-GAAP financial measures.

Safe Harbor statement

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by use of phrases or terminology such as "may," "will," "should," "hope," "could," "would," "expects," "plans," "intends," "anticipates," "believes," "estimates," "approximates," "predicts," "projects," "potential," and "continues" or other similar words or the negative of such terminology. Similarly, descriptions of Mannatech's objectives, strategies, plans, goals or targets contained herein are also considered forward-looking statements. Mannatech believes this release should be read in conjunction with all of its filings with the United States Securities and Exchange Commission and cautions its readers that these forward-looking statements are subject to certain events, risks, uncertainties, and other factors. Some of these factors include, among others, the impact of COVID-19 on Mannatech's business, Mannatech's inability to attract and retain associates and members, increases in competition, litigation, regulatory changes, and its planned growth into new international markets. Although Mannatech believes that the expectations, statements, and assumptions reflected in these forward-looking statements are reasonable, it cautions readers to always consider all of the risk factors and any other cautionary statements carefully in evaluating each forward-looking statement in this release, as well as those set forth in its latest Annual Report on Form 10-K, and other filings filed with the United States Securities and Exchange Commission, including its current reports on Form 8-K. All of the forward-looking statements contained herein speak only as of the date of this release.

Individuals interested in Mannatech's products or in exploring its business opportunity can learn more at Mannatech.com.

MANNATECH, INCORPORATED AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in thousands, except share information) | |||||||

December 31,

| December 31,

| ||||||

ASSETS | |||||||

Cash and cash equivalents | $ | 7,731 | $ | 13,777 | |||

Restricted cash | 938 | 944 | |||||

Accounts receivable, net of allowance of $1,278 and $973 in 2023 and 2022, respectively | 91 | 218 | |||||

Income tax receivable | 465 | 423 | |||||

Inventories, net | 14,535 | 14,726 | |||||

Prepaid expenses and other current assets | 1,774 | 2,389 | |||||

Deferred commissions | 2,130 | 2,476 | |||||

Total current assets | 27,664 | 34,953 | |||||

Property and equipment, net | 4,147 | 3,759 | |||||

Long-term restricted cash | 718 | 476 | |||||

Other assets | 7,066 | 8,439 | |||||

Deferred tax assets, net | 1,611 | 1,501 | |||||

Total assets | $ | 41,206 | $ | 49,128 | |||

LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||

Current portion of finance leases | $ | 269 | $ | 61 | |||

Accounts payable | 4,010 | 4,361 | |||||

Accrued expenses | 6,779 | 7,510 | |||||

Commissions and incentives payable | 8,175 | 9,256 | |||||

Taxes payable | 1,521 | 3,281 | |||||

Current notes payable | 240 | 263 | |||||

Deferred revenue | 4,786 | 5,106 | |||||

Total current liabilities | 25,780 | 29,838 | |||||

Finance leases, excluding current portion | 956 | 88 | |||||

Other long-term liabilities | 3,986 | 5,026 | |||||

Total liabilities | 30,722 | 34,952 | |||||

Commitments and contingencies (Note 11) | |||||||

Shareholders' equity: | |||||||

Preferred stock, $0.01 par value, 1,000,000 shares authorized, no shares issued or outstanding | - | - | |||||

Common stock, $0.0001 par value, 99,000,000 shares authorized, 2,742,857 shares issued and 1,860,154 shares outstanding as of December 31, 2023 and 2,742,857 shares issued and 1,858,800 shares outstanding as of December 31, 2022 | - | - | |||||

Additional paid-in capital | 33,309 | 33,377 | |||||

Retained earnings (accumulated deficit) | (1,301 | ) | 1,686 | ||||

Accumulated other comprehensive (loss) | (1,015 | ) | (208 | ) | |||

Treasury stock, at average cost, 882,703 shares as of December 31, 2023 and 884,057 shares as of December 31, 2022 | (20,509 | ) | (20,679 | ) | |||

Total shareholders' equity | 10,484 | 14,176 | |||||

Total liabilities and shareholders' equity | $ | 41,206 | $ | 49,128 | |||

MANNATECH, INCORPORATED AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share information) | |||||||||||||||||||||||

For the three months ended December 31 | For the years ended December 31 | ||||||||||||||||||||||

2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

$000 | % | $000 | % | $000 | % | $000 | % | ||||||||||||||||

Net sales | $ | 32,694 | 100.0 | % | $ | 34,335 | 100.0 | % | $ | 131,955 | 100.0 | % | $ | 137,208 | 100.0 | % | |||||||

Cost of sales | 8,048 | 24.6 | 10,633 | 31.0 | 29,090 | 22.0 | 33,060 | 24.1 | |||||||||||||||

Gross profit | 24,646 | 75.4 | 23,702 | 69.0 | 102,865 | 78.0 | 104,148 | 75.9 | |||||||||||||||

Operating expenses: | |||||||||||||||||||||||

Commissions and incentives | 13,389 | 41.0 | 13,996 | 40.8 | 53,588 | 40.6 | 55,483 | 40.4 | |||||||||||||||

Selling and administrative expenses | 11,748 | 35.9 | 12,078 | 35.2 | 48,613 | 36.8 | 47,443 | 34.6 | |||||||||||||||

Depreciation and amortization | 404 | 1.2 | 278 | 0.8 | 1,628 | 1.2 | 1,627 | 1.2 | |||||||||||||||

Total operating expenses | 25,541 | 78.1 | 26,352 | 76.8 | 103,829 | 78.7 | 104,553 | 76.2 | |||||||||||||||

Income (loss) from operations | (895 | ) | (2.7 | ) | (2,650 | ) | (7.7 | ) | (964 | ) | (0.7 | ) | (405 | ) | (0.3 | ) | |||||||

Interest income | 7 | - | 31 | 0.1 | 4 | - | 88 | 0.1 | |||||||||||||||

Other expense, net | (973 | ) | (3.0 | ) | (450 | ) | (1.3 | ) | (170 | ) | (0.1 | ) | (162 | ) | (0.1 | ) | |||||||

Income before income taxes | (1,861 | ) | (5.7 | ) | (3,069 | ) | (8.9 | ) | (1,130 | ) | (0.9 | ) | (479 | ) | (0.3 | ) | |||||||

Income tax (provision) benefit | 105 | 0.3 | (3,440 | ) | (10.0 | ) | (1,109 | ) | (0.8 | ) | (4,011 | ) | (2.9 | ) | |||||||||

Net loss | $ | (1,756 | ) | (5.4 | )% | $ | (6,509 | ) | (19.0 | )% | $ | (2,239 | ) | (1.7 | )% | $ | (4,490 | ) | (3.3 | )% | |||

(Loss) per common share: | |||||||||||||||||||||||

Basic | $ | (0.94 | ) | $ | 3.50 | $ | (1.20 | ) | $ | (2.35 | ) | ||||||||||||

Diluted | $ | (0.94 | ) | $ | 3.50 | $ | (1.20 | ) | $ | (2.35 | ) | ||||||||||||

Weighted-average common shares outstanding: | |||||||||||||||||||||||

Basic | 1,860 | 1,859 | 1,866 | 1,913 | |||||||||||||||||||

Diluted | 1,860 | 1,859 | 1,866 | 1,913 | |||||||||||||||||||

Non-GAAP Financial Measures (Sales, Gross Profit and Income From Operations in Constant Dollars)

To supplement its financial results presented in accordance with generally accepted accounting principles in the United States ("GAAP"), Mannatech discloses operating results that have been adjusted to exclude the impact of changes due to the translation of foreign currencies into U.S. dollars, including changes in: Net Sales, Gross Profit, and Income from Operations. It refers to these adjusted financial measures as constant dollar items, which are non-GAAP financial measures. The company believes these measures provide investors an additional perspective on trends. To exclude the impact of changes due to the translation of foreign currencies into U.S. dollars, it calculates current year results and prior year results at a constant exchange rate, which is the prior year's rate. Currency impact is determined as the difference between actual growth rates and constant currency growth rates.

The table below reconciles fourth quarter 2023 constant dollar sales to GAAP sales.

Sales - Q4 2023 | |||||||||

GAAP Measure: Total $ | Non-GAAP Measure: Constant $ | Constant $ Change | |||||||

Americas | $ | 11.0 | $ | 10.8 | $ | (0.2 | ) | ||

Asia Pacific | $ | 19.4 | $ | 19.3 | $ | (0.1 | ) | ||

EMEA | $ | 2.3 | $ | 2.4 | $ | 0.1 | |||

Total | $ | 32.7 | $ | 32.5 | $ | (0.2 | ) | ||

The table below reconciles fiscal year 2023 and 2022 constant dollar net sales, gross profit and income from operations to GAAP net sales, gross profit and income from operations.

2023 | 2022 | Constant Dollar Change | |||||||||||||||||||

GAAP Measure: Total $ | Non-GAAP Translation Adjustment | Non-GAAP Measure: Constant $ | GAAP Measure: Total $ | Dollar | Percent | ||||||||||||||||

Net sales | $ | 132.0 | $ | 2.3 | $ | 134.3 | $ | 137.2 | $ | (2.9 | ) | (2.1 | )% | ||||||||

Gross profit | $ | 102.9 | $ | 1.7 | $ | 104.6 | $ | 104.1 | $ | 0.5 | 0.5 | % | |||||||||

Loss from operations | $ | (1.0 | ) | $ | 0.6 | $ | (0.4 | ) | $ | (0.4 | ) | $ | - | - | % | ||||||

Contacts

Erin K. Barta

General Counsel and Corporate Secretary

972-471-7742

ir@mannatech.com

www.mannatech.com