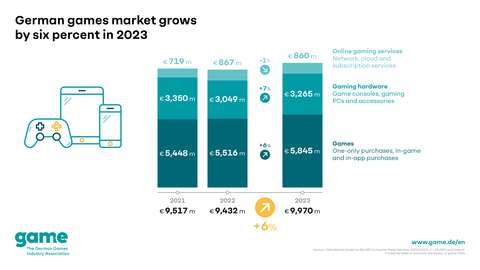

- Sales revenues from games, games hardware and fees for online gaming services rise by 6 per cent to 9.97 billion euros

- Game consoles as well as in-game and in-app purchases are among the biggest growth drivers

- Gaming PCs and related accessories see a clear drop in sales revenue

The German games market once again grew significantly overall in 2023: sales of games, games hardware and gaming online services rose by 6 per cent to around 9.97 billion euros. This is a significant increase after sales had only risen by 1 per cent in the previous year. The biggest growth drivers include games consoles and their accessories as well as in-game and in-app purchases. Despite the large number of top-class titles, which increased sales of games purchases by 4 per cent, the number of games sold fell by 8 per cent at the same time. There were also significant declines in some cases for gaming PCs and laptops. The data on the German games market is based on surveys conducted by the consumer panel services GfK and data.ai. The different developments in the individual market segments also show that 2023 was a year of contrasts for the games industry as a whole: on the one hand, more high-calibre titles were released within twelve months than ever before. On the other hand, some sales expectations were not met, particularly due to this abundance of outstanding games. Combined with generally high interest rates and a slowdown in the investment market, a wave of consolidation began worldwide, as a result of which developer studios are still being downsized or even closed and jobs are being cut.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240409611870/en/

German games market grows by six percent in 2023. game The German Games Industry Association

'The German games market continues to grow, but a close look at the data shows just how challenging these times are for game companies,' says Felix Falk, Managing Director of game. 'This is particularly true for small to medium-sized companies in Germany, most of which have only thin capital cover and therefore feel the impact of the tougher investment climate especially quickly. In such turbulent times reliable and internationally competitive political solutions are needed more than ever.'

Major differences between categories of games hardware

Sales revenues from various categories of games hardware developed very differently last year. Game consoles were among the most important growth drivers, posting a revenue increase of 44 per cent to break the billion-euro threshold, with total revenues of 1.1 billion euros. Demand for game console accessories was similarly robust, if at a slightly lower level. Sales revenues in this area jumped 32 per cent, to 374 million euros. In stark contrast, gaming PCs registered a clear decline as revenues from PCs and laptops marketed specially for games dropped by 17 per cent, to 547 million euros. Accessories for gaming PCs including special input devices, graphic cards, etc. fared only slightly better, with revenues falling by 7 per cent, to just under 1.3 billion euros.

'Last year was the first year in a long time in which all current game consoles were easily available on the market,' says Felix Falk. 'The huge revenue gain in this category in 2023 shows how great the pent-up demand was among players. On the other hand, there was a clear drop in sales revenues from gaming PCs. After investing in PCs and laptops during the Covid-19 pandemic, a lot of video game players seem to be well-equipped for the moment.'

Sales revenue from games rises and gaming online services stabilise at a high level

Sales revenue from games developed positively overall in 2023. Across all platforms, purchases of PC and console games generated 4 per cent more revenue than in the year before. Total sales revenues in this area increased to around 1.1 billion euros. Considering the many high-quality game releases, however, this rise seems rather low. Indeed, the number of games sold actually dropped by 8 per cent. This reveals that the growth in revenue here is attributable exclusively to higher average prices. Last year, many video game players appear to have purchased high-quality titles shortly after their release and not waited for discounts. Also, because many of the top titles of 2023 are especially time-intensive, they didn't leave room for players to acquire a larger number of games. In contrast, the market development for in-game and in-app purchases was significantly more positive, showing a revenue increase of about 6 per cent, to 4.7 billion euros. From an upgrade in a player character's armour, to a season pass with a lot of additional content, to completely new campaigns, it has become ever more common for the playing time of a game to be extended or individualised through additional content. This trend continued in 2023. In-game sales revenues contribute significantly to covering continuously rising game development costs.

After a number of years of strong growth, sales revenues from online gaming services stabilised at a high level. Among the categories in this segment are fee-based subscription services that provide access to a large selection of games, cloud-based gaming, online multiplayer functions and the ability to save game progress in the cloud. Examples of these services include EA Play, Nintendo Switch Online, PlayStation Plus, Xbox Game Pass and Ubisoft+. Revenue from these services fell by 1 per cent in 2023, to 860 million euros.

About the market data

Please note: the definition of gaming PCs and laptops has been fundamentally revised. The new definition has been applied not just to current figures, but also to those for the preceding years, resulting in retroactive changes to these sales figures.

The market data is based on statistics compiled by Consumer Panel Services GfK and data.ai. The methods used by CPS GfK to collect data on Germany's video game market are unique in terms of both their quality and their global use. They include an ongoing survey of 25,000 consumers who are representative of the German population as a whole regarding their video game purchasing and usage habits, as well as a retail panel. The data collection methods provide a unique insight into the German market for computer and video games.

game The German Games Industry Association

We are the association of the German games industry. Our members represent the entire video game ecosystem, from development studios and publishers to esports event organisers, educational institutions and other related entities. We are co-organisers of gamescom, the world's biggest event for computer and video games. We are a shareholder in the Entertainment Software Self-Regulation Body (USK), the Foundation for Digital Games Culture, the esports player foundation, devcom and the collecting society VHG, as well as co-host of the German Computer Game Awards. Serving as a central point of contact for media, as well as political and social institutions, we provide comprehensive expertise in areas including market development, game culture and media literacy, and address any inquiries or concerns. Together we are making Germany the heart of gaming worldwide. With games, we enrich the lives of all people.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240409611870/en/

Contacts:

Martin Puppe

game The German Games Industry Association

Email: martin.puppe@game.de

www.game.de

X: @game_verband

Facebook.com/game.verband

Instagram: game_verband