VANCOUVER, BC / ACCESSWIRE / April 5, 2024 / Sassy Gold Corp. (CSE:SASY)(OTCQB:SSYRF)(FSE:4E7) ("Sassy" or "the Company") is pleased to provide further information on its ongoing uranium property acquisitions in the Western United States, strategically positioning Sassy as the most dominant landholder with multiple past producing mines and deposits in Lisbon Valley, Utah, historically the state's most productive uranium district.

Highlights:

- Sassy's binding LOI's announced March 1, 2024, now include a Utah state lease contiguous to the claims comprising the Central Lisbon Project (without change to the terms of the Transaction);

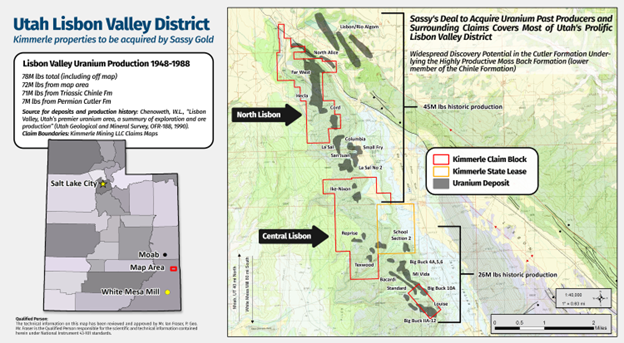

- The total Lisbon Valley land package to be acquired by Sassy (North Lisbon and Central Lisbon) encompasses approximately two-thirds of this entire past producing district (16 miles long and up to 1 mile wide) which was responsible for 78 million pounds of uranium production between 1948 and 1988, 9% of total U.S. domestic uranium produced during that period (see attached map), mostly from the lower member (Moss Back) of the Chinle Formation (source: Chenoweth, 2006, Utah Geological Association Publication 32);

- Significant new discovery potential exists in the underlying and under-explored Cutler Formation which hosts massive sandstone units and was determined to be an economic host in the late 1970's (source: Chenoweth, 2006, Utah Geological Association Publication 32);

- Except for the Jackpile-Paquate area in Cibola County, New Mexico, the Lisbon Valley in Utah has produced more uranium than any area of similar size in the United States. In addition to uranium, more than 24 million pounds of vanadium oxide (V2O5) was associated with some of the ores, especially in the central and southern parts of Lisbon Valley (source: Chenoweth, 2006, Utah Geological Association Publication 32).

Mr. Mark Scott, Sassy President and CEO, commented: "We are proceeding toward completion of the definitive agreement announced March 1. Utah is one of America's most friendly and dynamic jurisdictions for business and also features the country's only operating conventional uranium mill, Energy Fuels' White Mesa. Not only is the Independence Property permitted for small-scale production, but this deal gives us dominance in the critical Lisbon Valley District where there is exceptional exploration upside. We're assembling a team with the ability to unlock the value of these assets, highlighted by 14 past producing properties, and leverage the opportunity for Sassy shareholders."

Lisbon Valley Video

"We've been able to get nearly all of Lisbon Valley tied up. We think that has tremendous potential." - Kyle Kimmerle, Sassy uranium property vendor (Utah and Colorado) and underground mining contractor for Energy Fuels' Pandora mine.

Click on the link below to learn more:

https://www.youtube.com/watch?v=8X3h4qfqvao

Sassy Utah Uranium Video

"We're in kind of a niche market for sure." - Kyle Kimmerle.

Click on the link below to learn more.

https://www.youtube.com/watch?v=A7XSHoJ0PPU

Moving Forward in Lisbon Valley

The uranium deposits in the Lisbon Valley district form a mineralized belt approximately 16 miles long and up to one mile wide on the southwestern flank of the Lisbon Valley anticline, one of several northwest trending salt anticlines in the Paradox Basin. Sassy's deal to acquire the Kimmerle Mining LLC properties would give it control over most of this belt.

A 5-mile-long portion of the south-central part of the ore belt has been removed by erosion, leaving about 6 miles of large deposits to the northwest (the area largely covered by Sassy's ongoing acquisitions) and an additional 5 miles of scattered smaller deposits to the southeast. The cluster of nearby coalesced deposits at the north end of the belt (Lisbon to LaSal No. 2) has produced 43.8 million pounds of uranium oxide (U3O8), and the cluster in the center of the belt (Big Buck 4 to Ash) has produced 23.6 million pounds U3O8 (source: Chenoweth, 2006, Utah Geological Association Publication 32).

Economic production potential for the Lisbon Valley Chinle deposits may exist in the known deposits present in the past producing mines which were shuttered in 1984 and beyond. Bringing these resources current to today's NI-43-101 standards and the incremental expansion of these resources through routine production planning processes may bring new life to the Lisbon Valley Chinle-hosted deposits.

Even greater potential may yet exist in Lisbon Valley's known and as-yet-undiscovered Cutler hosted deposits. As these Cutler deposits do not occur within the Chinle belt, they are not limited to the relatively narrow width of the Chinle belt. Past exploration within the northern half of the Lisbon Valley has generally been focused on the Chinle belt, so here the potential to locate additional deposits in the Cutler Formation west of the Chinle is quite promising and has been accomplished previously.

Investors are cautioned that a Qualified Person (as defined in NI-43-101) has not done sufficient work to verify the historical drilling data. Additional work, including confirmatory drilling and logging, will be required to confirm and update the historical drilling and logging data, including a review of data integrity, assumptions, parameters, methods, and testing. Historical exploration data do not meet reporting requirements as prescribed under NI-43-101. Sassy is not treating the historical data as current, and it should not be relied upon.

Qualified Person

The technical information in this news release has been reviewed and approved by Mr. Ian Fraser, P. Geo. Mr. Fraser is the Qualified Person responsible for the scientific and technical information contained herein under National Instrument 43-101 standards.

About Sassy Gold Corp.

Sassy is an exploration stage resource company currently engaged in the identification, acquisition and exploration of high-grade precious metal and base metal projects in North America, and uranium properties in the Western United States. Sassy owns 100% of the Foremore Project located in the Eskay Camp, Liard Mining Division, in the heart of Northwest B.C.'s prolific Golden Triangle. Sassy also holds a 20% interest in the Highrock Uranium Project in Saskatchewan's Athabasca Basin, and significant equity positions in Gander Gold Corp., Galloper Gold Corp., and MAX Power Mining Corp., giving the Company and its investors direct and indirect exposure to gold, copper, lithium, and uranium.

Caution Regarding Forward Looking Statements

This news release contains "forward-looking statements" and "forward-looking information" (collectively referred to herein as "forward-looking statements") within the meaning of applicable securities legislation. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "continues", "projects", "potential", "budget" and similar expressions, or are events or conditions that "will", "would", "may", "could" or "should" occur or be achieved. Such forward-looking statements reflect the current views of the Company with respect to future events, and are subject to certain risks, uncertainties, and assumptions.

Certain information and statements contained in this news release constitute forward-looking statements, including: the signing of the Definitive Agreement; the closing of the Transaction; satisfaction of any conditions precedent, and satisfaction of those conditions with the Definitive Agreement, is not assured; closing of the Offering; any historical production and quality thereof; path and timing to future extraction; any potential exploration upside of the Properties or potential future drilling and target areas; payment methods for the Transaction; history of stone-hosted, roll-front uranium on any of the Properties; future opportunities to improve historic economics of the region's uranium/vanadium deposits; historic mineralization and production within the State of Utah and any inferred indication of future performance of properties to be acquired; accuracy of historical drilling or exploration data; certainty of any exchange, regulatory or securities approval, if applicable.

The forward-looking statements are based on certain assumptions that the Company has made in respect thereof as at the date of this news release regarding, among other things: that all required regulatory approvals can be obtained or maintained on the necessary terms and in a timely manner, as applicable; that counterparties to the Company's agreements and contracts will comply with the terms thereof in a timely manner; that there are no unforeseen events preventing the performance of contracts; and that there are no unforeseen material costs relating to exploration of the Company's properties.

Although the Company believes that the material factors, expectations and assumptions expressed in such forward-looking statements are reasonable based on information available to it on the date such statements are made, undue reliance should not be placed on the forward-looking statements because the Company can give no assurances that such statements and information will prove to be correct and such statements do not guarantee future performance. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties.

Actual performance and results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to known and unknown risks, including those set forth in the Company's Management Discussion and Analysis (a copy of which can be found under Sassy's profile on SEDAR+ at www.sedarplus.ca). Accordingly, readers should not place undue importance or reliance on the forward-looking statements. Readers are cautioned that the list of factors is not exhaustive. Statements, including forward-looking statements, contained in this news release are made as of the date they are given, and the Company disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. The forward-looking statements contained in this news release are expressly qualified by this cautionary statement. Additional information on these and other factors that could affect the Company's operations and financial results are included in reports on file with applicable securities regulatory authorities and may be accessed under the Company's profile on SEDAR+ at www.sedarplus.ca.

All currency within the news release is intended to be in USD, unless otherwise stated.

The CSE has neither approved nor disapproved the contents of this news release. Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Contact Information

Mark Scott

Chief Executive Officer

info@sassygold.com

Terry Bramhall

Corporate Communications & Investor Relations

terry.bramhall@sassygold.com

1.604.833.6999 (mobile)

1.604.675.9985 (office)

SOURCE: Sassy Gold Corp.

View the original press release on accesswire.com