CALGARY, AB / ACCESSWIRE / April 9, 2024 / CANEX Metals Inc. ("CANEX" or the "Company") announces that further to its news release dated March 5, 2024, it has received TSX Venture Exchange ("TSX Venture") approval for the option of the Louise copper-gold porphyry deposit in British Columbia and a surface mapping and sampling program at the Gold Range Project in Arizona has been successfully completed.

Louise Option Approved

The Company is pleased to announce the Exchange has approved the terms of the option agreement on the Louise Copper Gold Porphyry in British Columbia. The option agreement allows Canex to earn a 100% interest in the Louise Project by making the following payments over a 5 year period:

- $10,000 in shares or cash on Regulatory Approval; $25,000 in shares or cash on or before March 1st, 2025; $50,000 in shares or cash on or before March 1st, 2026; $90,000 in shares or cash on or before March 1st, 2027; $200,000 in shares or cash on or before March 1st, 2028; and $400,000 in shares or cash on or before March 1st, 2029

Canex issued a total of 200,000 shares upon receipt of regulatory approval to the Vendor at a price of $0.05 per share. These shares are subject to a hold period of four months plus one day or until August 9, 2024. There are no expenditure commitments with the option allowing CANEX to advance the project as market conditions allow. The vendor, Bernie Kreft, will retain a 2.5% net smelter royalty (NSR), with CANEX having the right to buy back 40% of the NSR (1% of the 2.5% NSR) for $1,500,000. CANEX will retain a right of first refusal on the sale of Kreft's royalty.

A milestone bonus of $50,000 in shares or cash will also be payable if CANEX drills over 4250 metres of core, and a second milestone bonus of $50,000 in shares or cash will be payable if CANEX publishes a resource estimate with greater than 1.5 million contained ounces of gold.

Louise Project Summary

The Louise Project is road accessible and located approximately 35 kilometres west of Smithers, in west central British Columbia. Previous drilling has defined a near surface mineralized zone 1000 metres long by 100 to 200 metres wide, extending to about 270 metres depth. Previous drilling has intersected strong copper and gold grades highlighted by hole LL04-03 which returned an interval of 158 metres grading 0.41% copper and 0.40 g/t gold starting at 53.5 metres downhole. Such strong grades, that appear to increase with depth, suggest good grade potential could exist in the main body of the porphyry system which is hypothesized to occur at depth or adjacent to the known mineralized zone.

Table 1. Louise Project Historic Drill hole highlights

Hole | From (m) | To (m) | Interval (m)1 | CuEq (%)2 | Cu (%) | Au (g/t) | Mo (%) | Ag (g/t) |

| LL04-03 | 49.5 | 253.5 | 204.0 | 0.57 | 0.37 | 0.35 | 0.012 | 1.2 |

| including | 53.5 | 211.5 | 158.0 | 0.64 | 0.41 | 0.40 | 0.014 | 1.3 |

| LL05-04 | 103.0 | 295.1 | 192.1 | 0.43 | 0.27 | 0.26 | 0.011 | 1.0 |

| LL05-05 | 140.8 | 311.3 | 170.5 | 0.41 | 0.25 | 0.25 | 0.011 | 0.9 |

| LL04-02 | 147.0 | 297.0 | 150.0 | 0.56 | 0.34 | 0.34 | 0.018 | 1.1 |

| including | 188.9 | 293.0 | 104.1 | 0.67 | 0.42 | 0.41 | 0.019 | 1.4 |

| LL06-10 | 208.8 | 289.0 | 80.2 | 0.60 | 0.40 | 0.41 | 0.005 | 1.5 |

| LL05-02 | 221.6 | 300.3 | 78.7 | 0.78 | 0.45 | 0.44 | 0.037 | 1.2 |

1 Interval refers to drill hole intercept, true thickness is not known.

2 CuEq (copper equivalent) is provided for illustrative purposes only and is calculated using metals prices (USD) of $3.75/lb Cu, $2000/oz Au, $18/lb Mo, and $22/oz Ag using recovery assumptions of 85% for Cu, 55% for Au, 80% for Mo, and 44% for Ag.

The Company is assembling and analyzing the historic data for the Louise Project and will formulate an exploration plan for the project once data interpretation is complete.

Gold Range Surface Exploration Program Completed

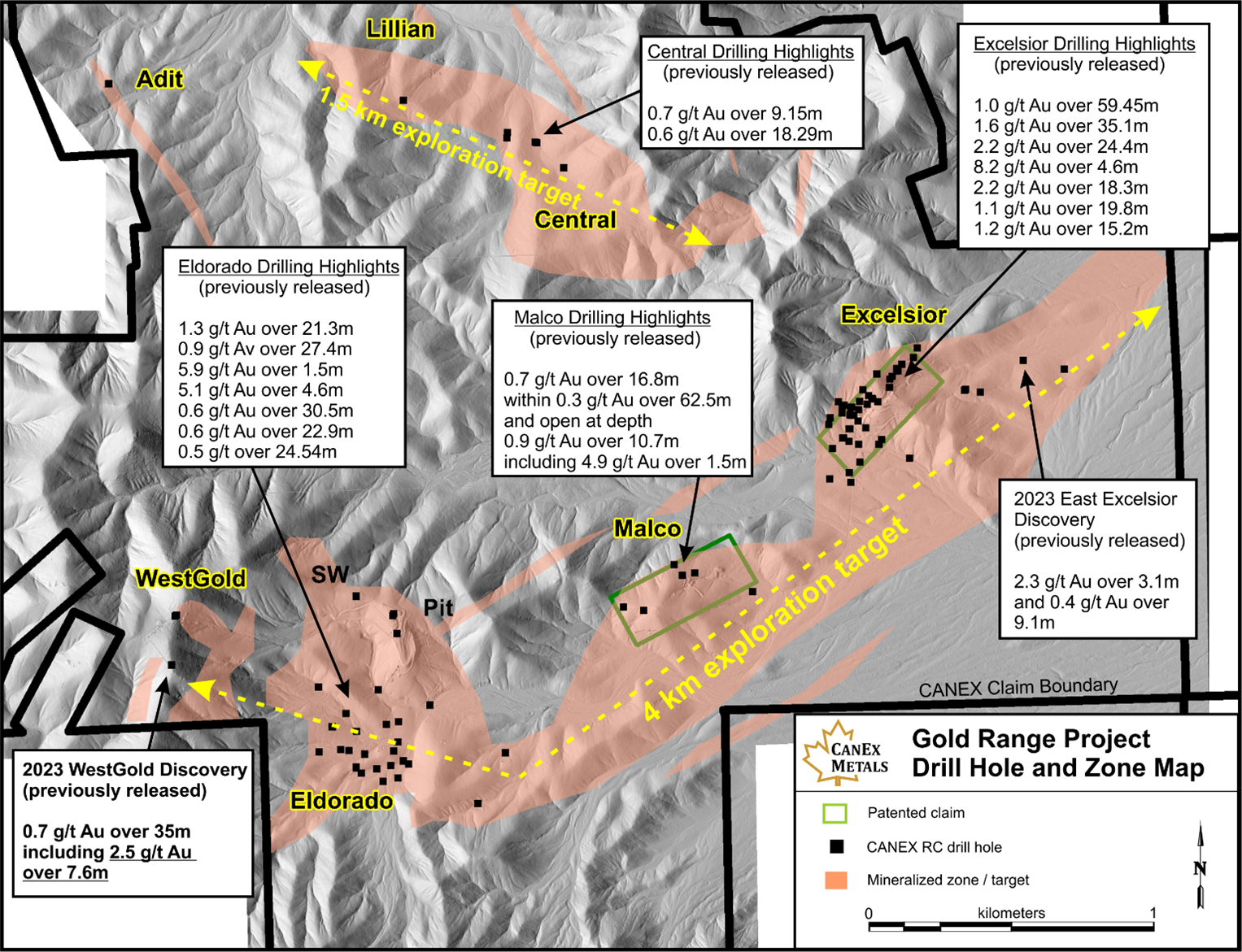

CANEX successfully completed a surface exploration program at the Gold Range Project in Arizona in March. The program included detailed surface mapping and sampling at the WestGold area resulting in increased understanding and further refinement of strong drill targets at the zone. Two new occurrences of gold mineralization were discovered and sampled in other parts of the property and their potential will be further evaluated once assay results have been received. In total, 151 surface rock and soil samples were collected and submitted for assay and an additional 125 samples of drill hole pulps were collected for alteration studies by shortwave infrared and near-infrared spectroscopy. Assay results from the program are expected in May.

Figure 1. Gold Range Property map showing drill holes and exploration targets.

About CANEX Metals

CANEX Metals (TSX.V:CANX) is a Canadian junior exploration company focused on advancing it's 100% owned Gold Range Project in Northern Arizona. With several near surface bulk tonnage gold discoveries made to date across a 4 km gold mineralized trend, the Gold Range Project is a compelling early stage opportunity for investors. CANEX is led by an experienced management team which has made three notable porphyry and bulk tonnage discoveries in North America and is sponsored by Altius Minerals (TSX: ALS), a large shareholder of the Company.

Dr. Shane Ebert P.Geo., is the Qualified Person for CANEX Metals and has approved the technical disclosure contained in this news release.

Shane Ebert, President/Director

For Further Information Contact:

Shane Ebert at 1.250.964.2699 or

Jean Pierre Jutras at 1.403.233.2636

Web: http://www.canexmetals.ca

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for the historical and present factual information contained herein, the matters set forth in this news release, including words such as "expects", "projects", "plans", "anticipates" and similar expressions, are forward-looking information that represents management of CANEX Metals Inc. internal projections, expectations or beliefs concerning, among other things, future operating results and various components thereof or the economic performance of CANEX. The projections, estimates and beliefs contained in such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause CANEX's actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, those described in CANEX's filings with the Canadian securities authorities. Accordingly, holders of CANEX shares and potential investors are cautioned that events or circumstances could cause results to differ materially from those predicted. CANEX disclaims any responsibility to update these forward-looking statements.

SOURCE: CANEX Metals Inc.

View the original press release on accesswire.com