HALIFAX, NS / ACCESSWIRE / April 9, 2024 / Namibia Critical Metals Inc. ("Namibia Critical Metals" or the "Company" or "NCMI") (TSXV:NMI)(OTCQB:NMREF) is pleased to announce an updated NI 43-101 Mineral Resource Estimate for the large-scale "Lofdal 2B-4" heavy rare earth project.

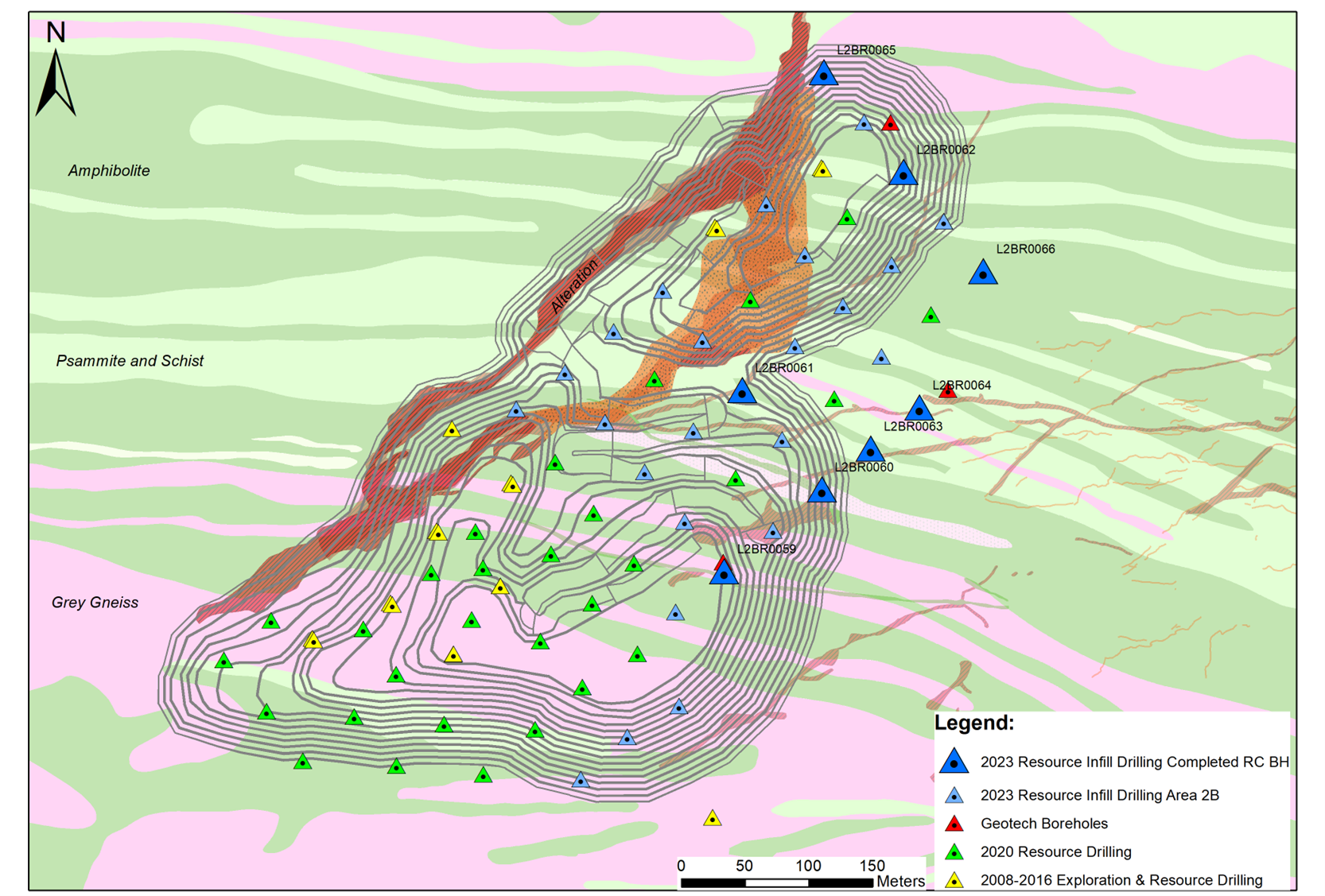

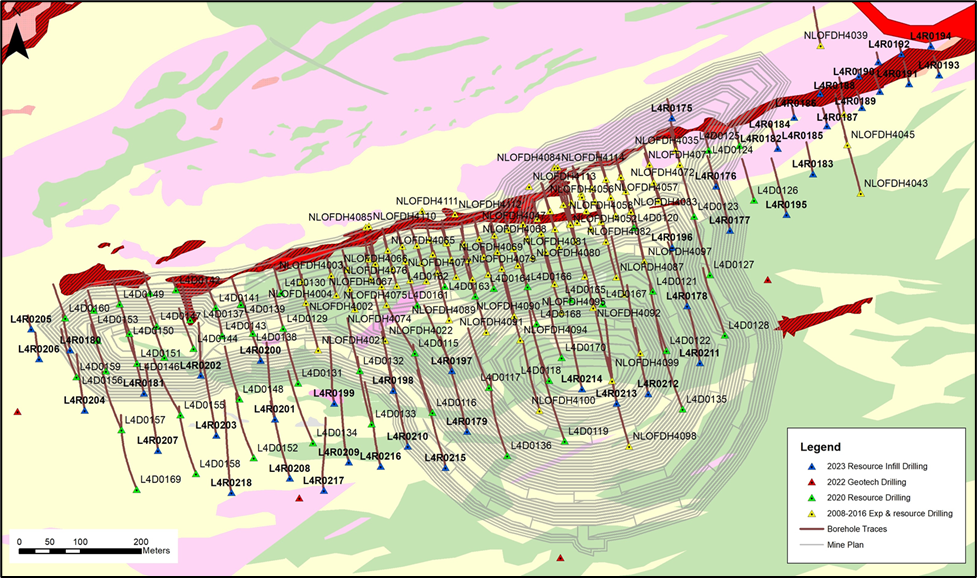

The Company conducted a two-stage infill drilling campaign for the subprojects Area 4 and Area 2B (press releases of 2 February 2024, 6 December 2023 and 31 January 2023) with the purpose of increasing the confidence of the resources for the planned open pits of Area 4 and Area 2B. The MSA Group provided an NI 43-101 Mineral Resource Estimate which includes the new data.

Highlights of the mineral resource update include:

- Contained tonnages of Dysprosium and Terbium - the most valuable heavy rare earth elements - amount to 4,503 tonnes Dysprosium oxide and 693 tonnes Terbium oxide in the combined Measured and Indicated Resource categories which represents an increase of 11% and 12%, respectively, compared to the previous Mineral Resource Statement (filed on SEDAR on 30 June 2021);

- 38% increase in contained Dysprosium oxide and 39% increase in contained Terbium oxide in the Inferred Resources for the combined Area 4 and Area 2B deposits;

- 31% increase in contained Total Rare Earth Oxide (TREO1) tonnage in the combined Measured and Indicated Resource categories from 72,680 tonnes to 93,731 tonnes;

- The combined Measured and Indicated Mineral Resources increased from 44.8 million tonnes at 0.17% TREO to 58.5 million tonnes at 0.16% TREO for the combined Area 4 and Area 2B deposits based on the same cut-off of 0.1 % TREO as in the previous PEA (filed on SEDAR on 30 June 2021);

Darrin Campbell, President of Namibia Critical Metals stated:

"We are very pleased with the continued success of our development approach at Lofdal. With just under 11,000 meters of drilling last year, we have increased the overall contained rare earth tonnage by an impressive 37%. The Measured and Indicated resource shells at Lofdal 2B and 4 contain over 4,500 tonnes Dysprosium oxide and over 690 tonnes Terbium oxide which clearly establishes Lofdal as a globally significant heavy rare earth deposit. The updated resource will be incorporated into our Pre-Feasibility Study for "Lofdal 2B-4" currently under way and expected to be completed in Q3 2024"

1"TREO" refers to total rare earth oxides plus yttrium oxide; "HREO" refers to heavy rare earth oxides plus yttrium oxide; "heavy rare earths" as used in all Company presentations comprise europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), lutetium (Lu) and yttrium (Y). Light rare earths comprise lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd) and samarium (Sm).

Infill drilling program at Area 2B and Area 4 Deposit

The final drill program was worked out by the Company with support by The MSA Group to increase the level of resource categories as required for the PFS for the expanded project "Lofdal 2B-4".

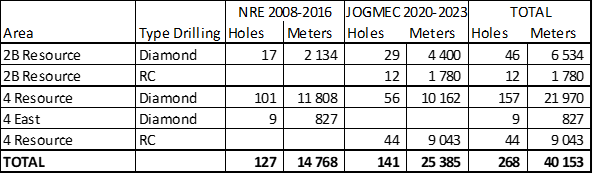

Resource infill drilling was completed in November 2023 which brought total drilling for Area 2B and Area 4 to 268 holes with a total of 40,153 m of both, diamond core drilling (DC) and reverse circulation drilling (RC), see table below:

Sampling, analysis and QAQC

Samples were collected at the drill rig's cyclone ("A-sample") and submitted to Actlab's preparatory laboratory in Windhoek, Namibia, in batches of 200 to 300 samples. The samples were dried and crushed to 2 mm, split using a riffle splitter and pulverised to 105 µm. Pulverised sub-samples were homogenised in a stainless-steel riffle splitter and a 15 g sample and duplicate were drawn for analysis. The pulverised sample aliquots were shipped to the ISO/IEC 17025 accredited Actlabs analytical facility in Ancaster, Ontario, Canada. The samples were assayed using lithium metaborate-tetraborate fusion and Inductively Coupled Plasma Mass Spectrometry (ICP-MS). Actlab's analytical code "8-REE" includes 45 trace elements, 10 major oxides, Loss on Ignition, and mass balance.

The samples were subjected to a quality assurance and quality control (QAQC) program consisting of the insertion of blank samples, field duplicates and certified reference materials at Lofdal and the preparation of a laboratory duplicate at the sample preparation facility in Windhoek.

The Qualified Person, Dr Scott Swinden, is satisfied that the assay results are of sufficient accuracy and precision for use in the future update of the Mineral Resource Estimation.

Mineral Resource Statement

The Mineral Resource was estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Best Practice Guidelines and is reported in accordance with the 2014 CIM Definition Standards, which have been incorporated by reference into National Instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101). The Mineral Resource is classified into the Measured, Indicated and Inferred categories and is reported at a cut-off grade of 0.1% total rare earth oxides (TREO). A summary of the Mineral Resource estimates is shown in Table 1 for Area 4 and Table 2 for Area 2B.

Table 1: Area 4 Mineral Resource Estimate above 0.1% TREO* cut-off grade

Category | Tonnes | TREO* | HREO** | LREO*** | Dy2O3 | TREO* |

Measured | 6.6 | 0.21 | 0.14 | 0.07 | 130 | 13.7 |

Indicated | 49.2 | 0.15 | 0.07 | 0.08 | 69 | 75.7 |

Measured & Indicated | 55.8 | 0.16 | 0.08 | 0.08 | 76 | 89.4 |

Inferred | 10.5 | 0.14 | 0.06 | 0.08 | 58 | 15.0 |

Notes:

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

- *TREO = Total Rare Earth Oxides and includes Y2O3

- **HREO = Total Heavy Rare Earth Oxides and includes Y2O3

- ***LREO = Total Light Rare Earth Oxides

Table 2: Area 2B Mineral Resource Estimate above 0.1% TREO* cut-off grade

Category | Tonnes | TREO* | HREO** | LREO*** | Dy2O3 | TREO* |

Indicated | 2.7 | 0.16 | 0.09 | 0.07 | 97 | 4.4 |

Inferred | 4.4 | 0.15 | 0.07 | 0.08 | 75 | 6.6 |

Notes:

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

- *TREO = Total Rare Earth Oxides and includes Y2O3

- **HREO = Total Heavy Rare Earth Oxides and includes Y2O3

- ***LREO = Total Light Rare Earth Oxides

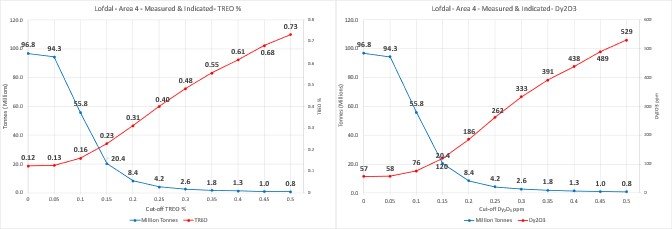

The Mineral Resource is presented at a variety of cut-off grades as shown in Error! Reference source not found. (Measured and Indicated) and Error! Reference source not found. (Inferred) for Area 4, and Error! Reference source not found. (Indicated) and Error! Reference source not found. (Inferred) for Area 2B. The grade-tonnage curves (Figure 3) underline the large upside potential of the Lofdal project by potentially beneficiating lower grade resources, likely by sorting technologies, in future.

Table 3: Area 4, Measured and Indicated Resources Grade-Tonnages

Cut-off TREO % | Tonnes | TREO* | HREO** | LREO** | Dy2O3 ppm | TREO |

0.10 | 55.8 | 0.16 | 0.08 | 0.08 | 76 | 89.4 |

0.15 | 20.4 | 0.23 | 0.13 | 0.10 | 120 | 46.5 |

0.20 | 8.4 | 0.31 | 0.20 | 0.11 | 186 | 26.0 |

0.25 | 4.2 | 0.40 | 0.29 | 0.11 | 262 | 16.8 |

0.30 | 2.6 | 0.48 | 0.38 | 0.10 | 333 | 12.4 |

Table 4: Area 4, Inferred Resources Grade-Tonnages

Cut-off TREO % | Tonnes | TREO* | HREO** | LREO*** | Dy2O3 ppm | TREO |

0.10 | 10.5 | 0.14 | 0.06 | 0.08 | 58 | 15.0 |

0.15 | 3.4 | 0.18 | 0.08 | 0.11 | 76 | 6.3 |

0.20 | 0.7 | 0.24 | 0.12 | 0.12 | 118 | 1.7 |

0.25 | 0.2 | 0.30 | 0.20 | 0.09 | 193 | 0.6 |

Notes:

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

- *TREO = Total Rare Earth Oxides and includes Y2O3

- **HREO = Total Heavy Rare Earth Oxides and includes Y2O3

- ***LREO = Total Light Rare Earth Oxides

Table 5: Area 2B, Indicated Resources Grade-Tonnages

Cut-off TREO % | Tonnes | TREO* | HREO** | LREO*** | Dy2O3 ppm | TREO |

0.10 | 2.7 | 0.16 | 0.09 | 0.07 | 97 | 4.4 |

0.15 | 1.3 | 0.21 | 0.11 | 0.10 | 117 | 2.7 |

0.20 | 0.6 | 0.25 | 0.12 | 0.13 | 133 | 1.5 |

0.25 | 0.3 | 0.29 | 0.14 | 0.15 | 150 | 0.8 |

Notes:

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

- *TREO = Total Rare Earth Oxides and includes Y2O3

- **HREO = Total Heavy Rare Earth Oxides and includes Y2O3

- ***LREO = Total Light Rare Earth Oxides

Table 6: Area 2B, Inferred Resources Grade-Tonnages

Cut-off TREO % | Tonnes | TREO* | HREO** | LREO*** | Dy2O3 ppm | TREO |

0.10 | 4.4 | 0.15 | 0.07 | 0.08 | 75 | 6.6 |

0.15 | 1.6 | 0.20 | 0.09 | 0.11 | 96 | 3.3 |

0.20 | 0.6 | 0.25 | 0.10 | 0.15 | 111 | 1.6 |

0.25 | 0.2 | 0.31 | 0.10 | 0.20 | 115 | 0.8 |

Notes:

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

- *TREO = Total Rare Earth Oxides and includes Y2O3

- **HREO = Total Heavy Rare Earth Oxides and includes Y2O3

- ***LREO = Total Light Rare Earth Oxides

The Mineral Resource is reported at a 0.1% TREO cut-off for each individual Rare Earth Oxide (REO) (Error! Reference source not found. for Area 4 and Error! Reference source not found. for Area 2B). Quantities for each individual REO are reported in tonnes (t) at a 0.1% TREO cut-off in Error! Reference source not found. for Area 4 and in Error! Reference source not found. for Area 2B.

Table 7: Area 4 Mineral Resource Estimate above 0.1% TREO* cut-off grade

Class | Tonnes | TREO* | La2O3 | Ce2O3 | Pr2O3 | Nd2O3 | Sm2O3 | Eu2O3 | Gd2O3 | Tb2O3 | Dy2O3 | Ho2O3 | Er2O3 | Tm2O3 | Yb2O3 | Lu2O3 | Y2O3 |

Measured | 6.57 | 0.21 | 173 | 313 | 34 | 124 | 42 | 18 | 81 | 19 | 130 | 28 | 83 | 12 | 76 | 11 | 935 |

Indicated | 49.22 | 0.15 | 217 | 383 | 40 | 145 | 40 | 14 | 55 | 11 | 69 | 14 | 41 | 6 | 36 | 5 | 463 |

M&I | 55.79 | 0.16 | 211 | 374 | 39 | 142 | 40 | 15 | 58 | 12 | 76 | 16 | 46 | 7 | 41 | 6 | 519 |

Inferred | 10.52 | 0.14 | 217 | 389 | 42 | 150 | 40 | 13 | 49 | 9 | 58 | 12 | 34 | 5 | 30 | 4 | 369 |

Notes:

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

- *TREO = Total Rare Earth Oxides and includes Y2O3

Table 8: Area 4 TREO and Individual REO Quantities above 0.1% TREO* cut-off grade

Class | Tonnes | TREO* | La2O3 | Ce2O3 | Pr2O3 | Nd2O3 | Sm2O3 | Eu2O3 | Gd2O3 | Tb2O3 | Dy2O3 | Ho2O3 | Er2O3 | Tm2O3 | Yb2O3 | Lu2O3 | Y2O3 |

Measured | 6.57 | 13 650 | 1 137 | 2 055 | 220 | 815 | 276 | 120 | 531 | 124 | 855 | 186 | 545 | 82 | 496 | 72 | 6 136 |

Indicated | 49.22 | 75 728 | 10 660 | 18 832 | 1 983 | 7 134 | 1 962 | 694 | 2 713 | 528 | 3 391 | 695 | 2 009 | 291 | 1 781 | 257 | 22 798 |

M&I | 55.79 | 89 378 | 11 797 | 20 888 | 2 203 | 7 950 | 2 238 | 814 | 3 243 | 653 | 4 246 | 881 | 2 554 | 373 | 2 277 | 329 | 28 934 |

Inferred | 10.52 | 14 955 | 2 279 | 4 089 | 437 | 1 580 | 426 | 137 | 520 | 97 | 611 | 124 | 356 | 51 | 317 | 46 | 3 886 |

Notes:

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

- *TREO = Total Rare Earth Oxides and includes Y2O3

1"TREO" refers to total rare earth oxides plus yttrium oxide; "HREO" refers to heavy rare earth oxides plus yttrium oxide; "heavy rare earths" as used in all Company presentations comprise europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), lutetium (Lu) and yttrium (Y). Light rare earths comprise lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd) and samarium (Sm).

Table 9: Area 2B Mineral Resource Estimate above 0.1% TREO* cut-off grade

Class | Tonnes | TREO* | La2O3 | Ce2O3 | Pr2O3 | Nd2O3 | Sm2O3 | Eu2O3 | Gd2O3 | Tb2O3 | Dy2O3 | Ho2O3 | Er2O3 | Tm2O3 | Yb2O3 | Lu2O3 | Y2O3 |

Indicated | 2.65 | 0.16 | 187 | 303 | 32 | 126 | 51 | 20 | 73 | 15 | 97 | 19 | 55 | 8 | 51 | 7 | 596 |

Inferred | 4.37 | 0.15 | 196 | 320 | 36 | 160 | 76 | 25 | 80 | 13 | 75 | 14 | 40 | 6 | 36 | 5 | 440 |

Notes:

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

- *TREO = Total Rare Earth Oxides and includes Y2O3

Table 10: Area 2B TREO and Individual REO Quantities above 0.1% TREO* cut-off grade

Class | Tonnes | TREO* | La2O3 | Ce2O3 | Pr2O3 | Nd2O3 | Sm2O3 | Eu2O3 | Gd2O3 | Tb2O3 | Dy2O3 | Ho2O3 | Er2O3 | Tm2O3 | Yb2O3 | Lu2O3 | Y2O3 |

Indicated | 2.65 | 4 353 | 496 | 805 | 85 | 334 | 136 | 52 | 193 | 40 | 257 | 51 | 147 | 22 | 135 | 19 | 1581 |

Inferred | 4.37 | 6 647 | 856 | 1398 | 156 | 701 | 331 | 108 | 351 | 56 | 326 | 62 | 174 | 25 | 157 | 23 | 1922 |

Notes:

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

- *TREO = Total Rare Earth Oxides and includes Y2O3

Table 11: Comparison of Lofdal Mineral Resource Estimates of 2021 and 2024 at a 0.1% TREO cut-off grade

| Year of Mineral Resource Estimate | 2021 | 2024 | ||

Million tonnes | Grade | Million tonnes | Grade | |

(Mt) | %TREO | (Mt) | %TREO | |

| Measured Resource Area 4 | 5.93 | 0.21 | 6.6 | 0.21 |

| Indicated Resource Area 4 | 36.63 | 0.16 | 49.2 | 0.15 |

| Indicated Resource Area 2B | 2.2 | 0.19 | 2.7 | 0.16 |

| Total Measured & Indicated Resources | 44.76 | 0.17 | 58.5 | 0.16 |

| Inferred Resource Area 4 | 6.09 | 0.17 | 10.5 | 0.14 |

| Inferred Resource Area 2B | 2.58 | 0.19 | 4.4 | 0.15 |

| Total Inferred Resources | 8.67 | 0.17 | 14.9 | 0.14 |

Table 12: Comparison of contained TREO, Dysprosium oxide and Terbium oxide in Mineral Resource Estimates of 2021 and 2024 at a 0.1% TREO cut-off grade

TREO | Dy2O3 | Tb2O3 | ||||

| Year of Mineral Resource Estimate | 2021 | 2024 | 2021 | 2024 | 2021 | 2024 |

tonnes | tonnes | tonnes | tonnes | tonnes | tonnes | |

| Measured Resources | 12,710 | 13,650 | 820 | 855 | 120 | 124 |

| Indicated Resources | 59,970 | 80,081 | 3,240 | 3,648 | 500 | 568 |

| Total Measured & Indicated Resources | 72,680 | 93,731 | 4,060 | 4,503 | 620 | 692 |

| Total Inferred Resources | 10,120 | 21,602 | 680 | 937 | 110 | 153 |

The Mineral Resource was reported from within a Whittle optimised pit shell using the following assumed parameters and a cut-off grade of 0.1% TREO+Y2O3.

- Basket price USD 91.64 per kg TREO1,

- Mining Cost USD 2.65 per tonne,

- Processing Cost USD 32.00 per tonne of run-of-mine feed,

- General and Administration Cost (G&A) USD 1.41 per tonne run-of-mine feed,

- Offshore treatment cost and shipment priced in discounted basket price,

- Metallurgical recovery 65% of contained run-of-mine TREO,

- Transport cost of USD 36.31 per tonne of concentrate.

From the assumed parameters, a 0.1% TREO cut-off grade was calculated, which together with the Whittle optimised pit shell demonstrates reasonable prospects for eventual economic extraction (RPEEE) for the Mineral Resource. The assessment to satisfy the criteria of RPEEE is a high-level estimate and is not an attempt to estimate Mineral Reserves.

1"TREO" refers to total rare earth oxides plus yttrium oxide; "HREO" refers to heavy rare earth oxides plus yttrium oxide; "heavy rare earths" as used in all Company presentations comprise europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), lutetium (Lu) and yttrium (Y). Light rare earths comprise lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd) and samarium (Sm).

Filing of Report

The NI 43-101 compliant technical report ("Report") will be filed on SEDAR within the next 45 days.

The Qualified Person for the Mineral Resource estimate is Mr. Jeremy C. Witley (BSc Hons, MSc (Eng.)) who is a geologist with more than 30 years' experience in base and precious metals exploration and mining as well as in Mineral Resource evaluation and reporting. He is a Principal Resource Consultant for The MSA Group (an independent consulting company), is registered with the South African Council for Natural Scientific Professions (SACNASP) and is a Fellow of the Geological Society of South Africa (GSSA). Mr. Witley has the appropriate relevant qualifications and experience to be considered a "Qualified Person" for the style and type of mineralization and activity being undertaken as defined in National Instrument 43-101 Standards of Disclosure of Mineral Projects. The information in this press release that relates to the estimate of Mineral Resources for the Lofdal Project is based upon, and fairly represents, information and supporting documentation compiled by Mr. Witley and Mr. Witley has reviewed and approved this press release.

Neither Mr. Witley nor any associates employed by The MSA Group in the preparation of the Mineral Resource Estimate ("Consultants") have any beneficial interest in Namibia Critical Metals. These Consultants are not insiders, associates, or affiliates of Namibia Critical Metals. The results of the mineral resource estimate are not dependent upon any prior agreements concerning the conclusions to be reached, nor are there any undisclosed understandings concerning any future business dealings between Namibia Critical Metals and the Consultants. The Consultants are to be paid a fee for their work in accordance with normal professional consulting practices.

Geological services were provided by Gecko Exploration (Pty) Ltd. under the supervision of Dr Rainer Ellmies, who is VP Exploration for Namibia Critical Metals. Drilling services were provided by Günzel Drilling and Prinsloo Drilling, both Namibian contract drilling companies, which also carried out the downhole geophysical measurements. Sample preparation and analytical services were provided by Activation Laboratories Ltd. (Windhoek, Namibia and Ancaster, Ontario) as the primary laboratory employing ICP-MS techniques suitable for rare earth element analyses and following strict internal QAQC procedures inserting blanks, standards and duplicates. Check analyses were carried out by ALS Minerals (North Vancouver) as the umpire laboratory on approximately 5% of the resource database.

About Namibia Critical Metals Inc.

NCMI is developing the Tier-1 Heavy Rare Earth Project, Lofdal, a globally significant deposit of the heavy rare earth metals dysprosium and terbium. Demand for these critical metals used in permanent magnets for electric vehicles, wind turbines and other electronics is driven by innovations linked to energy and technology transformations. The geopolitical risks associated with sourcing many of these metals has become a repeated concern for manufacturers and end users. Namibia is a proven and stable mining jurisdiction.

The Lofdal Project is fully permitted with a 25-year Mining License and is under a Joint Venture Agreement with Japan Organization for Metals and Energy Security (JOGMEC).

The Company filed a robust updated PEA for "Lofdal 2B-4" on November 14, 2022, with a post-tax NPV of USD$391 million and an annual IRR of 28% with a capital expenditure of USD$207 million. The project is projected to generate a life of mine nominal cash flow of USD$698 million post-tax over a 16-year mine life.

About Japan Organization for Metals and Energy Security (JOGMEC) and the JV

JOGMEC is a Japanese government independent administrative agency which seeks to secure stable resource supplies for Japan. JOGMEC has a strong reputation as a long term, strategic partner in mineral projects globally. JOGMEC facilitates opportunities with Japanese private companies to secure supplies of natural resources for the benefit of the country's economic development.

Rare earth elements are of critical importance to Japanese industrial interests and JOGMEC has extensive experience with all aspects of the sector. JOGMEC provided Lynas with USD$250,000,000 in loans and equity in 2011 to ensure supplies of the Light Rare Earths metals suite to the Japanese industry.

Namibia Critical Metals owns a 95% interest in the Lofdal project with the remaining 5% held for the benefit of historically disadvantaged Namibians. The terms of the JOGMEC joint venture agreement with the Company stipulate that JOGMEC provides C$3,000,000 in Term 1 and C$7,000,000 in Term 2 to earn a 40% interest in the Lofdal project. Term 3 calls for a further C$10,000,000 of expenditures to earn an additional 10% interest. JOGMEC can also purchase another 1% for C$5,000,000 and has first right of refusal to fully fund the project through to commercial production and to purchase all production at market prices. The collective interests of NCMI and historically disadvantaged Namibians cannot be diluted below a 26% carried working interest upon payment of C$5,000,000 to JOGMEC for the dilution protection. NMI may elect to participate up to a maximum of 44% by funding pro rata after the earn in period is completed.

To date, JOGMEC has completed Term 2 and earned a 40% interest by reaching the C$10 million expenditure requirement. JOGMEC has approved an additional C$3,050,000 budget for Term 3 through to March 31, 2024. Total approved project funding to date is C$13,050,000 of the $20,000,000 Earn-In requirement to reach 50% interest.

Rainer Ellmies, PhD, MScGeol, EurGeol, AusIMM and Vice President of Namibia Critical Metals Inc., is the Company's Qualified Person and has reviewed and approved this press release.

The common shares of Namibia Critical Metals Inc. trade on the TSX Venture Exchange under the symbol "NMI" and the OTCQB Market under the symbol "NMREF".

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information please contact -

Namibia Critical Metals Inc.

Darrin Campbell, President

Tel: +01 (902) 835-8760

Email: Info@NamibiaCMI.com Web site: www.NamibiaCriticalMetals.com

This news release contains certain "forward-looking information" within the meaning of applicable securities laws. Forward looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "would", "potential", "proposed" and other similar words, or statements that certain events or conditions "may" or "will" occur. These statements are only predictions. Forward-looking information is based on the opinions and estimates of management at the date the information is provided, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company's Management's Discussion and Analysis. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, unless required by law. The reader is cautioned not to place undue reliance on forward-looking information.

SOURCE: Namibia Critical Metals Inc.

View the original press release on accesswire.com