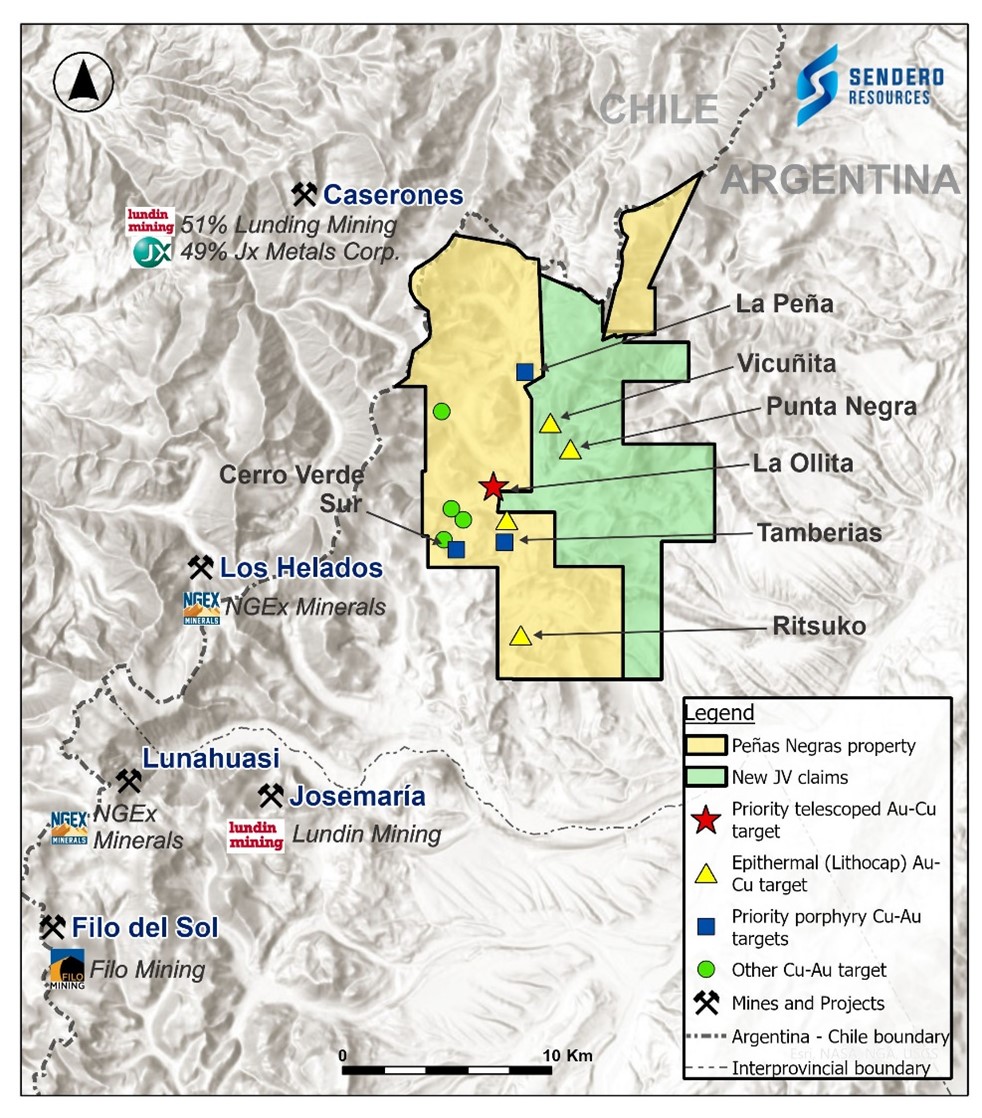

VANCOUVER, BC / ACCESSWIRE / April 3, 2024 / Sendero Resources Corp. (TSX:SEND) ("Sendero" or the "Company") is pleased to announce results of the first three diamond drillholes from the ongoing maiden drilling program at its 100% owned Peñas Negras Project in the Vicuña District in La Rioja, Argentina.

Highlights

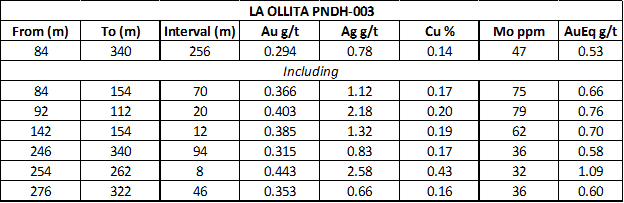

- PNDH003 (La Ollita) intersected 256m of 0.53 g/t Gold Equivalent "AuEq" from 84m.

- including 70m of 0.66 g/t AuEq from 84m

- including 20m of 0.76 g/t AuEq from 92m

- including 94m of 0.58 ag/t AuEq from 246m

- including 8m of 1.09 g/t AuEq from 254m

- including 70m of 0.66 g/t AuEq from 84m

- Ongoing drilling at La Ollita (holes PNDH004-PNDH006) is confirming the presence of a large mineralized advanced argillic epithermal lithocap telescoped on a porphyry gold - copper system.

Sendero Executive Chairman, Michael Wood, commented:

"We are delighted with the initial results from La Ollita in our maiden drilling program which confirms our thesis that La Ollita is a telescoped high-sulfidation epithermal/ porphyry system, like other major deposits in the Vicuña District, such as Filo del Sol, and with comparable grade to the resource grade at Josemaria. Such telescoped systems create large, diverse mineral systems and La Ollita will be the sole focus for the rest of the current drill program as we seek to gain a better understanding of the deposit geometry, grade distribution and mineralogy."

Discovery Hole PNDH003

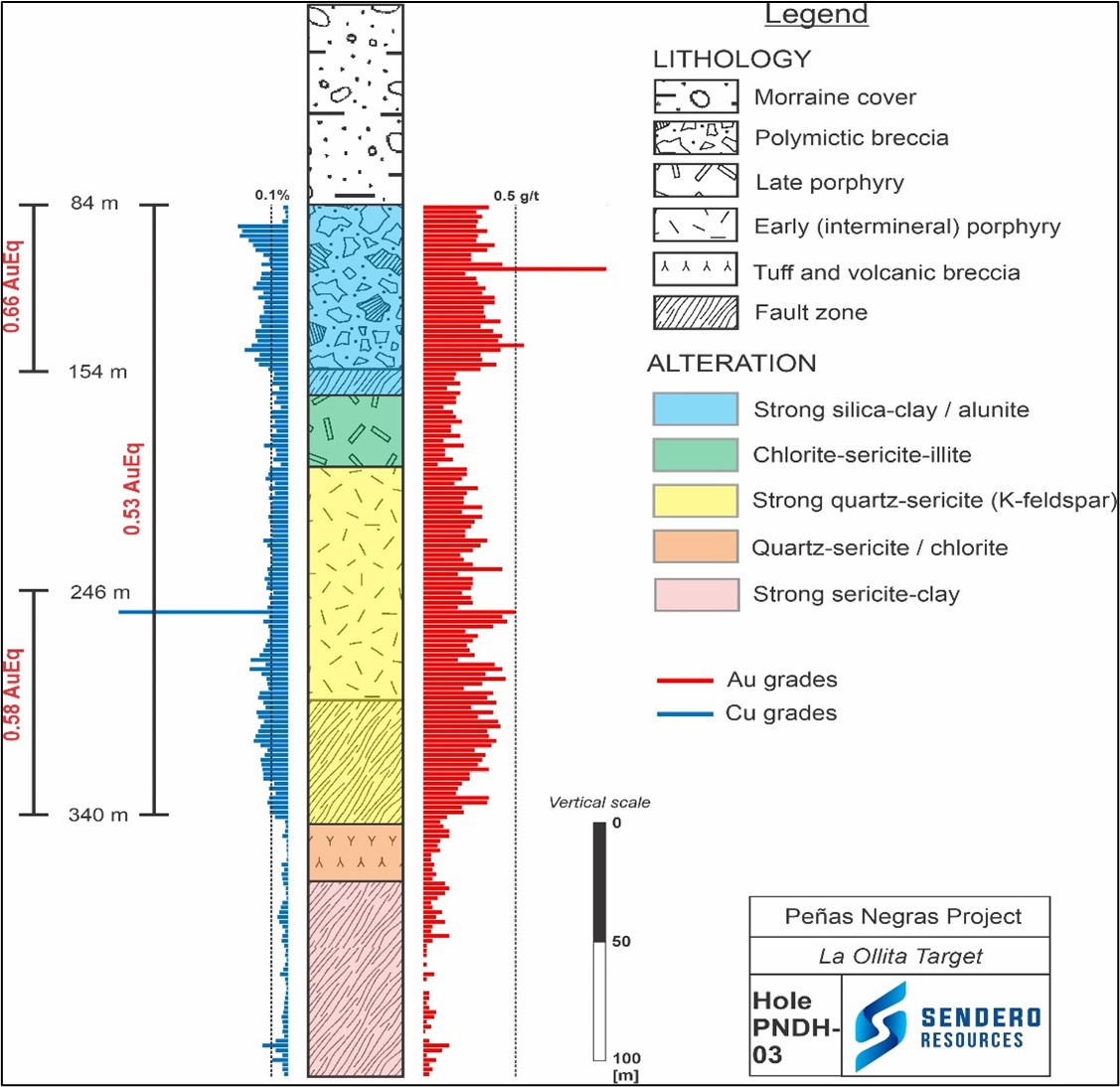

After initial drilling at La Peña and Tamberías, attention was shifted to the La Ollita target where previous drilling in the 1990's by Eldorado Gold had intersected gold (Au) - copper (Cu) mineralisation at relatively shallow depths (=150m). PNDH003, a vertical hole drilled to 450m depth, intersected an advanced argillic lithocap below 84m of moraine cover to a depth of 159m. Below this depth the hole intersected several phases of dacite porphyry, an early mineralized phase, and a late-mineralized phase, before ending in a post-mineral fault zone (Figure 2).

The upper part of the hole intersected a phreatomagmatic breccia with intense pervasive residual vuggy silica and clays with alunite and returned 70m of 0.66 g/t AuEq from 84m (Table 1 and Figure 2). In this advanced argillic style alteration were pyrite-enargite-chalcocite and black sulfide veins with metal values up to Au (1.1g/t), Ag (7.3g/t), Mo (200ppm) and Cu (0.3%). In addition, late intermediate sulfidation epithermal style Zn-Pb-Ag-Cu veins overprint the porphyry Au-Cu mineralization.

Below 159m the hole intersected high sulfidation mineralization and advanced argillic alteration overprinting porphyry-style sericite and potassic (K-feldspar-biotite) alteration with A-type quartz veinlets. The early porphyry phase returned 94m of 0.58 g/t AuEq from 246m (Table 1 and Figure 2). Note that Au-Cu grades dropped off considerably when entering extensive post-mineral faults below 340m, with the reduction in grade due to displacements by the faults rather than a reduction in Au-Cu grades of the system itself. Despite extension drilling into this post-mineral fault zone, we were unable to pass and stopped the hole on advice of the drill contractor.

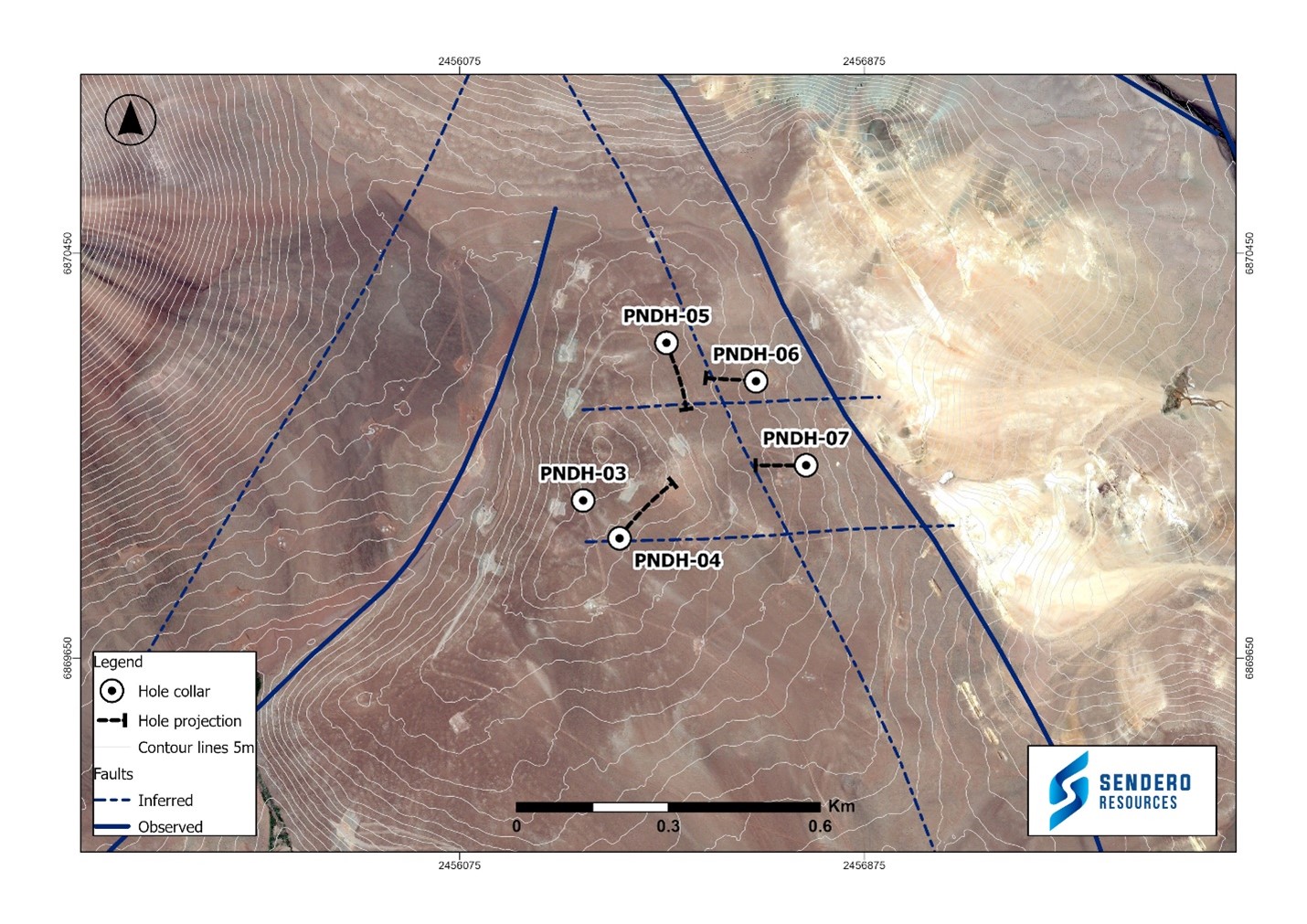

The Company's initial exploration drilling at La Ollita is focused within a triangle-shaped structural zone formed by the intersection of NE-NW-EW faults (Figure 3), which coincides with magnetic and IP chargeability anomalies. The Company's thesis is that this triangular zone represents a zone of weakness and provided a feeder for magmatic-hydrothermal fluids forming the advanced argillic lithocap measuring at least 600 x 600m. The Company believes the advanced argillic lithocap could be far more extensive than this and exploring extensions will be a focus for future drilling.

The results of PNDH003 and the ongoing drilling at La Ollita are demonstrating the existence of an extensive well preserved telescoped Au-Cu-Ag mineral system concealed beneath the moraine cover. This finding is comparable to other deposits in the Vicuña District like Filo del Sol which show alteration and mineralization telescoping on large systems of both high-sulfidation Cu-Au-Ag and porphyry Cu-Au.

The mineralization in PNDH003 is richer in gold than copper with average grades of 0.294 g/t Au to 0.142% Cu across the 256m interval, with the highest metal grades of 1.11 g/t Au (110-112m), 1.35% Cu (254-256m), 9.4 g/t Ag (254-256m) and 200pm of Mo (86-88m). Copper could become dominant in some zones of the system but for now the Company is reporting in gold equivalent (AuEq) as gold has been observed to be the dominant metal in the system to date. If PNDH003 was being reported in Copper Equivalent it would be comparable in grade to the resource grade at the nearby Josemaria deposit.

The remainder of the current drill program will be completed at La Ollita with holes PNDH004, PNDH005 and PNDH006 now completed and PNDH007 currently being drilled (Figure 3). Drilling will continue to mid to late April, with approximately 3,100m drilled so far.

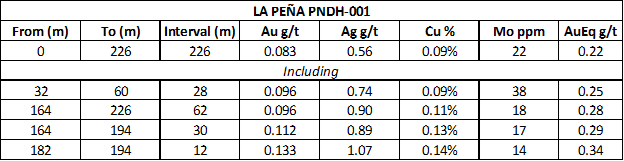

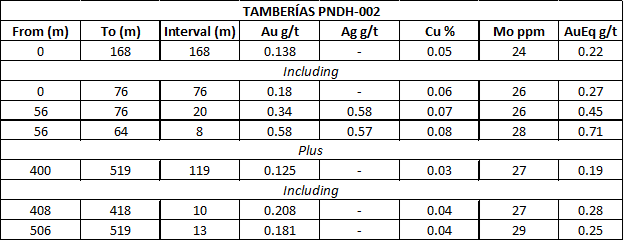

La Peña (PNDH001) and Tamberías (PNDH002)

Drilling started at the two targets, La Peña (PNDH001) and Tamberías (PNDH002), with the most compelling exposed geology, surface soil and rock geochemistry, and magnetic and IP signatures (Figure 1, Tables 2 & 3). In both PNDH001 & PNDH002, Au-Cu and intermediate sulfidation epithermal style mineralization was encountered associated with quartz-diorite porphyry cut by various breccia facies including both magmatic-hydrothermal and late phreatomagmatic breccias. The early magmatic-hydrothermal breccia is mainly polymictic containing clasts of country rock, including porphyritic and fragmental rhyolite, granite, microdiorite, andesite, and volcaniclastic rocks, as well as porphyry Cu clasts with A-style veins.

Assay results confirm low tenor but consistent Au-Cu-Mo grades & Ag at La Peña (see Tables 2 & 3). This is reminiscent of the periphery of Maricunga style gold-rich porphyry systems, and the Company is evaluating future drill hole locations to test different parts of these systems.

Additional Lithocap Targets - Ritzuko, Punta Negra and Vicuñita

Following the positive findings at La Ollita, the Company has been conducting initial field investigations on other lithocap targets on the property known to host gold mineralization from historic geochemistry: two at Ritzuko and two on the new joint venture ground at Punta Negra and Vicuñita (Figure 1). In all four locations there is a similar structural setting to La Ollita with the intersection of NE-NW faults and all four targets show visible advanced argillic alternation (alunite-pyrophyllite-dickite-kaolinite) on ASTER images.

Table 1: PNDH003 La Ollita Drill Highlights

Table 2: PNDH001 La Peña Drill Results

Table 3: PNDH002 Tamberias Drill Results

Note: Gold Equivalent Values are based on metals prices of $2000/oz Au $4/lb Cu, $25/oz Ag, $20/lb Mo and recovery is assumed to be 100% as no metallurgical data is available.

About Sendero Resources Corp.

The Company is focused on copper-gold exploration at its 100% owned Peñas Negras Project in the Vicuña Belt in Argentina. The Peñas Negras Project has similar geological characteristics to other deposits in the Vicuña Belt and a cluster of porphyry and epithermal targets have been identified on the project. The Company, through its wholly owned subsidiary, Barton SAS, is the holder of ten granted mining concessions covering 120 km2 in the province of La Rioja, Argentina. The company also has an option agreement to earn 80% interest on eight granted mining concessions covering 91.7 km2 adjacent to the East of the Peñas Negras Project. The Company has an experienced management and exploration team who will use their expertise and operational knowledge to advance the multiple targets across the project.

Further Information

For further information, please contact:

Sendero Resources Corp.

Michael Wood, Executive Chairman

Email: michael@senderoresources.com

Forward-Looking information

This press release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this press release. Forward-looking information herein includes, without limitation, statements regarding the potential grade and quantity of deposits on the Property, the Company's anticipated drilling program and results of its current further drilling program, the inferred geometry and mineralization of the Property, and the development of the Property and prospects thereof. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected" "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could, "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are necessarily based upon several estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to; general business, economic, competitive, political and social uncertainties; the delay or failure to receive shareholder, director or regulatory approvals; and actual results of exploration at the Peñas Negras Project which may differ from anticipated results. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

QA/QC Statement

Sendero Resources follows industry standard diamond core drilling and sample analysis procedures. Drilling is done with PQ and HQ-size tools. The drill core is cut in half with a diamond rock saw and then half of the core is taken as a sample for analysis and the other as a log. Sampling intervals are 2 m intervals, producing samples between 5 and 15 kg. Half-core samples are transported to Alex Stewart internationally certified laboratory facility in Mendoza, Argentina where the samples are prepared. Alex Stewart has a quality management system (ISO 17025), and testing is performed in Mendoza, Argentina. Samples are fire tested for Au (Au4-30) and analyzed for Ag and multiple elements using the ICP method code (ICP-MA 39) after digestion with 4 acids (HF, HClO4, HNO3 and HCl). Over limits are analyzed using an appropriate method (ICP-ORE). Multi-element geochemical standards and blanks or duplicates are inserted systematically every 10 regular samples, having 10% QA/QC control samples per hole, thus monitoring the laboratory performance. The control samples are inserted in a blank, standard and duplicate pattern. The standard is chosen between low, intermediate or high grade (Au-Cu) according to the geology observed in the corresponding interval. In reference to the chain of custody, the samples are transported from Peñas Negras by Sendero Resources personnel to Alex Stewart laboratory in Mendoza Argentina.

Qualified Person

David Royle (FAusIMM (CP)) supervised the preparation of and reviewed and approved the scientific and technical information pertaining to Peñas Negras Project contained in this news release. David Royle has reviewed the sampling and QA/QC procedures and results as verification of the data disclosed in this news release. David Royle is a qualified person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES.

SOURCE: Sendero Resources Corp

View the original press release on accesswire.com